U.S. Structural Unemployment Trillion Dollar Question

Economics / Unemployment Sep 06, 2012 - 02:27 AM GMTBy: Ian_R_Campbell

Why read: Because it is arguable that the most important questions facing America and its politicians today are:

Why read: Because it is arguable that the most important questions facing America and its politicians today are:

-

has there been structural change in the American economy after 1995?;

-

does a significant amount of structural unemployment exist in American today?; and,

-

if the correct answer to either or both of those two questions is 'yes', can those things be dealt with a way that will restore 'economic opportunity' to America in coming years? - and, if so, what specific strategy(ies) can get America on that 'road to economic recovery'?

Recall that structural unemployment, simply described, occurs where:

-

people are not trained to fill the jobs that are available;

-

people are not physically located where the available jobs are; or

-

some combination of those two things prevails.

Commentary: There is increasing debate over whether the unemployment now facing Americans and their politicians is of a 'structural nature', or where it is simply of a 'cyclical nature'. There can be little if any disagreement that if current U.S. unemployment is comprised of any significant degree of structural unemployment, that America's unemployment issues are more significant and 'economy threatening' than if they are purely of a cyclical nature. In a paper presented last week at the Kansas City Federal Reserve's Jackson Hole Conference, U.S. economists Edward Lazear (Stanford University) and James Spletzer (U.S. Census Bureau) said that current U.S. unemployment is cyclical and not structural - see referenced paper.

While that paper includes what I think is an excellent background as the meaning of structural unemployment, I don't think it reaches the correct conclusion. This is because as I read their paper, the authors:

-

seem to take the position that all jobs in America are created equal. They deal with raw unemployment statistics, and don't seem to distinguish (for example) the comparative importance of high-paid manufacturing jobs, and low-pay part time service jobs;

-

develop their conclusions using arithmetic formulas, and seem not to consider the practical underlying business issues suggested by the statistics they use. For example it seems evident from the data shown in the charts in the paper that the only percentages of the work force that has increased after 1999:

-

based on age has occurred in the over-55 year old age group,

-

based on education for the 25+ age group has been the college graduate group, and

-

for the so-called services groups 'labor force share' has increased in some categories, but dropped for the manufacturing sector,

-

all of which is consistent with manufacturing jobs being lost, and some service sector jobs (most notably in education and health services) showing increases.

For me, if it is as simple as 'America is just experiencing cyclical unemployment' and not 'structural unemployment', the percentage relationships of what sectors are employing people, what age groups are being employed, and the average wage rate for each sector and age group within each sector ought not to deviate very much over time.

It seems clear to me that is not what has been, and is, going on in the United States. That in turn leads me to the continuing conclusion that:

-

the U.S. indeed does suffer today from structural unemployment; and,

-

any conclusion that says current U.S. unemployment is simply a cyclical problem that will resolve itself when the cycle reverses ought to be discounted.

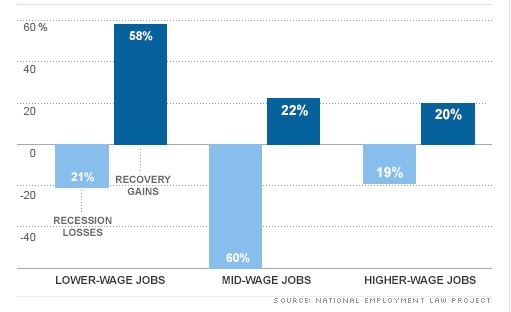

I suggest that support for the view that America faces structural employment issues can be found in a recently released report by the U.S. National Employment Law Project (NELP). That report, which apparently looked at U.S. employment trends from 2008 - 2012 included the following chart, which clearly shows the shift to low-wage jobs from what are referred to as mid-wage and higher-wage jobs measured by what are referred to as 'recession (jobs) losses' and 'recession (jobs) gains'.

You can read the referenced CNNMoney article for more detail from the NELP report.

Topical References: The United States Labor Market: Status Quo or a New Normal, from The Kansas City Fed, Edward P. Lazear and James R Spletzer, July 22, 2012 - reading time 30 minutes.

Ian R. Campbell, FCA, FCBV, is a recognized Canadian business valuation authority who shares his perspective about the economy, mining and the oil & gas industry on each trading day. Ian is also the founder of Stock Research Portal, which provides stock market data, analysis and research on over 1,600 Mining and Oil & Gas Companies listed on the Toronto and Venture Exchanges. Ian can be contacted at icampbell@srddi.com

© 2012 Copyright Ian R. Campbell - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.