Governments Raising Taxes: 73% of Nothing is Nothing

Politics / Taxes Sep 12, 2012 - 06:39 AM GMTBy: Colin_Twiggs

President Francois Hollande recently increased the top income tax rate in France to 75 percent — for incomes in excess of €1 million. This is part of a wider trend with President Obama targeting the wealthy in his election campaign, promising to raise taxes on incomes in excess of $1 million. Shifting the tax burden onto the wealthy might be clever politics, but does it make economic sense? To gauge the effectiveness of this strategy we need to study tax rates and their effect on incomes in the 1920s and 1930s.

President Francois Hollande recently increased the top income tax rate in France to 75 percent — for incomes in excess of €1 million. This is part of a wider trend with President Obama targeting the wealthy in his election campaign, promising to raise taxes on incomes in excess of $1 million. Shifting the tax burden onto the wealthy might be clever politics, but does it make economic sense? To gauge the effectiveness of this strategy we need to study tax rates and their effect on incomes in the 1920s and 1930s.

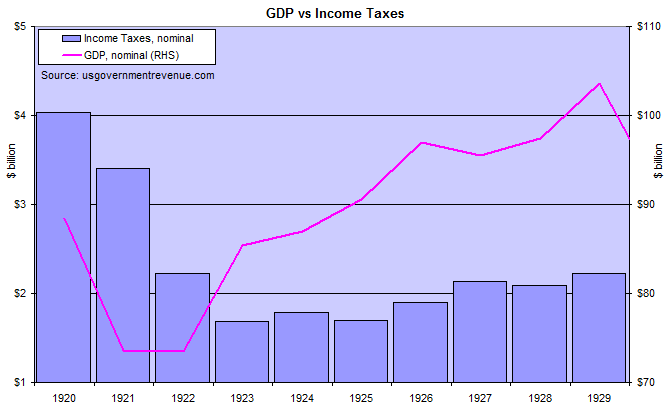

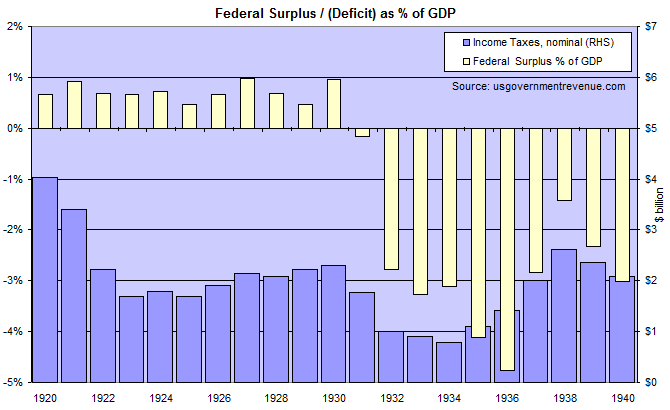

By the end of the First World War, Federal government debt had soared to $25.5 billion, from $3 billion in 1915. Income taxes were raised to repay public debt: 60 percent on incomes greater than $100,000 and a top rate of 73 percent on incomes over $1 million. When Andrew Mellon was appointed Treasury Secretary in 1921, he inherited an economy in sharp recession. Falling GDP and declining income tax receipts led Mellon to observe that “73% of nothing is nothing”. He understood that high income taxes discourage entrepreneurs, leading to lower incomes and lower tax receipts — what we now refer to as the Laffer curve. By 1925, under President Coolidge, Mellon had slashed income taxes to a top rate of 25 percent — on incomes greater than $100,000. The economy boomed, tax collections recovered despite lower rates, and Treasury returned budget surpluses throughout the 1920s.

Interestingly, Veronique de Rugy points out that taxes paid by those with incomes over $100,000 more than doubled by the end of the decade.

Andrew Mellon was a wealthy banker and investor: in the mid-1920s he was the third highest taxpayer in the US. His strategy of cutting income tax rates may appear self-interested, but showed an understanding of how taxes can stimulate or impede economic growth, and succeeded in rescuing the economy from prolonged recession in the 1920s.

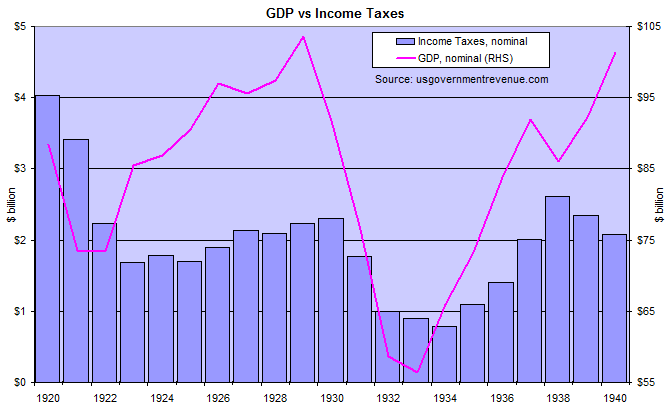

A decade later, President Herbert Hoover spent liberally on infrastructure programs in an attempt to shock the economy out of recession following the 1929 Wall Street crash. By 1932 Hoover and Mellon raised income taxes to rein in the growing deficit. Tax on incomes greater than $100,000 was increased to 56 percent and the top rate lifted to 63 percent — on incomes over $1 million.

The budget deficit continued to grow. Higher tax rates were maintained throughout the 1930s, under FDR, but failed to achieve their stated aim and may have contributed to the severity of the Great Depression.

GDP rose steeply after 1934. Income tax receipts recovered to pre-crash levels but declined again after 1937, when President Roosevelt introduced payroll taxes. Increased taxes reduced the fiscal deficit but caused a double-dip recession: GDP contracted, income tax receipts fell and the deficit grew.

Comparing the 1920s to the 1930s it is evident that Barack Obama and Francois Hollande threaten to repeat the mistakes of the 1930s. Increasing taxes in the middle of a recession does not reduce the deficit. It merely prolongs the recession.

Sources:

Cato Institute: 1920s Income Tax Cuts Sparked Economic Growth and Raised Federal Revenues by Veronique de Rugy

National Debt History

Wikipedia: Andrew W Mellon

Wikipedia: Laffer Curve

The Politically Incorrect Guide to the Great Depression and the New Deal by Robert Murphy

By Colin Twiggs

http://www.incrediblecharts.com

Colin Twiggs is a former investment banker and author of the popular Trading Diary and Goldstocksforex.com newsletters, with more than 140,000 subscribers. His specialty is blending fundamental analysis of the economy with technical analysis of stocks, markets, commodities and currencies. Focusing on the role of the Fed and banking credit as primary drivers of the economic cycle, Colin successfully forecast the October 2007 bear market -- eight months ahead of the sub-prime crisis.

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use .

© 2012 Copyright Colin Twiggs - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.