Timing The Gold Bull Market

InvestorEducation / Learn to Trade Oct 30, 2012 - 02:20 AM GMTBy: Darryl_R_Schoon

Dreaming the impossible dream

Dreaming the impossible dream

The question of when gold’s long awaited ascent will happen is not without precedence. A similar question is still being asked by the Jews concerning the appearance of the Messiah. Prediction has always been an inexact science.

TIMING MARKETS AND TIMING GOLD

In my book, Time of the Vulture, How to Survive the Crisis and Prosper in the Process, I quote market timer and industry insider, Rick Ackerman:

…the stock market is a rigged game… It really is just a giant carny game, one in which there are only predator and prey, and precious few big winners. Wall Street’s best and brightest may have more teeth and fewer tattoos than carny men, but they employ essentially the same skills in separating the gullible from their hard-earned dollars. Both try to convince us that “Everybody goes home a winner!” even though we know better. We always imagine ourselves winning the big stuffed panda, even though we know we’ll be lucky to take home a pack of Marlboros or a Luke Skywalker keychain

Ackerman’s cynical comments are a result of Ackerman’s 12 years experience as a market maker on the floor of the Pacific Stock Exchange. That markets are rigged, however, doesn’t mean that hedged, educated and often accurate predictions cannot be made. In fact, Ackerman’s newsletter, Rick’s Picks, purports to do just that.

I first became aware of Ackerman’s refreshingly cynical market commentary in the 1990s when he wrote a financial column for the San Francisco Chronicle. It was not, however, until ten years later that I became aware of Ackerman’s sometimes astounding accuracy.

Using a proprietary technical methodology Ackerman calls ‘hidden-pivots’, Ackerman predicts tops and bottoms, i.e. turning points, for all markets, i.e. commodities, treasuries, stocks, etc; and, in 2006 we had an opportunity to see what Ackerman’s hidden-pivots could do.

In 2006, we were holding warrants issued by Agnico-Eagle Mines. Warrants on gold mining shares can often be more volatile than profitable. In March 2006, our warrants had lost 2/3 of their value before gold suddenly began moving upwards, increasing exponentially the value of our warrants in a very short period of time.

Warrants, by definition, are time-dependent giving buyers the option for a limited time to purchase underlying shares at a predetermined price; and as gold began rising in 2006, the question became, what would be gold’s top before it turned down?

Gold had started its rise in mid-March at $535. In April, it moved up past $600 and by the end of the month was nearing $700. The hidden-pivot Ackerman predicted for gold’s turning point was $715.50 and I remember watching gold’s daily move towards Ackerman’s hidden-pivot.

In early May, gold crossed $700. Then on May 11th, gold exceeded Ackerman’s hidden-pivot during inter-day trading before dropping to end exactly at $715.50, Ackerman’s hidden pivot. The next day, gold rose to $725.00 before beginning a multi-week decline.

On May 12th, we sold our warrants and that summer flew to New York to attend Ackerman’s hidden pivot seminar. We wanted to know how anyone could predict with that degree of accuracy, gold’s then top; and, at the seminar, Ackerman explained how he had come by his methodology and how it worked.

Today, when I was referencing Ackerman’s website, in his October 29th newsletter, Ackerman explained his methodology in About the Hidden Pivot Method:

The method I use to forecast swing points and trends is the most accurate and powerful I’ve discovered in 30 years of trading. It is also by far the simplest, requiring little more than junior high school math to do the necessary calculations. I first learned about this amazingly precise method of analysis from a floor trader on the Pacific Stock Exchange named Ira Tunik. At the time, Ira was using the cycles work of J.M. Hurst, a pioneer in the field of technical analysis, to make a very good living on the options floor. When he retired as a pit trader in the late 1980s, he shifted his nest egg mostly into bonds, which at the time were providing annualized returns approaching 10 percent. However, when interest rates began to decline from those cyclical peaks, Ira realized he would need a foolproof trading strategy to live well off his savings without having to dip into principal.

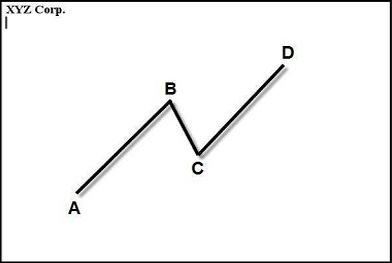

How does the system work? To start with, I always try to visualize the price movement of stocks, commodities, options and indexes in the perspective of an ABCD pattern such as the one shown above. Unlike Elliott Wave Theory, which is rooted in trend patterns with five legs and corrections with three, my method distills all of the action down to three legs. It also sidesteps the often daunting task of distinguishing corrections from trend moves. Those who are familiar with Elliott Wave Theory know that even EWT experts sometimes bog down in the choppy seas of corrective patterns. Terms such as expanded flats, extended or truncated fifths, double and triple threes, zigzags, and contracting, ascending and descending triangles are all part of Elliott Wave terminology, and they must all be mastered by the chartist who would attempt to forecast accurately and profitably. However, Hidden Pivot strategies, on the other hand, shun such complexities, focusing instead on the most fundamental rhythms of the market. If you can distinguish good art from bad, you can learn the Hidden Pivot Method.

Nothing can be predicted with 100% accuracy and Ackerman doesn’t make that claim. Heisenberg’s Uncertainty Principal is far too ubiquitous a truth for that to occur. Nonetheless, for those not yet committed to buy and hold gold and silver for the long term, Ackerman offers a viable alternative to investing in increasingly unpredictable markets.

Caveat: Ackerman’s methodology requires a sustained concentration that I don’t possess. You may.

THE FUTURE

Buckminster Fuller was described as a futurist. Of that future, Fuller wrote in 1981 that the world’s power structures were about to collapse; but, in that collapse, humanity’s vast resources would become available on a scale never before experienced.

The introduction to Fuller’s The Critical Path was titled Twilight of the World’s Power Structures, Fuller wrote: …the world’s power structures have always “divided to conquer” and have always “kept divided to keep conquered.”

As a consequence the power structure has so divided humanity—not only into special function categories but into religious and language and color categories—that individual humans are now helplessly inarticulate in the face of the present crisis. They consider their political representation to be completely corrupted; therefore they feel almost utterly helpless. (1981)

Buckminster Fuller believed, however, that it was not political and economic systems that needed examination. It was ourselves; that as individuals we needed to examine our own integrity.

…When we speak of the integrity of the individual, we speak of that which life has taught the individual by direct experience. We are not talking about loyalty to your mother, your friends, your college fraternity, or your boss, who told you how to behave or think. In speaking of truth, we are not talking about the position to take that seems to put you in the most favorable light.

If we want the future to be a better future we must be that better future ourselves. Expecting it to be otherwise is as self-deceiving as it is futile. These are significant times. Expecting politicians to provide us with answers will leave us with none.

My current youtube videos are Today’s crisis: The 1930s Magnified and The Mystery of my Writing: Time of the Vulture, etc.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.