'Mugabenomics' From Zimbabwe To The UK - "Gold Is Good"

Commodities / Gold and Silver 2012 Oct 03, 2012 - 08:48 AM GMTBy: GoldCore

Today’s AM fix was USD 1,777.25, EUR 1,374.73, and GBP 1,102.38 per ounce.

Today’s AM fix was USD 1,777.25, EUR 1,374.73, and GBP 1,102.38 per ounce.

Yesterday’s AM fix was USD 1,778.50, EUR 1,377.19 and GBP 1,100.56 per ounce.

Silver is trading at $34.83/oz, €27.08/oz and £21.71/oz. Platinum is trading at $1,688.00/oz, palladium at $651.30/oz and rhodium at $1,150/oz.

Determined selling saw gold inch down $1.80 or 0.10% in New York yesterday which saw gold close at $1,775.10. Silver climbed to $35.04 then it pulled back on sharp selling and finished with a loss of 0.37%.

Currency Ranked Returns – GBP in Fiat and Precious Metals In Last 5 Years

Gold continues to hover near its 11 month high in dollar terms and near new records and the €1,400 level in euro terms.

The lack of confidence over Spain’s finances has kept investors alert as they await a US jobless report on Friday to ascertain just how poorly the US economy is. Recent data suggests that the US economy is in a recession and may be on the verge of a Depression.

Recent disappointing economic data from Australia and China increased speculation of more ‘quantitative easing’ from central banks after Australia’s surprise rate cut yesterday. The Aussie dollar has fallen by nearly 3% already this week after the rate cut.

Although Spain’s Prime Minister Mariano Rajoy denied a Reuters report of an imminent request for a bailout, Spain has taken centre stage in the eurozone debt crisis while Greece, Portugal, Italy and France wait in the wings.

Bill Gross has compared the US government's reliance on debt financing to a "crystal meth" addict, in the latest in a series of dire warnings from one of the most influential investors in the bond market.

"The US, in fact, is a serial offender, an addict whose habit extends beyond weed or cocaine and who frequently pleasures itself with budgetary crystal meth", said Gross, who manages the $273bn Total Return bond fund for PIMCO.

Gross places the US in a "ring of fire" that includes countries with precarious finances such as Greece, Spain and Japan. He said that failing to address the problem would ultimately lead to government printing of money and inflation. "Bonds would be burned to a crisp and stocks would certainly be singed; only gold and real assets would thrive within the "Ring of Fire"."

Industrial unrest in South Africa has deepened and is spreading from the mining sector to other sectors of the economy. Gold Fields, South Africa’s second-biggest producer of the metal, said striking workers threw fire bombs at cars today (see News).

The South African truckers strike has halted the delivery of goods across the country, as more than 20,000 truckers dig in on their demands for higher wages.

ATMs ran out of cash, fuel stations were running dry and hospitals saw vital coal supplies diminish as the nation felt the pinch from the strike that entered its second week. Petrol stations have begun to dry up in several areas in Gauteng province, the country's economic centre.

The strike in the gold mining sector continues to put a halt to 39% of the nation’s sizeable gold output. This is supporting gold.

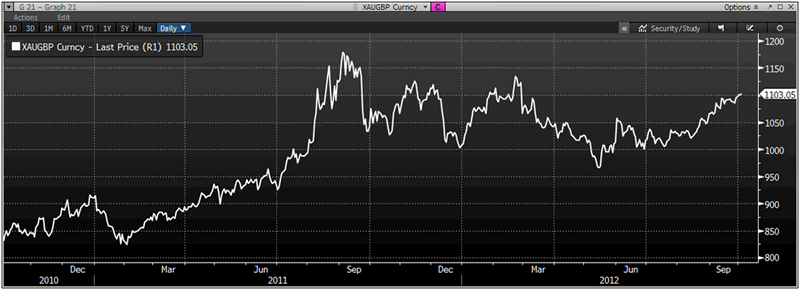

XAU/GBP Daily 2 Years – (Bloomberg)

The well followed and influential UK blog 'Guido Fawkes' has an interesting blog today again warning of the significant risk that rampant money creation will lead to rampant inflation

It also points out the hypocrisy of the current UK Conservative / Liberal Democrat government.

In a post entitled 'Mugabenomics: Inflation in UK Higher than in Zimbabwe,' Guido Fawkes points out how the Liberal Democrats Vince Cable once warned that Quantitative Easing (QE) was “Mugabenomics.”

This was prior to coming to power and a swift u-turn which would make even the most slippery politician proud.

Remember when Vince Cable warned that Quantitative Easing (QE) was “Mugabenomics”? Vince flip-flopped on that even before he joined the coalition.

Guido Fawkes then reminds its readers about the time when George Osborne said “Printing money is the last resort of desperate governments when all other policies have failed.”

Alas as the blog rightly warns, "In government Osborne has overseen the printing of more money than any other Chancellor in British history. A quarter of the national debt – all this government’s overspending – has been bought by the Bank of England via QE."

“So it is not a shock that inflation in Zimbabwe (3.63%) is now lower than inflation in the UK (3.66%, August 2011-July 2012).”

Those who have been warning about this monetary madness for some years are gradually being proved right.

Bank of England and UK government policies have already seen the British pound fall sharply in the last 5 years. The pound has fallen sharply versus stronger fiat currencies such as the Japanese yen and Swiss franc and by much more against gold and silver.

The pound has fallen by 208% against gold and by 229% against silver in the last five years (see table above)and the continuation of similar monetary policies will likely see similar falls in the coming five years.

Like the world’s largest bond fund manager, Bill Gross, Guido Fawkes correctly and pithily comes to the conclusion that "gold is good."

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.