Mish Mike Shedlock Exposed, the Deflation Great Pumpkin

Politics / Investing 2012 Dec 11, 2012 - 01:13 PM GMTBy: Peter_Schiff

In January 2009, just as the "Peter Schiff was Right" YouTube video that catalogued my previously derided predictions about a coming financial collapse was racking up views and attracting mainstream attention, a blogger and investment advisor named Mike Shedlock (aka "Mish") saw an opportunity to make an unethical grab at my current and prospective clients by breaking the nascent wave.

In January 2009, just as the "Peter Schiff was Right" YouTube video that catalogued my previously derided predictions about a coming financial collapse was racking up views and attracting mainstream attention, a blogger and investment advisor named Mike Shedlock (aka "Mish") saw an opportunity to make an unethical grab at my current and prospective clients by breaking the nascent wave.

Shedlock put together a misleading marketing piece entitled "Peter Schiff was Wrong" which compared my recent investment performance with that of his little known firm, Sitka Pacific Investment Advisors. The piece, that circulated widely in the press and on the Internet, focused on how the foreign stocks and currencies I favored had fallen sharply in 2008 while the Sitka Pacific strategy prevented huge losses during the crash. By ignoring long-term data in favor of highly selective short-term performance, the piece tempted people to bail on positions that were poised to make sharp upward moves and lured them into a strategy that has been a long-term disaster for investors.

While I never publically denied large declines in 2008, I maintained that the moves did not invalidate my economic forecasts or long-term investment strategy. In fact, in my book "Crash Proof" that Shedlock referenced repeatedly in his piece (often times inaccurately or out of context), I advocated a three-legged investment stool; dividend paying foreign stock, cash and foreign bonds, and precious metals.

Shedlock neglected to point out that the book specifically warned that foreign stocks would likely fall in sympathy with U.S. stocks once the real estate bubble burst and the financial crisis began. I had advised readers to use funds from the "cash" leg of the stool to take advantage of buying opportunities created by the declining share prices.

As an outsider to Wall Street, the government, and academia, I represented a threat to the establishment's spin that no one could have foreseen the crisis. But the popularity of the "Peter Schiff was Right" video made it hard for the media to ignore my unorthodox views. After all I had been right when the rest of the talking heads had been clueless. Shedlock's piece undermined much of that credibility and led to a negative Wall Street Journal story that was far more widely read. Thanks to Shedlock, I was no longer the guy who called the crash, but the fraud who made "minced-meat" out of his client's accounts.

From Shedlock's perspective his attack was wildly successful. By undercutting the credibility of one of the most visible spokesmen for Austrian economics (a school of thought to which he supposedly subscribes himself); he did manage to make some bucks for himself.

At the end of 2008, Sitka Pacific had only 75 clients and $18 million dollars in assets under management (AUM). A typical junior stockbroker at a mid-tier brokerage firm would have a larger book. In fact, during seven of the eight years Shedlock's firm has been in business, they raised an average of less than $5 million per year. However, in 2009, the year the "Peter Schiff was Wrong" marketing campaign was launched, Sitka had a banner year adding 225 new accounts and $40 million in AUM. Today Sitka manages $75 million for 342 accounts. Still extremely small, but had 2009 been a typical year, today's AUM would likely be just $40 million.

While the 'Peter Schiff was Wrong" campaign was a great marketing success for Shedlock, it was a disaster for any investors taken in by the rhetoric. Despite his criticism of my performance, his own performance is undeniably horrible over the long term. Just about the worst investment decision one could have made was to send money to Shedlock's firm in January 2009. Since then, global stock markets and foreign currencies have rebounded sharply and Shedlock's clients have completely missed the gains. By following Shedlock's advice to sell near the lows, investors converted temporary paper losses into permanent realized losses!

Central to Shedlock's augment was that I was wrong to have advised investors to get out of the U.S. dollar and wrong to have advised them to buy foreign stocks. To prove his point, he reproduced a short-term chart of the Australian dollar and a spreadsheet representing an account of one of my clients whose account details he managed to obtain (we had over 15,000 accounts at the time).

Let's start with the Australian dollar. It had just fallen from about 95 U.S. cents in July of 2008 to about 65 U.S. cents in October of that year. According to Shedlock, it was going even lower as the Fed was done with its easing cycle and the Reserve Bank of Australia had only just begun to ease. However, unknown to Shedlock at the time was that the Austrian dollar had already made its low, and by April of 2011 it hit a new record high of $1.10 cents, a 70% rise. Today the Australian dollar is worth about $1.05.

So was Shedlock right to advise investors to sell the Australian dollar near its lows? Or was I right to have advised people to ride out the decline? In fact, I have been advocating buying the Australian dollar for over ten years, just as Shedlock had criticized me for doing. When "Crash Proof" came out the currency was worth 80 cents, and earlier in the decade you could buy it for closer to 50 cents.

Shedlock's heavy artillery however, was the specific Euro Pacific client account he "discovered" that showed unrealized losses of 49%. (Dividends received that would have mitigated those losses, were omitted). Shedlock implied that the account he showcased was a typical representation of all my accounts, and demanded that I provide proof if that was not the case. He specifically challenged me to post a year-by-year track record of all my client accounts, similar to what his firm did.

The problem is that Shedlock threw down a gauntlet that he knew I was legally prohibited from picking up. At that point Euro Pacific Capital was simply a brokerage firm, while Shedlock's firm was a Registered Investment Advisor (RIA). As Shedlock well knew, the rules governing the two structures are very different and so there was no realistic way that I could have accepted his challenge and remained compliant with these rules.

The truth is that all non-discretionary brokerage accounts are unique. Back then none of our accounts were managed, and each reflected the unique objectives and decisions made by the individual account holders. Some were very aggressive, others much less so. Some favored foreign stocks, others foreign bonds. Some clients just bought physical precious metals. The account Shedlock featured was highly concentrated in resource stocks and Australian utilities, two sectors hit particularly hard by the 2008 financial crisis. I was not allowed to make any claims about the performance of a "typical" account.

Instead of giving my strategy time to play out, Shedlock seized the opportunity to exploit the short-term declines in the Australian dollar and foreign stocks, to tout the alleged superior performance of his own firm. Since these are the very benchmarks Shedlock chose to evaluate the short-term performance of his strategies, let's see how well those strategies have held up against those very benchmarks over longer time periods.

For the Australian dollar, we will use the returns on Australian government bonds (after all, investors in Australian dollars are going to want to earn interest), and for foreign stocks, we will use a hypothetical portfolio that replicates the precise composition of the single Euro Pacific account that Shedlock featured in the "Peter Schiff was Wrong " campaign (hence forth to be known as "the spreadsheet portfolio.")

Sitka features four unique investment strategies: Hedged Growth, Absolute Return, Dividend Growth, and Commodity Focused. Let's compare each strategy to both benchmarks over two relevant time periods. The first begins Jan 1, 2009 (the month Shedlock launched the "Peter Schiff was Wrong" campaign) and ends Sept 30, 2012 (the most recent date for which performance numbers have been posted for Sitka Pacific). This time period would reflect the returns an investor would have achieved if he had opened accounts with Sitka Pacific after having read "Peter Schiff was Wrong." The second, and longer, time period begins with the inception dates of each Sitka investment strategy, and also ends Sept 30, 2012. And just for good measure, I threw in the returns on 10 year U.S. Treasuries and the S& P 500 as well.

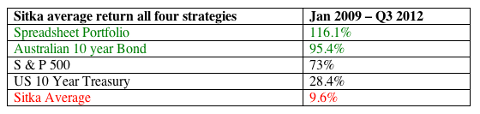

First let's look at the performance starting in Jan 1, 2009. Since we have no way of knowing which of Sitka's four strategies an investor would have selected, I simply averaged the returns of all four.

As you can see Shedlock's strategies substantially underperformed both Australian government bonds and the spreadsheet portfolio. If after reading "Peter Schiff was Wrong," an investor put $100,000 into Sitka Pacific ($25,000 into each of Shedlock's four strategies), his total gain as of the end of Sept. 2012 would have been a mere $9,600. That's 89% less than the $95,400 that the same investor would have earned had he put the funds into Australian government bonds, and 92% less than the $116,100 he would have earned had he invested in the spreadsheet portfolio!

Now some may think that Jan 2009 is not a fair starting point, as foreign stocks and the Australian dollar were way down at that time. While this is true, Shedlock had the opportunity to buy those lows, but chose not to, as he incorrectly anticipated further declines. Others might say that starting in Jan of 2009 is unfair as it omits 2008, Shedlock's only relatively good year.

At first blush this might seem to be a valid point, until you compared the returns on all four managed account strategies since their inception dates to the same benchmarks. Even if you include his one good year the relative performance of his strategies is almost as bad. Take a look at the data below.

.png)

The "Hedged Growth Strategy" has the longest track record of all Sitka's strategies. Had you invested $100,000 back in July of 2005 your account would have been worth $116,700 by the end of Sept. 2012. That represents a meager annual return of about 2%. No wonder Shedlock wants his clients to believe there is no inflation, as he cannot even outperform the CPI! Contrast that to the $242,300 his client's accounts could have been worth had they purchased Australian government bonds, or the $255,500 had they invested in the spreadsheet portfolio. Those returns annualize to about 18% and 19.5% respectively.

Alternatively, had you invested $100,000 in Shedlock's Dividend Growth Strategy at its inception in June of 2007 (three months after my book Crash Proof came out), your account would have been reduced in value to $92,200 by the end of the third quarter of 2012. However, had you bought Australian government bonds on that date instead you would have had $215,000. Even if you put $100,000 into the spreadsheet portfolio, despite its being down nearly 50% in 2008, your account would have recovered to $140,600 by the end of Sept. 2012!

So even from their respective inception dates, and despite the huge declines in the Australian dollar and foreign stocks in 2008, no matter which Shedlock strategy an investor chose, his account substantially underperformed both Australian government bonds and the spreadsheet portfolio!

Shedlock has been warning about the specter of deflation for years, and his strategies are apparently designed to guard against this outcome. However, like Linus sitting in that pumpkin patch, it's been eight years, and the Great Pumpkin has yet to appear. By preparing for deflation and a strengthening U.S. dollar, Shedlock's clients missed out on the far more substantial returns they otherwise might have earned preparing for the opposite.

More significantly, if investors really feared deflation and simply bought U.S. Treasuries instead of giving their money to Shedlock, they would also have been much better off. Apparently Shedlock has succeeded in developing an investment strategy that underperforms under both inflation and deflation! So, when it comes to the inflation/deflation debate, no matter which camp wins, Shedlock's clients still lose.

The only reason I decided to revisit this topic is that Shedlock is at it again. As a result of his unethical "Peter Schiff was Wrong" advertising campaign, I decided long ago not to dignify him by doing any joint interviews. Not realizing this, a new member of my staff agreed to a request from RTV to host an informal inflation/deflation debate between Shedlock and me. As soon as I found out, I politely told RTV that I preferred not to appear with Shedlock. I suggested that I would be happy to debate respected "deflationist" voices such as Harry Dent or Robert Prector. In the end they decided to book me for a solo interview.

Shedlock then circulated another blog post that was picked up by numerous web sites, in which he accused me of backing out of the debate, presumably out of fear. Even though I informed Shedlock that I never agreed to debate him, he refused to revise his post.

In addition, Shedlock also lied about having supported my 2010 Senate run. Though he did write a self-serving endorsement of my candidacy, it was merely another advertising campaign in disguise. Despite his talk about wanting to host a fundraiser, Shedlock did not contribute one dime to my campaign himself. He simply wanted to use his endorsement to attract the attention of my clients so as to solicit their business.

Had Shedlock really wanted to patch things up between us he would have apologized for his conduct in 2009. He would have attempted to set the record straight himself with respect to the performance of my investment strategy. Instead, he continues to market his RIA with more insults and false allegations against me. He absurdly claims to have personally taken the high road to patch things up, while accusing me of vindictively holding an irrational grudge against him.

As is always the case with Shedlock, the truth is something that is easily cast aside when it interferes with his inflated ego or marketing agenda. Now that I have presented the truth for all to see, let's see how Shedlock likes stewing in his own brew. The only upside for Shedlock is that he doesn't have much of a reputation to lose.

Disclosure

Performance of Sitka Pacific Capital Management portfolios were calculated as a time weighted return, using annual figures available on their public website, as of September 2012.

The following assumptions were made for the spreadsheet portfolio -- All positions weighted according to their original cost basis as featured in the Shedlock "Peter Schiff was Wrong" campaign, for both inception and 2009 starting dates. 2% commission charged on all buys. All dividends reinvested proportionately into each stock in the portfolio. Proceeds of companies acquired for cash reinvested proportionally into the remaining positions. Stocks not publicly traded at various Sitka Pacific strategy inception date were added to the portfolio as soon as they went public, with funds to finance the purchases raised by proportionately reducing the previously established positions.

The performance of the stocks in the hypothetical spreadsheet portfolio and Australian government bonds in no way implies anything with respect to past performance of Euro Pacific Capital clients' portfolios, and in no way should this article be seen as being indicative of future performance for Euro Pacific clients. Past performance is no guarantee of future results and current results may be lower or higher than the data quoted. The return analysis is simply offered to demonstrate the poor performance of Shedlock's strategies relative the specific benchmarks he chose to use in Jan 2009.

For those of you who are interested in performance figures for Euro Pacific Asset Management, which did not begin managing money until after Shedlock's piece, it can be found on our web site at http://www.europac.net/services/wealth_management

Investing in foreign stocks and bonds involves a high degree of risk, as the volatility of 2008 certainly evidences, including currency fluctuations and political risks. Past performance does not guarantee future success. Do not invest in foreign markets if you cannot afford to lose your principal. Read any prospectus carefully before you invest. Consult with a professional to determine if such investments are suitable for you. Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital, best-selling author and host of the syndicated Peter Schiff Show.

Subscribe to Euro Pacific's Weekly Digest: Receive all commentaries by Peter Schiff, John Browne, and other Euro Pacific commentators delivered to your inbox every Monday!

And be sure to order a copy of Peter Schiff's NY Times Best Seller, The Real Crash: America's Coming Bankruptcy - How to Save Yourself and Your Country.

Euro Pacific Capital

http://www.europac.net/

Peter Schiff, CEO of Euro Pacific Capital and host of the nationally syndicated Peter Schiff Show, broadcasting live from 10am to noon ET every weekday, and streaming at www.schiffradio.com. Please feel free to excerpt or repost with the proper attribution and all links included.

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

DR01D

13 Dec 12, 19:27 |

my 2 cents

Mish has a long standing feud with Eriz Janszen from Itulip as well. Shedlock is one angry dude. It's a shame. |