The High-risk World of Junior Resource Stocks

Commodities / Gold & Silver Stocks Dec 22, 2012 - 02:50 PM GMTBy: Casey_Research

As many people know, I'm a frequent traveler. This means I spend a lot of time standing in lines at airports, taxi stands, train stations, and so forth. My habit has been to use this time reading books, playing with lines of poetry, or simply thinking about whatever needs thinking about. If I believed in sin, the cardinal sin in my book would be to waste time; every squandered minute is a piece of my life I will never get back.

As many people know, I'm a frequent traveler. This means I spend a lot of time standing in lines at airports, taxi stands, train stations, and so forth. My habit has been to use this time reading books, playing with lines of poetry, or simply thinking about whatever needs thinking about. If I believed in sin, the cardinal sin in my book would be to waste time; every squandered minute is a piece of my life I will never get back.

But a couple months ago, I saw my wife playing a game on her phone and remembered that my phone has games on it too… and sometimes one is just too tired or jet-lagged to do good work. So I started playing solitaire.

Now, Doug has long said that he loves playing poker, a game with instructive lessons for speculators. He always stresses that speculative investment is – or should be – very different from gambling, but there are obvious parallels in how one assesses odds and the like. That's great, but I'm a terrible poker player; I can't seem to bluff. Solitaire is more my speed.

Solitaire is a silly use of time, really, but relaxing. After a few hands, my wife showed me the "Undo" function that lets you try different solutions to the challenge each hand of cards presents. And down there by the Undo icon was another for stats. The game had been keeping track the whole time, and I had won approximately 30% of all the games I'd played. Checking on my progress, I noticed that the stats don't include the games I don't play – if I didn't like a hand I was dealt and hit the "New Game" button, it didn't count as a loss, didn't show up in the stats at all. And then I saw an option to reset all statistics…

As my daughter likes to say: light bulb!

It was like Doug Casey's favorite Warren Buffett aphorism about investing being like a ball game with no called strikes. You don't have to swing at every – or any – pitches. You can wait for one you like and then swing for the bleachers. So, what would my stats look like if I simply refused to play any hand that didn't offer me the advantages that I've learned help me win?

Well, you can see in the photo below what happened: I reset the statistics, applied my new criteria, and doubled my success rate to 60%.

On the left is a hand of solitaire I was playing. On the right is the stats screen that shows I've won 60% of 205 games played since resetting the statistics and beginning my experiment. Note that the "Games Won" is greater than "Wins Without Undo" by one game – that was the time my wife showed me how she would play the hand.

Before You Make Your Move

After playing many hands, I'd found that the more moves I had at the outset the greater the odds of winning. If I am dealt a hand in which I can make three moves before turning over my first card from the deck, I can win 50% to 60% of the time. And if I have that plus an ace I can move up top, I can win 80% to 90% of the time.

So, my criteria were simple: I needed to see at least three moves at the start, or I wouldn't play.

This is, I submit, very similar to the due diligence on a mining stock. If the 8 Ps are not all there, we should not invest. If they are, it doesn't guarantee success, but it sure improves the odds.

I was even tempted by hands that did not quite meet my criteria but looked really interesting – like showing two aces at the start. When I tried such hands anyway, I lost more often than I won. I didn't track it, but I lost a lot more than I won, perhaps even the 70% loss rate I started with.

I found this to be very, very much like investing in resource stocks; the times I've been tempted by something with an exciting story but not quite up to snuff, I've regretted it far more often than not.

Solitaire is not stock picking, I know, but the principle of not acting unless the odds are in your favor is the same; if you don't like anything about the hand you're dealt, the ball you're thrown, or the investment opportunity you're pitched, don't buy the stock.

It's a simple twist on the Nike motto: Just don't do it.

The Deeper Lesson

Not playing unless dealt a favorable hand is an incisive instance of something far more important that's familiar to long-time readers: discipline.

Not being tempted by an exciting but flawed story is just the beginning. Believe it or not, even in something as simple as solitaire, discipline in how one plays matters a lot – perhaps as much as refusing to play unless dealt a great hand.

Patience throughout the game is key.

On my phone, I can turn over the cards in the deck as many times as I like. So, unless I'm going for speed, there's actually no need to use any of the cards in the deck the first time I turn them over. I can go through them as many times as I like, learn what's there, and think about how to play the cards before making a single move.

Boring?

Maybe. But remember, my objective is not just to solve the puzzle but to win without undoing any moves. I don't get to call my broker and ask him to undo trades that don't work out. Once I play a card in the deck, or uncover a card in the hand, it stays played. There's more I can do, but there's no going back.

For example, if I have a space for a king, I don't just fill it with the first king I find in the deck; I go through the deck looking for the color of king that will help me the most.

So, yes, patience is a virtue – as is due diligence. Going through the deck is like reading financial statements and examining drill core. I don't want to get too excited by what I find early on, because I can't undo a blunder.

I also discovered that I make more mistakes when tired. I found that – this shouldn't have surprised me, but it did – if I get stuck in a game and put it away long enough to clear my mind, and come back to it, I can often see moves not seen before.

The same thing happens when I research investment opportunities; sometimes the most important thing I can do is take a break and come back to it after a rest, then think it through again. Makes sense – picking winners is very complicated and requires assessing market conditions, global trends, and the individual psychology of the players involved, as well as the technical merits of the mineral prospect itself.

I could go on, but I'm sure you get the idea. What excited me about this analogy was not just how well it fits my experience as a speculator, but the statistical result. I don't just think it works; I know it does. And I have numbers that show it – as you can see in the photo above.

Our Market Today

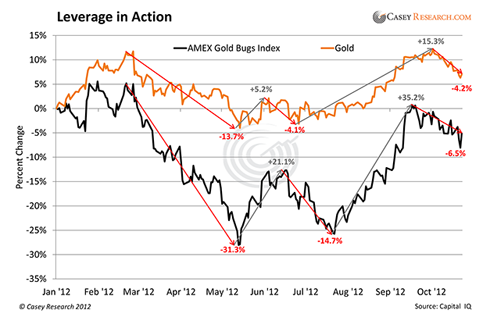

Moving from theory to practice, the article we ran in the October 29 Daily Dispatch sums up the Casey metals team's view of the market today. In short, as we have long said, our stocks move with greater volatility than the underlying metals. For most good companies, the extreme bargains of last summer are gone. I sincerely hope that those who bought at higher prices heeded my calls to average down. Yet, gold's retreat in October has created a new buying opportunity, as you can see in the chart below.

Could our market head lower again? Of course it could – but our experience throughout this bull market (since the bottom in 2001) tells us that the odds favor rising prices this fall and winter, and that makes buying the current dip the right move. It's like being dealt an advantageous hand; it doesn't guarantee success, but it's the way to play.

It's also highly advantageous to have expert advice guiding your stock selections in the potentially lucrative but all too often heartbreaking junior resource sector. If you want to increase your chances of seeing portfolio gains like 46% in one day, or 522% in just over two years – plus get a special bonus if you act now – click here to learn how.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.