Iran's Hyperinflation: Questions from Tehran

Economics / HyperInflation Oct 27, 2012 - 05:54 AM GMTBy: Steve_H_Hanke

Interview with Steve H. Hanke By: Kourosh Ziabari

Interview with Steve H. Hanke By: Kourosh Ziabari

Targeted with the biting sanctions of the United States and European Union over its nuclear program, Iran's economy is experiencing difficult and breathtaking days. The import of vital goods, including medicine and foodstuff is being impeded, the energy, insurance, transportation and industrial companies are unable to smoothly do business with their foreign counterparts and their financial transactions have been obstructed and the price of goods increases on a daily basis.

Prof. Steve H. Hanke, Professor of Applied Economics at the Johns Hopkins University believes that Iran is facing hyperinflation, with a monthly inflation rate of nearly 70% per month and its national currency, rial, has lost its value against the U.S. dollar dramatically.

Prof. Hanke is an internationally renowned economist, who specializes in international economics with a particular focus on monetary policy. He is a Senior Fellow at the Cato Institute, co-director of the Johns Hopkins Institute for Applied Economics, Global Health, and Study of Business Enterprise, and a contributing editor at "Globe Asia magazine." Prof. Hanke also serves on the Financial Advisory Council of the United Arab Emirates, as well as on the National Bank of Kuwait's International Advisory Board.

He has provided consultation to several countries grappling with hyperinflation in the past decade. According to Prof. Hanke, Iran has three options to put an end to its shocking inflation and free-fall of the value of its national currency.

What follows is the text of Iran Review's interview with Prof. Hanke who spoke to us from Paris and discussed the current situation of Iran's economy and the scenarios which can help to salvage its troubled economy.

Q: Iran is the latest country added to the Hanke-Krus Hyperinflation Index. Would you please explain about this table and its indicators? How do you record the start date and end date of the hyperinflation, time required for prices to double and daily inflation rate, as you did to several countries such as China, Hungary and Greece in the past 50 years?

A: The Hanke-Krus Hyperinflation Table lists every episode of hyperinflation in history, ranking the episodes in order of their highest monthly inflation rate. It uses Philip Cagan's (1956) widely-accepted definition of hyperinflation: a price-level increase of at least 50% per month.

Thus, an episode of hyperinflation starts when there is a month in which the inflation rate increases by at least 50%. When the monthly inflation rate drops below 50% and stays there for at least one year, the episode is said to end. For example, in the case of Hungary's 1945/46 episode of hyperinflation, the monthly inflation rate exceeded 50% per month from August 1945 until its peak in July 1946. For the next 12 months, the monthly inflation rate was below 50%. From this, we conclude that the episode started in August 1945 and lasted until July 1946.

One of the biggest problems encountered when discussing hyperinflation is the extreme size of the monthly inflation rates. For example, in 2009, Alex Kwok and I determined that Zimbabwe had a peak monthly inflation rate of 7.96 x 10^10%, in Mid-November 2008. This number is obviously quite hard to comprehend. To address this, Nick Krus and I included the equivalent daily inflation rate and the time required for prices to double. These numbers are calculated using the highest monthly inflation rate and “shrinking” the rate to a smaller time period. Accordingly, we calculated that Zimbabwe had a daily inflation rate of 98% in Mid-Nov. 2008 implying that prices doubled almost every day, every 24.7 hours to be precise.

Q: An economic commentator with Britain's Daily Telegraph has said that all the solutions to get out of hyperinflation involve the adoption of a new currency or another country's currency, because the people don't trust the current domestic currency anymore. Do you agree? Would you please elaborate on that?

A: Well, I should point out that the Telegraph commentator wrote his column based on an interview with me. Indeed, I have played a significant role in stopping more hyperinflations than any living economist - including 10 of the 57 episodes on the Hanke-Krus hyperinflation list. His comments bear elaboration, as they are not quite correct. To be specific, there are three ways that episodes of very high or hyperinflation end.

The first is “spontaneous dollarization,” whereby the people in a country experiencing hyperinflation abandon the rapidly-depreciating domestic currency and transfer their wealth into a stable foreign currency, though not necessarily the U.S. dollar. This took place during Zimbabwe's 2008 hyperinflation - as the hyperinflation intensified, more and more Zimbabweans began convert their Zimbabwe dollars to U.S. dollars and other foreign currencies, until finally, in 2009, the Central bank of Zimbabwe abandoned the Zimbabwe Dollar altogether.

The second way to end hyperinflation is the coordinated adoption of a foreign currency - also known as “official dollarization.” This worked very well in Ecuador, where I was an early advocate of dollarization. Although Ecuador did not experience hyperinflation, inflation was very high and the Sucre lost 75% of its value against the U.S. dollar from the start of 1999 until the first week of January 2000. After the Ecuadorian government abandoned the Sucre, inflation dropped dramatically, and economic indicators shifted from negative to positive almost immediately.

The third way to end hyperinflation is by adopting a type of fixed-exchange-rate monetary arrangement known as a currency board. Under an orthodox currency board, the domestic currency is backed 100% by a stable, foreign anchor currency such as the U.S. Dollar or the pound sterling. The currency board itself simply exchanges domestic currency for the anchor currency at a fixed rate - exercising no discretionary monetary policy. This can be accomplished using the existing domestic currency or by adopting a new currency - in either case, the end result is a domestic currency that is effectively a clone of the stable foreign anchor currency.

I have personally helped establish currency boards in Argentina, Estonia, Lithuania, Bosnia and Herzegovina, and Bulgaria - all of which had experienced hyperinflation in the years prior to their adoption of their currency board. Once these countries adopted currency boards, inflation rates quickly plummeted, and economic growth resumed.

Q: Can we say that the unjustifiable economic sanctions against Iran are to be blamed for the staggering inflation and plummeting of the value of Rial? In what ways do the sanctions influence country's currency?

A: There are several factors - both domestic and foreign - that have contributed to the collapse of the rial. One partial explanation is that sanctions have resulted in a supply shock, whereby the supply of many goods drop dramatically. This can cause higher prices throughout the economy. That said, Iran's complex system of subsidies, capital controls, and multiple exchange rates is clearly distorting this effect across different goods markets, exacerbating, in some cases, the inflationary effects.

That said, there are several other factors contributing to Iran's hyperinflation. Almost every episode of hyperinflation has one common factor: a massive overprinting of money. Iran has a long history of rapidly expanding its monetary base. But, unfortunately the data needed to asses the monetary causes of Iran's hyperinflation are simply not available. Conveniently, the Central Bank of The Islamic Republic of Iran has not reported any such statistics for some time.

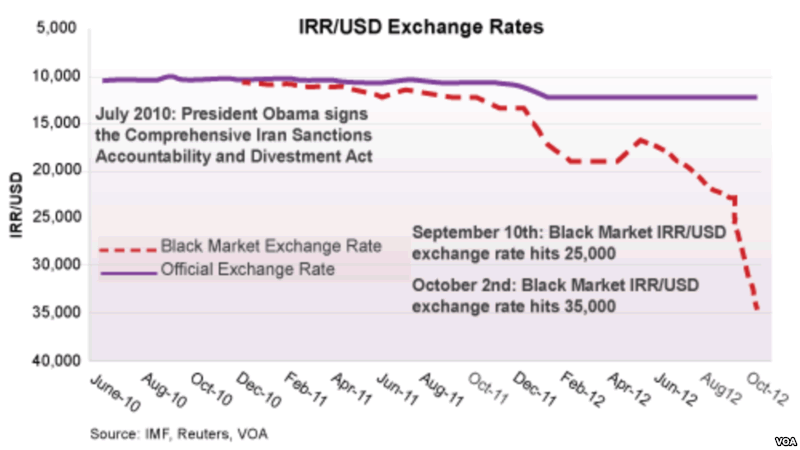

This lack of information, transparency, and trust has ultimately resulted in a dramatic reduction in demand for the Iranian rial. With each collapse in demand, there has been panicked selling of the rial - something like a “bank run” on rials. A sharp rise in the black-market IRR/USD rate has ensued, and these have resulted in inflationary surges.

Q: I think one of main causes of the downfall in the value of national currency in Iran is the psychological operation which is underway against it. The Western media and Israeli politicians are constantly talking about the possibility of a military strike against Iran, and this has in one way or another troubled the country's economy. Am I right?

A: While consumers' expectations do importantly influence prices, I can't say I agree with your assessment. Fear surrounding military tensions is nothing new for Iranians. Rather, what we are witnessing in Iran is an economic panic. Iranians are worried that inflation and a depreciating rial will wipe out their savings and diminish their ability to consume in the future. To combat this, they are converting their wealth to stable currencies (the U.S. dollar) and hard assets such as precious metals and real estate. This is reflected in rising real estate prices and the declining value of the rial, relative to the dollar.

In addition, Iranians are rationally stocking up on basic necessities. This increased demand for goods today, in anticipation of higher prices tomorrow, also puts upward pressure on prices today. As previously described, the supply of such goods has also gone down. In consequence, Iran is witnessing both an increase in demand and a decrease in supply - a recipe for staggering price increases i.e. hyperinflation.

Q: Is there any direct relationship between hyperinflation and the fluctuations in the exchange rate? The government has announced that it would offer the official exchange rate to importers of a few select items and the importers who want to import other consumer goods should buy dollars that is closer to the black market rate. Can this be a cause of the hyperinflation in Iran?

A: The story of Iran's hyperinflation has been one of divergence between the official and black-market (read: free-market) exchange rates. This reflects the fact that the true value of the rial is much lower than what the Iranian government claims it is. Although the government subsidizes many goods by offering preferential exchange rates, the fact of the matter is that the rial is worth significantly less than it was in 2010. In consequence, consumers must pay more rials to receive the same quantity of goods, and prices have risen accordingly.

That said, the recently-announced multiple exchange-rate regime is an immediate cause for concern. This wrong-headed attempt to exert more control over the price of domestic goods and combat inflation has failed and will continue to fail. Iran's multiple-exchange-rate system results in lying prices that distort economic activity. By offering different exchange rates for different types of imports, the Iranian government is, in effect, subsidizing certain goods - distorting their true price. In consequence, any fluctuations in the black-market exchange rate - and, accordingly, in the price level - will be amplified to different degrees for different goods. The end result for Iranian consumers is confusion and mistrust, which, as we have seen, are feeding the panic that has been driving the collapse of the rial and Iran's hyperinflation.

Q: What solutions are prescribed for the current crisis which has engulfed Iran's economy? Have there been similar cases that an economy, under foreign pressure, has reached a deadlock, and then salvaged with the resolve of the statesmen and politicians? How is it possible for Iran to get out of the current situation?

A: Well, I offered three solutions to hyperinflation: spontaneous dollarization, official dollarization, and the adoption of a currency board. That said, I don't foresee the Iranian government adopting any such solution any time soon. Indeed, if anything, the Iranian government has only exacerbated the effects of the collapse of the rial.

For years, Iran's economy has been weighed down by government monopolies, price controls, and Soviet-style economic planning. In consequence, Iran has experienced sustained, excessively-high inflation, and it has failed to live up to its economic growth potential.

Thus, the solution to Iran's economic woes will not come from statesmen and politicians - it must come from the free market. Q: And finally, what's your viewpoint about the humanitarian aspect of the economic sanctions which have complicated Iran's economy and created serious problems for the ordinary citizens? Aren't these sanctions, imposed by the U.S. and EU, some kind of violation of human rights?

A: For my thoughts on the relationship between hyperinflation and human rights, see the last paragraph of my May 2007 Globe Asia column.

Source: http://www.iranreview.org/...

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2012 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.