Austrian Central Bank Has Parked 80% of Countries Gold Reserves In London

Commodities / Gold and Silver 2012 Nov 22, 2012 - 08:51 AM GMTBy: GoldCore

Today’s AM fix was USD 1,729.75, EUR 1,344.23, and GBP 1,084.35 per ounce.

Today’s AM fix was USD 1,729.75, EUR 1,344.23, and GBP 1,084.35 per ounce.

Yesterday’s AM fix was USD 1,726.75, EUR 1,350.71, and GBP 1,085.05 per ounce.

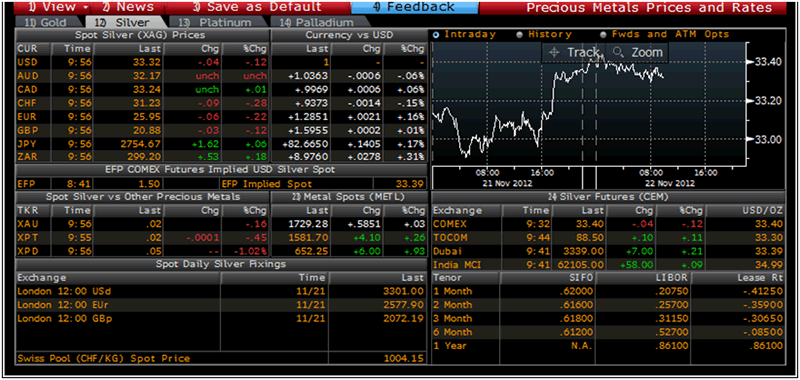

Silver is trading at $33.38/oz, €26.00/oz and £21.00/oz. Platinum is trading at $1,588.25/oz, palladium at $650.60/oz and rhodium at $1,060/oz.

Gold inched up $1.50 or 0.09% in New York yesterday and closed at $1,729.20. Silver surged to a high of $33.378 and finished with a gain of 0.51%. Gold is now some 1% higher for the week and silver nearly 3% higher for the week and higher weekly closes will be bullish from a technical perspective.

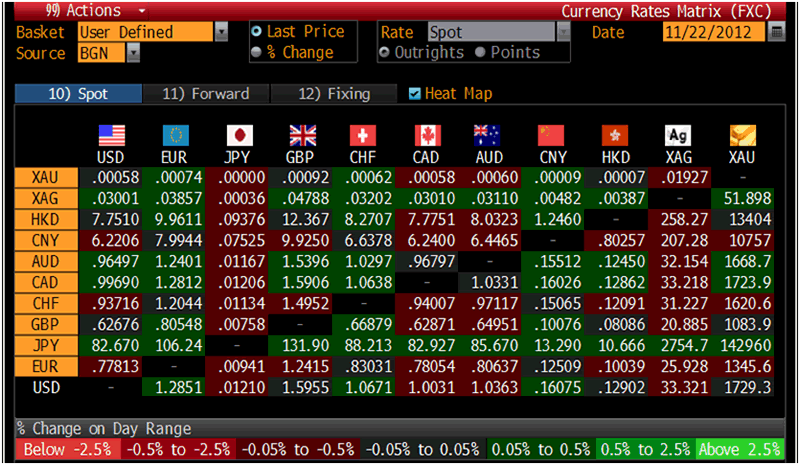

Cross Currency Table – (Bloomberg)

Gold priced in Japanese yen rose to a nine-month high this morning at 143,262 yen/oz and is on track for its biggest weekly rise since February, up 2.8% according to Reuters.

The yen came under heavy pressure from growing speculation that the Bank of Japan would aggressively ease monetary policy in the coming months.

Gold trading is quiet with the US markets closed for the Thanksgiving holiday today and the early close tomorrow.

Given the degree of uncertainty in the world - from the Middle East to Greece and the Eurozone debt crisis to the US fiscal cliff – most traders will be reluctant to take sizeable positions long or short and lacklustre, directionless trading may continue.

However, any of these risks could lead to a sudden spurt of safe haven buying that leads to gold eking out gains this shortened week.

The Austrian central bank keeps most of its 280 metric tons of gold reserves in the United Kingdom, Vice Governor Wolfgang Duchatczek was quoted as saying in the finance committee of the country’s parliament today, according to Bloomberg.

Answering lawmakers’ questions, Duchatczek said 80%, or 224.4 metric tons of the metal was stored in the U.K., 17% or 48.7 metric tons in Austria and 3% in Switzerland, according to a summary of a closed-door committee meeting provided by the parliament.

The reserve has been unchanged since 2007, Duchatczek was quoted as saying. The central bank has earned 300 million euros ($385 million) over the last ten years by lending the gold, he said.

Goldman Sachs is bullish on silver in 2013 and believe it will rise in price.

Silver is seeing strong investment demand due to high inflationary pressures, monetary easing and low interest rates, Goldman Sachs said in a note on silver stocks.

High silver prices in recent years have led to increased supply from mine production and old silver scrap.

Goldman noted that world silver supply grew by just 2.2% in 2012, driven by a 3% gain in mined production and a 1% increase in scrap supply.

Silver Prices/Fixes/Rates/Vols – (Bloomberg)

Gold is poised to rise above $2,000/oz next year according to Merrill Lynch Wealth Management.

They are wary of industrial metals and say that the lack of clarity on demand outlook and policies in China dim prospects for industrial metals

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.