Gold Mining Stock Margins Will Expand Further

Commodities / Gold and Silver 2012 Oct 27, 2012 - 05:14 AM GMTBy: Jordan_Roy_Byrne

Longtime readers know that we are a fan of intermarket analysis. The movement of certain markets influences other markets so it is always wise to analyze a handful of markets rather than just a single market by itself. Several years ago we learned from others before us how intermarket analysis can help us get a handle on the margins of gold (and silver) miners. Generally, Oil (energy) represents about 25% of the cost of mining while industrial metals prices can be a proxy for the costs of trucks, chemicals and blasting agents (like cyanide). It has been a while since we’ve looked at these charts but with the gold stocks having put in a major bottom it is time to analyze whether it is sustainable or not.

Longtime readers know that we are a fan of intermarket analysis. The movement of certain markets influences other markets so it is always wise to analyze a handful of markets rather than just a single market by itself. Several years ago we learned from others before us how intermarket analysis can help us get a handle on the margins of gold (and silver) miners. Generally, Oil (energy) represents about 25% of the cost of mining while industrial metals prices can be a proxy for the costs of trucks, chemicals and blasting agents (like cyanide). It has been a while since we’ve looked at these charts but with the gold stocks having put in a major bottom it is time to analyze whether it is sustainable or not.

Simply put, we look at Gold relative to oil (bottom) and Gold relative to industrial metals (top). These ratios were quite low in 2007 when share prices were driven more so by positive sentiment and high valuations then by positive fundamentals. As you can see, the financial crisis was a major catalyst for the gold mining industry. Gold surged against oil and industrial metals. During the weak recovery these ratios held their ground and are reaching higher levels once again.

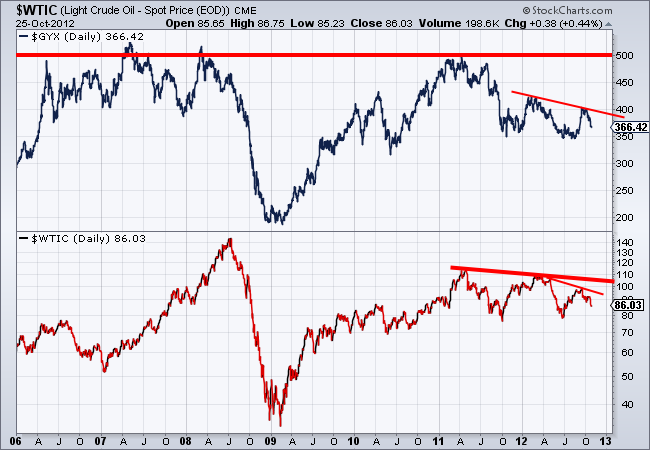

Next, we want to look at these markets by themselves. Industrial metals prices are on top while oil is on the bottom. Do these markets appear to be any threat to move much higher? Industrial metals have substantial resistance at 500 and have made obvious lower highs and lower highs in the past year. GYX is threatening a move below 350. Oil has also made lower lows and appears far more likely to test $78-$80 then to rebound above $95.

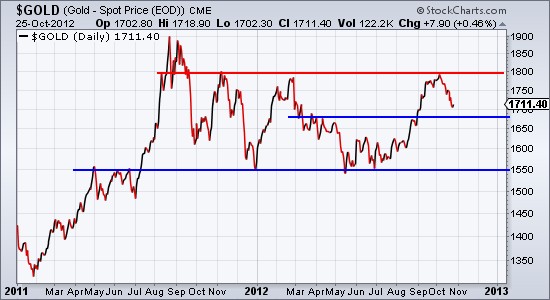

Meanwhile, Gold continues to hold up quite well within a consolidation. Predictably, its rebound ended at $1800. Yet, the market has a very strong bottom in place and has good support just below $1700.

As you can see, according to this simple straightforward analysis, Gold mining margins should continue to expand. The commodities that represent mining cost inputs are not only trending bearish but are little threat to move much higher anytime soon. Meanwhile, Gold is trading in a healthy range and once it breaks $1800 will be within a month or two of breaking to a new all time high.

In the early years of the boom, gold stocks performed quite well even as cost inputs surged. The reason was the market was willing to pay more and more for gold stocks. Presently we have a very different situation. The fundamentals for gold producers are improving yet the market is attaching low valuations to these companies. Our view is that if Gold breaks to and sustains a new high then the current valuations of these companies will increase materially.

All this being said, it is important to understand that gold mining is an extremely difficult industry. Despite this positive analysis, a fair portion of the industry will struggle. It is geologically and mathematically impossible for major producers to grow consistently. Small miners often lack the expertise and manpower to be successful. Most are aware of the 80-20 rule. We just returned from a tour of one of the best producer’s projects. We heard that this management team believes in the 95-5 rule. In other words, in the gold mining industry, 5% of the people produce 95% of the profits. You should keep this in mind when evaluating producers and potential producers. This is also why we focus on stock selection. In this sector, it is crucial to achieving great returns.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.