Where’s Iran’s Money?

Economics / Iran Nov 30, 2012 - 02:23 PM GMTBy: Steve_H_Hanke

Since I first estimated Iran’s hyperinflation last month , I have received inquiries as to why I have never so much as mentioned Iran’s money supply. That’s a good question, which comes as no surprise. After all, inflations of significant degree and duration always involve a monetary expansion.

Since I first estimated Iran’s hyperinflation last month , I have received inquiries as to why I have never so much as mentioned Iran’s money supply. That’s a good question, which comes as no surprise. After all, inflations of significant degree and duration always involve a monetary expansion.

But when it comes to Iran, there is not too much one can say about its money supply, as it relates to Iran’s recent bout of hyperinflation. Iran’s money supply data are inconsistent and dated. In short, the available money supply data don’t shed much light on the current state of Iran’s inflation.

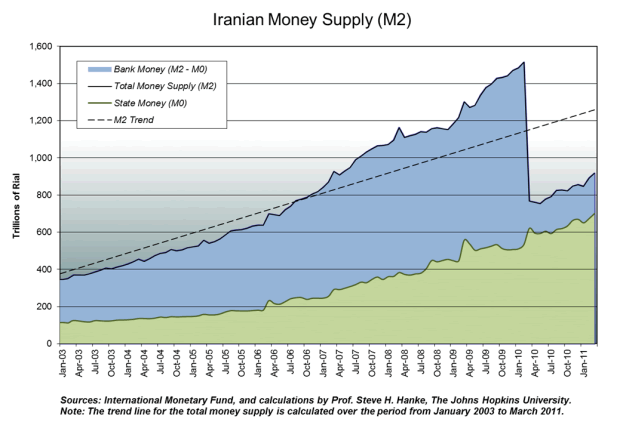

Iran mysteriously stopped publishing any sort of data on its money supply after March 2011. Additionally, Iranian officials decided to change their definition of broad money in March 2010. This resulted in a sudden drop in the reported all-important bank money portion of the total money supply, and, as a result, in the total. In consequence, a quick glance at the total money supply chart would have given off a false signal, suggesting a slump and significant deflationary pressures, as early as 2010

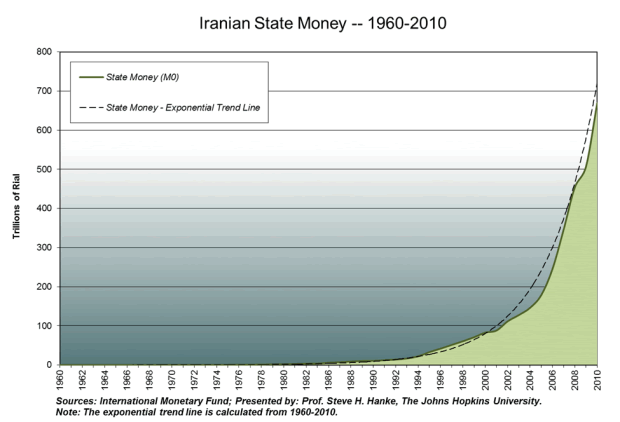

While very dated, at least Iran’s state money, or money produced by the central bank (monetary base, M0), is a uniform time series. The state money picture, though dated, is consistent with a “high” inflation story. Indeed, the monetary base was growing at an exponential rate in the years leading up to the end of the reported annual series. No annual data are available after 2010 (see the chart below).

Iran is following in Zimbabwe’s well-worn footsteps, trying to throw a shroud of secrecy over the country’s monetary statistics, and ultimately its inflation problems. Fortunately for us, the availability of black-market exchange-rate data has allowed for a reliable estimate of Iran’s inflation—casting light on its death spiral.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2012 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.