Gold $1109 Price Target Still Prevails

Commodities / Gold and Silver 2012 Nov 03, 2012 - 10:15 AM GMTBy: Brian_Bloom

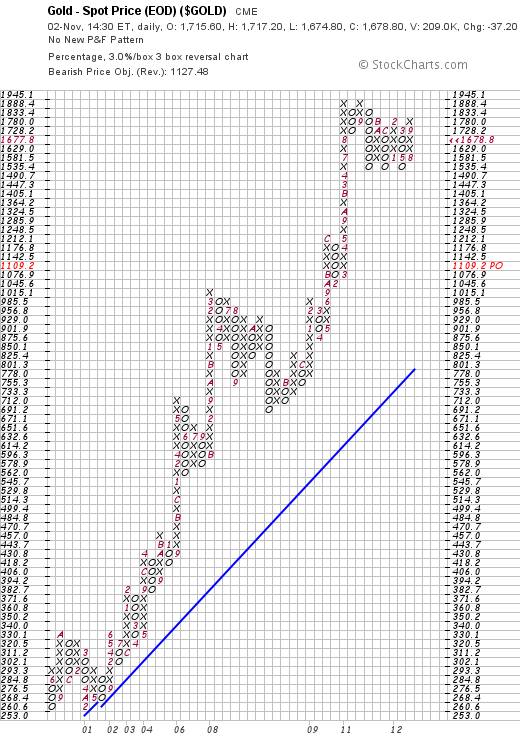

Within the context of a Primary Bull Market, the price destination target of $1,109 an ounce for gold remains prevalent; as can be seen from the 3% X 3 box reversal Point & Figure chart below (courtesy stockcharts.com)

Within the context of a Primary Bull Market, the price destination target of $1,109 an ounce for gold remains prevalent; as can be seen from the 3% X 3 box reversal Point & Figure chart below (courtesy stockcharts.com)

Chart #1 – 3% X 3 Box reversal P&F chart

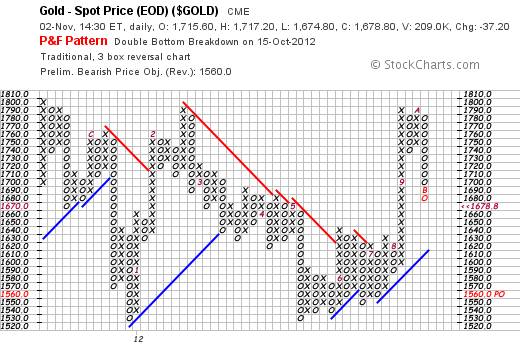

Intriguingly, on the more sensitive scale, $10 X 3 box reversal P&F chart below, a sell signal was given on October 15th.; and the price destination on this chart is $1,560 an ounce, which level (if it is reached) will penetrate the rising blue trend line on the downside.

Chart #2 - $10 X 3 box reversal P&F chart

Of course, this begs the question as to “why?”

If Dr Bernanke is up to his eyeballs in Quantitative Easing and the US dollar is inevitably going to collapse as a consequence, then why are the P&F charts anticipating a strong downside technical reaction? (Within a Primary Bull Trend, for the benefit of those who find such questions as offensive as nails scraping on a blackboard)

Well, as a starting point, let’s have a look at a chart of the US Dollar.

Interestingly, according to the chart below, the market is in two minds about the dollar index. It tried (and failed) to rise above its falling trend line and there is now as much chance of the dollar index falling back to 76 as rising to 102.

Chart #3 – P&F chart of US Dollar Index.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.