How High Can Gold Go?

Commodities / Gold and Silver 2012 Sep 21, 2012 - 07:50 AM GMTBy: GoldCore

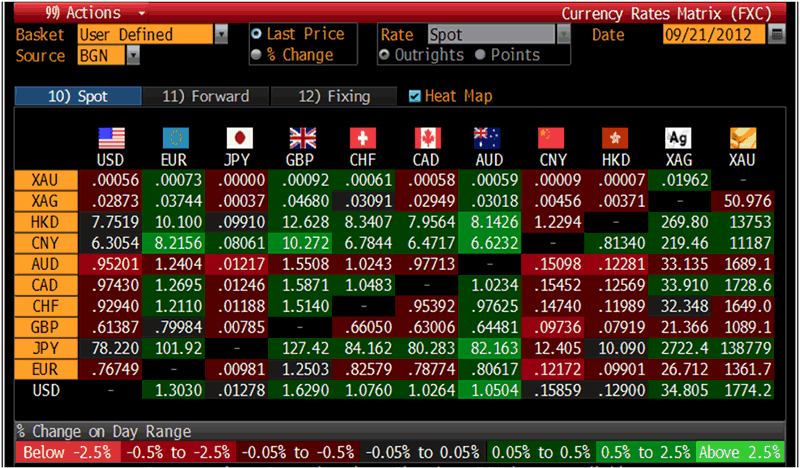

Today’s AM fix was USD 1,773.75, EUR 1,361.28, GBP 1,089.19 per ounce.

Today’s AM fix was USD 1,773.75, EUR 1,361.28, GBP 1,089.19 per ounce.

Yesterday’s AM fix was USD 1,760.00, EUR 1,360.33 and GBP 1,088.03 per ounce.

Silver is trading at $34.71/oz, €26.84/oz and £21.42/oz. Platinum is trading at $1,638.50/oz, palladium at $670.30/oz and rhodium at $1,250/oz.

Gold fell $2.10 or 0.12% in New York yesterday and closed at $1,768.40. Silver dropped to $34.084 in London, but rallied back higher later in the session and finished with a gain of 0.03%.

James Grant Interview on CNBC

Gold is slightly higher today and is being supported by investor concerns not just about ‘stimulus’ but about “open ended” QE or ‘QE to infinity’.

Gold and silver have this week consolidated on their recent sharp gains which is a healthy development as there were concerns that the markets were getting ahead of themselves.

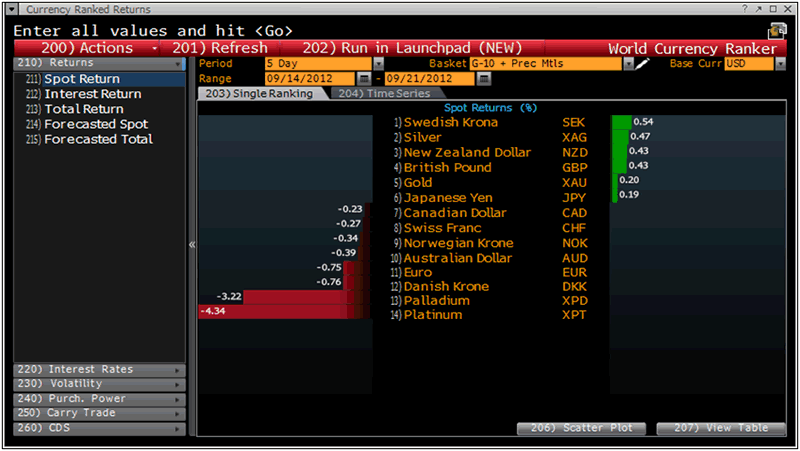

Currency Ranked Returns - (Bloomberg)

Gold has been hovering near $1,775/oz a 6 ½ month high seen after the US Federal Reserve launched QE3 and vowed to keep borrowing costs low until 2015, fuelling global demand for gold, which benefits from a low and negative interest rate environment.

Deutsche Bank has reported that their high net worth private clients have expressed an increasing interest in owning gold in order to protect their wealth from the growing risk of inflation (see Newswire).

Thursday’s US manufacturing figures showed the sector suffered its weakest quarter in 3 years.

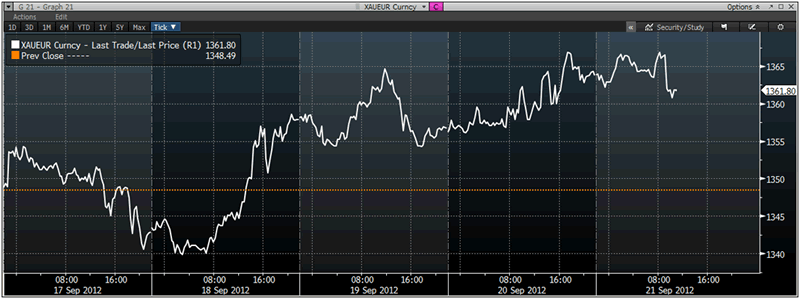

Gold Tick (17/09/2012-Today) - Bloomberg

The recent renewed appetite for gold and silver has shot the precious metal backed funds to their highest levels in a year. SPDR Gold Trust, the world's largest gold ETF, said its holdings had hit 1,308.41 tonnes. Holdings in iShares Silver Trust, the world's biggest silver ETF, climbed to an 11-month high of 9,940.66 tonnes.

XAU/EUR Exchange Rate Daily, 17/09/12-Today - (Bloomberg)

Gold is consolidating near record highs in the euro and is less than 1% below the record intraday high from just over a year ago on September 9th 2011.

One of the most astute financial analysts in the world, Jim Grant, founder of highly respected Grant's Interest Rate Observer, was asked by Maria Bartiromo on CNBC yesterday “how high can gold go”? Grant responded that "there is no telling."

Grant was asked about the stock market and where to invest today and asked if “you want to get in front of this train?”

He responded by advocating “security analysis” and said that he thinks that that is “where an investment in gold and silver comes in”.

Grant said the following:

“Central banks around the world are bound and determined -- either through actions or words to debase their currency. They're telling us”

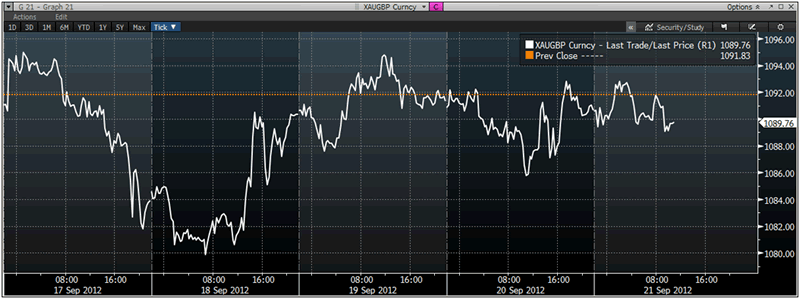

XAU/GBP Exchange Rate Daily, 17/09/12-Today - (Bloomberg)

When asked how high gold could go, Grant astutely noted that:

“The nice thing about gold, it has no PE multiple. There’s no telling.

Gold is a speculative -- it earns no yields, gold is a speculation on an anticipated macro economic outcome. That macro economic outcome being the systematic debasement of currencies by the central banks.

They've done QE 3, right? The economy appears not to be in the best of health. Why wouldn't they do QE 4? What intellectual argument do they have against doing it again and again and again?

That's one of the risks, right? Well, it's open ended already. Maybe they'd need it, because we know it's open ended. They can save the paper in the press release”.

With regard to hard assets such real estate and gold, Grant said:

“There is an argument to be made that you want to be buying hard assets like gold, like real estate ... that's not a bad way to hedge against the currency”.

The interview ends on a funny but sadly telling note when the “Money Honey” Bartiromo says that she knows that Federal Reserve Chairman, “Bernanke knows you have been so critical. What is his answer to you, when you raise these points?”

James Grant said:

“We don't talk any more.”

Ron Paul named Grant as his likely candidate for Chairman of the Federal Reserve to replace Ben Bernanke whose term expires in 2014.

The interview is a must watch and can be seen here.

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.