Stock Market Soothsayers, Naysayers And Ostriches

Stock-Markets / Financial Markets 2013 Jan 23, 2013 - 09:41 AM GMTBy: Darryl_R_Schoon

January 2013, US stock markets are at record highs, the volatility index, the VIX, is as quiet as a dormant caldera and hope the US economy is recovering is growing again as it has every January since 2010.

January 2013, US stock markets are at record highs, the volatility index, the VIX, is as quiet as a dormant caldera and hope the US economy is recovering is growing again as it has every January since 2010.

Dow, S&P close at five-year highs; VIX plunges near 12 CNBC, January 18, 2012

“It’s darkest before the dawn” is a saying often used to rally the dispirited. The opposite sentiment, “it’s brightest before the night”, instead cautions that unqualified optimism is just that—unqualified.

Today, hopes the global economy can overcome massive and historic levels of debt are again on the rise. Those hopes, unfortunately, are as unfounded as Mitt Romney’s presidential aspirations on November 6th.

JOHN EXTER: THE CENTRAL BANKER WHO MADE A FORTUNE IN GOLD

John Exter after graduating from college in 1932 pursued graduate studies at Harvard University in economics. Exter wanted to understand the causes of the Great Depression which had brought economic activity in the US and around the world to a virtual halt during his youth.

As a banker and economist, Exter was to have a storied career. After being at MIT during WWII, he joined the Board of Governors at the Federal Reserve Bank as an economist. In 1950 Exter founded and became governor of the Central Bank of Ceylon.

In 1953 he was division chief for the Middle East at the World Bank and in 1954 he returned to the New York Federal Reserve Bank as Vice-President of International Relations and Precious Metals Operations. In 1959, Exter left the Federal Reserve to become Vice-President at First National City Bank (now Citigroup) with special responsibilities for foreign central banks and governments.

How Exter, an economist, a central banker and investment banker, was to make a fortune in gold is told by W A Wijewardena, Deputy Governor of the Central Bank of Ceylon, in John Exter – Central Banker For All Times an article published on the first anniversary of Exter’s death at 95 on February 28, 2006.

… With a huge fortune made on the gold market by using his own expertise on the foresight of irresponsible central banking and its inevitable consequences, Exter took an early retirement in 1972 and went into private consultancy work.

According to his own admission, the prospect for his fortune on gold dawned on him after a friendly debate he had in 1962 with his one time Harvard buddy and Nobel Laureate Paul Samuelson.

In that debate on why the dollar was becoming weak and USA was losing gold, Exter gave his diagnosis which was based on his experience with the Federal Reserve System. “Paul, it is very simple. The Fed is printing too many dollars and they flow out of the country into foreign central banks who demand gold” Exter is reported to have said.

But, Paul Samuelson did not accept it and wanted to explain the malady in terms of productivity differences between USA and other countries, namely, Europe and Japan. Samuelson’s thesis was that the latter category of countries had a higher productivity than USA and therefore the dollar was becoming weaker.

Exter says that he countered Samuelson saying that Japan was in more trouble than USA, because “the Bank of Japan was running its printing press even faster than the rest of the central banks around the world”

Exter had decided then and there that the irresponsible government expenditure by the Kennedy administration could not keep the dollar stable in the long run and one day, gold would become the preferred asset by the world’s nations.

Hence, he says that he converted all his savings into gold based assets and waited patiently. He was amply compensated in 1971 when the US government was forced to sever dollar’s link with gold under the gold exchange standard and allow the gold prices to be determined in the free market

Overnight, gold prices doubled from $35 per ounce to $70 per ounce. So did the gold based assets portfolio held by Exter. [At today’s price of $1690 per ounce, the appreciation of Exter’s gold-based portfolio would certainly be noteworthy.]

In 1971, Exter had been at the epicenter of US discussions on gold. President Nixon who closed the gold window in August 1971 was heavily influenced by the views of Milton Friedman who believed free-market dynamics would better regulate paper currencies than the rigid discipline of gold. Friedman was wrong.

Paul Volker, then Under-Secretary of the Treasury under Nixon, had asked Exter’s advice on the matter. Exter recommended the US raise the price of gold to accommodate the growing pressure on the US dollar. Volker said that wasn’t politically possible. Exter then told Volker that Volker had no choice but to close the gold window. Two weeks later, Nixon did just that.

Exter later commented on the significance of that act:

The final link between the dollar and gold was broken. The dollar became nothing more than a fiat currency and the Fed [and especially the banks] were then free to continue monetary expansion at will. The result... was a massive explosion of debt.

Gold Wars, Ferdinand Lips, Foundation for the Advancement of Monetary Education, New York (2001)

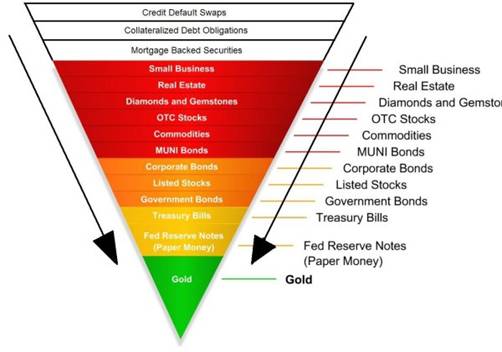

Today, Exter is best known for what is called ‘Exter’s inverse pyramid’, a model of what will happen during a deflationary collapse when investors flee increasingly illiquid assets for those offering safety and liquidity.

EXTER’S INVERSE PYRAMID

Ultimately, the fatal flaw in the bankers’ paradigm of paper money is the hubris of central bankers themselves. Economists had convinced themselves that by printing money, they could achieve full employment (Keynes), that without gold, free market forces would stabilize currencies (Friedman) and that by sufficiently expanding the money supply a deflationary collapse in demand, i.e. depression, could be prevented (Friedman) and/or safely offset by increased borrowing (Keynes).

Both Keynsians on the left and Friedmanites on the right were convinced that central bank stewardship of paper money was better done without the constraint of gold. That somehow a house built on sand is preferable to one built on rock—proving once again that if thought has no bounds neither does thoughtlessness.

Exter, a friend of Ludwig von Mises, was an adherent of the Austrian School of Economics, an economic discipline shunned by ‘house’ economists who much preferred the apparent opportunities afforded by credit and debt. After a discussion of Exter’s Austrian views, Paul Samuelson told him, “John, you may be right but you’re lonely”.

In a conversation I had with Exter’s daughter, Jane Exter Butler, about her father, she commented that she wished her father had lived long enough to see evidence of the economic collapse he had predicted. Exter had passed away in 2006 two years before the collapse.

I replied that I was certain her father didn’t need any such evidence. Exter knew with complete certainty he was right—as he still is today.

JOHN EXTER: THE COMING DEPRESSION AND GOLD

Exter’s understanding of macro economic factors allowed him to accurately predict economic events. Exter was certain another depression was coming and that it would be worse than what had happened in the 1930s. The following is excerpted from a 1981 interview with Exter:

I lived through the great depression. I remember it vividly. I know what it did to people. I remember the 25% unemployment. So I’m very unhappy when I have to say this depression is going to be worse.

A time will come when housing prices will weaken so much that many people who bought houses recently will lose all their equity. Once they lose their equity, they may say: “Why should I go on paying the bank? Why don’t I just let them have it?” So I think you’re going to have defaults on mortgage loans and foreclosures…

More foreclosures, of course, put more pressure on home values. Then more defaults-and when people start to default on their debts, troubles multiply. This is one reason why I think we cannot avoid a banking collapse.

I think people have rather been seeing—in their heart of hearts—that a depression is coming, or at least some sort of hard times…When your income shrinks and you have a debt burden, the debt burden becomes more and more onerous-and you get desperate to borrow…I expect the government to respond to the deflation by trying desperately to re-inflate. I expect huge budget deficits. So I expect the dollar ultimately to become worthless.

The Federal Reserve has already defaulted-gone bust. When I was a young man, the Fed had to redeem its liabilities in gold at $20.67 per ounce. As a matter of practice, any of us could go to any bank in the US and write a $100 check and take out five $20 gold pieces. To maintain that obligation, the Fed had to avoid borrowing short term and lending long term. But it didn’t. As a result it had its own liquidity squeeze and defaulted on its IOUs-the paper dollars circulating-are not promises to pay anything. They’re IOU nothings.

Paper is worthless as a store of value. The only thing that can give the US dollar any value is its promise to pay something that is a good store of value-primarily gold-to the holder. The government now has welched on that promise, so these paper IOUs are not really worth anymore than the paper they are printed on.

Sooner or later the public will catch on and the dollar will become worthless…As the crisis intensifies; as the results of the liquidity squeeze become apparent and illiquid debtors start to default; as the depression and deflation set in; gold will once again emerge as the supreme store of value.

…This is hard for me to say, for I am a banker: On the subject of income, I’d definitely stay away from banks. Bank deposits are paper IOUs. A bank owes you Federal Reserve notes. Even Federal Reserve notes are not good. A bank is even worse because you have the added risk that it will default on its promise to pay such notes. Remember: gold never defaults.

‘HELICOPTER BEN’ BERNANKE & ‘KAMAKAZI SHINZO’ ABE ARE

2013 CO-SPONSORS OF EXTER’S PREDICTED DEFLATIONARY COLLAPSE

In October 2011, Jay Taylor, an expert on gold stocks, interviewed Exter’s son-in-law, Barry Downs. During the interview, Downs discussed the signs Exter said to watch for, signs which would signal the approach of the coming economic downturn.

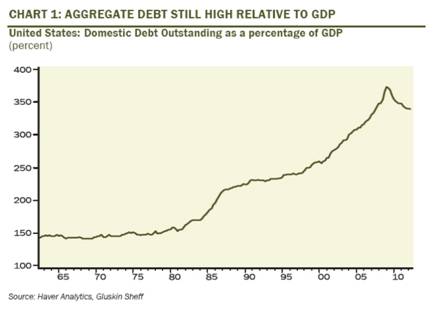

In credit-based economies, aggregate debt levels must constantly grow and when they don’t, it signals the economy is entering a dangerous phase; and, if aggregate debt contract, i.e. shrink, that is a far more dangerous sign. That signals a deflationary depression is beginning; and in 2008, Downs noted that levels of aggregate debt began to shrink.

Note: Taylor’s interview with Barry Downs begins at the 20 minute mark and ends at the 30 minute mark, see http://www.voiceamerica.com/episode/56715/pondering-the-possibilities-of-a-greater-deflationary-depression .

This is why the Fed, the Bank of Japan, the Bank of England and the European Central Bank have thrown caution to the wind in a desperate and last ditch attempt to save their ponzi-scheme of credit and debt that has served them so well.

Exter told Barry Downs that once aggregate debt levels began shrinking, nothing central bankers could do could reverse the process. A tidal wave of deleveraging debt would sweep aside any and all attempts to inject enough credit to reverse the process.

QE3 will be no more effective than QE1 nor will QE4 or QE5. No amount of bond buying, no amount of credit can turn back the tsunami of defaulting debt that has already begun to gather momentum. The tipping point has been reached.

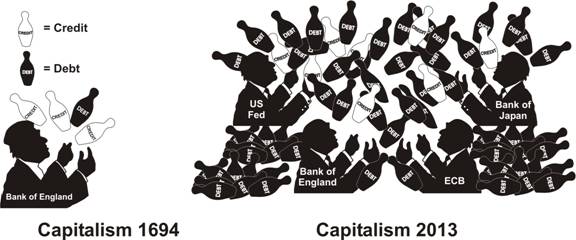

Excessive central bank credit has turned into such levels of debt that no amount of credit can subsume it. This is why it’s called the end game. Credit-based capitalism was headed towards this finale in 1694. In 2013, it arrived.

The Japanese central bank said it would aim to achieve a rate of 2 per cent inflation – up from its current goal of 1 per cent – “at the earliest possible time” by shifting to the kind of limitless stimulus embraced by the US Federal Reserve and the ECB.

Financial Times, January 21, 2013.

THE END GAME AND THE BETTER TIMES TO COME

Ben Bernanke’s belated attempts to restore US employment levels and economic growth through even more monetary easing is as futile as Lance Armstrong’s attempts to salvage his tattered reputation.

No amount of optimism, no amount of denial and no amount of credit can fix what central bankers themselves broke. Nothing lasts forever. Not even the dream of bankers who attempted to live off the productivity, ingenuity and labor of others merely by printing debt-based paper coupons they could loan to others as money.

Remember: gold never defaults

John Exter

In my current youtube video, 2013: The Mother of All Paradigm Shifts, I explain how the banker’s paradigm arose. I also show how the collapse of the bankers’ paradigm coincides with the end of a far older and far more fundamental paradigm, gender inequality, see http://youtu.be/EZ7HTALQ4JU.

It might be assumed by readers that my expectation of another depression is evidence of a pessimistic outlook. Nothing could be farther from the truth. After the coming collapse, I expect a far better world will emerge; and, although the process will not be easy, it will be rewarding beyond our greatest expectations.

John Exter, in his wisdom, firmly believed that when laws fail, human beings working with moral consciousness could do wonders.

W A Wijewardena, Deputy Governor of the Central Bank of Ceylon

… the vulture feeds neither upon the pastures of the bull nor the stored up wealth of the bear. The vulture feeds instead upon the blind ignorance and denial of the ostrich.

Darryl Robert Schoon, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, 3rd ed. 2012

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.