Financial Repression: Invisible Taxation, Surprise Inflation and Gold Confiscation?

Commodities / Gold and Silver 2012 Oct 07, 2012 - 09:32 AM GMTBy: DK_Matai

What is financial repression in a nutshell? Financial repression is invisible taxation which erodes the purchasing power of individuals via inflation. "By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some..." wrote Lord Keynes in The Economic Consequences of the Peace in 1919, in the aftermath of the Treaty of Versailles that followed the First World War and delivered "Carthaginian peace" sowing the seeds for the second global conflict within two decades.

What is financial repression in a nutshell? Financial repression is invisible taxation which erodes the purchasing power of individuals via inflation. "By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some..." wrote Lord Keynes in The Economic Consequences of the Peace in 1919, in the aftermath of the Treaty of Versailles that followed the First World War and delivered "Carthaginian peace" sowing the seeds for the second global conflict within two decades.

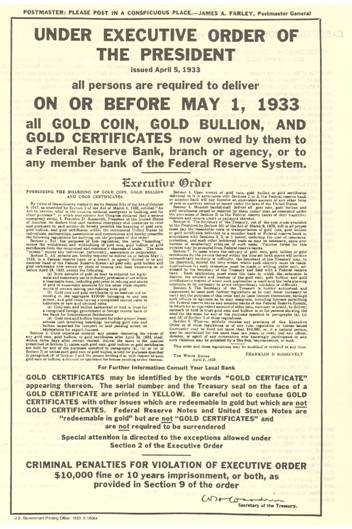

US President’s Gold Confiscation Order: Issued April 5th 1933

Recession, Depression or Repression?

In many advanced economies around the world, we appear to be neither in a simple recession and nor in a depression but in a financial repression, which is a subtle type of debt restructuring. The term "financial repression" was originally introduced in the works of Shaw and McKinnon in 1973.

Advanced Nations In The Same Boat?

This ATCA 5000 briefing looks into the current phase of financial repression around the world -- especially amongst the advanced countries -- and its implications for government debt, inflation and across asset classes. The timing of this Socratic dialogue seems appropriate, as the debt level for advanced economies continues to surge to absurd levels after the financial crisis. In all the previous instances of high debt, a period of deleveraging has ensued, with events of default, financial repression, inflation, surprise inflation spikes and hyperinflation. The attached chart gives the periods of surges in debt in advanced and emerging economies over the last century.

Is History Repeating Itself?

Are policymakers around the world using the strategy of financial repression once again to control government debt in their countries? Yes, this would appear to be the case given that in recent years, policymakers have been repeatedly resorting to inflation targeting, and financial repression necessitates a steady dosage of inflation. This appears to underscore the point that financial repression is being used as a method to reduce the national debt to GDP levels and/or to reduce the national debt servicing cost. If history were to repeat itself, the world is likely to witness continuing defaults, financial repression, inflation, surprise inflation spikes and hyperinflation over the next decade.

Three Key Pillars of Financial Repression

Many distinguished members of the ATCA 5000 are convinced that we are in a period of financial repression, as policymakers have been implementing measures identified with the three key pillars of financial repression:

1. There is an indirect cap on government bond yields through extensive Quantitative Easing (QE) via bond purchase programmes, which have been recently expanded and extended yet again. Record low yields on long-term government bonds are a direct result of the printing of money by major central banks and their associated bond purchase programmes.

2. It is increasingly evident that there are more domestic buyers of government debt in the aftermath of the start of the global financial crisis in August 2007 which set an unprecedented milestone with the collapse of Lehman Brothers in September 2008. The national central bank authorities and domestic players have now become amongst the largest buyers of their own government bonds.

3. Whilst there is no case of the government sector owning large banks outright, however, government regulators in advanced economies have focused on extensive management and oversight of banks and other financial institutions.

Liquidation of Government Debt

According to a more recent paper on financial repression -- The Liquidation of Government Debt -- by Reinhart and Sbrancia:

"Historically, periods of high indebtedness have been associated with a rising incidence of default or restructuring of public and private debts. A subtle type of debt restructuring takes the form of "financial repression." Financial repression includes directed lending to government by captive domestic audiences (such as pension funds), explicit or implicit caps on interest rates, regulation of cross-border capital movements, and (generally) a tighter connection between government and banks."

Surprise Inflation Spike

In the modus operandi of financial repression, if a steady dose of inflation is not enough to liquidate the massive debt; the central banks of advanced economies have another option, as explained in the Reinhart and Sbrancia research paper:

"We have argued that inflation is most effective in liquidating government debts (or debts in general), when interest rates are not able to respond to the rise in inflation and in inflation expectations. This disconnect between nominal interest rates and inflation can [also] occur if... all (or nearly all) debt is liquidated in one 'surprise' inflation spike."

Some distinguished members amongst the ATCA 5000 are of the opinion that "surprise inflation spikes" are one of the options for the policymakers of advanced economies in order to liquidate large tranches of debt in the near future. Would it then be surprising to see high double digit inflation in the advanced economies in the coming decade with the sole purpose of liquidating debt per the step-by-step ratcheting of the financial repression scenario?

Conclusions

1. Mixed Financial Repression? The problem with a steady dose of inflation, surprise inflation and artificially low interest rates is that it punishes the savers and the middle class. However, on this occasion the outsourcing of manufacturing and services to China and India -- amongst other emerging nations -- is helping to keep a somewhat better lid on inflation than was witnessed during previous "financial repression" regimes.

2. Demand Destruction? The massive rise in youth unemployment, the stubborn refusal of the general unemployment rate to go down swiftly, and negative equity associated with house prices, is also dampening demand which translates into lowering prices or causing "deflation vectors" via demand destruction. For these reasons and many more, including the quadrillion dollar derivatives pyramid, the consequences of "financial repression" appear to be less aggressive than would be the case if one looked at the absolute amounts of quantitative easing carried out in trillions by the central banks of advanced economies.

3. Youth Insurrection? The "Jasmine Revolution" in the Middle East via "Self-Assembling Dynamic Networks" was ignited by high food and fuel prices caused by the first round of quantitative easing. Let us not forget that "financial repression" has enormous consequences for rocketing food and fuel prices around the world which may yet again become precursors to further civil unrest and youth insurrection.

4. Direct Default? A steady dose of inflation creates a prolonged period of invisible taxation, lowering the standards of living and purchasing power for most average households caught in the midst of "financial repression" by stealth. From that perspective, a better option to get out of the inescapable debt trap may be to default directly and not default through steady inflation. This was the case with Iceland and may eventually be the case for certain peripheral Eurozone countries such as Greece, Portugal and Spain because the "euro" currency may remain exalted for longer than their export businesses can remain solvent. However, outright default is certainly not the option policymakers would want to implement in advanced industrial economies unless things become much more severe in the shape of another global financial crisis caused by the manifestation of multiple unknowns unknowns or black swans.

5. Rising Inflation and Confiscation of Gold? Consumers and investors can expect steadily rising inflation over the next decade as a result of ongoing "financial repression." From an investment perspective, investors need to beat inflation in order to retain their purchasing power. How do they do that whilst minimising risk? Which asset classes ought to be favoured in times of high inflation? Whilst global asset diversification may be deemed necessary in order to ensure relatively robust returns and to have resilience but aren't most asset classes highly correlated so they now appear to go up and down together? Where is the protection in that? Could gold and other precious metals be an automatic choice for a portfolio structured to hedge against "financial repression" until governments take the 1930s-type step of national confiscation? The US President -- Franklin Delano Roosevelt -- under Presidential Executive Order number 6102, confiscated all privately held gold in the United States on April 5th, 1933. That order remained in place for more than four decades until 1974. The rest, as they say, is history...

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

By DK Matai

Asymmetric Threats Contingency Alliance (ATCA) & The Philanthropia

We welcome your participation in this Socratic dialogue. Please access by clicking here.

ATCA: The Asymmetric Threats Contingency Alliance is a philanthropic expert initiative founded in 2001 to resolve complex global challenges through collective Socratic dialogue and joint executive action to build a wisdom based global economy. Adhering to the doctrine of non-violence, ATCA addresses asymmetric threats and social opportunities arising from climate chaos and the environment; radical poverty and microfinance; geo-politics and energy; organised crime & extremism; advanced technologies -- bio, info, nano, robo & AI; demographic skews and resource shortages; pandemics; financial systems and systemic risk; as well as transhumanism and ethics. Present membership of ATCA is by invitation only and has over 5,000 distinguished members from over 120 countries: including 1,000 Parliamentarians; 1,500 Chairmen and CEOs of corporations; 1,000 Heads of NGOs; 750 Directors at Academic Centres of Excellence; 500 Inventors and Original thinkers; as well as 250 Editors-in-Chief of major media.

The Philanthropia, founded in 2005, brings together over 1,000 leading individual and private philanthropists, family offices, foundations, private banks, non-governmental organisations and specialist advisors to address complex global challenges such as countering climate chaos, reducing radical poverty and developing global leadership for the younger generation through the appliance of science and technology, leveraging acumen and finance, as well as encouraging collaboration with a strong commitment to ethics. Philanthropia emphasises multi-faith spiritual values: introspection, healthy living and ecology. Philanthropia Targets: Countering climate chaos and carbon neutrality; Eliminating radical poverty -- through micro-credit schemes, empowerment of women and more responsible capitalism; Leadership for the Younger Generation; and Corporate and social responsibility.

© 2012 Copyright DK Matai - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.