The Dangers of Holding Overvalued Stocks

Companies / Stock Market Valuations Nov 01, 2012 - 03:22 AM GMT We often write about valuation because we believe it is one of the most misunderstood aspects of investing in common stocks. This causes many people to hold what we consider to be unjustified biases that are based primarily on price action. For example, the concept of the lost decade, which many almost gleefully point to as evidence validating that stocks are poor investments, fail to recognize that the true culprit was overvaluation during the appropriately labeled “irrational exuberance” days.

We often write about valuation because we believe it is one of the most misunderstood aspects of investing in common stocks. This causes many people to hold what we consider to be unjustified biases that are based primarily on price action. For example, the concept of the lost decade, which many almost gleefully point to as evidence validating that stocks are poor investments, fail to recognize that the true culprit was overvaluation during the appropriately labeled “irrational exuberance” days.

However, one of the most misunderstood aspects of overvaluation is how wide ranging and relative it is. To clarify, one company can technically be labeled overvalued, but due to other important factors, still be a good investment or even an above-average investment. It all comes down to the degree of overvaluation the market is applying, relative to the potential long-term growth the business is capable of achieving.

Starbucks Corp. (SBUX): Overvalued High Growth

We offer Starbucks Corp. (SBUX) as an example of a stock that is technically overvalued, but not necessarily a poor long-term investment. First of all, by looking at the earnings and price correlated F.A.S.T. Graphs™ below, we discover that the market has historically placed a high valuation on this high-quality growth stock that has only recently morphed into a fast growing dividend growth stock. Consequently, even though you would have had to overpay to invest in the stock, as a long-term owner you would have made good money. The reason for this is simple; strong earnings growth would have bailed you out.

As a long-term shareholder of Starbucks your total annual return would have been over six times more than you could have earned in the market as represented by the S&P 500. Keep in mind that although you would have technically been investing in an overvalued stock in 1999, strong earnings growth overcame high valuation in the long run.

The following estimated earnings and return calculator based on the consensus of 28 analysts reporting to Standard & Poor’s Capital IQ tells a very interesting story, assuming of course it turns out to be a true story. Currently, Starbucks trades at a PE ratio above 25; however, the company’s 5-year forecast growth rate is estimated at 18%.

Now here’s the interesting part. The 5-year estimated total return of 13.2% per annum (including dividends) assumes that the Company achieves the 18% growth rate, but also assumes that the future price earnings ratio falls to its earnings justified PE of 18 from its current 25. Therefore, this simple calculation shows that this company could produce a double-digit annualized long-term rate of return as long as earnings grew 18%, and even though the PE ratio contracts to 18.

The point is that a 13% compounded annual return is very healthy, and one that we dare say would be enthusiastically embraced by most investors. Theoretically, the real risk here is that Starbucks’ stock price would fall to the orange line over the short run. In other words, there is a potential short-term opportunity cost of buying it today. That opportunity cost could be that it’s possible that you could wait a few weeks or so, and be able to pick up shares at their intrinsic value of $35-$38 per share, compared to today’s current price of $45.87. On the other hand, if this doesn’t occur and the stock continues to rise, you have missed the opportunity of owning.

In summary, Starbucks is a company that is technically overvalued today, but has been overvalued through most of its recent history. Nevertheless, it has generated excellent long-term returns for shareholders exercising the intelligent patience to hold on as long as its fundamentals remained intact. On the other hand, we would argue that the great returns that Starbucks generated were achieved at a higher risk level than a more rational market would have facilitated.

Colgate-Palmolive Co. (CL): Overvalued Moderate Growth

Our second example reviews Colgate-Palmolive, a moderately fast-growing blue-chip Dividend Champion with a legacy of premium valuation. A quick glance at the earnings and price correlated F.A.S.T. Graphs™ shows that the market typically values this blue-chip above its orange earnings justified valuation line. On the other hand, thanks to the great recession and once again in 2010, there were two times in recent history where Colgate could have been purchased at what technically would be called intrinsic value (where the price touches the orange line). Clearly, both of those situations would have been ideal times to invest in Colgate.

From a performance point of view, even when Colgate is purchased when it is overvalued, its above-average growth rate and consistency, coupled with its steadily increasing dividend, adequately rewarded shareholders. The question the investor has to ask themselves is, are they willing to take the overvaluation risk to own this blue-chip dividend growth star?

Colgate-Palmolive appears to, once again, being awarded its traditional premium valuation by Mr. Market. Nevertheless, including dividends, long-term shareholders would stand to earn an annual return of 6.4% per annum. Keep in mind that this return assumes that the company grows its earnings by the 9% consensus estimate, but also that the PE ratio rationally contracts from its current 23 PE to a fair value PE of 15. On the other hand, if the current PE ratio were to hold, shareholders could achieve a return in excess of 9% per annum. Once again, as an investor you must ask yourself are you willing to take this level of valuation risk to earn those potential rates of return from this blue-chip dividend growth star.

When Overvaluation Becomes Long-term Dangerous

Thus far, we have shown examples where stocks were technically overvalued, but not dangerously so. With our first two examples the real risk was that stock price could temporarily fall to fair value before it advanced long term based on its earnings growth potential. From our perspective, we believe this kind of overvaluation simply means taking a higher risk than is rational, in order to earn a rate of return that is less than fundamentals justify. This implies that it would be possible to find alternative companies with similar fundamentals that could be purchased at more rational valuations.

With our next examples we will illustrate overvaluation situations that were long-term devastating. In addition to providing a vivid and quintessential picture of overvaluation and a true bubble, we are also provided with incontrovertible evidence that the stock market is not always sufficient. In other words, it would be nothing short of absurd to try to argue that the market was correctly pricing EMC Corp. (EMC) during the timeframe 1999 -2002. A quick glance at the earnings and price correlated graphic on EMC defines the term “irrational exuberance.”

Although EMC was technically overvalued in 1997 and 1998, valuation went to the extreme in 1999 and 2000. Therefore, any purchases of the stock in 1998, 1999, 2000, 2001 or 2002 proved disastrous both in the short run and the longer run. Unlike the moderate overvaluation we looked at previously, this dangerous overvaluation would have resulted in significant long-term losses. The point is that, as previously postulated, valuation is a relative thing. Clearly, and admittedly a “duh” statement, but there is overvaluation, and then there is dangerous overvaluation, with many variances in between.

To drive this point home, an investment at the beginning of 2001 in EMC would have resulted in devastating losses over the next decade and beyond. However, of equal importance, is the fact that EMC Corp., the business, actually performed rather well, especially from calendar year 2003 going forward. Dangerous overvaluation can completely negate a good business. It might be interesting to point out that most tech stocks suffered from the same dangerous overvaluation during the years 1999 -2002, to include stalwarts such as Microsoft (MSFT), Intel (INTC), Cisco (CSCO), Oracle (ORCL) and many others. In other words, all of their graphs look very similar to EMC regarding price action.

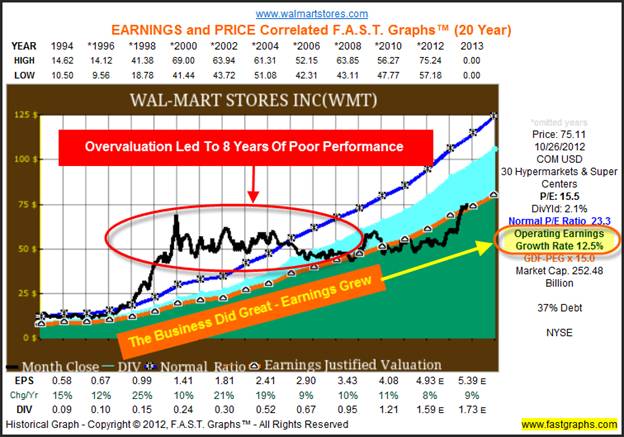

With our next example, Wal-Mart Stores (WMT), we see another iteration of the risk associated with dangerous overvaluation. In some ways, the EMC example above was merciful in that the overvaluation was running out rather quickly, albeit with a vengeance. When Wal-Mart became dangerously overvalued during the irrational exuberance era, its price action created an insidious slow death, so to speak. It took approximately 8 years as Wal-Mart’s stock price drifted sideways and then down, before it moved back into earnings justified intrinsic value (the orange line).

What’s perhaps even more interesting about this example is how well the company performed as a business as its stock price underperformed. Wal-Mart grew its earnings and dividends at above-average rates every year during this time, but because their share price was so massively overvalued, it was all for naught. Once again, we see another clear example of the market mispricing a great business.

Summary and Conclusions

Perhaps the most important message that we are attempting to convey with this article relates to the importance of having a solid perspective regarding valuation. This is especially important to those that are either near or currently in their retirement years. We contend that all this talk about how dangerous it is to invest in stocks is overblown. The evidence clearly confirms that if you invest in great businesses at sound valuations, long-term risks are relatively low and returns more than adequate to meet your needs.

To put this into another context, although it does happen, the failure of a great business is a relatively rare occurrence. However, market mispricing, especially when it overvalues a great business, is much more common. Moreover, the biggest losses will generally occur more from overvaluation than any failure on the business behind the company’s part.

On the other hand, it’s also important to distinguish between the various levels of overvaluation. In some cases, a slight or even a moderate overvaluation of a company’s shares, even a great company, will moderately increase risk while simultaneously lowering long-term return. However, in the long run these situations may not be devastating, especially for best-of-breed companies.

In other words, a moderately overpriced stock of impeccable quality can still generate an adequate, or even more than adequate long-term rate of return and a growing dividend income stream. However, when valuations become too excessive, they can be devastating. It’s important to also note that valuations tend to be very high during times when greed has kicked in. Greed spawns overconfidence, thereby blinding investors to the grave danger like lambs being led to the slaughter.

In conclusion, it’s important to have a sound perspective on valuation. Calculating current and future earnings yields are a straightforward and simple method of accomplishing that task. When the earnings yield on stocks, which is the inverse of the PE, is very low it should be obvious that there is not enough return being generated by the company’s fundamentals to compensate for the risk you are taking by owning them. This situation occurs most often when the stock is experiencing great price momentum. The more the stock rises, the more it attracts investors as the greed response takes hold.

Disclosure: Long CL, MSFT, INTC, CSCO and ORCL at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm.

Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2012 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.