Is Financial Crime A Systemic Risk?

Stock-Markets / Global Debt Crisis 2012 Oct 23, 2012 - 07:15 AM GMTBy: Ron_Hera

Famed Austrian economist Ludwig von Mises wrote in his seminal work, Human Action (originally published by the Yale University Press in 1949), that “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” The collapse of a historic credit bubble occurred in 2008. However, despite years of further credit expansion, “a final and total catastrophe” of the U.S. dollar system has yet to occur.

Famed Austrian economist Ludwig von Mises wrote in his seminal work, Human Action (originally published by the Yale University Press in 1949), that “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” The collapse of a historic credit bubble occurred in 2008. However, despite years of further credit expansion, “a final and total catastrophe” of the U.S. dollar system has yet to occur.

While an inflationary U.S. monetary policy has serious consequences, hyperinflation is not an immediate result. There are three general ways in which the U.S. dollar system could break down: (1) rejection of the U.S. dollar as the world reserve currency, or (2) as an eventual consequence of U.S. federal government insolvency and (3) a domestic failure of confidence. Of the three, U.S. federal government insolvency is the most serious because it would result in both the loss of the U.S. dollar’s world reserve currency status and also in a failure of domestic confidence. However, a new threat to the U.S. dollar has emerged which could trigger a hyperinflationary collapse before the U.S. federal government’s finances become unworkable, e.g., when debt service begins to crowd out military and Social Security spending. Specifically, the perceived legitimacy of the U.S. financial system has not merely been tarnished by recent scandals but is in danger of collapsing. The consequences of a domestic breakdown of confidence and trust in the U.S. financial system cannot be overstated.

World Reserve Currency Status

The most commonly cited challenge to the U.S. dollar system relates to its waning status as the world reserve currency. The BRIC countries (Brazil, Russia, India and China), along with South Africa, no longer use the U.S. dollar for trade settlement amongst one another. The Chinese have internationalized the renminbi (RMB), which is now used in trade settlement with the other BRIC countries, as well as with Australia, Japan, the United Arab Emirates (UAE), Iran and various South American and African countries under bilateral agreements. Iran, which is the world’s 4th largest oil exporter, has refused to accept U.S. dollars in exchange for crude oil since 2009. While European countries utilize the euro, South American countries have instituted a local currency payment system, the Sistema de Pagamentos em Moeda Local or SML. At the same time, the IMF stands ready to settle international trade using Special Drawing Rights (SDRs). However, local settlement at the regional level is largely irrelevant.

At the global level, the implicit crude oil backing of the U.S. dollar by the Organization of the Petroleum Exporting Countries (OPEC) remains in place and the U.S. military remains dominant. As long as OPEC backs the U.S. dollar, and as long as there is no viable challenger, the U.S. dollar is unlikely to be deposed. The euro, for example, is a troubled currency and its future is questionable. China’s economic ascent is likely to continue and the RMB can be redeemed for Chinese-manufactured goods. However, the Chinese economy is currently in a recession, the RMB is not a fully international currency and China’s military is not ready to take on the role of a global superpower.

At present, no national currency stands as a viable challenger for the position held by the U.S. dollar and there is no consensus regarding its eventual replacement. However, discussion of the gold standard has moved from the fringes of the financial world into the mainstream. The price of gold has risen in response to widespread currency debasement, i.e., as a hedge against inflation.

OPEC and many other countries could, potentially, fall back to gold if the U.S. dollar were no longer viable, i.e., if the prices of global commodities, and especially the price of gold, were to rise at an accelerating rate measured in U.S. dollars. China and Russia, for example, are significant buyers of gold and crude oil can be purchased with gold instead of U.S. dollars pursuant to bilateral agreements, if not on world markets generally. An eventual return to the gold standard is possible but seems unlikely in the near term.

Governments, banks and corporations around the world hold trillions of U.S. dollars along with U.S. dollar denominated financial assets, such as U.S. stocks and U.S. Treasury bonds. Even countries hostile to the United States cannot benefit by refusing U.S. dollar transactions or by dumping U.S. Treasury bond holdings in the market. Ignoring the fact that the Federal Reserve and its Primary Dealers, together with other Western central banks, stand ready to intervene as needed to support the U.S. dollar, retaining the majority of the value of U.S. dollar holdings is always a superior alternative in the short run, particularly if the alternatives are economic sanctions, war, or, in the case of the U.S. dollar’s collapse, a 100% loss.

In other words, the tolerance of the world financial system and of the global economy for the U.S. zero percent interest rate policy (ZIRP), ongoing U.S. Treasury bond market interventions, i.e., Operation Twist, and quantitative easing is far greater than is commonly believed. The U.S. dollar certainly will be replaced as the world reserve currency at some point in the future, but claims that the U.S. dollar is in danger of imminent collapse as a result of international rejection are exaggerated.

U.S. Federal Government Debt and Unfunded Liabilities

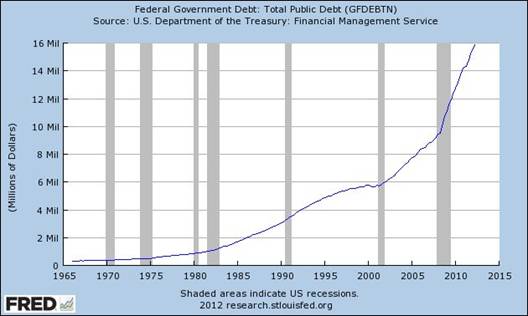

Setting aside the world reserve currency status of the U.S. dollar, the largest threat lies in the risk of U.S. federal government insolvency. Before the 2008 financial crisis, the U.S. federal government had reached a point where no combination of economic growth, tax increases or government budget cuts will allow it to pay back its public debt and also meet its unfunded liabilities.

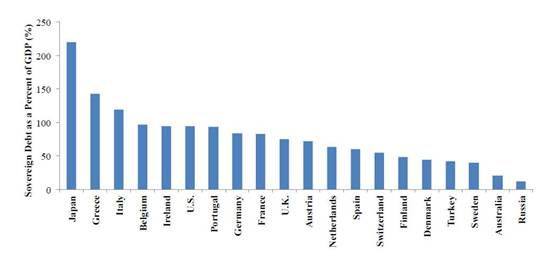

As a percentage of GDP, total U.S. federal government debt is larger than that of Spain and nearly as large as that of Portugal and Ireland.

The U.S. federal government’s budget deficit, which stands at approximately 8.7% of U.S. GDP, is as high as that of Greece and higher than those of Spain, Portugal and Italy.

Total U.S. government spending at all levels is approximately 40% of GDP and, unless economic conditions improve, will increase further. Unfunded liabilities of the U.S. federal government total $61.6 trillion ($534,000 per household). The liabilities include federal debt ($9.4 trillion) and obligations for Medicare ($24.8 trillion), Social Security ($21.4 trillion), military retirement and disability benefits ($3.6 trillion), federal employee retirement benefits ($2 trillion) as well as state and local government obligations ($5.2 trillion). Based on Generally Accepted Accounting Principles (GAAP), economist John Williams has projected U.S. federal government insolvency and, as a result, hyperinflation, as soon as 2014. Mr. Williams’ projections do not include the fact that numerous U.S. states, counties and cities are insolvent or at risk for bankruptcy.

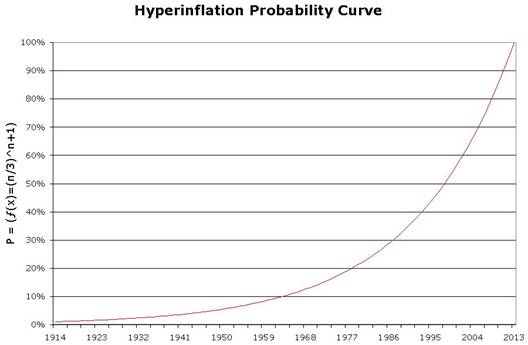

The insolvency of a sovereign nation becomes inevitable once new borrowing is required to service existing debt, but the Minsky moment only arrives when (1) further borrowing becomes impossible and also when (2) monetization results in rejection of the currency. The more unworkable U.S. federal government finances become, the more likely a hyperinflationary collapse of the U.S. dollar will become. Increases in the money supply and in debt levels suggest that the probability of a hyperinflationary collapse of the U.S. dollar is increasing at an accelerating rate.

An inevitable outcome is not necessarily an immediate one and U.S. policymakers are masters of “kicking the can down the road.” Another financial crisis or a further economic decline in the U.S. could accelerate the financial breakdown of the U.S. federal government, but a robust U.S. economic recovery, technological breakthroughs and other decelerating factors could delay it.

Despite the fact that Mr. Williams’ Hyperinflation Special Report 2012 is required reading, the timing of the predicted outcome assumes a low international tolerance for the monetization of U.S. federal government debt. Mr. Williams implicitly assumes that the market for U.S. treasuries is a free market and that, therefore, either U.S. Treasury bond yields will skyrocket or that willingness to lend to the U.S. will collapse, but that may not be the case. Together with other central banks, the Federal Reserve could continue to manipulate U.S. Treasury bond yields and the value of the U.S. dollar for an indefinite period of time. On one hand, according to Herbert Stein’s Law, “If something cannot go on forever, it will stop.” On the other hand, the U.S. dollar remains ‘the worst currency in the world, except for all the rest.’

Since the start of the Federal Reserve System, the U.S. dollar has passed one apparent ‘point of no return’ after another and with each one, e.g., the start of QE3, critics have argued that the collapse of the U.S. dollar is imminent. The roots of the arguments generally date back to 1971 when Nixon closed the gold window. Severing the link to gold was a crucial point of no return, but, more than forty years later, a hyperinflationary collapse of the U.S. dollar has yet to occur. If history is any guide, additional points of no return lie ahead for the U.S. dollar.

Domestic Confidence in the U.S. Dollar

Within the United States, outside of Wall Street and Washington D.C., the overall economic environment in the broad U.S. economy remains deflationary. Bank lending to consumers and small businesses remains depressed while debt service represents steady deflationary pressure. In other words, private sector debt levels remain high and money is relatively scarce in the ‘real economy’. Reported increases in consumer credit are significantly the result of increased student loans, which are linked to unemployment and poor job prospects for young people.

A scarcity of physical notes or a race to shed currency in favor of hard assets seems unlikely to originate within the U.S. unless there is first a conspicuous scarcity of goods. Virtually unlimited support for banks by the U.S. federal government and by the Federal Reserve has thus far proven sufficient to prevent a panic. U.S. households do not generally have cash and often rely on electronic conveniences, such as automated payroll deposits, electronic bill payment and on credit and debit cards. Additionally, unlike countries that have suffered hyperinflation in recent history, U.S. citizens have no practical alternative currency. In the absence of runaway inflation, the impetus to flee the banking system or to rush out of the U.S. dollar is unlikely to originate in a domestic collapse of confidence regardless of U.S. monetary policy.

An outlying but growing problem is the risk of a breakdown of confidence and trust in the U.S. financial system related to its perceived legitimacy. Recklessness, criminality, out-of-control automated trading systems (ATS) and apparent failures of regulation and law enforcement pose a serious threat to the U.S. dollar system.

Before the 2008 financial crisis, confidence in the U.S. financial system was shaken by fraudulent sub-prime mortgage lending and securitization practices. The collapse of the housing bubble and the 2008 financial crisis revealed profound systemic risks. In 2010, the so-called “Flash Crash” reopened questions about the stability of U.S. financial markets and, in 2011 “robo-signing” and other foreclosure frauds were reminiscent of sub-prime lending.

In late 2011 and 2012 perception of the U.S. financial system suffered a staccato of blows, including the failure of MF Global Holdings Ltd., with the loss of $1.6 billion in customer funds; JPMorgan Chase & Co.’s $6.2 billion “London Whale” OTC derivatives trading loss; the failure of Peregrine Financial Group Inc. (PFGBest), with the loss of over $200 million in customer funds; money laundering by HSBC for drug cartels, including Mexico’s most violent criminal organization, Los Zetas, and for states that sponsor terrorist organizations; Knight Capital Group Inc.’s high-frequency trading (HFT) loss of $440 million; as well as a growing number of civil and criminal cases linked to mortgage, foreclosure and securities fraud.

Scandals elsewhere in the world, such as the rigging of the London Interbank Offered Rate (LIBOR) by Barclays, in cooperation with other banks, including JPMorgan Chase & Co. and Citigroup, Inc. in the U.S., further undermine confidence in the U.S. financial system.

A Black Swan?

Recklessness, criminality, out-of-control automated trading systems (ATS) and apparent failures of regulation and law enforcement could trigger a hyperinflationary collapse. The result of a domestic breakdown of confidence and trust in the U.S. financial system would not be a traditional run on banks or a rush into cash due to mistrust of banks (creating demand for physical notes) or a rush out of dollars into hard goods due to runaway inflation but rather a run on financial markets. If investors, pensioners, private institutions and fund managers withdraw from the markets in order to preserve their capital, it could potentially cause not merely a stock market decline but a crash. In the worst case, a domestic breakdown of confidence and trust could lead to a near total collapse of U.S. financial markets. The failure of financial firms, the accelerated disintegration of the U.S. dollar’s world reserve currency status and the final bust of the U.S. government’s finances would follow. Neither the federal government nor the Federal Reserve can fix the U.S. financial system if its perceived legitimacy were to fail. An inflationary policy response, at that point, would only exacerbate the problems of the U.S. dollar. History may record yet again that “there is no means of avoiding the final collapse of a boom brought about by credit expansion” because the escalating moral hazard engendered by limitless bailouts is itself a cause of collapse.

About Hera Research Hera Research, LLC, provides deeply researched analysis to help investors profit from changing economic and market conditions. Hera Research focuses on relationships between macroeconomics, government, banking, and financial markets in order to identify and analyze investment opportunities with extraordinary upside potential. Hera Research is currently researching mining and metals including precious metals, oil and energy including green energy, agriculture, and other natural resources. The Hera Research Newsletter covers key economic data, trends and analysis including reviews of companies with extraordinary value and upside potential.

###

Articles by Ron Hera, the Hera Research web site and the Hera Research Newsletter ("Hera Research publications") are published by Hera Research, LLC. Information contained in Hera Research publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in Hera Research publications is not intended to constitute individual investment advice and is not designed to meet individual financial situations. The opinions expressed in Hera Research publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and Hera Research, LLC has no obligation to update any such information.

Ron Hera, Hera Research, LLC, and other entities in which Ron Hera has an interest, along with employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. The policies of Hera Research, LLC attempt to avoid potential conflicts of interest and to resolve conflicts of interest should any arise in a timely fashion.

Unless otherwise specified, Hera Research publications including the Hera Research web site and its content and images, as well as all copyright, trademark and other rights therein, are owned by Hera Research, LLC. No portion of Hera Research publications or web site may be extracted or reproduced without permission of Hera Research, LLC. Nothing contained herein shall be construed as conferring any license or right under any copyright, trademark or other right of Hera Research, LLC. Unauthorized use, reproduction or rebroadcast of any content of Hera Research publications or web site, including communicating investment recommendations in such publication or web site to non-subscribers in any manner, is prohibited and shall be considered an infringement and/or misappropriation of the proprietary rights of Hera Research, LLC.

Hera Research, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of Hera Research publications or website, any infringement or misappropriation of Hera Research, LLC's proprietary rights, or any other reason determined in the sole discretion of Hera Research, LLC. ©2011 Hera Research, LLC.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.