Stock Market Double Pop-N-Drop

Stock-Markets / Stock Markets 2012 Aug 31, 2012 - 02:25 PM GMT Have you noticed that stocks elevate just prior to any of Bernanke’s speeches? The press reports this as if the market hangs on every word that he speaks. Today there was nothing to hang on to.

Have you noticed that stocks elevate just prior to any of Bernanke’s speeches? The press reports this as if the market hangs on every word that he speaks. Today there was nothing to hang on to.

From ZeroHedge: The market is not amused...

- *BERNANKE SAYS STAGNATION IN LABOR MARKET IS `GRAVE CONCERN'

- *BERNANKE SAYS FED WILL BOOST ACCOMMODATION AS NEEDED FOR GROWTH

- *BERNANKE SAYS HE WOULDN'T RULE OUT FURTHER ASSET PURCHASES

- *BERNANKE: QE `SIGNIFICANTLY LOWERED LONG-TERM TREASURY YIELDS'

- *BERNANKE SAYS IMPACT OF QE IS `ECONOMICALLY MEANINGFUL'

- *BERNANKE: BIG BOOST IN QE MAY REDUCE CONFIDENCE IN SMOOTH EXIT

Right. Now the HFT machines are being turned on to intimidate the “great unwashed” and shares will start being dumped in large quantities on an unsuspecting public. Once SPY drops below 139.95 and the SPX below 1396, the selling volume may explode. Today may close much lower because of this.

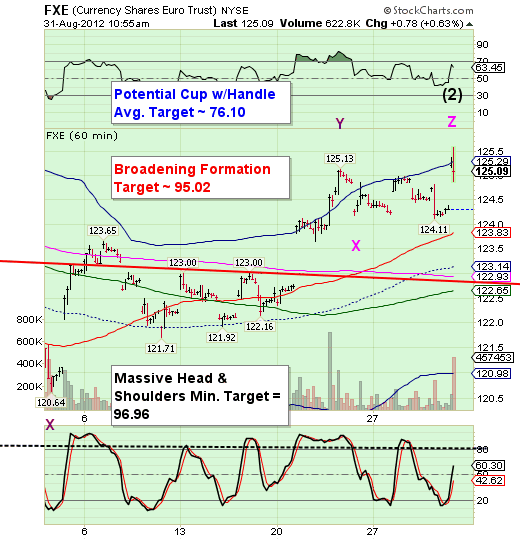

FXE extended its wave (2) retracement into a triple zigzag. It, too may begin its decline today. The big issue I see is for those investors away on vacation and not paying attention to the markets. Today is a critical time to position oneself for the decline if one hasn’t already done so. The reason is that the liquidity cycle is turning down hard over the weekend and our markets will be closed for the holiday. Unfortunately, Europe and Asia will be open and beginning their decline in earnest.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.