Stock Market Downtrend May Be Underway

Stock-Markets / Stock Markets 2012 Oct 14, 2012 - 11:15 AM GMTBy: Tony_Caldaro

The bull market that has been full of surprises dropped another one this week. Early in the week the Tech indices, NDX/NAZ, confirmed downtrends. Ending a three month uptrend in those indices. The Cyclical indices, SPX/DOW, continued higher into October with the DOW making a new bull market high. However, they too are weakening now. For the week the SPX/DOW were -2.15%, and the NDX/NAZ were -3.10%. Asian markets lost 1.1%, European markets lost 1.9%, and the DJ World index lost 2.0%. On the economic front things continue to improve: positive reports out numbered negatives ones 8 to 1. On the downtick: the Trade deficit expanded. On the uptick: wholesale inventories, export/import prices, consumer sentiment, the WLEI, the PPI, a Budget surplus, and weekly Jobless claims declined. Next week we get a look at Housing, Industrial production and Retail sales.

The bull market that has been full of surprises dropped another one this week. Early in the week the Tech indices, NDX/NAZ, confirmed downtrends. Ending a three month uptrend in those indices. The Cyclical indices, SPX/DOW, continued higher into October with the DOW making a new bull market high. However, they too are weakening now. For the week the SPX/DOW were -2.15%, and the NDX/NAZ were -3.10%. Asian markets lost 1.1%, European markets lost 1.9%, and the DJ World index lost 2.0%. On the economic front things continue to improve: positive reports out numbered negatives ones 8 to 1. On the downtick: the Trade deficit expanded. On the uptick: wholesale inventories, export/import prices, consumer sentiment, the WLEI, the PPI, a Budget surplus, and weekly Jobless claims declined. Next week we get a look at Housing, Industrial production and Retail sales.

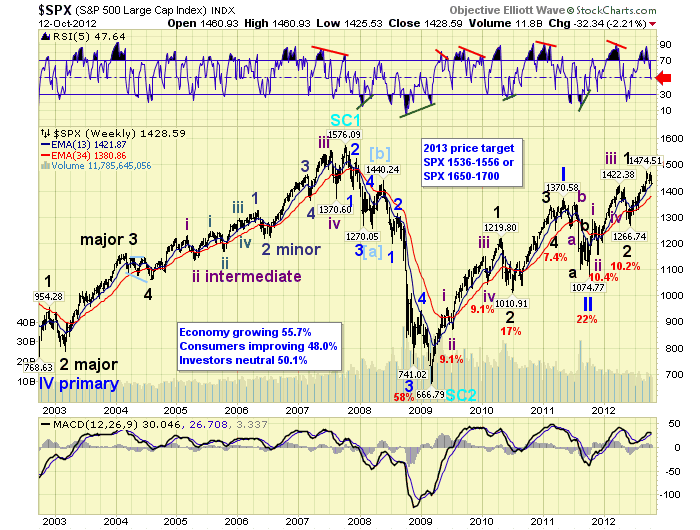

LONG TERM: bull market

On the economic front things continue to improve. This week alone weekly Jobless claims were reported at their lowest level since early 2008. Consumer sentiment reached its highest level since late 2007 - before the great recession. Plus the WLEI has been rising for about a year, and is now at its highest level in about 18 months. Apparently the Central Bank liquidity programs are finally filtering down to the 99%.

The 2009 bull market continues to make progress, but appears to have run into some headwinds this week. While the NDX/NAZ have been flirting with a downtrend confirmation the past week or so. They actually confirmed one this week. With the Tech indices trending downwards, selling pressure is now on the Cyclicals. Currently, it looks like the SPX/DOW are likely to follow and confirm a downtrend as well. The weekly RSI has now declined below neutral, after getting quite overbought. This usually indicates a correction is underway. We would now place the probabilities of this occurring at 60%/40%. While a downtrend may change the medium term picture with a correction. The long term uptrend is still underway.

The weekly chart displays the 2002-2007 bull market, the 2007-2009 bear market, and the current bull market. We have been labeling this market as five Primary waves within a Cycle wave [1] bull market. Primary waves I and II ended in 2011 at SPX 1371 and SPX 1075 respectively. Primary wave III has been underway since that low. Primary wave I divided into five Major waves, with Major 1 subdividing into five Intermediate waves. Primary wave III appears to be following the same wave pattern. Major wave 1 subdivided into five Intermediate waves and concluded in May at SPX 1422/17. After a Major wave 2 correction to SPX 1267, Major wave 3 was underway. Recently Major wave 3 hit SPX 1475/71 in Sept/Oct – a new bull market high.

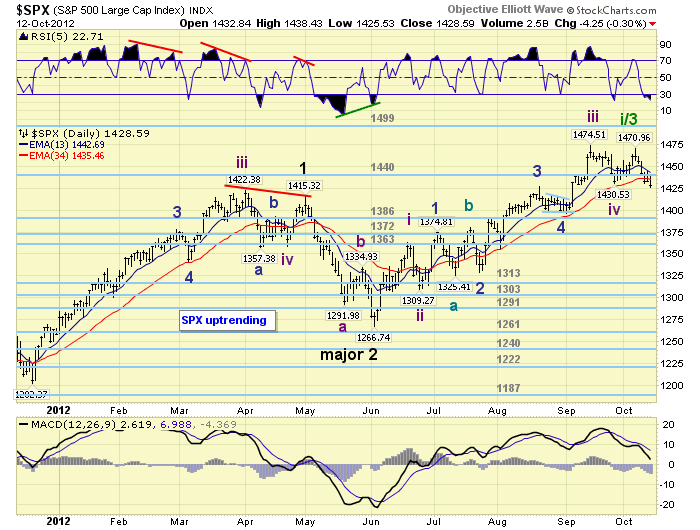

MEDIUM TERM: uptrend in jeopardy

The uptrend, off the Major 2 low in early June, has run into some trouble this week. We have been counting its rise as an extended Major wave 3. Near its beginning we anticipated this uptrend would last from late Q2 into Q4 and reach the OEW 1499 pivot. Thus far it has advanced from SPX 1267 to SPX 1475. In recent weeks we suggested the possibility of SPX 1523/27, or even higher, once the 1499 pivot was cleared. Thus far 1499 has not been reached.

During the uptrend we counted four completed Intermediate waves: Int. one SPX 1363, Int. two SPX 1309, Int. three SPX 1475, Int. four SPX 1431 and Int. five underway. Just last friday the SPX rallied to 1471, while the DOW made a new uptrend high at 13,662. This week, both the SPX and DOW have come under selling pressure, while the NDX/NAZ confirmed downtrends. If the four month uptrend did end in the Cyclicals last friday. The bellwether DOW completed its five waves up, while the SPX had another fifth wave failure. Just another example of keeping an eye on the DOW, when trading the SPX. Medium term support is now at the 1386 and 1372 pivots, with resistance at the 1440 and 1499 pivots.

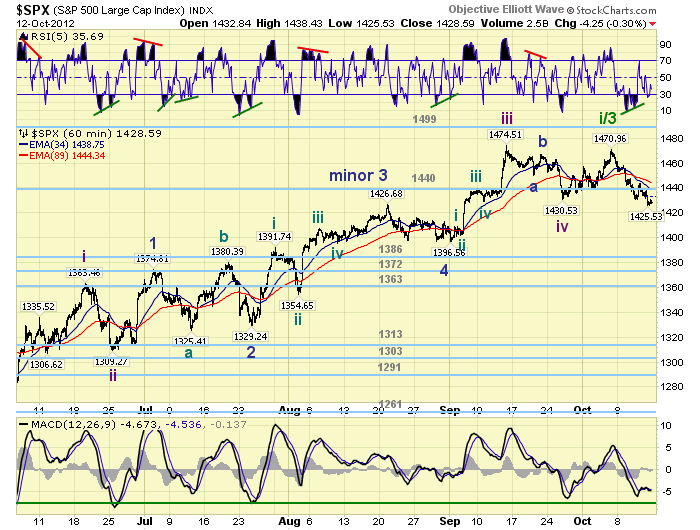

SHORT TERM

Short term support is at SPX 1422/27 and SPX 1413/16, with resistance at the 1440 pivot and SPX 1463/64. Short term momentum ended the week just above oversold. The short term OEW charts remain in a negative bias from SPX 1456 with the swing level now around 1442.

The decline from the recent SPX 1471 has already reached 45 points at SPX 1426. This is the largest decline since mid-July, when Minor wave 2 ended. Typically, in this bull market, fourth waves have been smaller than second waves. This decline now exceeds Minor 4 (30 pts), and the 44 point decline we labeled Intermediate iv. This looks like something more than just a pullback, and is not a good sign medium term.

Should we get a SPX/DOW downtrend confirmation, this entire uptrend was likely Intermediate wave i of Major 3. Not the entire Major 3. This would suggest Major 3 of Primary III is also subdividing, just like the Major wave 1′s. Then the next important support levels would then be in the mid-1390′s and the 1363 pivot. There are several other possibilities at this time. But nothing can be determined until the downtrend is confirmed, or the market surges to new highs. This tricky, at times, bull market continues.

FOREIGN MARKETS

The Asian markets were mixed on the week for a net loss of 1.1%. Japan confirmed a downtrend after a diagonal triangle uptrend.

The European markets were all lower for a net loss of 1.9%. No downtrend confirmations yet.

The Commodity equity group were all lower on the week for a net loss of 1.0%. No downtrend confirms here as well.

The DJ World index lost 2.0% on the week and has not confirmed a downtrend.

COMMODITIES

Bonds remain in a choppy downtrend but gained 0.3% on the week.

Crude is still in a downtrend, but did find support with the positive divergence and gained 1.8% on the week.

Gold continues to look like it has started a downtrend, losing 1.6% on the week.

The USD may have bottomed at its first attempt at DXY 79 support. It gained 0.4% on the week.

NEXT WEEK

Monday kicks off the economic week with Retail sales and the NY FED at 8:30, then Business inventories at 10:00. Tuesday: the CPI, Industrial production and the NAHB housing index. Wednesday: Housing starts and Building permits. Thursday: weekly Jobless claims, the Philly FED and Leading indicators. Then on friday Existing home sales, and Options expiration. As for the FED. FED chairman Bernanke will give a speech on sunday in Japan. Best to your week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.