Obama Election Victory Allows 4-Year Stock Market Rally to Continue

Stock-Markets / Stock Markets 2012 Nov 06, 2012 - 10:33 AM GMTBy: PhilStockWorld

4 more years!

4 more years!

That's right, it's over. Actually, was it ever really a race or was the "close" election nothing but a fantasy engineered by the MSM to keep people interested in their election coverage? The more I read and the more I talk to people – Romney doesn't stand a chance. I'm in Las Vegas this week for our PSW Conference and most of the conversations I have with people about Romney is "who the hell is voting for him?" We're being told he's a viable candidate but maybe that's only because his team buys all the media time.

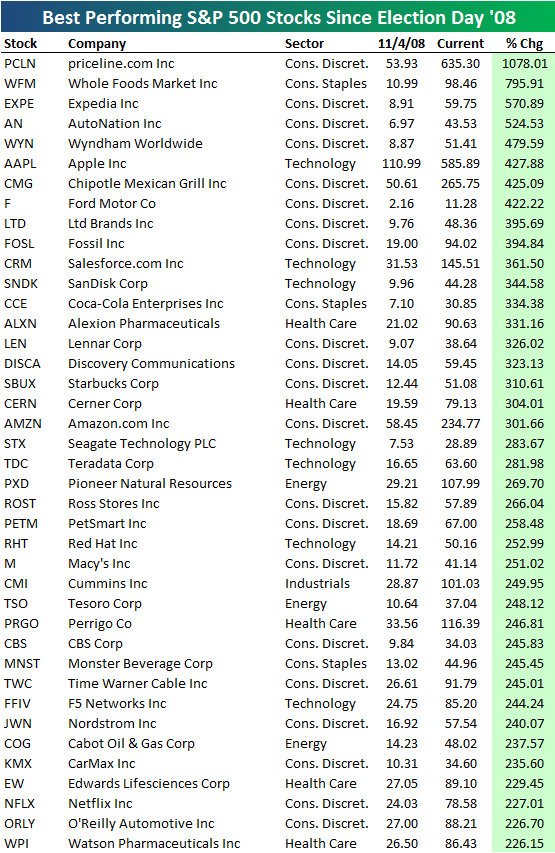

On the right is a Bespoke Chart indicating the best-performing stocks under President Obama and you can follow this link to several more but what you'll notice is that Consumer Discretionary stocks have done very, very well under the Obama administration – not energy, not metals, not even Financials – as we had under Bush. No, it's Consumer stocks doing well and, therefore, it's not too much of a stretch to assume the consumer is doing better and consumers are, in the end, voters.

On the right is a Bespoke Chart indicating the best-performing stocks under President Obama and you can follow this link to several more but what you'll notice is that Consumer Discretionary stocks have done very, very well under the Obama administration – not energy, not metals, not even Financials – as we had under Bush. No, it's Consumer stocks doing well and, therefore, it's not too much of a stretch to assume the consumer is doing better and consumers are, in the end, voters.

Ford is on the list – they were going to go Bankrupt. Romney wanted them to go bankrupt – Obama saved them. Is Ohio or Michigan in play with Auto Nation the 4th most successful company with a 524% increase in market cap reflecting the turnaround in those state's main industry? Of course not – it's silly to think they are.

Two travel companies (PCLN and EXPE) are in the top 3, WFM is a grocer for yuppies and SBUX also serves the upper middle class and CMG feeds us expensive burritos and M and JWN sell us clothes so the working class must be happy with the last 4 years and the middle to upper-middle class are happy so who is Romney's base? Not the bottom 47% – I think he made damned sure to alienate them early on.

No, it's the upper class – the top 10% – and not even all of them and, while that is enough to buy the Media – it's not enough to buy the election and that's why today the outcome is not going to be as close as the projections – in the end, people vote their pocketbooks and after having our pockets picked by Bush for 8 years – the American people are not looking to roll back the clock to the beginning of the century and give back all we have gained back in the past 4 years.

CNBC has created its very own Obama and Romney portfolios of stocks that would be expected to benefit depending on who wins the election. "Obama sectors" include healthcare services, homebuilding, and food and staples retailing, although banks could sell off. "Mitt Romney stocks" include coal, specialty retail, managed care and telecommunications services. What does that tell you? What America do you want to live in – the one where homes are built, people are fed, retailers are booming and the people who PROVIDE healthcare do well or Romney's America, where only the insurers who manage your health care do well (standing in between you and your doctor) while our energy of choice is filthy coal (Kochs) and only "specialty retail" does well (WSM, COH, KORS, BOSS…)?

Probably the biggest mistake the Republicans made is asking people whether they are better off than they were 4 years go. While you may be able to bamboozle people with BS on Fox News and work a crowd into a lather by mis-stating statistics and pretending that Obama was somehow responsible for runaway debt and massive job losses – nothing serves to jog the old memory better than being back in that voting booth for maybe the 2nd time in 4 years and thinking about what a complete and utter disaster we were facing at the time – when "hope and change" were the things we longed for.

Sure, Obama did not fix everything in 4 years but 4 years ago we were wondering if we should get all our money out of the bank before it collapsed. 4 years ago banks were collapsing! AIG was going bankrupt, Freddie Mac and Fannie Mae were collapsing, students were not sure there would be loan money for college 800,000 people a month were losing their jobs – are we better off now than we were 4 years ago? Are you freakin' kidding me? The fact that they have to ask that question shows how completely out of touch the GOP is with the average voter – 30% of whom had a friend or family member who lost their home to foreclosure.

Mitt Romney is the face of the guy who foreclosed on your home, who showed up and blamed you for borrowing over your head and accused you of lying to get your home loan in the first place – even though it was his agent who encouraged you to exaggerate your income and understate your expenses to "get the most home you can afford." 20M American voters lost their jobs and Mitt Romney is the guy who said they were lazy and should have their benefits cut off – even though they paid for those benefits with payroll deductions their whole lives.

The American people simply are not as stupid as the GOP thinks they are – today should be a good slap in the face for them.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.