Gold Double Flash Crash

Commodities / Gold and Silver 2012 Sep 22, 2012 - 10:31 AM GMTBy: Jesse

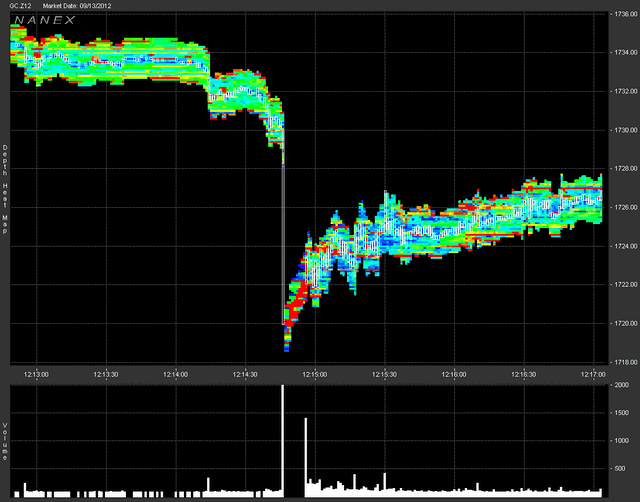

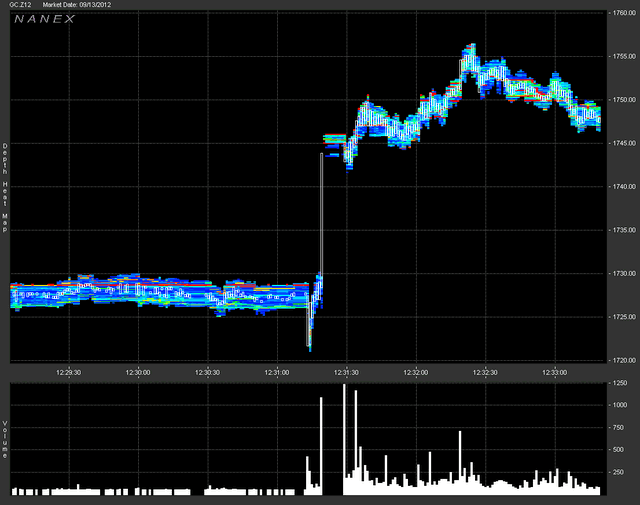

The 'Dr. Evil' strategy in two pictures. From Nanex Research:

The 'Dr. Evil' strategy in two pictures. From Nanex Research:

Trading was so furious in Gold, that the CME circuit breakers triggered and halted the futures contract for 5 seconds. First on the downside, then on the upside. This is the same circuit breaker that triggered only once in the eMini during market hours: that time was at the bottom of the flash crash on May 6, 2010.

The first halt in the December 2012 Gold Futures contract (GC.Z12) was at 12:14:44: you can see the gap in volume in the lower panel of Chart 1. One second before the halt, 2,000 contracts traded the price down $10, from $1,730 to $1,720. The CME halt logic triggers a 5 second market pause whenever orders appear that would remove all available liquidity and move the price by a certain amount.

For this event, this basically means that if this order represented a true intent to sell, then we should expect additional selling (from the balance of the order that triggered the halt) when trading resumes.

However, in this case, the additional selling did not materialize, which leads us to believe the large sell order was meant to disturb any market based on the price of gold. And disturb the markets, it did.

1. December Gold Futures (GC.Z12) ~ 1 second interval trades with depth of book color coded by how much size is at each level.

Note the gap showing the halt after the drop. The depth of book shows orders continue to be added/removed from the book during the halt.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.