Stock Market Continues to Correct

Stock-Markets / Stock Markets 2012 Oct 22, 2012 - 06:51 AM GMTBy: Tony_Caldaro

Another wild week! After we posted last weekend that the SPX/DOW appeared to be declining in a downtrend. The market promptly rallied, from monday thru thursday, to within 1% of the bull market highs. Then, suddenly, gave all of those gains back in 24 hours. For the week the SPX/DOW were +0.2%, and the NDX/NAZ were -1.4%. For a change, the Foreign markets did much better. Asian markets gained 1.5%, European markets gained 3.0%, and the DJ World index rose 1.3%. On the economic front positive reports outnumbered negative reports 13 to 3. On the downtick: the NY FED, existing home sales and weekly jobless claims rose. On the uptick: retail sales, business inventories, the CPI, industrial production, capacity utilization, the NAHB housing index, housing starts, building permits, the Philly FED, leading indicators, the M1 multiplier, the monetary base and the WLEI. Next week the FED meets tuesday/wednesday, plus we get the first report on Q3 GDP.

Another wild week! After we posted last weekend that the SPX/DOW appeared to be declining in a downtrend. The market promptly rallied, from monday thru thursday, to within 1% of the bull market highs. Then, suddenly, gave all of those gains back in 24 hours. For the week the SPX/DOW were +0.2%, and the NDX/NAZ were -1.4%. For a change, the Foreign markets did much better. Asian markets gained 1.5%, European markets gained 3.0%, and the DJ World index rose 1.3%. On the economic front positive reports outnumbered negative reports 13 to 3. On the downtick: the NY FED, existing home sales and weekly jobless claims rose. On the uptick: retail sales, business inventories, the CPI, industrial production, capacity utilization, the NAHB housing index, housing starts, building permits, the Philly FED, leading indicators, the M1 multiplier, the monetary base and the WLEI. Next week the FED meets tuesday/wednesday, plus we get the first report on Q3 GDP.

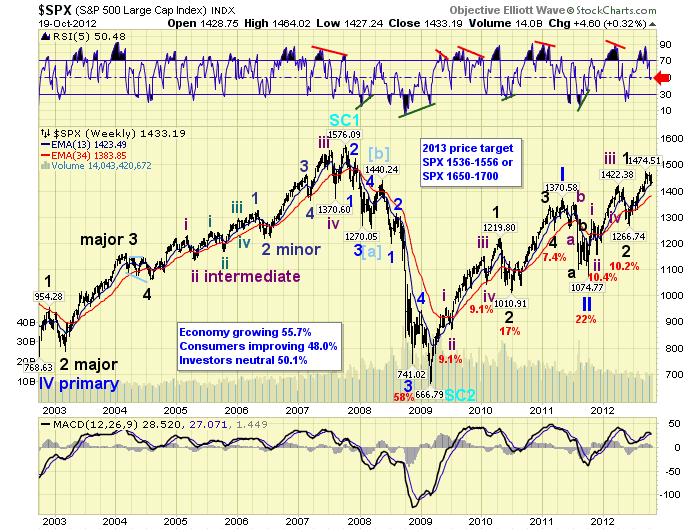

LONG TERM: bull market

While the stock market has remained in a SPX 1426 to SPX 1475 trading range for the past several weeks we have continued to receive improving economic reports. Housing starts/permits are currently at four year highs, New home prices just hit four year highs, the Unemployment rate is at a four year low, the WLEI has risen from 51.9% to 56.1% during this period, and Consumer sentiment just hit a 5 year high. But corporate earnings and the GDP, for the past two quarters, have been somewhat lackluster. We believe, based on our fundamentals indicators, the economy is perking up again.

Our long term review continues to suggest a bull market, of Cycle degree, has been unfolding since March 2009. This Cycle wave [1] bull market is dividing into the normal five Primary waves. Primary waves I and II completed in 2011 at SPX 1371 and SPX 1065 respectively. Primary wave III has been underway since that low. Primary I divided into five Major waves, with a subdividing Major wave 1. Primary wave III has also been following the same path, as you can observe on the weekly chart. The market appears, however, to be entering a period that may create a slight deviation from the expected path. This is explained below.

Longer term: once Major wave 3 completes, a Major wave 4 correction will follow. Then a rising Major wave 5 will complete Primary III. Then after a Primary wave IV correction a rising Primary wave V will complete the bull market. We still anticipate this will occur by mid to late 2013 near all time new highs SPX/DOW, or higher.

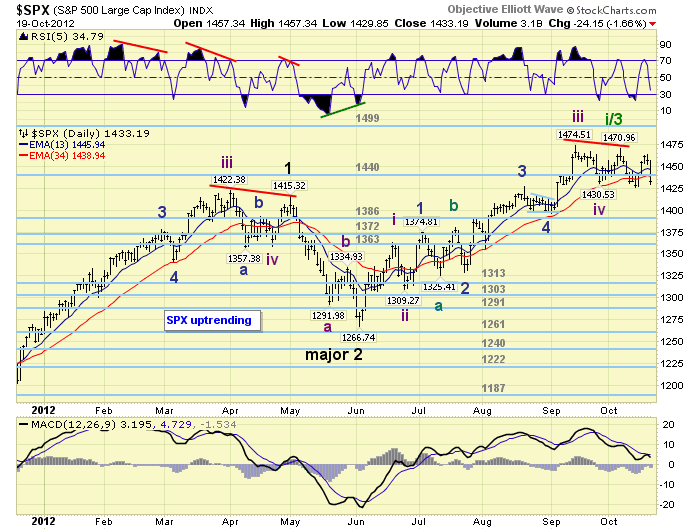

MEDIUM TERM: uptrend in jeopardy

Last weekend we noted the growth NDX/NAZ indices were already in confirmed downtrends. And, the most probable course would be for the cyclical SPX/DOW indices to follow. The rally, during the week, was quite strong and offered several alternate short/medium term possibilities. Nevertheless, we kept the tentative green labels as posted and waited for the market to tip its hand during the three day options expiration period. After the thursday/friday decline it looks like it has.

Major wave 3, of Primary I, was an uninterrupted seven month uptrend. This means there were no trend reversals during the entire uptrend. When Primary III entered Major wave 3 in June we expected the same. We projected a lengthy uptrend into late 2012 nearing the OEW 1499 pivot. After the market hit SPX 1475 in September it appeared to be on track to reach that target, or higher, in the months ahead. Early October, however, right after the bellwether DOW was made a new uptrend high, the SPX failed to make a higher high by 4 points and then the NDX/NAZ confirmed downtrends shortly thereafter. Should the SPX/DOW now confirm downtrends as well, which is probable. The downtrend low will probably overlap the Major wave 1 high at SPX 1422/17. Negating a completed Major wave 3 scenario. This would suggest that Major wave 3, of Primary III, is also subdividing into five Intermediate waves. Just like Major wave 1 of Primary waves I and III.

Currently we prefer this count over a completed Major wave 3 at SPX 1475/71. For now we will keep the current labeling as is until a downtrend is confirmed and the overlap occurs. If this does come to pass Major wave 3 will then be subdividing into five Intermediate waves. Intermediate wave one would have just completed, and the currect correction would be Intermediate wave two. What would follow is a rising Int. wave three, then a correctional Int. four, followed by a rising Int. wave five to complete Major 3. This would suggest a much higher, than SPX 1499, upside price target for Major wave 3. Interesting times!

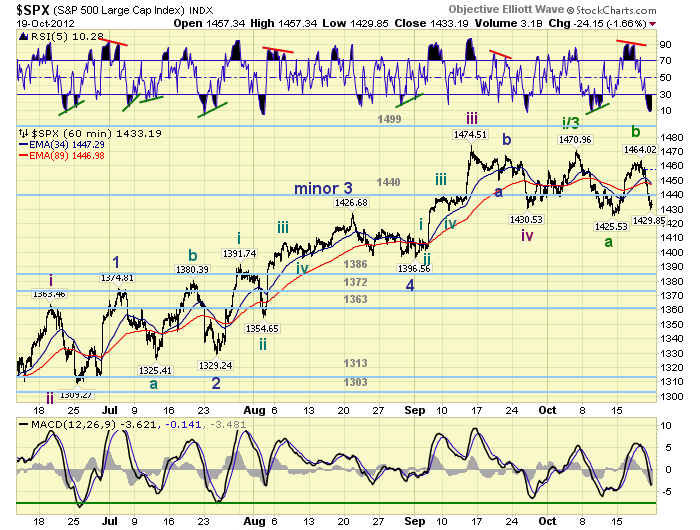

SHORT TERM

Short term support is at SPX 1422/27 and SPX 1413/16, with resistance at the 1440 pivot and SPX 1463/64. Short term momentum ended the week extremely oversold. The short term OEW charts are now negatively biased with the swing level around SPX 1447.

Counting the entire uptrend from early June at SPX 1267 we have five waves up: wave 1 SPX 1363, wave 2 SPX 1309, an extended wave 3 to SPX 1475, wave 4 SPX 1431, and wave 5 ending at SPX 1471, (a 5th wave failure). During Major wave 1, Primary III, the SPX 5th wave also ended in a failure. So this is not unusual in this market. If we count this as a completed uptrend, with a downtrend underway. We can then label, (and we have), wave A at SPX 1426, and wave B at SPX 1464, with wave C underway now.

We also have to keep in mind that second waves, (should this be Intermediate wave two), during this bull market have been rather steep corrections. It’s the fourth waves that have been relatively minor corrections. With this in mind we can now project some Fibonacci and retracements targets for wave C. At SPX 1419 wave c = wave a, at SPX 1391/93 wave c= 1.618 wave a and a 38.2% retracement of the uptrend, SPX 1369 it’s a 50% retracement, and at SPX 1345/46 wave c = 2.618 wave a and it’s a 61.8% retracement. There you have it: SPX 1419, SPX 1391/93 (OEW 1386 pivot range), SPX 1369 (OEW 1363 pivot range) and SPX 1345/46. Best to your trading!

FOREIGN MARKETS

The Asian markets were all higher on the week for a net gain of 1.5%. Only China and Japan are in confirmed downtrends, but are improving.

The European markets were all higher as well for a net gain of 3%. No confirmed downtrends yet.

The Commodity equity group were mixed on the week for a net gain of 1.2%. No confirmed downtrends as well.

The DJ World index is still uptrending and gained 1.3% on the week.

COMMODITIES

Bonds continue to downtrend and ended the week with a 0.7% loss.

Crude is still downtrending and lost 1.1% on the week.

Gold has nearly confirmed a downtrend and lost 1.9% on the week.

The USD remains in a downtrend but ended the week flat.

NEXT WEEK

The market will likely trade on earnings reports and technicals, until the first economic reports of the week are released on wednesday. On wednesday: New home sales and the FOMC statement. Thursday: weekly Jobless claims, Durable goods orders and Pending home sales. On Friday: Q3 GDP (estimates +0.9% to +1.9%), and Consumer sentiment. Best to your weekend and week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.