Global Copper Production Under Stress

Commodities / Copper Nov 09, 2012 - 12:39 PM GMTBy: Richard_Mills

Capital inputs account for about half the total costs in mining production - the average for the economy as a whole is 21 per cent. Obviously many of the costs, once incurred, cannot be recovered by sale or transfer of the fixed assets.

Capital inputs account for about half the total costs in mining production - the average for the economy as a whole is 21 per cent. Obviously many of the costs, once incurred, cannot be recovered by sale or transfer of the fixed assets.

Mining is an extremely capital intensive business for two reasons. Firstly mining has a large, up front layout of construction capital called Capex - the costs associated with the development and construction of open-pit and underground mines. There are often other company built infrastructure assets like roads, railways, bridges, power generating stations and seaports to facilitate extraction and shipping of ore and concentrate. Secondly there is a continuously rising Opex, or operational expenditures. These are the day to day costs of operation; rubber tires, wages, fuel, camp costs for employees etc.

Copper mining has become an especially capital intensive industry - the average capital intensity for a new copper mine in 2000 was between US$4,000 - 5,000 to build the capacity to produce a tonne of copper, now capital intensity is north of $10,000/t, on average, for new projects.

Capex costs are escalating because:

- Declining copper ore grades means a much larger relative scale of required mining and milling operations

- A growing proportion of mining projects are in remote areas of developing economies where there’s little to no existing infrastructure

The bottom line? It is becoming increasingly expensive to bring new mines, especially new copper mines, on line and run them:

- Antofagasta’s Esperanza Sur project capex went from under US$3 billion to US$3.5 billion

- Inmet’s Cobre Panama project capex climbed to US$6.2 billion from US$4.8 billion, that’s a capital intensity north of $15,000/t

- Teck’s Quebrada Blanca’s capex is US$5.6 billion. The amount of money required to build Teck’s new, and very large copper mine in a difficult environment, corresponds to a US$28,000/t capital intensity.

There are several serious concerns in regards to global resource extraction that we need to consider:

- Resource nationalism/Country risk

- A looming skills shortage

- Smaller areas open for exploration

- Competition with Chinese mining investment

- Low hanging fruit, the high quality large deposits have already been found

- Supply bottlenecks for equipment

- Lack of financing options for smaller deposits

- Lack of innovation and technological advancements

- Incredibly difficult and lengthy permitting processes

- Declining open pit production

- Ongoing operational issues

- Environmental group and labor risks

- Natural disasters

- *Lower economic attractiveness of new projects.

*Capex and Opex cost inflation have been felt across the entire mining industry for the past several years in what many say is the most severe cost escalation environment in decades.

The International Copper Study Group (ICSG) recently released its 2012 Statistical Yearbook. According to ICSG data the mine capacity utilization rate averaged 81% from 2008-2011 and mine production grew by an average of only 0.9%/yr. The ICSG Yearbook says the low numbers were a result of numerous factors including lower head grades, labor unrest, technical problems, and temporary shutdowns or production cuts.

Consider the following…

Resource nationalism is increasing - Xstrata Plc’s plans to create a $5.9 billion copper-gold project in the Philippines has been halted because of a mining reform bill.

At least 15 mining projects in Peru (world’s second largest copper producer) have been delayed with their start dates set-back for up to two years because of social unrest, mining investment in the country is expected to fall 33% in 2013 because of the unrest.

Barrick Gold Corp. has lowered its copper production outlook for 2013 due to permitting delays at its Jabal Sayid project in Saudi Arabia.

Chile is the world’s top copper producer but the country as a whole is woefully short of power. The country’s power generation capacity currently stands at 17,000 megawatts. It is estimated that the country will need at least 30,000 megawatts of power by 2020 to keep up with the demand, the increased demand coming primarily from mining projects. Unfortunately the government only plans to add 8,000 megawatts between now and 2020 and there is serious opposition to these plans from environmental groups who have, so far, been wildly successful by suspending several key projects and more than $22 billion worth of power investment. The Chilean Supreme Court recently struck down the planned 2,100-megawatt, $5 billion Castilla thermoelectric power plant project, citing environmental concerns.

Codelco, the Chilean state owned copper company, and the world’s largest copper miner with 20% of global copper reserves, said that their 2012 first half copper production fell 6.4% because of lower grades mined. Codelco’s direct cash costs increased 27% year-on-year mostly because of paying higher prices for electricity from the drought stricken SIC grid.

Many copper mining companies are having to go back to the drawing board in regards to their economic studies trying to lower their cost of production.

Zambia is Africa’s largest copper producer (and wants to directly market its copper), in second place is the DRC. The copper-belt which straddles Zambia’s and the Democratic Republic of the Congo’s borders is being tied up for internal development by the two countries. The DRC and Zambia are amending their mining codes to enable the government to raise taxes and implement a 35-percent minimum ownership threshold for state shareholding in projects.

According to the World Bureau of Metals Statistics (WBMS), the global copper market had a deficit of 129,000 tonnes (t) for the first six months of 2012 on consumption of 10.2 million t.

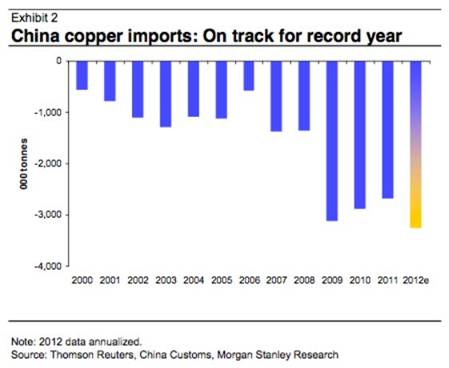

China uses 43% of the worlds copper. Chinese copper prices are in line with LME prices, Chinese traders are not de-stocking and the countries copper imports are on track for a record pace.

“Total copper product imports improved 4% YoY and 11% MoM and are up 5% YTD, in line with our expectations of copper consumption growth in China this year. We attribute this result to the emerging pockets of strength for copper use in China, namely in power infrastructure, white goods restocking and auto production.” Morgan Stanley

“Total copper product imports improved 4% YoY and 11% MoM and are up 5% YTD, in line with our expectations of copper consumption growth in China this year. We attribute this result to the emerging pockets of strength for copper use in China, namely in power infrastructure, white goods restocking and auto production.” Morgan Stanley

Commodities expert Jim Rogers said there are three questions you need to ask (and answer) to determine if a commodity is headed higher in price.

Lets answer based on coppers perspective:

Q1 - How much production is there worldwide?

A – Not enough, most older existing mines, the foundation of our supply, have increasing costs with production rates stagnating or even declining because of lower grade ore. Half of the world’s copper reserves are more than 50 years old and four of the seven largest copper producers are over 70 years old.

Q2 - Are there new sources of supply?

A – Yes, but the rate of depletion is much greater than the rate of discovery.

We are also faced with increasingly complicated and more expensive extraction of metals from increasingly harder to find, lower grade ore bodies in almost inaccessible and hostile parts of the world

Q3 - Are there new potential supplies?

A – Yes, if energy was cheap and unlimited then recoverable resources would be unlimited. The metal content of copper ore has been falling since the mid 1990s. A miner now has to dig up an extra 50 percent of ore to get the same amount of copper. As grade drops the amount of rock that must be moved and processed per tonne of produced copper rises dramatically – all the while using more energy that costs several times more than it use to.

With the lower grades of ores now being mined energy becomes more and more of a factor when considering economics. The cost of energy is climbing, the amount used is climbing but the returns from energy expended is declining. Eventually the quantity of resources used in the extraction process will be 100% of what is produced

Conclusion

Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and come with increased political and nationalization risk. Extraction of metals from the mined ore will become increasingly more complex and expensive, even more so when one considers the effects of increased energy costs – the cost of technology innovation to power mining will be very high.

The facts are:

- Highly capital-intensive greenfield projects in geo-political risky developing countries requiring significant infrastructure investment beyond the ordinary scope of the mining operations are associated with a higher risk of delays and capex overruns

- Capital intensity best determines a project’s potential return and capital intensity clearly favors Brownfield projects in countries with adequate existing infrastructure

“In 2014, substantially all the mine production growth will come from new greenfield projects and these are subject to higher risk of production shortfall. New production from Africa, where infrastructure is less developed, also faces higher risk of shortfall particularly from power disruption.” FitchRatings, Base Metals Update

BMO’s London-based mining analyst Tony Robsonsaid; “Major copper projects required to meet demand long term are located in riskier jurisdictions, and come with increased execution risk; 75% of estimated additional supply required between 2010 and 2025 is from greenfield projects.”

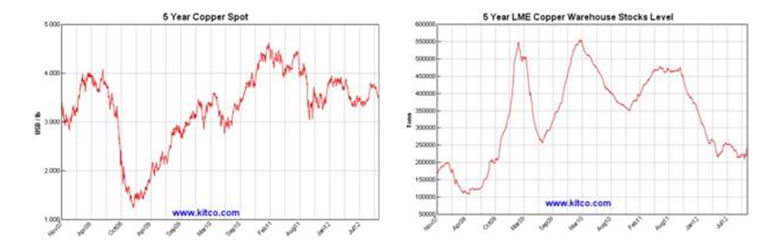

“This lack of inventory growth is the hardest indicator that there has neither been a significant negative shock to demand nor a pronounced destocking cycle.” Andrew Keen, Head of Metals and Mining Equity Research for Europe, the Middle East and Africa, CNBC’s Asia Squawk Box

The few new mines that are being developed in geo-politically safe jurisdictions in close proximity to existing mines should be able take advantage of:

- Pre-existing infrastructure such as transport corridors, processing and power plants

- A known, established permitting process

- No green, or environmental opposition

In 2005 copper prices collapsed to under $3,000 a tonne leading many miners to rethink mine development and expansion plans, prices nearly tripled by 2007 because of a vastly under supplied market.

Perhaps higher Opex costs, Capex overruns, permitting delays, social unrest and resource nationalization should be on all our radar screens. Are they, and a brownfield copper investment opportunity, on your screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.