Gold Versus Bonds - When Bond Markets Crash, Investors Will Rush The Exits

Stock-Markets / Global Debt Crisis 2012 Sep 11, 2012 - 02:41 AM GMTBy: Darryl_R_Schoon

When capital markets expand, the action is in the equity markets. When capital markets contract, bond markets are where the action is; because when credit and debt-based markets reach their limit, debt, not credit, has the upper hand.

When capital markets expand, the action is in the equity markets. When capital markets contract, bond markets are where the action is; because when credit and debt-based markets reach their limit, debt, not credit, has the upper hand.

Today’s economists, trapped between the flawed theories of John Maynard Keynes and Milton Friedman, assiduously avoid the observations of Carl Menger and the Austrian School of Economics. But try as they might, the misguided and devoted followers of Friedman and Keynes can’t escape the results of their misguided assumptions—today, economies everywhere are drowning in debt.

The inevitable collapse of over-indebted economies is obvious to all except to those too fearful to confront their demise. Credit’s excessive gifts have now been spent and exist today only as constantly compounding debts so large they are incapable of ever being repaid.

The belief that an expanding GDP can save capitalism is no different than believing more worshipers of Baal could have saved Chaldea.

SPECULATORS IN THE BULL RING

In their illusory world of fantasy and finance, central bankers imagine themselves to be the matadors of the bond markets, expertly controlling the flow of bonds by fixing the rate of interest; but, in reality, central bankers are as much victims as the bulls the matadors stalk; and, like the bulls, their demise is certain.

The real matadors are not the central bankers. The real matadors are the bond speculators; and, today, the bond speculators, too, are in danger; for today’s bond markets are more dangerous than they have ever been.

Pushed to their limits and of a size heretofore inconceivable, today’s bond markets pose a danger not only to the speculators and central bankers in the ring but to the spectators in the stands as well.

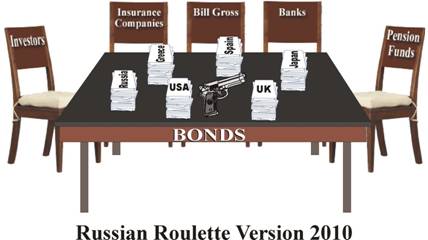

In my article, Will the US Devalue the Dollar?, written just as the European sovereign debt crisis was beginning in 2010, I discussed the quandary of Bill Gross, founder and co-chief investment officer of PIMCO, the world’s largest bond fund, and a bond matador of justifiable repute.

… As Managing Director of PIMCO, the world’s largest bond fund, Mr. Gross is in the business of buying debt and betting on the outcome, an avocation that increasingly resembles Russian roulette.

Spreads on sovereign debt are rising and credit default swaps reflect the higher premiums being charged to protect against default. Investors such as Mr. Gross compare risk to reward in regards to debt and when the reward is believed to compensate for the risk, the bond is bought and the bet is placed.

As we enter the end-game, the odds, as in Russian roulette, exponentially increase making previous yield curves irrelevant. The trigger event may be Greece, Spain, the UK, the US, Latvia, Japan or some other nation. But, one thing is certain, when someone takes a bullet, all bets will be off. No one can cover what can’t be covered.

In March 2010, Bill Gross asked the question: What if – to put it simply – you couldn’t get out of a debt crisis by creating more debt? The answer to that question will be supplied by the markets—and soon.

THE BONFIRE IN THE BOND MARKETS

The bond matadors’ 30-year run of luck is running out. Interest rates have fallen for 30 years making previously-issued bonds more valuable. But, today, with US Treasury debt close to 0 %, interest rates can’t go lower and bond valuations can’t continue to rise.

In the end game, the bond market will be capitalism’s final resting place as issues of debt become paramount. In the end game, credit can no longer induce sufficient growth to cope with accelerating levels of debt; and when capitalism can’t expand, it collapses.

Capitalism is like a bicycle. It doesn’t do well at slow speeds.

We are moving into the end game, the grand denouement of credit and debt-based markets, the grand finale of the debt super-cycle, the crack-up boom, the blow-off Ludwig von Mises predicted would happen as a result of constantly expanding credit.

THE END GAME AND THE COMING PANIC IN THE BOND MARKETS

David Stockman, author of The Emperor is Naked and Reagan’s former budget director, is an outstanding observer of America’s problems in the end game. Recently, Stockman was asked by the editors of The Gold Report, what catalyst could bring the end game to a final resolution.

The Gold Report: If we are in the final innings of a debt super-cycle, what is the catalyst that will end the game?

David Stockman: I think the likely catalyst is a breakdown of the U.S. government bond market. It is the heart of the fixed income market and, therefore, the world's financial market.

Because of Fed management and interest-rate pegging, the market is artificially medicated. All of the rates and spreads are unreal. The yield curve is not market driven. Supply and demand for savings and investment, future inflation risk discounts by investors—none of these free market forces matter. The price of money is dictated by the Fed, and Wall Street merely attempts to front-run its next move.

As long as the hedge fund traders and fast-money boys believe the Fed can keep everything pegged, we may limp along. The minute they lose confidence, they will unwind their trades.

On the margin, nobody owns the Treasury bond; you rent it. Trillions of treasury paper is funded on repo: You buy $100 million (M) in Treasuries and immediately put them up as collateral for overnight borrowings of $98M. Traders can capture the spread as long as the price of the bond is stable or rising, as it has been for the last year or two. If the bond drops 2%, the spread has been wiped out.

If that happens, the massive repo structures—that is, debt owned by still more debt—will start to unwind and create a panic in the Treasury market. People will realize the emperor is naked.

http://www.theaureport.com/pub/na/13278

WHEN BOND MARKETS CRASH, INVESTORS WILL RUSH THE EXITS; THOSE NOT ALREADY OUT THE DOOR WILL BE TRAPPED.

BILL GROSS NOW RECOMMENDS GOLD OVER STOCKS AND BONDS

On September 5, 2012, legendary bond trader, Bill Gross, said the age of credit expansion is over… Pension funds and individuals and investors that expect 10% consistent returns to pay those bills are going to be disappointed…the price of gold will be higher than it is today and certainly a better investment than a bond or stock, which will probably return only 3% to 4% over the next 5 to 10 years.

That, perhaps, the best and, certainly, the most well-known—of the world’s bond traders, Bill Gross, is now recommending gold over stocks and bonds is extraordinary news. It is news, however, that will be ignored by most investors, i.e. today’s ostriches, who have made a living arbitraging the opportunities afforded by the bankers’ paper markets—for this is the time of the vulture.

… the vulture feeds neither upon the pastures of the bull nor the stored up wealth of the bear. The vulture feeds instead upon the blind ignorance and denial of the ostrich. The time of the vulture is at hand.

p. 5, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, Darryl Robert Schoon, 3rd ed., 2012

Bill Gross knows the endgame is not the same game in which he made his reputation and considerable fortune; and, unlike his equities counterpart, Warren Buffet, who still believes paper markets will pay off in the future as they have in the past, Bill Gross is preparing for a future most investors cannot see and do not expect.

Dancing in the endgame is going to be a bloody affair

GOLD IN THE END GAME

In the end game, gold is the ultimate hedge as gold is a hedge against both deflation and inflation. Deflation, characterized by a collapse in demand, is now in motion; and inflation—and perhaps accompanied by its virulent stepsister, hyperinflation—is coming.

My youtube video, The Bank of New York, the Fed and 9/11, marks the anniversary of 9/11 by shedding light on financial transactions involving hundreds of billions of dollars of covert securities secretly cleared by the Fed in the aftermath of 9/11; and my economic site, Moving Through the Maelstrom with Darryl Robert Schoon, is now free without subscription.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.