Nickel Metal Mining Like its 1864

Commodities / Nickel Nov 17, 2012 - 03:53 AM GMTBy: Richard_Mills

Nickel Sulphide Project Pipeline Empty

Nickel Sulphide Project Pipeline Empty

Nickel is present in over 3000 different alloys that are used in over 300,000 products for consumer, industrial, military, transport/aerospace, marine and architectural applications.

Nickel's biggest use, about 65%, is in alloying - particularly with chromium and other metals to produce stainless and heat-resisting steels. Its primary function is to stabilize the austenitic (face-centered cubic crystal) structure of the steel. Normal carbon steel will, on cooling, transform from an austenite structure to a mixture of ferrite and cementite. When added to stainless steel nickel stops this transformation keeping the material fully austenite on cooling. Austenitic stainless steels have high ductility, low yield stress and high tensile strength when compared to carbon steel - aluminum and copper are examples of other metals with the austenitic structure.

Another 20% is used in other steels, non-ferrous alloys (mixed with metals other than steel) and super alloys (metal mixtures designed to withstand extremely high temperatures and/or pressures or have high electrical conductivity) often for highly specialized industrial, aerospace and military applications.

About 9% is used in plating to slow down corrosion and 6% for other uses, including coins, electronics, in *batteries for portable equipment and hybrid cars, as a catalyst for certain chemical reactions and as a colorant - nickel is added to glass to give it a green color. In many of these applications there is no substitute for nickel without reducing performance or increasing cost.

*Rechargeable nickel-hydride batteries are used for cellular phones, video cameras, and other electronic devices. Nickel-cadmium batteries are used to power cordless tools and appliances.

The U.S. Department of Energy (DOE) has funded a variety of programs designed to encourage more rapid development of renewable energy sources. Specific research and development projects included:

-

domestic manufacturing of advanced batteries

-

development of improved stationary and portable fuel cell power systems

-

development of commercial scale bio-refineries

-

improved design of molten salt storage facilities at power plants that concentrate solar energy

-

design and evaluation of parabolic troughs, dishes, and heliostats for solar power stations

-

construction of demonstration facilities designed to recover and better utilize geothermal energy

All of these expanding subsectors for generating power have the potential to be important users of nickel metal and or nickel-bearing alloys.

Nickel Deposits Come in Two Forms

Nickel deposits are generally found in two forms: sulphide or laterite. About 60% of the world's known nickel resources are laterites. The remaining 40% are sulphide deposits.

Nickel Sulphide Deposits - the principal ore mineral is pentlandite (Fe,Ni)O(OH) - are formed from the precipitation of nickel minerals by hydrothermal fluids. These sulfide deposits are also called magmatic sulfide deposits. The main benefit to sulphide ores is that they can be concentrated using a simple physical separation technique called flotation. Most nickel sulfide deposits have traditionally been processed by concentration through a froth flotation process followed by pyrometallurgical extraction.

Magmas (magma is a mixture of molten rock, volatiles and solids that is found beneath the surface of the Earth - Lava is the extrusive equivalent of magma) originate in the upper mantle and contain small amounts of nickel, copper and PGE. As the magmas ascend through the crust they cool as they encounter the colder crustal rocks.

If the original sulfur (S) content of the magma is sufficient, or if S is added from crustal wall rocks, a sulphide liquid forms as droplets dispersed throughout the magma. Because the partition coefficients of nickel, copper, iron and Platinum Group Elements (PGE) favor sulphide liquid these elements transfer into the sulphide droplets in the magma. The sulphide droplets sink toward the base of the magma because of their greater density and form sulphide concentrations. On further cooling, the sulphide liquid crystallizes to form the ore deposits that contain these metals.

There are two main types of nickel sulphide deposits. In the first, Ni-Cu sulphide deposits, nickel (Ni) and copper (Cu) are the main economic commodities - copper may be either a co-product or by-product, and cobalt (Co), Platinum Group Elements (PGE) and gold (Au) are the usual by-products.

The second type of deposit is mined exclusively for PGE's with the other associated metals being by-products.

Nickel sulphide deposits can occur as individual sulphide bodies but groups of deposits may occur in areas or belts ten's, even hundreds of kilometers long. Such groups of deposits are known as districts. Two giant Ni-Cu districts stand out above all the rest in the world: Sudbury Ontario, and Noril'sk-Talnakh, Russia.

The most important platinum-rich PGE district in the world is the Bushveld Complex, South Africa. The second PGE district in importance is the Noril'sk-Talnakh district, which is exceptionally Palladium (Pd) rich as a by-product of its Ni-Cu ores.

Nickel Laterite deposits - principal ore minerals are nickeliferous limonite (Fe,Ni)O(OH) and garnierite (a hydrous nickel silicate) - are formed from the weathering (nickel sulphides are converted to oxide ores) of ultramafic rocks and are usually operated as open pit mines. There is no simple separation technique for nickel laterites. The rock must be completely molten or dissolved to enable nickel extraction. As a result, laterite projects require large economies of scale at higher capital cost per unit of capacity to be viable. They are also generally much higher cash-cost producers than sulphide operations.

Roughly 60 percent of global available nickel is in laterite deposits - a deposit in which weathering of ultramafic rocks has taken place. The initial nickel content is strongly enriched in the course of lateritization - under tropical conditions fresh rock weathers very quickly. Some metals may be leached away by the weathering process but others, such as aluminum, iron and nickel can remain.

Typically nickel laterite deposits are very large tonnage, low-grade deposits located close to the surface. They tend to be tabular and flat covering many square kilometers. They are most often in the range of 20 million tonnes and upwards, with some examples approaching a billion tonnes of material.

Laterite deposits usually contain both an upper dark red limonite (higher in iron and lower in nickel, magnesium and silica) and lower bright green saprolite zone (higher nickel, magnesium and silica but lower iron content). Due to the different quantities of iron, magnesium and silica in each zone they must be processed differently to cost-effectively retrieve the nickel.

Laterite saprolite (higher nickel, magnesium and silica but lower iron content) orebodies are processed with standard pyrometallurgical technology.

However a laterite limonite zone is higher in iron and lower in nickel, magnesium and silica, which means using High Pressure Acid Leaching (HPAL) technology.

HPAL (which has up to now enjoyed a highly mixed performance record) involves processing ore in a sulphuric acid leach at temperatures up to 270ºC and pressures up to 600 psi to extract the nickel and cobalt from the iron rich ore - the pressure leaching is done in titanium lined autoclaves.

Counter-current decantation is used to separate the solids and liquids. Separating and purifying the nickel/cobalt solution is done by solvent extraction and electrowinning.

Production

Today, nickel sulfide deposits are the primary source of mined nickel - about 58% of world's nickel production come from nickel sulfide and 42% of mined nickel comes from nickel laterite deposits. The majority of today's nickel is produced from sulphide deposits because they are easier and cheaper to mine and process than lateritic ore.

However, known sulphide deposits, which are large in scale and of higher nickel grade, are depleting.

The trend of future nickel production is changing because of the current lack of high quality nickel sulfide exploration targets - nickel laterites are most likely to be developed as the world's future primary nickel sources.

Three countries dominate the top three spots in terms of nickel deposits:

Russia is the world's leading country for nickel production and Russian mining giant Norilsk Nickel is the world's largest producer. Most of the countries nickel production (an amazing one-fifth of global production) is from Norilsk - the largest nickel sulfide deposit in the world.

Canada is the world's second largest nickel producing country. Most of the country's nickel currently comes from the Thompson Nickel Belt in Manitoba, the Sudbury Basin of Ontario, and the Ungava peninsula of Quebec.

Australia is the world's third most important producer of nickel. The country primarily exports its nickel products to Europe, Japan and the United States.

Capital Intensity

Capital inputs account for about half the total costs in mining production - the average for the economy as a whole is 21 per cent. Obviously many of the costs, once incurred, cannot be recovered by sale or transfer of the fixed assets.

Mining is an extremely capital intensive business for two reasons. Firstly mining has a large, up front layout of construction capital called Capex - the costs associated with the development and construction of open-pit and underground mines. There are often other company built infrastructure assets like roads, railways, bridges, power generating stations and seaports to facilitate extraction and shipping of ore and concentrate. Secondly there is a continuously rising Opex, or operational expenditures. These are the day to day costs of operation; rubber tires, wages, fuel, camp costs for employees etc.

Capex costs are escalating because:

-

Declining ore grades means a much larger relative scale of required mining and milling operations

-

A growing proportion of mining projects are in remote areas of developing economies where there's little to no existing infrastructure

The bottom line? It is becoming increasingly expensive to bring new mines on line and run them. The same trends are also evident for new nickel mines, where capital intensity has gone through the roof:

-

Capital costs on a per pound basis escalating rapidly over the last decade

-

The discrepancy between the initial per pound capital cost of nickel projects, and the ultimate construction costs, are over 50 percent

-

Economies of scale have not been reflected by lower unit capital costs - large projects have similar or even higher capital intensity

As written earlier in the article global nickel supply is increasingly going to come from laterite nickel deposits, and the high-pressure acid leach (H-Pal) plants to treat the ore require much bigger investments - there is often significant cost and technical challenges associated with laterite projects.

We are now looking at north of $35/lb capital intensity as we move into these very large ferronickel and H-Pal projects that are requiring many billions of dollars to build.

Key nickel projects going forward are:

Vale's New Caledonia (Goro) is many years behind schedule. The Goro nickel project in New Caledonia has become the bad boy poster child for the assortment of problems associated with HPAL technology. Minority partners Sumitomo and Mitsui have reduced their participation in the project.

Vale's Onca Puma project, a ferronickel producer, has been completely shutdown. Vale has said that a return to production is not yet scheduled.

Xstrata's Koniambo - In 2007 capex was set at US$3.8b, in August of 2011 it was revised upwards to US$5b. According to Xstrata the increased cost was because of increased labor costs from competition from the oil and gas sectors for a limited labor pool on a remote island. First pour was slated in the second half of 2012, there has been no news from the company.

US$5b/60,000t capacity = $41.66lb capital intensity.

Sherritts Ambatovy - Sherritt has run into permit delays at its US$5.5-billion Ambatovy nickel-cobalt project in Madagascar. The company revealed on July 25 that it had received notice from Madagascar's transitional government indicating there would be a subsequent review of the Ambatovy operational permit. Sherritt's commercial deadline at Ambatovy has been pushed back.

US$5.5b/60,000t capacity = $45.83lb CI

In cost cutting moves Xstrata closed its Cosmos mine in Australia, Vale shuttered its Frood mine in Canada and BHP Billiton has been trimming costs at its Australian operations.

In September Anglo-American closed its 17,000 tonne per year Loma de Niquel mine (a ferronickel producer in Venezuela) because of disputes over mining concessions.

Nickel Pig Iron

Chinese sulphide nickel ore supply was insufficient to support demand from its stainless steel industry so they began direct shipping nickel laterite ore from the Philippines, Indonesia and New Caledonia into the country to produce a low-nickel, high-iron product called nickel pig iron or "NPI" that is used as a feedstock for stainless steel mills in China. In 2011, over 25 million tonnes - 53% of China's total imported nickel ore - came from Indonesia.

Indonesia (the world's top exporter of nickel ore) enacted an export tax system, effective May 6, 2012, under which a 20% export tax is levied on 14 raw ores of Indonesian origin, including nickel - the result was to drive hundreds of small miners out of business and sending Chinese laterite buyers elsewhere. This is the first step by Indonesia towards a full ban on the export of minerals that is scheduled to begin in 2014.

Indonesia's first nickel pig iron smelter recently began initial production of about 1,000 tonnes of ingots a day. The Indoferro smelter will be the first of several different kinds of mineral smelters as the Indonesian government forces operators downstream into value-added production through a combination of an outright ban on exports of nickel (and other ores) ore and higher taxation for approved shippers.

Consider:

-

35 years of underinvestment equals few new large scale greenfield nickel sulphide exploration discoveries - since 1990, the only large greenfield discoveries that have occurred, happened when exploration was going on for other metals: Voisey's Bay diamond exploration, Kabanga was gold exploration and when Enterprise was discovered they were looking for copper. Very little project development and exploration has been done over past few years for nickel, the result has been a very limited pipeline of new projects, especially lower cost sulphide projects in geo-politically safe mining jurisdictions

-

Increased political risk, population and economic growth are causing the exploitation of lower grade larger deposits in geo-politically riskier countries. Mineral deposit distribution is log-normal - a few large deposits control supply. Generally sulphide deposits are found in more politically stable jurisdictions (e.g. Canada, Australia, Greenland) versus laterite deposits (Indonesia, Philippines, PNG, New Caledonia, many parts of Africa)

-

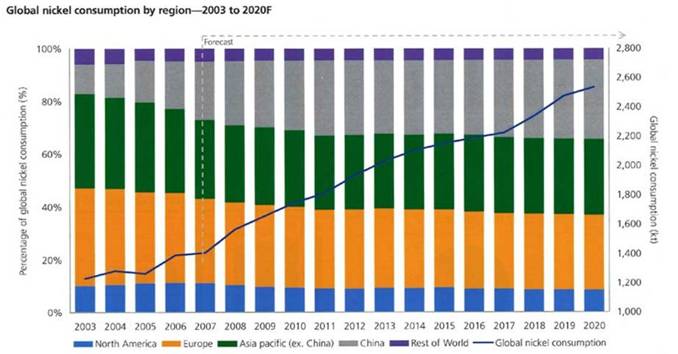

In 2010 Chinese nickel consumption was .4 kilogram per capita, Germany was at 1.3 and Japan was the same. If the Chinese were to consume nickel at the same rate as Germans and Japanese Chinese nickel demand would increase by over one million tonnes

-

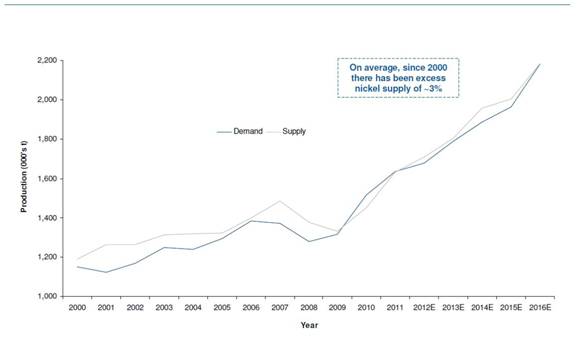

Collapse of former Soviet Union demand (20% of world total) provided supply during 1990s. Ni pig iron and demand destruction in 2000-10 closed gap caused by lack of new supply from weak project pipeline development.

-

Inherently, sulphide minerals require much less energy to liberate nickel than laterites - Nickel sulfide flash smelt +SG ref: 114 MJ/kg (0.39 gal/lb), Nickel laterite pressure acid leach:194 MJ/kg (0.66 gal/lb)

-

China is the leading consumer of nickel and is competing for supplies with US industrial demand, as well as India, Russia and Brazil. Exploration and development are subject to bubbles - boom to bust to boom. Capital Requirements are huge and the time required to bring in new capacity is measured in decades

-

Technology is leading to the use of more and more exotic minerals, this causes an increase in refining - metallurgy (extraction of mineral) gets more complex and energy intensive, more expensive. Over the longer term prices are dependent on technology keeping ahead of resource depletion. So far technology has been winning the race but with the increasingly lower grades of ores now being mined energy becomes more and more of a factor when considering economics. The cost of energy is climbing, the amount used is climbing but the returns from energy expended is declining. Eventually the quantity of resources used in the extraction process will be 100% of what is produced

-

Global demand growth is dominated by China, China's nickel demand is expected to increase by 4-8% per year going forward. North American demand is expected to increase by 6-7% per year. With the current market so tight production delays, for any reason, even if only for a short period of time, could result in even tighter markets and much higher prices

Conclusion

Nickel laterite deposits were first discovered in 1864 by French civil engineer Jules Garnier in New Caledonia - commercial production started in 1875. New Caledonia's laterites were the world's largest source of nickel until Sudbury Ontario's sulphide deposits started production in 1905 and totally dominated global production.

Mining companies are now stepping back in time and are shifting exploration efforts to ever more remote, geo-politically challenged locations in a search for laterite ore because of a lack of discovery of new nickel sulfide deposits.

Ask yourself, "when is the best time to invest?"

While you mull over that question here's five facts for you:

-

Nickel is currently unloved

-

There aren't any nickel names left. Without Inco or Falconbridge, who do you invest in if you want nickel? The largest nickel producing companies, Norilsk, Vale and Xstrata don't actually provide a lot of leverage to nickel as they are diversified miners - meaning they also produce iron, manganese, bauxite, aluminum, copper, coal, cobalt, potash, platinum-group metals, gold and silver

-

Every country needs to secure supplies of needed commodities at competitive prices yet supply is increasingly constrained and demand is growing

-

All of a sudden, in the not too distant future, juniors exploring for nickel from sulphide ore deposits will become much more interesting. Especially so if they are working in geopolitically stable countries

-

Pure junior sulphide nickel exploration plays aren't common

Is there a junior sulphide nickel play, exploring on a district sized scale in a geo-politically safe jurisdiction, on your radar screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.