Stock Market Gaps and Other Nasty Formations

Stock-Markets / Stock Markets 2013 Feb 07, 2013 - 10:11 AM GMT Here is a closer examination of the NDX. Starting from left to right, you can see the huge island gap left on January 2. The NDX closed on December 31 at 2660.93. The Head is also an island reversal pattern, with the gap left open. You may say that the rally in the right shoulder to 2768.63 filled the gap. That may be so. That still leaves the massive gap underneath the current island formation. The Head & shoulders pattern will either fill the gap or, as I have suggested, leave another gap on the way down. The fascinating part is the closing price in the NDX on December 31 was 2660.93, only 78 ticks from the Head & Shoulders Minimum Target.

Here is a closer examination of the NDX. Starting from left to right, you can see the huge island gap left on January 2. The NDX closed on December 31 at 2660.93. The Head is also an island reversal pattern, with the gap left open. You may say that the rally in the right shoulder to 2768.63 filled the gap. That may be so. That still leaves the massive gap underneath the current island formation. The Head & shoulders pattern will either fill the gap or, as I have suggested, leave another gap on the way down. The fascinating part is the closing price in the NDX on December 31 was 2660.93, only 78 ticks from the Head & Shoulders Minimum Target.

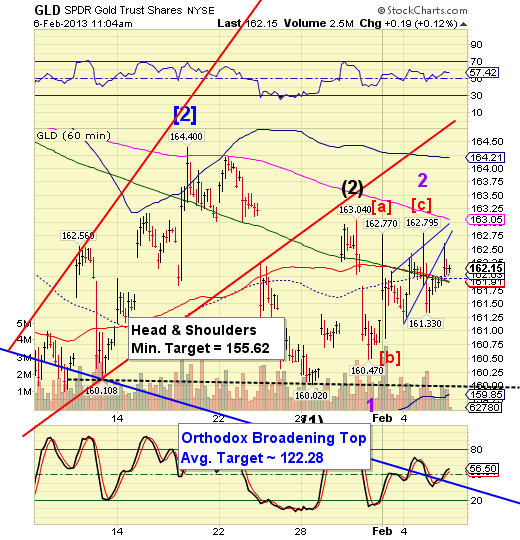

Another fascinating development is in GLD. You can see that I outlined an Ending Diagonal Wave [c] with a throw-over to 162.795. You can see how this action is “juicing up” the gold bugs by appearing to be ready to break out, but not quite making it. Today appears to be the final attempt to “juice the bugs” as GLD is retesting the underside of the Ending Diagonal. The minimum target for the ED is at 160.47, but any accident may drive GLD below the Head & Shoulders neckline at 160.00, which will pick up the slack for the next decline.

Gold is also overdue for a combined Primary Cycle and Master Cycle low. I am not sure whether it will fall in conjunction with SPX or not, but it looks like a candidate for the same treatment.

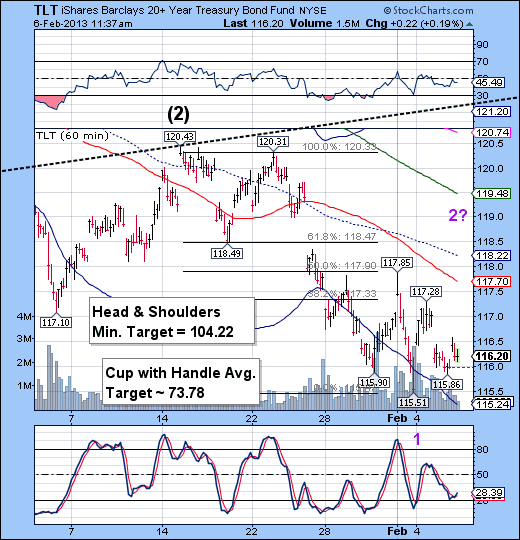

Traders may have already recognized a bottom forming in TLT. They may also be contemplating the unfilled gap left at 119.40. There is a natural urge for the market to fill gaps, but if this is a wave (3) the selling pressure may be so great that the gaps are often left unfilled.

A more likely target is the top of wave iv of 3, which is also matched by the top of wave 4 and the 50% retracement at 117.90. This may be fuelled by money exiting stocks at the onset, but the need for liquidity may be so great as to siphon money out of Treasuries as well.

Best wishes,

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.