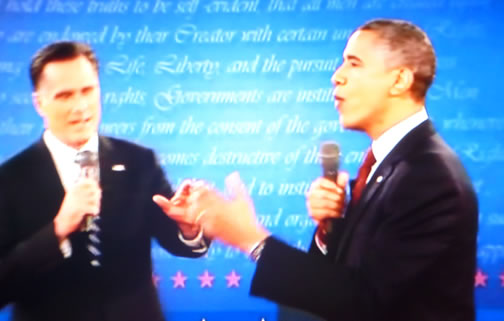

Obama/Romney Presidential Debate Was a Long Walk Through Fantasy Land

ElectionOracle / US Presidential Election 2012 Oct 19, 2012 - 06:47 AM GMTBy: Money_Morning

Martin Hutchinson writes:

On economic matters, the second presidential debate on Tuesday evening is one that took place in fantasyland.

Martin Hutchinson writes:

On economic matters, the second presidential debate on Tuesday evening is one that took place in fantasyland.

Despite the spin, it bore no relation whatsoever to the problems we actually face.

Much of the economic part of the discussion centered around the President Barack Obama's and Governor Mitt Romney's competing plans to cut taxes. That discussion itself was laughable.

The federal budget is in deficit to the tune of $1 trillion per annum; without a major program of spending cuts and -- yes - tax increases, we will be staring bankruptcy in the face by the end of the next presidential term.

The federal budget is in deficit to the tune of $1 trillion per annum; without a major program of spending cuts and -- yes - tax increases, we will be staring bankruptcy in the face by the end of the next presidential term.

The truth is any possible tax cuts will be trivial.

The important questions revolve around which taxes will be increased and, most important, how will we ensure that Congress actually makes the gigantic spending cuts that are necessary.

Romney Has Serious Math Problem

Romney was the worst offender in this respect. But neither candidate's plans were anywhere close to adding up. At least the president's emphasis on soaking the rich makes a gesture towards balancing the budget.

Romney's attempt to prove that he can cut tax rates, keep the proportion of taxes paid by the wealthy constant and give the middle class a tax cut all without widening the deficit doesn't work algebraically.

He's imposing four incompatible criteria on an equation with only three unknowns, and it won't work.

As both candidates know perfectly well, the next four years will be ones of austerity, with the ideal mix of austerity being three dollars of spending cuts for every dollar of tax increases. As Britain has discovered, a more tax-centered austerity simply plunges you back into recession.

Yet the question of how they would cut spending was never discussed, even though, if we are to avoid another deep recession, it needs to be about three quarters of the solution to our problems.

Romney's proposal to eliminate tax deductions is the best way to increase taxes, but his offsetting tax rate cuts are hopelessly unrealistic.

Spending has been allowed to grow out of control, a process begun by a Republican President, George W. Bush, and a Republican Congress led by Dennis Hastert.

Given the lack of discipline in the past, some tax increases are now necessary. We should hope that they can be confined to eliminating the home mortgage and charitable deductions, both of which would be economically beneficial.

Obama Has A Big-Government Problem

If Romney's tax arithmetic was most skewed, President Obama failed to address the real economic problem with his presidency.

I'm reasonably confident that a re-elected President Obama would produce only moderate tax increases -- he'd have difficulty getting severe ones through Congress.

As for spending, the president will undoubtedly try to waste some more money, but again the real problem is in Congress, which is quite capable of wasting huge amounts of money on its own.

However, the real economic area where President Obama has free rein is in regulatory policy, and here his re-election is genuinely dangerous.

His EPA has already effectively banned the construction of new coal-fired power stations and asserted its right to regulate greenhouse gases by regulatory diktat, rather than through a market-based carbon tax pricing system.

He has also refused permission for the Keystone pipeline, which would have brought us vast quantities of cheap Canadian oil. His EPA hasn't prevented fracking, however, and has doubtless kicked itself for missing the opportunity to kill it before it took off.

But with four more years he may well find a way of killing its expansion.

His automobile fuel standards have set a goal of over 50 miles per gallon that is impossible to meet with current technology, and thus imposes ruinous costs on both Detroit and U.S. automobile buyers.

Regulatory costs are the principal reason why U.S. growth has been so unsatisfactory, and has produced so little benefit for the middle class.

Productivity growth averaged 2.8% annually for the quarter-century to 1973, then took a sudden nosedive and has since averaged only 1.8% annually, more than a third lower.

It is not a coincidence that the early 1970s saw the birth of the EPA, along with OSHA and other regulatory agencies; it also saw the birth of the environmental trial-lawyer movement, which ties up every new project for years with legal disputes.

That's also why we can't build infrastructure these days. The legal and regulatory costs are so great as to make it impossibly expensive. The Holland Tunnel under the Hudson River between New York and New Jersey was completed in 1927 at a cost of $48 million, equivalent to $700 million today.

A functionally identical duplicate tunnel was recently vetoed by New Jersey Governor Chris Christie on the grounds of its cost of $8.7 billion. The two tunnels were across the same river, and designed to do the same thing -- carry two lanes of traffic in each direction.

Yet today's tunnel costs 12 times as much in real terms as the one built in the 1920s -- and would doubtless take 5 or 6 years longer to complete.

Without our current regulatory and trial-lawyer infrastructure, our GDP would be about 40% higher, based on the difference between pre-1973 and post-1973 productivity trends.

That's the hidden secret of U.S. decline, and that's the hidden cost of an additional Obama term, far above any tax increases or wasteful government spending.

The problem is bipartisan; the major additions to the regulatory bloat came under President Nixon and the first President Bush. A President Romney might not tackle the problem, but at least he probably wouldn't make it worse.

The bottom line is neither candidate's plan is based in reality at the moment.

Source :http://moneymorning.com/2012/10/19/the-obamaromney-debate-was-a-long-walk-through-fantasy-land/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.