Gold Confiscatation, When and How?

Commodities / Gold and Silver 2012 Nov 30, 2012 - 08:08 AM GMT There has been a persistent fear among both institutions and private owners of gold that, at some point in the near future, their gold will be confiscated by their governments, as was the case in 1933. For very different reasons, we believe that that danger persists and is growing by the day. We feel that because gold is rapidly returning to an active role in the global monetary system -as we have seen in the gold/currency swaps within the Bank for International Settlements and in the discussions on redefining gold as a Tier I asset right now--investors should be aware of the conditions in which this would. We also indicate what we feel to be a solid solution for protecting yourself against a gold confiscation.

There has been a persistent fear among both institutions and private owners of gold that, at some point in the near future, their gold will be confiscated by their governments, as was the case in 1933. For very different reasons, we believe that that danger persists and is growing by the day. We feel that because gold is rapidly returning to an active role in the global monetary system -as we have seen in the gold/currency swaps within the Bank for International Settlements and in the discussions on redefining gold as a Tier I asset right now--investors should be aware of the conditions in which this would. We also indicate what we feel to be a solid solution for protecting yourself against a gold confiscation.

Gold Moves to Pivotal Role in Global Monetary System

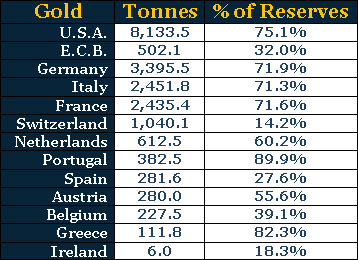

In the past we've already discussed the overall moves being made by a host of central banks to increase their holdings of gold and how, in the developed world, the percentage of gold in the gold and foreign exchange reserves stood at over 70% in the major four developed nations. Here's a closer look...

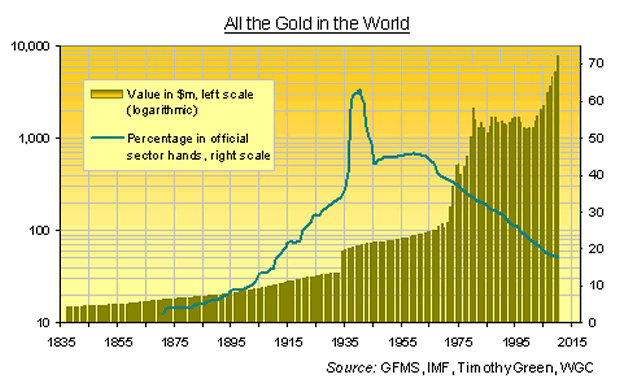

The on-going acquisition of gold by the emerging world and the firm grip on current gold holding by the world's banks, show just how important a reserve asset gold still is and how it is becoming increasingly important. Bear in mind too that the bulk of this gold was bought in by these banks at around $35 an ounce. At the current level of $1,670, the increase in value of gold from the 1960's when this gold was bought has been nearly 48- fold, nearly 100% a year. Not bad for an investment?

Tier I Asset Brings the Banking System to Gold

Gold's elevation from a Tier II asset (where only 50% of its value can be allotted to the bank held assets in terms of capital ratio) to a Tier I asset (where 100% of its value can be allotted to the bank held assets in terms of capital ratio) is expected to be implemented on January 1st 2013.

At this point, not only will central banks want to hold gold but so will commercial banks. This brings into the gold market a whole new demand feature, one that could prove a major driving force in the market place. It institutionalizes gold again!

Before and not After a Dollar Collapse-to Shore up the System

The monetization of gold will dramatically changes the way it will be looked at by the powers that be.

It doesn't require a dollar collapse for this to happen; it will happen because of falling confidence levels in currencies and the potential danger we might well face in the near future. Just as the confiscation of gold in 1933 was done so as to rectify a major fault in the U.S. monetary system in existence then and to prepare the world for the conflagration of WWII, the return of gold now is for the positive aspects gold can bring to shore up confidence in the current monetary system. At that time, the gold price may well be encouraged to rise to such a high level that confidence in the dollar and other key currencies will be restored. This again, will enable the banking system to be used as a means to a further unlimited expansion of credit. Gold's role will be to provide a value anchor to currencies from then on.

Control Needed

In such an important role, can each government allow its citizen's to affect the gold price as they want at any time? Could such freedom affect gold's role in the system to become unstable? It's more than likely that one or more central banks -perhaps acting in concert?-- would want to remove its citizen's privilege of owning gold once again, as a measure solely to keep the gold market stable. We're not simply talking about manipulating the gold price; we are talking about keeping the market price with a low volatility.

Please note that while several countries may confiscate the gold of their citizens at the same time, you may also see country after country act separately as the credibility of their currencies become doubtful. This could reach all countries within the global monetary system at one time or another.

The world as we know it cannot afford a dollar or any major currency collapse and no government will willingly sit idly by and watch it happen. They will do all in their power to avert such an event. This means acting before it's likely to happen, while credibility still remains.

No Gold Standard but Gold "Floating" Up

We've lived in a world of currency decay for a long time now and one in which we can no longer afford to see any further battle of gold against currencies, started in 1971 by the closure of the "gold window" by President Nixon. As we have seen in the last three years, gold has begun to compliment currencies and facilitate their liquidity and the lowering of risk in international loans. It has worked. We expect that the monetary authorities have already made plans to capitalize on this, and it is just a matter of time before the complete rehabilitation of gold is complete.

We do not envisage a "Gold Standard" system because this implies a fixed price of gold. Instead, we see gold price that must 'float' in a stable manner; to achieve this, however, central banks would need to be able to control the gold price to ensure that stability. The price would have to rise dramatically to achieve this, but under central bank control this could be done. Without such measures, confidence in the global monetary system may well move to collapse on a broad, domino-like front, the likes of which we have never seen.

And it's this objective that will trigger central bank confiscation of its citizen's gold. There may well be other stated reasons, but this will underlie them.

How Will Confiscation Be Instituted?

Expect no warnings at all. Don't be surprised if such an event were preceded by denials. Most likely it would happen over a weekend or public holiday so as to catch all off-guard. This would maximise the gold caught in the authorities net.

The objective of such legislation would be to ensure that a nation could reap as much gold as possible into the State's coffers.

-

The first targets would be gold held -on behalf of clients or the banks themselves-- by banks

-

In the States, the prime target would be the SPDR gold Exchange Traded Fund, with more than 1,600 tonnes of gold held by its Custodian, HSBC. For the sake of keeping its license (as we see in the speed it pays heavy fines to regulators) it would simply hand over that gold to the central bank. Expect their clients to be offered market-related prices at the time or U.S. Treasury bonds in payment for the gold. SPDR would then simply inform their clients of what happened, and the fund's gold would be gone!

-

Next would be the private gold vaults within the jurisdiction of the monetary authority doing the confiscating. Again, the law would force them to hand over their gold to the authorities, backed up by the relevant legislation or government order. And again, the haul would be substantial.

-

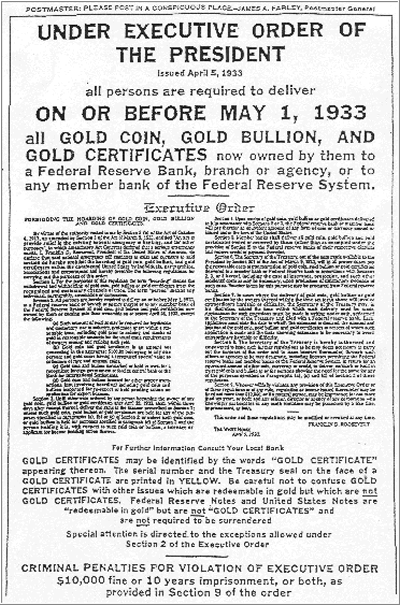

Next would be gold dealers and their clients, within the jurisdiction of the confiscating authority. Again, the haul would be good and easily attached. We attached the 1933 Gold Confiscation order here (pull the corner of the document down to enlarge it). We would expect the penalty of $10,000 to be a mind-blowing number by now?

Under the coming legislation [FATCA] and possibly new supporting legislation, a declaration of assets, including gold by citizens and institutions would likely be ordered.

Including Foreign-held Gold

You would think this could only apply to institutions and individuals whose gold is within the jurisdiction of the confiscating authority, but a look at the tenacity with which the I.R.S. has taken on foreign banks hiding U.S. citizen's money overseas, shows that their tentacles reach all over the world. U.S. citizens living and working overseas -for as long as they have a U.S. passport-- are liable to U.S. tax. Any foreign bank operating inside the States is liable to lose its license to bank inside the U.S. if they don't cooperate with the U.S. monetary authorities. That's why Swiss banks no longer want new U.S. clients. They have reviewed the proposed FATCA legislation too and are getting ready for it now. So U.S. citizen-owned, foreign-held gold remains vulnerable to any confiscation order made inside the U.S.

Not to be Fought Outside U.S.

Surely the government of the jurisdiction where the gold is held will fight that?

Of course they will, if the matter is taken to their courts by the U.S. authorities. But it won't be. Even the mighty U.S. will not try to impose such a confiscation order on other nations. They would be thrown out of court. Jurisdiction is everything! The secret there is to bluster noisily enough to give the impression they would. But they never would. No country has successfully tried to impose Capital or Exchange Controls outside its jurisdiction just as no foreign nation would attempt to enforce their laws inside the U.S.

Take a look at the successful tactics the I.R.S. used lately. They took on foreign entities inside the U.S. but did not venture outside the U.S. where they would be infringing those foreign laws.

Forced Transfer of Ownership

The same would happen to individuals and institutions with gold held outside their nation's borders. They would simply impose the law on the owner of the gold, not the gold itself. It's easier to force an institution or individual to transfer ownership of the title to that gold to the government, with a gold market, price-related payment being made to close the deal (in 2% Treasuries?) than to venture into a foreign court on spurious ownership claims.

Likewise -where it remains directly under the ownership and control of the individual-- extreme penalties for non-cooperation would soon diminish the virtues of his gold.

But there is a way that has just been set up that we believe will provide a robust solution.

How can one avoid gold confiscation without being penalized?

We know of only one set of structures that can successfully overcome these obstacles. The writer, Julian D.W. Phillips, has been working for some time to develop this set of structures. It is Stockbridge Management Alliance Ltd. [SMA] [and he has an interest in SMA] and its Guardian, the Ultimate Gold Trust [UGT]. It is finally in the early days of deployment.

How to Avoid the Confiscation

-

The first step is to have your gold held on your behalf by such a structure. But holding it in an unallocated state is insufficient. SMA holds client's gold in an allocated form (physically separated from the Custodian's other gold) having bought it through one of the very reputable members of the London Bullion Market Association, or LBMA.

-

SMA client's gold is allocated and held on your behalf.

-

-

For security and anonymity, SMA gives each client a private codename through which they can check their holdings within the structure on a daily basis.

-

SMA website has a page where clients check their holdings on a daily basis, anonymously, via their codename.

-

-

The physical gold is held in a jurisdiction that will not cooperate with the U.S. or any other country's imposition of such an order against gold. Switzerland has such a reputation. When UBS was being forced to hand over the names of its 45,000 clients, the Swiss government intervened to prevent that and agreed that only around 4,500 tax evaders' names were handed over, leaving 40,500 names undisclosed. The Swiss National Bank has acted in a similar manner with other countries that tried the same breach of Swiss Bank Secrecy Laws. Any attempt by any government to claim citizens' legally-bought gold would receive a far more blunt answer from them, I'm sure.

-

SMA holds client's gold in Zurich, Switzerland.

-

-

The gold must be held outside the banking system because the banks will fall over themselves to obey government, even if it is against their client's interests to do so. SMA hold's client's gold in VIA MAT, a private Swiss Vault in Zurich.

-

VIA MAT, in Zurich is outside the banking system.

-

-

Clients can redeem their gold at any time. The only exception is when the authorities of the jurisdiction in which they live, have issued a confiscation order against its people's and institution's gold. This is to prevent you being forced to transfer the ownership of your gold to the government, under pressure. If you reside in a country where a confiscation order has been issued, the possibility of such an event is very high. If clients refused to cooperate and transfer their gold to the authorities, they could certainly invite serious penalties.

-

To this end the Gold Bullion Certificates certifying your beneficial ownership of the gold by SMA are non-transferable.

-

-

Most folks would liquidate their holdings or turn in their gold, rather than "break the law" and suffer harassment by their government. We have no doubt that the authorities would not force a sale of the gold; otherwise such an order would apply to all its citizen's foreign-held assets. So we believe that under such an order, the Authorities would exclusively target client's gold holdings and not require its sale. Their object would not be to get more [e.g.] dollars, but gold.

-

This is why SMA keeps client's right to sell their gold at any time.

-

-

In most structures where your gold is directly owned by you, or your entity (of which there are some very good ones) you still face the danger from your monetary authorities. They may simply order you to repatriate it, threatening you if you don't. That is why if you live in a country where a gold confiscation order is issued, then there is little point in holding gold outside your jurisdiction, if you still live there. Pressuring you to repatriate your gold would be the easiest route for the authorities to follow.

-

SMA's structure would enable you to honestly say that you are not able to repatriate the gold, while a confiscation order persists, in your country.

-

-

You may think that the Stockbridge Management Alliance is itself vulnerable; however, this danger has been ameliorated by directly contracting with the Ultimate Gold Trust, based in Geneva, to do whatever is necessary to retain client's gold in Switzerland. Their contingency plans are effective and will achieve this objective for the sake of the continued holding of client's gold in Switzerland, while some of its client's gold is in a jurisdiction under a gold confiscation order.

-

Use of a Swiss-based, guardian company, dedicated entirely to this objective, is required to stave off any attempts by governments to attack the structures holding client's gold

-

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2012 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.