Fiat Currency Credit Creation to Prevent Banking System Failure

Stock-Markets / Credit Crisis 2008 Feb 15, 2008 - 05:01 AM GMTBy: Ty_Andros

Bombfire of the Vanities! - As the Wolf wave of income growth spreads throughout the G7 (see 2008 outlook in the archives at www.TraderView.com ), the last several years of financial alchemy lights fires to bond markets, banks and financial institutions worldwide. The complete and absolute mispricing of risk since Alan Greenscam, er Greenspan, became Federal Reserve chairman in 1987 is now causing the great inflationary crisis predicted by Ludvig von Mises. The days of New York as financial capital to the world are coming to an end! They can never regain the confidence of their customers! The epicenter of this unfolding crisis is Wall Street, but the bomb blasts are occurring throughout the G7 and the world. You can expect the G7 central banks to act in a predictable manner. THEY WILL PRINT THE MONEY!

Bombfire of the Vanities! - As the Wolf wave of income growth spreads throughout the G7 (see 2008 outlook in the archives at www.TraderView.com ), the last several years of financial alchemy lights fires to bond markets, banks and financial institutions worldwide. The complete and absolute mispricing of risk since Alan Greenscam, er Greenspan, became Federal Reserve chairman in 1987 is now causing the great inflationary crisis predicted by Ludvig von Mises. The days of New York as financial capital to the world are coming to an end! They can never regain the confidence of their customers! The epicenter of this unfolding crisis is Wall Street, but the bomb blasts are occurring throughout the G7 and the world. You can expect the G7 central banks to act in a predictable manner. THEY WILL PRINT THE MONEY!

The great paper factories and castles are crumbling and burning throughout the G7. As the assets underpinning those securitized NOTES are reverting to their true values and exposing them for the malinvestments that they are, so are the notes which have been sold to investors. The dichotomy of triple AAA and other highly rated, securitized notes yielding up to 14% is being resolved to the detriment of the investors in them. They were too good to be true, and they weren't. So now they are being re-rated to reflect the junk that they are and were: Falling from their previous lofty status to their true values. The delicious IRONY of these financial wizards left holding the most toxic of their own brew is poetic justice of the highest order.

In order to keep the game of FIAT CURRENCY AND CREDIT CREATION going and save the most powerful sector of constituents (the financial and banking industries) of the G7 public servants, w e are going to see one of the greatest redistributions of wealth from creditors to debtors in history. Government treasuries, while appearing to be safe, are also set to lose purchasing power on a gargantuan scale, in what will become known in the history books as the “great reflation”. First, let's recall the prophetic words outlining the G7 central banks' unlimited power to create inflation by the Federal Reserve governor, and now chairman, “Helicopter” Ben Bernanke in November 2002:

In order to keep the game of FIAT CURRENCY AND CREDIT CREATION going and save the most powerful sector of constituents (the financial and banking industries) of the G7 public servants, w e are going to see one of the greatest redistributions of wealth from creditors to debtors in history. Government treasuries, while appearing to be safe, are also set to lose purchasing power on a gargantuan scale, in what will become known in the history books as the “great reflation”. First, let's recall the prophetic words outlining the G7 central banks' unlimited power to create inflation by the Federal Reserve governor, and now chairman, “Helicopter” Ben Bernanke in November 2002:

“The U.S. government has a technology, called a printing press (or today, it's electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation”.

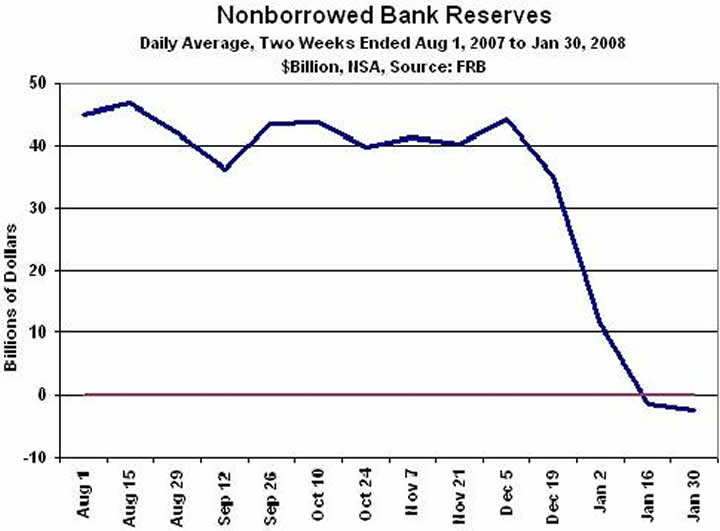

In the United States a run on the banks has begun, foreign depositors and scared individuals are withdrawing their money in epic fashion. However, it is being held out of the headlines as the Federal Reserve applies its latest techniques to underpin the systemic risks to the banks and financial systems -- known as the Temporary Auction Facility, aka TAF. This is where the Federal Reserve acts as lender of last resort and has opened the borrowing facility window in an anonymous fashion, in order to prevent bank runs such as was witnessed with Northern Rock. This is the mechanism the central bank has created that will allow banks to take their most impaired assets and monetize them to meet the calls for withdrawal from depositors and maintain daily/weekly/monthly/yearly operations. Let's take a look at a chart showing non-borrowed reserves since August from the Saint Louis Federal Reserve:

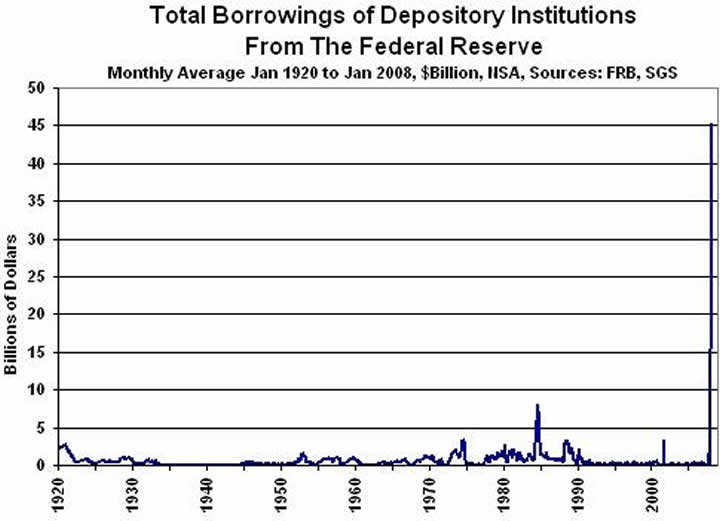

Now let's take a look at borrowings since the 1920 from John Williams at www.shadowstats.com :

These charts are nothing more then a reflection of a RUN ON THE BANKS, domestic and international. The US banking system would be closed at this point, had the Temporary Auction Facility not been created. It is clear that this technique was imported from the ECB (European central bank), which has lent about $500 billion euros of the same since November 2007. As we have said to readers for years, the banks are nothing more then hedge funds in disguise and they are blowing up on a daily basis as their managers have never been up to the task of speculation on the scale which was being practiced, facilitated and financed.

Just this morning, UBS announced another $25 billion dollars of exposure to ALT-A mortgage securities. This is not going to be the last exposure announcement for a major bank. Money center and investment banks are STILL choking on the Pigs in the Investment Python (private equity loans which were slated to be collateralized loan obligations) that we covered last summer. At that time there was over $360 billion dollars of these lending obligations sitting in the warehouses, now that has been reduced to approximately $250 billion, but the bids on them are now in the mid 80's indicating the junk they were then are now beginning to be properly priced as such. NO ONE WILL TOUCH THEM AT CURRENT PRICES! In the mid 80's, this represents another $40 billion dollars of losses yet to be announced.

In congressional testimony today, Bernanke acknowledged the risks sitting on the balance sheets of Freddie Mac and Fannie Mae, stating balance sheet repair looms on the near horizon. The finger pointing has just begun and it remains to be seen on which donkey the public servants PIN the tail. The trial bar is holding packed seminars on how to go after the culprits who perpetrated these frauds called CDO's, CLO's, CMO's and the alphabet soup of securitized financial alchemy. The money is just going to money heaven, along with the money you are holding.

The G7 Central banks are beginning to extend their limitless balance sheets to any and all within their respective regions . It is as easy for them as a few keystrokes and abra cadabra; it appears out of thin air, LITERALLY! In Spain , the market for mortgage-backed securities is closed for business. Instead of letting the mortgaging of real estate stop and freeze, the Spanish banks are lending, then packaging them into securities. And then, rather then selling them to investors, they are taking them directly to the ECB, who buys them and creates the liquidity that has vanished from the private sector lenders and investors.

The money to invest is there, but the trust that investors will get it back is not. In the United States , the TAF facility has been extended to amounts as small as $5 million. So banks big and small can belly up to the window in anonymity. There are approximately $300 billion dollars of announcements left in the mortgage arena and that does not include the coming commercial real estate and construction CDO's, credit card and auto loans which are going to sour considerably. Throughout the G7, financial institutions will probably suffer as much as a trillion dollars of losses on various types of bad debt before this is over.

You can expect the G7 lending windows and TAF facility to grow enormously, as well as the definition of securities and eligible collateral to be pledged to widen considerably . The troubled banks will probably be allowed to roll the loans indefinitely. Then the G7 and the Federal Reserve will lower interest rates to bolster bank balance sheets and, as they can withstand the write downs, the bad loans will be dribbled out over the time needed to do so without destroying the bank in question.

The risks will be socialized to the taxpayers of the G7 (they will print the money) and the profits will be allowed to remain in the private hands of the owners of the financial institution. Inflation is set to jump and the purchasing power of your FIAT currencies will continue to melt away. There is approximately $3.5 trillion dollars sitting in U.S. money market funds and the number is growing at record rates seeking shelter from the unknown storms. Unfortunately, there is one storm they won't sidestep and that is the printing press.

Savers will be tossed overboard and the savings yield they would normally receive will flow to the balance sheets of the banks, rather than to their savings accounts. During this time you can expect depositors to be left in the dark to avoid bank runs due to the BAD news. I imagine it will also be accessible to the investment banks as well. New lending will take place but lending requirements will be considerably tightened so as to not create new MORAL hazards during the period of low interest rates. Of course the little guy will be crushed under the heels of the incipient inflation this will create.

The top three Monoline insurers suffered a withering blow this week as Warren Buffet offered to reinsure their Muni bond business; in effect snatching their best and safest business and leaving them with the trash, and giving them 30 days to take it or leave it. The banks howled as the insurance they purchased from them is now about WORTHLESS. You can expect this deal to close as the political pressure to allow the escape of the now trapped municipalities from these TAR babies will be relentless until they hand over the business to Berkshire Hathaway. Leave it to Warren to snatch the jewels and side step the trash. The bidding has begun for these insurance contracts on the state and municipal business. I will lay dollars to donuts he gets the business.

In conclusion , the bailout of the G7 banks, brokers and financial systems is in full swing, it will require trillions of Dollars, Euros, Pounds, etc. be printed and interest rates will crumble lower. It will be done. The public will demand it and the public servants will deliver it. Federal, state and municipal income is set to implode while their budget deficits just march higher; the bailout here is yet to come into view. A bailout of the Monoline insurance firms will happen in one form or another. It is clear that every level of government is aware of the systemic risk from them and working hard on a solution. Black helicopters are making nightly drops of money into the G7 financial systems on a daily basis, dropping money into the blast holes of financial institutions' balance sheets. Vigorous efforts are underway to PAPER over the problems!

The turmoil generated by the blow-by-blow headlines will provide you opportunities to gather value from your paper currencies, and then the assets will rocket higher to reflect the lower purchasing power of the currency in which they are priced. If the financial system was going to implode it would have done so by now, as illustrated by the non borrowed reserves. Take a look at what gold has done in price since those reserves took a nose dive. It has raced higher to reflect the money creation; M3 is still racing along at a 15% plus clip. The unfolding “Crack up Boom” just slipped into a higher gear!

Remember, currencies don't float they just sink at different rates and this time will be no different. The deflation of the purchasing power is set to accelerate, and bonds and paper currencies are bombs, guaranteed certificates of confiscation. As the G7 lowers short term rates, bondholders and savers will be hit with a double whammy: Low rates of return and loss of purchasing power. Last year the loss of purchasing power was approximately 25 to 30% based on a basket of commodities or gold, somehow money markets don't seem so safe anymore? This is going to send volatility solidly higher in all markets, as perceptions change and are then priced into the various markets. Whoooppppeeee!!! Volatility is opportunity, get comfortable with it and thrive. Short circuiting the printing press in your investments is job number one, once done then you can invest for potential profit.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Gordon

25 May 10, 16:14 |

The Prediction

What happened? The disaster you proclaimed hasn't happened as of this date: 05/25/10. |