Gold Price About to Pull Back

Commodities / Gold & Silver Feb 06, 2008 - 01:14 AM GMTBy: Brian_Bloom

The charts are not telling a particularly happy story at present.

The charts are not telling a particularly happy story at present.

The attached chart (decisionpoint.com ) tells me that $XAU may start to rise sharply relative to gold. More likely, because the shares have been underperforming, the gold price is likely to pull back sharply relative to shares. The shares may have been right all along.

What's the message in this?

Australia and the UK are facing rising interest rates because we have internal inflation. By contrast, the Fed is cutting, cutting and cutting further.

It “feels” to me like the velocity of money is slowing in the US and the Fed is desperately trying to push on a string.

I remain convinced that the issue is eroding underlying “wealth creation” momentum. The engine began to stall in the 1980s and the Fed opened the spigots to artificially stimulate the world economy. The analogy is Sylvester Stallone on steroids. There's a limit to what you can expect the steroids to achieve. Ultimately the fossil fuel driven economic cycle has been ageing and the “decision makers” delayed the birth of the newborn and robustly bawling baby in the 1990s when they failed to ratify Kyoto . Peak Oil has passed and oil will be replaced by ……………………. drum roll …………………… what?

Now we're about to face the consequences of that short sightedness. As an example, South Africa , once the most economically powerful country on the African continent, is now experiencing daily electricity brown-outs across the entire country. The place is sitting, literally, on a gold mine and it can't produce enough energy to get the stuff out of the ground in an efficient manner anymore. Mine management is scared to send the miners underground for fear that they will get trapped there. Forget about the hoists that won't be reliable anymore. It gets damned hot far below the surface of the earth when the air conditioning is switched off.

But let's get back to interest rates.

See that lonely little bar that submerged below the 42 level briefly and the next one that bobbed up robustly above the surface. The gap looks suspiciously like a gap island reversal to me. How can Australia have had 11 straight rises in interest rates and the Fed think that it can operate in a vacuum by cutting short rates?

The monthly chart of the PMO is saying ‘Uh uh. Sorry sport, but I don't think we, the market, can allow further falls.'

The low on the bar of that gap island reversal on the daily yield chart looks like it may be a double bottom bounce on the monthly yield chart given the series of rising bottoms on the PMO.

So what's the market telling us?

Well, its different strokes for different folks, and also on what colour spectacles you are wearing, but it's telling this analyst the following.

- The double whammy impact of a world wide credit crunch and cost push inflation is causing other countries outside the US to have to raise rates.

- The Fed is feverishly stoking the embers of a dying fire where the charcoal may be turning to ash – because the people who “control” the decisions in the USA – the oil and banking industries – zigged when they should have zagged. They locked the US into yesterday's energy technologies and encouraged the US motor car industry to continue to produce gas guzzlers when the rest of the world was hybridising and going compact. All three of the motor biggies in the US hit the wall at 100 miles an hour. Ouch! There was a time when 1 in 4 people in the USA were gainfully employed in and around the motor car industry. No longer. Now its taking smoke and mirrors just to make the US auto manufacturing industry appear to be solvent.

- In context that the US is/was generating 23%-25% of the total world economy, it's a matter of time before the US 's pain spills over into the ROW. That's why the gold price is resisting further rises in the short term.

But there's another issue lurking in the background. That issue is:

![]()

The US Debt clock just keeps right on ticking along. Tick tock, tick tock.

And George W – God bless his cotton socks – puts forward a $3 trillion budget which “admits” to a $400 billion deficit (over and above what is not being admitted to because it's being swept under the mat. See that lump under the debt mat? See the debt mat rising?).

My bet is that within 12 months of writing these words the US National Debt will be trending towards $10 trillion – because if the velocity of money slows, then income to the US Federal Treasury from taxes on real estate, stock and other origami transactions will begin to shrink – and the US politician's response to this little dilemma has historically been to open the spending spigots. So there will be an upside pressure on spending and a downside pressure on income.

And there are some people who are arguing that we are in a Primary Bull Market? Go figure.

Well, let's be absolutely honest. They may be right. At the end of the day, if there's too much money floating around it will raise the level of everything in the bathtub – right up to the point when the bath starts to overflow – and, if we're not super careful, we may slip on the bathmat and break our necks.

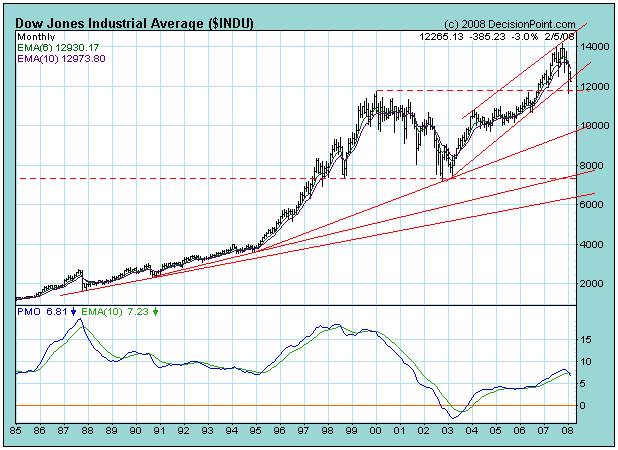

There's a worrying little “sell” signal that has manifested on the PMO of the monthly DJIA, and the price is peeking below its rising trendline ,

Can the price bounce from here? Of course it can! The five man Fed (with one banker amongst them) and the five presidents of the Federal Reserve Banks have, between them, a 6-4 majority on the FOMC – which will be fighting to keep pushing on that string. They don't want the market to start unwinding and they will do everything in their power to raise the level in the bathtub.

I wish them the best of British luck on that one. The more prudent amongst us will have closed the bathroom door on their way out of the building.

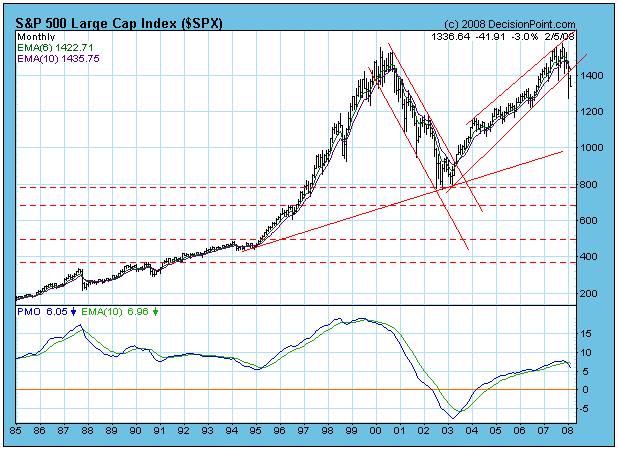

As evidence that discretion is the better part of valour, the broader market ($SPX) is looking less optimistic than the manipulable Dow Jones

And what of the Wilshire? (Even broader, with 5,000 stocks)

Yes, it looks oversold on the oscillator, but those of us who can tell up from down are looking at that 200 day Moving Average and are starting to ask some soul searching questions.

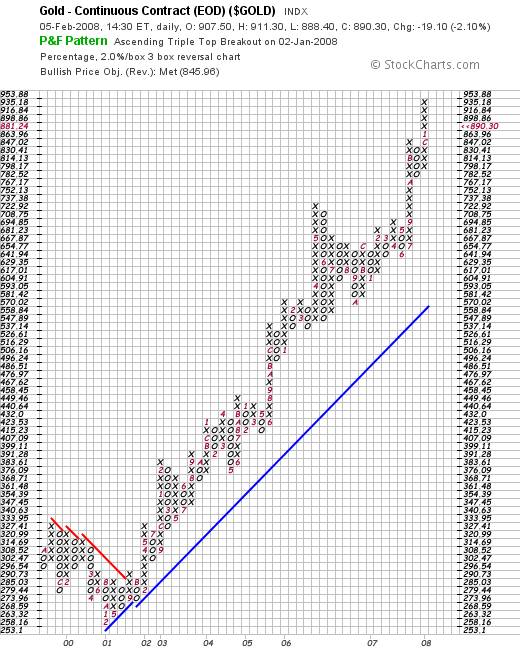

Based on the chart below, $878 an ounce is a key support level. (3 X 2% = 6% reversal from the $935 peak). If it is broken, we can probably expect the price to fall further. But, so far, it looks like gold is well entrenched in its bull market. A fall may be nerve wracking but technically it will not be particularly worrying.

So, in summary we seem to be facing decreasing velocity of money which may be nudging the USA to an increasingly moribund US economy, a minimum $400 billion deficit which will quite possibly be closer to double that number by the time the dust has settled, and all this against the background of increasing cost-push world inflation? And the Fed just keeps right on printing, printing, printing and printing.

What do you call it when you keep doing the same thing over and over and over again, and yet you keep expecting a different outcome?

It's enough to bring a tear into the eye of the most seasoned politician.

By Brian Bloom

www.beyondneanderthal.com

Since 1987, when Brian Bloom became involved in the Venture Capital Industry, he has been constantly on the lookout for alternative energy technologies to replace fossil fuels. He has recently completed the manuscript of a novel entitled Beyond Neanderthal which he is targeting to publish by end March 2008.

The novel has been drafted on three levels: As a vehicle for communication it tells the light hearted, romantic story of four heroes in search of alternative energy technologies which can fully replace Neanderthal Fire. On that level, its storyline and language have been crafted to be understood and enjoyed by everyone with a high school education. The second level of the novel explores the intricacies of the processes involved and stimulates thinking about their development. None of the three new energy technologies which it introduces is yet on commercial radar. Gold, the element , (Au) will power one of them. On the third level, it examines why these technologies have not yet been commerci alised. The answer: We've got our priorities wrong.

Beyond Neanderthal also provides a roughly quantified strategic plan to commerci alise at least two of these technologies within a decade – across the planet. In context of our incorrect priorities, this cannot be achieved by Private Enterprise. Tragically, Governments will not act unless there is pressure from voters. It is therefore necessary to generate a juggernaut tidal wave of that pressure. The cost will be ‘peppercorn' relative to what is being currently considered by some Governments. Together, these three technologies have the power to lift humanity to a new level of evolution. Within a decade, Carbon emissions will plummet but, as you will discover, they are an irrelevancy. Please register your interest to acquire a copy of this novel at www.beyondneanderthal.com . Please also inform all your friends and associates. The more people who read the novel, the greater will be the pressure for Governments to act.

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.