How to Profit From A Potential Doubling in Copper Prices

Commodities / Copper Feb 06, 2013 - 08:30 AM GMTBy: DailyWealth

"I think copper has at least 50% upside from today's price..." legendary analyst Adrian Day told me recently.

"I think copper has at least 50% upside from today's price..." legendary analyst Adrian Day told me recently.

"I wouldn't be surprised to see the price double by the end of the decade."

When Adrian talks commodities, I listen... He's written his Global Analyst newsletter for over 25 years. At one time, it was one of the most popular investment letters in America, with over 60,000 subscribers. And for a decade now, he has focused on commodities for customers of Adrian Day Asset Management.

Today, Adrian has his sights set on copper... Over coffee last week, he explained why copper prices could soar. He also shared his favorite way to profit from it. Here's the story...

Adrian believes there's a big opportunity in copper. It's a simple story of supply and demand...

"In recent years, we've seen a record copper price and record demand. Yet production has actually declined," Adrian told me. "Output from Escondida, the world's largest producer, is down 25% over the last five years."

Adrian explained there are currently 82 new mines set to come online by 2020. "About 80% of them had their start dates delayed in the past 12 months. The future supply of copper is anything but certain."

With uncertain supply, a "pop" in demand could easily send copper prices soaring. And Adrian sees China as an obvious source of continued demand growth...

China's copper demand has tripled in the last 15 years. Based on where the country is in its development cycle, I believe demand will triple again over the next 15 years.

By 2020, world copper production won't even meet China's demand.

Adrian's story here is simple. It's Economics 101.

With demand exploding and supply decreasing, the copper price has only one way to go... higher. Again, Adrian says prices could double by 2020.

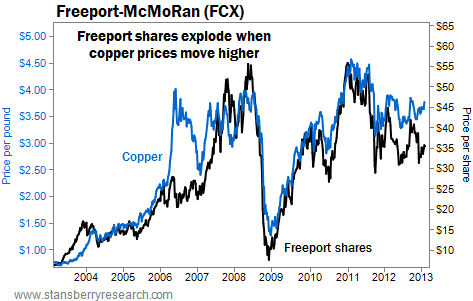

As investors, we have one simple way to profit from a rising copper price. Longtime readers are familiar with this opportunity... When copper prices increase, shares of Freeport-McMoRan (NYSE: FCX) explode. Take a look...

For example, shares of Freeport soared from below $10 to near $60 in about two years (roughly 2009 through 2010). When copper takes off, shares of Freeport can go nuts.

Freeport is currently a "buy" in our True Wealth newsletter. And Adrian says the stock is one of his top ideas right now. It's easy to see why...

The stock is dirt-cheap. As I write, it trades for just 7.5 times next year's earnings. The company also pays a 3.5% dividend.

The company is cheap today because of a recently announced acquisition of Plains Exploration & Production (NYSE: PXP) and McMoRan Exploration (NYSE: MMR). Freeport shares fell 16% on the news. But Adrian believes this offers a fantastic buying opportunity...

Freeport acquired fantastic oil and gas assets in this deal. The potential is enormous, and they didn't overpay for it. We've been buying at the depressed prices, and we'll continue to do so.

Even with Freeport's diversification into oil and gas, I expect the company to continue trading in-step with copper. If Adrian's forecast is correct, that could mean enormous gains like we have seen in the past with Freeport.

Today, we have an opportunity to get in cheap. It will surely be a bumpy ride. But long-term, both Adrian and I expect big gains in shares of Freeport.

Good investing,

Brett Eversole

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.