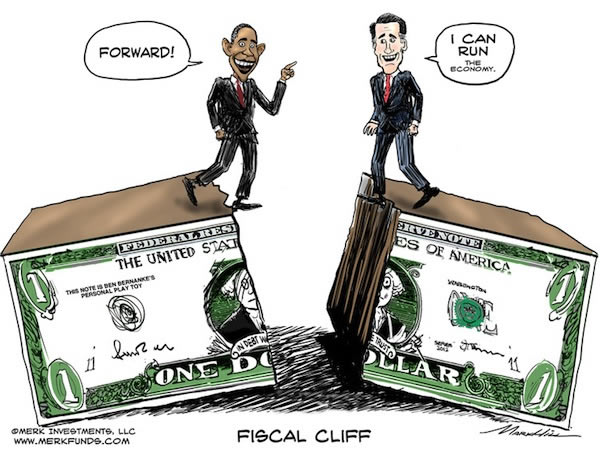

Beyond the U.S. Fiscal Cliff, Dollar At Risk?

ElectionOracle / US Presidential Election 2012 Oct 10, 2012 - 05:15 AM GMTBy: Axel_Merk

Beyond the U.S. Fiscal Cliff, Dollar At Risk?

Looking beyond the fiscal cliff, we are afraid the greenback may be at risk no matter who wins the election. We examine the risk to the U.S. dollar in the context of the likely policies pursued under either an Obama or Romney administration.

Looking beyond the fiscal cliff, we are afraid the greenback may be at risk no matter who wins the election. We examine the risk to the U.S. dollar in the context of the likely policies pursued under either an Obama or Romney administration.

Some context: The budget deficit as a percentage of Gross Domestic Product (GDP) in the U.S. is worse than that of some of the weak Eurozone countries (Portugal, Italy); the Eurozone as a whole has a far lower deficit. If the “fiscal cliff” were to take place – that is, if the tax hikes and government spending cuts were to take effect as currently scheduled - the U.S. would still face a deficit exceeding 3% of GDP before factoring in any economic slowdown as a result of the cliff. The fiscal cliff the U.S. is facing would impose Eurozone style austerity measures and – just as in the Eurozone – not eliminate the deficit.

Why does it matter? Unlike the Eurozone, the U.S. has a significant current account deficit. The current account deficit is exactly the amount foreigners must buy in U.S. dollar denominated assets to keep the dollar from falling. As a result, the U.S. dollar may be vulnerable should foreigners reduce their appetite for U.S. bonds. In contrast, the fallout from the Eurozone debt crisis has had a limited effect on the Euro because the Eurozone as a whole does not need inflows from abroad to keep the currency stable.

U.S. bond market at risk: Foreigners don’t need to sell U.S. bonds for there to be a risk to the U.S. dollar: they simply need to include fewer Treasuries in their purchases going forward. Should the decades old bull market in U.S. bonds turn into a bear market, foreigners might be inclined to deploy fewer of their reserves into U.S. Treasuries. We see three primary scenarios that could lead to a sell-off in the U.S bond market:

- A return to normal times

- Strong economic growth

- A crisis of confidence in U.S. bonds

Normal times: Why would “normal” times be a threat to the U.S. bond market? In our analysis, one of the best bubble indicators is below-average volatility in an asset or asset class. When tech stocks seemingly went nowhere but up in the late 1990s, when housing prices seemingly went nowhere but up last decade, when we had the hallmarks of a “goldilocks” economy – respective asset price volatilities were below their historic norms. The 2008 crisis was triggered by a return of risk to the markets: as investors had to price in rising volatility – for no apparent reason – banks had to de-lever to make their sophisticated value-at-risk models work; similarly, as investors more broadly pared down their risk, the credit bubble burst. With regard to the bond market, we only need to return to historic levels of volatility for there to be a potentially rather rude awakening: we have had many yield chasers going out ever further on the yield and credit curves (buying longer-dated and less creditworthy securities) that might run for the hills as volatility picks up in the bond market.

Strong economic growth: Some argue that we can outgrow our challenges, but the looming explosion of entitlement spending makes relying on growth unfeasible. However, our concern is with the fallout higher growth might have on the bond market. We got a glimpse of that earlier this year as a couple of economic indicators came in better than expected, leading to a sharp selloff in the bond market. Good luck to the Federal Reserve in containing fallout in the bond market if indeed we get the sort of growth Fed Chairman Ben Bernanke is advocating.

Crisis of confidence: If there is one lesson to be taken from the Eurozone debt crisis, it is that the only language policy makers appear to be listening to is that of the bond market. Policy makers decide between the political cost of acting versus the political cost of not acting. As such, we are not very optimistic that we will implement true entitlement reform unless and until the bond market forces us to. As indicated, however, should that happen, the risk to the U.S. dollar might be significant.

Obama versus Romney: A key difference promoted between Obama’s and Romney’s view of the world is the level of government spending. But independent of our political preferences, any level of government spending must be financed through revenue and borrowing. And that’s where we have a problem:

Obama’s slowing spending growth: Listening to budget experts in support of Obama’s policies, we hear a lot about how spending growth has slowed since 2008. The problem with that argument is that spending levels at the outset of President Obama’s administration were unsustainably high. Trillion dollar deficits are simply not good enough, even if the rate of growth of such deficits is low. When quizzed on the sustainability of the deficit considering the risk to the bond market, we hear that the U.S. dollar is a reserve currency and, as such, we have plenty of time to get to a more sustainable path. We certainly don't have a crystal ball and we know that it may be all but impossible to time if and when the U.S. bond market will tell the government that enough is enough. Forecasting when the tech or housing bubbles would burst was also extremely difficult, although the warning signs were there for all to see. However, relying on the bond market behaving is, in our view, bad policy. Any policy maker that agrees that there’s a potential risk should set policy to mitigate that risk sooner rather than later. Conversely, any investor that agrees that there’s a risk to the bond market should consider taking it into account in his or her portfolio allocation now.

Romney’s sustainable budget: Supporters of a Romney presidency are quick to point out how a Romney/Ryan budget leads to a sustainable budget over time. Indeed, the most positive aspect of the proposal is that it puts a budget on healthcare. Many are not aware that the current healthcare system in the U.S. does not have a budget – it simply lists entitlements: not surprisingly, costs are exploding. One can argue about how one goes about introducing a budget, but the fact that Romney wants to introduce a healthcare budget is extremely important for long-term fiscal sustainability. Because kid you not: Medicare as we know it won’t be around in twenty years – it’s mathematically impossible – there aren’t enough rich folks out there to tax to make it work. But the Romney/Ryan budget plan has a key flaw: we believe it’s most unlikely to be implemented (before those opposing a Romney/Ryan budget breathe a sigh of relief, please re-read the section on Obama’s spending growth). Our pessimism is based not on current polls favoring an Obama/Biden administration, but on the likely stalemate in Congress. Good luck getting a budget through Congress without it being watered down rather severely. But even if Romney/Ryan principles were to prevail, Romney has already made so many concessions, from continued subsidization of student loans to preserving defense spending that a Romney/Ryan budget is at risk of looking very much like the sort of budget we see anywhere in the world: one that replaces the faces, cuts “wasteful” spending and replaces it with “worthy” spending; clearly, what is “wasteful” and “worthy” is in the eye of the beholder; but don’t worry, as in four years, citizens have the opportunity to vote for change yet again. Unfortunately, we might replace the faces, but the deficits may remain.

Real wages haven’t gone anywhere over the past decade. Voters are frustrated. In such an environment, politicians able to distill their message into a Tweet may have a better chance of being elected. That is, we believe more populist politicians may increasingly become members of Congress. In that context, the rise of the Tea Party on the right, as well as Occupy Wall Street on the left is no coincidence. As far as policies are concerned, however, the implication may be that real entitlement reform – key to making our budgets sustainable - remains elusive. In the U.S., just as in the Eurozone, we may be tempted to “kick the can down the road” until the bond market forces us to tackle our problems. Until then, we believe inflation is the path of least resistance: the government nominally delivers on promises made, but the real value of entitlements received is eroded. We just point to the most recent debt ceiling discussion where both Democrats and Republicans appeared open to changing the definition of the Consumer Price Index (CPI) to do just that. Investors may want to consider these risks in their portfolio allocation. For a broader discussion on how global dynamics affect the U.S. dollar and currencies, please join us for our Webinar on Thursday, October 18. Please also sign up to our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.