Why Bill Gross is Wrong About Stocks

Stock-Markets / Stock Markets 2012 Aug 17, 2012 - 11:03 AM GMTBy: money_morning

Keith Fitz-Gerald writes:

I've gotten quite a few great questions from readers lately so I thought we'd take a quick peek into the mail bag today.

Keith Fitz-Gerald writes:

I've gotten quite a few great questions from readers lately so I thought we'd take a quick peek into the mail bag today.

As always, I love answering questions from the Money Morning family so please feel free to keep the conversation going by sending your questions to: keith@moneymorning.com

Let's get started with a great question about what Bill Gross said a few weeks ago regarding stocks....

Q - What do you think of Bill Gross's recent comment that equities are dead? - Martin R.

A - I think he's as wrong about this as he was about his well-publicized February 2009 call to avoid bonds - a mistake, by the way, that cost investors $5.7 trillion according to Forbes contributor Peter Cohen - and his February 2012 call to do the same thing.

Sure it sounds great considering who he is in his capacity as a bond manager with $1.4 trillion under management, but avoiding equities is a sure path to ruin. They've always involved risk and risk produces returns. Therefore, if you want the returns, you have to take the risk.

It's how you control risk that matters when it comes to big, consistent profits. Most people, though, fail to make the connection and pay a terrible price as a result.

The other thing to think about is that the markets don't price on growth. That's something Wall Street analysts have cooked up to keep you distracted. They price for risk and always have, which is yet another reason to turn conventional thinking on its ear.

Q - I can't believe our leaders. A year after the last debt debate our spending is up another $2.1 trillion. And? - Dan B.

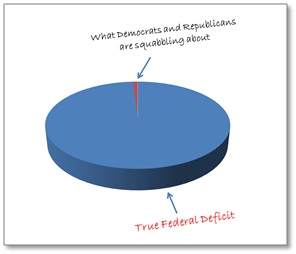

A - Me neither. The actual fiscal gap - that's the present value difference between projected spending and income - is a staggering $222 trillion. That's $11 trillion more than it was last year and represents the true federal deficit according to Boston University Professor, Laurence Kotlikoff, who reviewed the latest CBO data.

Let me put that into perspective.

Our leaders portray themselves as making heroic efforts to cut funds that will save us money over the next ten years. They love to appear on the evening news with very earnest faces and dour expressions.

Puuuulllleeeeeeaaaassseeee -- the $2.1 trillion they're fighting over is 0.95% of the money we already owe ourselves.

Figure 1: Source: CBO, Laurence Kotlikoff - Boston University

They're essentially arguing over a leaky faucet when the house is floating away. $2.1 trillion is little more than a rounding error.

Disgusting!

Q - What do you make of the Justice Department dropping its criminal probe of Goldman Sachs? - Paula R.

A - A travesty. So far not a single mega-bank nor trading house has been held accountable for its role in the financial crisis. The fact that the Justice Department cannot meet the criminal standards of proof needed to prosecute suggests three things: a) a lack of competence in the Justice Department, b) a clear need to change the laws to enable effective prosecution, and/or c) the fact that the sleazy characters involved continue to maintain their incestuous relationships and are therefore somehow afraid of the repercussions associated with prosecution or turning the lights on people who would just as soon remain in the shadows.

Selling clients products privately described in internal emails as "crap" just isn't acceptable behavior. Period.

Q - What do you make of China missing its export estimates recently? - Hairong L.

A - Not much. Look closely at what happened. China reported exports rose 1% versus a year earlier as imports rose 4.7%, resulting in $25.15 billion trade surplus. This points to continued internal development and less reliance on exports.

Don't forget that China's stated policy goal is balanced imports and exports by 2015; therefore, it's only logical. I have warned many times that we will see more surpluses like this in the meantime.

There's something else to consider, too. Many news sources reported last week that the markets dropped because "analysts expected Chinese export gains of 8%," according to Bloomberg.

What they should highlight is the fact that Wall Street analysts are so poor at predicting things and understand so little about what they are forecasting that they got it wrong again.

This is as true with exports as it is with earnings, which is why I am reminded of the old joke that God invented economists to make weather forecasters look good.

Q - I watched your video recently and was stunned to learn that banks were told to prepare for complete collapse and no Federal aid...by the Federal government. Do they know something we don't? - Carol D.

A - Emergency planning is a normal part of financial markets. Every financial institution is responsible for preparing contingency plans. What makes this different is that the so-called "living-wills" directive actually requires the banks involved to specify how they would liquidate themselves and not blow up the financial system in the process.

To call me skeptical would be an understatement. Don't get me wrong, the idea is a great one as outlined in the Dodd-Frankenstein act, but we have not seen a bank, nor a regulator, nor a congressional leader act decisively since this crisis began.

I doubt we will when the next crisis surfaces, either, if for no other reason than there will be entirely new risks not presently contemplated.

In that sense the "living wills" are nothing more than a financial Maginot Line and probably about as effective.

Source :http://moneymorning.com/2012/08/17/qa-with-keith-why-bill-gross-is-wrong-about-stocks/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.