Buy to Let Landlords Start to Feel the Mortgage Rate Pinch

Housing-Market / Buy to Let Feb 28, 2008 - 01:54 PM GMTBy: MoneyFacts

Results from the Council of Mortgage Lenders this week have shown an increase in the number of loans taken by buy-to-let landlords in 2007. With first time buyers finding it increasingly difficult to get onto the property ladder, it might be expected that private landlords are having it easy. Alan Harper, Senior Analyst at Moneyfacts.co.uk looks at the availability of buy-to let mortgages:

Results from the Council of Mortgage Lenders this week have shown an increase in the number of loans taken by buy-to-let landlords in 2007. With first time buyers finding it increasingly difficult to get onto the property ladder, it might be expected that private landlords are having it easy. Alan Harper, Senior Analyst at Moneyfacts.co.uk looks at the availability of buy-to let mortgages:

“Moneyfacts.co.uk research shows that landlords have not escaped the fallout from the credit crunch. As in the residential market maximum loan to value limits have fallen during the second half of 2007.

“Moneyfacts.co.uk calculates that, this time last year, the average buy-to-let LTV across all prime products was 82.8%: today it is 80.1%. Based on taking an average LTV on an ‘average’ house price in February 2007 of £189,197, a borrower would have required a contribution of £32,542. On today’s figures, they would need to find £38,063.

“Despite the recent tail off in house prices, the average new buy-to-let landlord needs to find around £5,500 more now than a year ago to buy their first rented property. Go back five years and the same calculation (based on an average LTV, researched by Moneyfacts.co.uk, of 79.2%) and the Halifax average house price average of £123,686, equates to a contribution of £25,727, nearly £12,500 less than today.

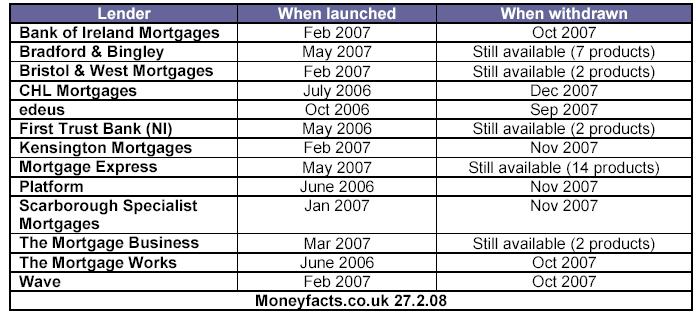

“In May 2007, when property prices were rising and the market was booming, 13 buy-to-let lenders were prepared to offer 90% LTV, the highest LTV ever offered on a buy-to-let mortgage. Now this number has dropped to five.

Lenders with maximum 90% loan-to-value products

“Additional research shows that the percentage of the market offering 75% LTV or less has increased from 17% to 30% over the past year. This figure suggests that lenders are more actively competing for less risky business and allowing landlords with larger portfolios - who can afford to put down more substantial deposits - to take advantage of the most competitive rates.

“For individuals who are not existing homeowners and who are looking to buy-to-let on their first property, the market is even more restrictive. Nearly half of all buy-to-let lenders won’t lend at all to first time buyers, leaving 80% less products than in the residential market.

“In order to account for the additional risk that lenders are taking when offering higher LTVs (especially in a market of falling house prices), the rates offered on higher LTV products are priced accordingly. Moneyfacts.co.uk research shows that the typical difference in rate between a comparable mortgage at 75% and one at 85% is around 0.22%. Based on an advance of £150K this equates to an additional £27.50 in interest per month, or £34.38 per month more in rental income to meet the typical 125% rental cover required. Again this is more likely to have an adverse impact on those new to the market.

“The impact of increased demand for private rental property will enable landlords to demand more rental income from their tenants. So for existing landlords the outlook is bright.

“On the other hand, falling LTVs are unlikely to help those looking to invest in their first buy-to-let property. Landlords with larger portfolios and enough equity to afford a substantial deposit will be better off in the current climate.”

Moneyfacts.co.uk is the UK's leading independent provider of personal finance information. For the last 20 years, Moneyfacts' information has been the key driver behind many personal finance decisions, from the Treasury to the high street.

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.