Investors Dive into Commodities and Resources ...as a Safe Haven?

Commodities / Resources Investing Mar 03, 2008 - 01:06 PM GMT

“With credit and equity out of favour, investment managers ride the commodities price boom...International investment managers have dived into the commodity market to exploit sharp price rises across the board, leaving behind the troubled credit and equity markets to focus on the China-India boom story... ‘The other thing (is the) hedge funds and the commodity trade advisors who can go long and short' said Citi's global head of commodities Alan Heap. ‘They are covering their short positions very aggressively and that is fuelling the fire as well, particularly for copper.” Scott Murdoch, The Australian Feb 23-24, 2008.

“With credit and equity out of favour, investment managers ride the commodities price boom...International investment managers have dived into the commodity market to exploit sharp price rises across the board, leaving behind the troubled credit and equity markets to focus on the China-India boom story... ‘The other thing (is the) hedge funds and the commodity trade advisors who can go long and short' said Citi's global head of commodities Alan Heap. ‘They are covering their short positions very aggressively and that is fuelling the fire as well, particularly for copper.” Scott Murdoch, The Australian Feb 23-24, 2008.

“Surge puts a rocket under resources... Recession in the US? What recession? As far as global resource markets are concerned the US just doesn't matter anymore... Commodity markets are surging with China the big price-driver...As well, supply bottlenecks in a boost of resources are also helping to push these markets upwards....Some analysts see this as the start of another strong bull run in resources.” Stephen Wyatt, Financial Review Weekly 23-24, 2008.

The world is in turmoil. The contagion of the US sub-prime debacle (allowed to develop by Alan Greenspan and naively thought to be “contained” by Bernanke) has spread rapidly through global markets. The US is heading into or is perhaps already in recession (depending on who you want to believe).

Real Estate and Retail out of Favour.

The US residential property market is in deep trouble with the commercial property market likely to follow. The stock prices of builders, mortgage lenders, monoline insurers, furniture retailers, and anyone associated with the building industry are battling strong headwinds while some are in freefall. Californians can now take “ foreclosure tours ” with realtors like Alexis McGee whose media release reads “ Who doesn't like to buy quality product at 30, 40, 50 per cent and more off retail prices? Don't be scared off by the gloom and doom talk swirling around housing markets. It's a S-A-L-E. ” However, there are still many out there betting that real estate has a lot further to fall over the next eighteen months and that it's too early to be bottom-picking just yet.

Even Treasury Secretary Henry Paulson (in regard to the US housing crisis) admits “ The worst is just beginning .”

Investors are also unloading Retail Stocks which look to have peaked as cash-strapped and debt-choked consumers rein in their spending due to rising cost-of-living expenses, fuel prices and interest rates. One major retailer has “ seen evidence of a slowdown from consumers of lower socio-economic standing already, and we expect the well-heeled consumer to follow .”

Some Banks Shaky

Global credit market concerns and a global financial squeeze have taken their toll on the traditional safe-haven sectors of banks, financial institutions, the municipal bond market and the infrastructure sector leading to fears of a pronounced US and Global recession. Professor Nouriel Roubini (Stern School of Business, New York University) certainly doesn't soothe investor's jangled nerves when he warns:

“A pronounced US and global recession is an increasingly plausible scenario... A vicious circle is under way in the US...America's financial crisis has triggered a severe credit crunch that is making the US recession worse, while the deepening recession is leading to larger losses in financial markets, thus undermining the wider economy. There is now a serious risk of a systemic meltdown in US financial markets as huge credit and asset bubbles collapse”.

With massive losses being reported by the world's largest financial institutions, little wonder skittish investors are looking to safer-havens.

Especially when ANZ (Australia/New Zealand) bank CEO Mike Smith broke the news on February 19th 2008 that his bank has been forced to make a further large provision for a credit-default swap trade gone wrong. Smith stressed that the write-down was not due to sub-prime exposure, but rather a monoline exposure (as if it really matters...the money is still gone!) and followed up with;

“I would recommend all of you to visit London or New York in the near future just to see the effect of what is really happening there. This is a financial services bloodbath. The Australian banking system is in remarkably good shape in comparison.”

Smith was hopeful that the number of corporates behind the insured debt who might be in danger of going “ belly up ” was not high, or else... “ If that happens, we're looking at an Armageddon situation! ”

Not exactly reassuring words from one of our top bankers.

And even worse, Comptroller of the Currency, John Dugan, last month told a group of bankers in Florida that:

over a third of America's community banks and three fifths of Florida's banks are exposed to commercial-property loans totalling more than three times their capital. His prediction?...more losses and a rise in bank failures.

“Gerard Cassady of RBC Capital Markets estimates between 50 and 150 banks with assets of up to a couple of billion dollars each could fail in the next couple of years, the highest rate since the savings- and-loan crisis of the 1980's”. The Economist, Financial Review Weekly Feb 9-10 2008.

Resources to the Rescue?

Little wonder then that the spectacular strength of the resources and commodities sector over the past six years now looks like providing a welcoming safe-haven to frazzled investors. It has also attracted the attention of hedge-fund managers looking for the hottest game in town.

After all, who wouldn't be impressed with returns like these; Oil up from under $20 to $100; Gold up from $300 to $970; Copper up from $70 to around $400, Silver up from $5 to $19; steel up from $300 per tonne to $800 per tonne. Soybeans and wheat up more than 75 per cent in the past year.

Some analysts fear that resources may be signalling signs of a speculative blow-off and are in danger of peaking and being dragged down by a global recession and slumping economic growth rates. They worry how much of the momentum is coming from speculative hedge funds who could just as quickly desert the market, and point out that the current COT (Commitment of Traders) Report for Silver shows the four biggest short traders (supposedly the “smart money”) holding a historically high 59,564 short contracts (around 300 million ounces or roughly six months world production). Someone has to lose big-time here.

Many investors and hedge fund managers believe continuing strong demand from China will ensure that commodity prices remain high. They are counting on the “decoupling theory” that China will survive a global slump by growing its domestic market should its export market turn down.

Everyone is relying on China and Japan to both hold up in the face of a global slump. The Yen carry trade was largely responsible for providing the easy money that fired the biggest ever real estate boom, while the resources boom kicked in along the way to keep the party going longer, especially for resource exporters like Australia, Canada, Russia and Brazil.

China...Cracks Appear.

Not everyone is convinced that China can dodge the bullet of a global recession.

“I think that the global developed world is 75% of the demand, and that is slowing in a hurry. And if that disappears, then I don't know where China is going to send their product.” Credit Suisse strategist, Adnan Kucukalic.

“People assume growth in China's a foregone conclusion, but it's a highly unbalanced economy and there are clear signs of excesses emerging.” Justin Braitling, Australian Leaders Fund.

“A serious slowdown in the US economy will have quite a serious impact on the Chinese economy.” Yu Yongding, Chinese Academy Social Sciences & former People's Bank China.

In the January release of its economic outlook the International Monetary Fund downgraded China and India's contributions to global gross domestic product. China contributed 10.9 per cent in 2007 while India's contribution was only 4.6 per cent compared to the United States' 21.4 percent.

Meanwhile, Stephen Roach (Morgan Stanley Asia) points out that the US is by far the world's biggest consumer economy at around $9.5 trillion compared to China's $1 trillion and India's $650 billion . He also warns that the theory that world growth would “decouple” from the US economy is “ dead wrong ”, and predicts a recession may have severe consequences for Asia and Australia.

These latest calculations lead Bob Cunneen (economist AMP Capital Investors) to conclude that “maybe China won't be able to come to the rescue of the global economy as it has been hoped.”

China's Shanghai Composite has soared 600 per cent over the past three years from 998 in mid 2005 until it peaked at 6,030 on October 16th 2007. Since then it has dropped almost 30 per cent (4,333.03 as of February 22nd 2008) showing that even Chinese investors are spooked at the moment.

And now the prospect of a post-Olympic China slowdown has also surfaced. Research by Morgan Stanley reveals that countries hosting the Olympics usually enjoy something of a boom in the year leading up to the event, only to be followed by a slump during the following eighteen months. Particularly noticeable downturns were experienced by Australia in 1956, Japan in 1964, the US in 1984 and Korea in 1988. Spain fell into recession the year after their 1992 Olympics, while more recently Athens and Sydney saw some 2 per cent shaved off their growth. Even though the authors of the report (Stephen Jen and Luca Bindelli) are optimistic that “ there are special features (in regard to China) that are likely to mute the magnitude of this slowdown ”, it is still one more uncertainty to worry about.

Last but not least, what might happen to global trade should a world-wide recession occur?

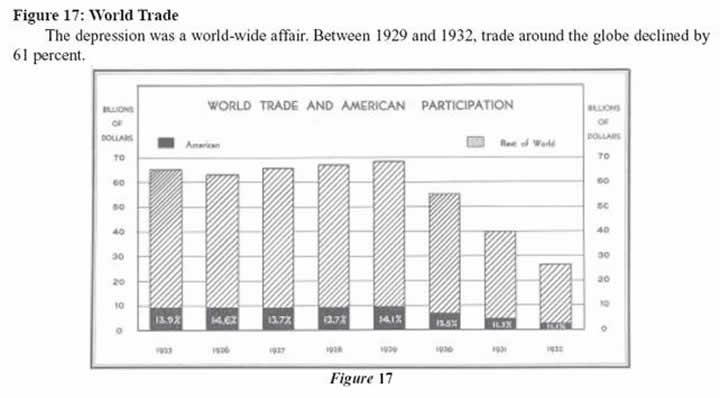

Robert Prechter has included a chart in the February Elliott Wave Theorist that provides food for thought. It has been taken from Bradstreet's Weekly (as in Dun & Bradstreet) from their 1932 “Business Year in Review”. The term “globalization” was born sometime around the 1920's, however the Great Depression well and truly stopped it dead in its tracks by 1933. World trade plummeted by an astonishing 61 per cent.

Graph courtesy of Robert Prechter's Elliott Wave International. www.elliottwave.com

All the best, Joe.

www.lifetoday.com.au

Copyright © 2007 Dr William R Swagell

Disclaimer: This newsletter is written for educational purposes only. It should not be construed as advice to buy, hold or sell any financial instrument whatsoever. The author is merely expressing his own personal opinion and will not assume any responsibility whatsoever for the actions of the reader. Always consult a licensed investment professional before making any investment decision.

Dr William R Swagell Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

eric swan

03 Mar 08, 20:22 |

commodities

reason or emotion. Which rules? |