Stocks Bull Markets Never Make it Easy

Stock-Markets / Stock Markets 2013 Feb 11, 2013 - 05:41 PM GMTBy: Toby_Connor

I see a lot of people lately agonizing over what we should have done. By that I mean it's obvious to all by now that the correct move was to buy stocks back in November instead of precious metals and miners. I mean seriously, it's obvious that liquidity was going to flow into every asset class except precious metals. Well it's obvious now in hindsight anyway.

I see a lot of people lately agonizing over what we should have done. By that I mean it's obvious to all by now that the correct move was to buy stocks back in November instead of precious metals and miners. I mean seriously, it's obvious that liquidity was going to flow into every asset class except precious metals. Well it's obvious now in hindsight anyway.

Of course everyone has conveniently forgotten how tough it was coming out of that November low.

There were ongoing concerns about the approaching fiscal cliff, not to mention a significant sell off as we approached the end of the year. Once the fiscal cliff was resolved the markets rallied violently. Of course no one was positioned ahead of the rally because there was the risk that politicians wouldn't make a deal. So the upshot was almost everyone missed the first day, and virtually no one was expecting a second day of huge gains.

So by that time the market was overbought and right up against resistance at the September highs. It's pretty tough to buy into an overbought market that is butting up against a major resistance level, so I don't think anyone could be faulted for abstaining at that point.

Once the market broke through 1475 it only took five days for it to reach the next resistance level at 1500. So if you didn't buy immediately you missed that move also.

At that point we moved into the timing band for a half cycle low. Again, probably a dangerous time to be initiating long positions.

Unfortunately the market didn't give us a half cycle low and continued higher, with two strong down days thrown in to keep traders off-balance.

It's easy in hindsight to rationalize the correct trade, but as I have just shown, tough to do in real time.

Next I'm going to show you a market progression. Imagine you are experiencing this in real time.

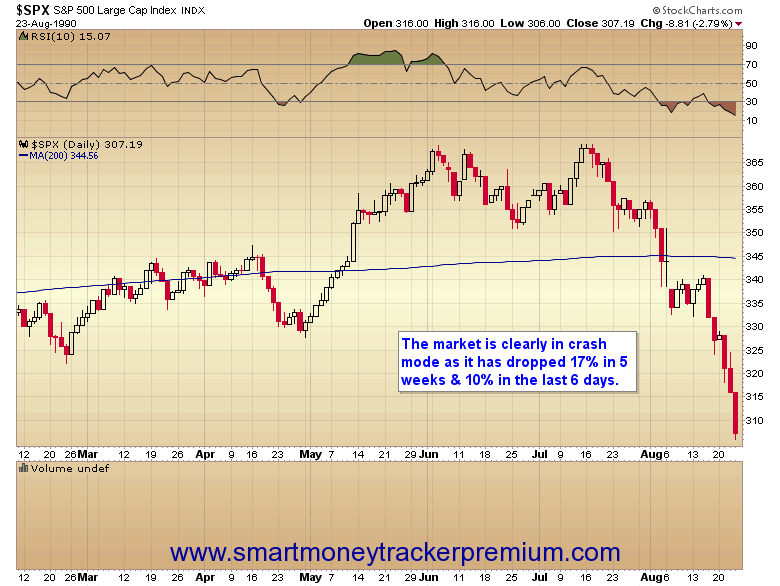

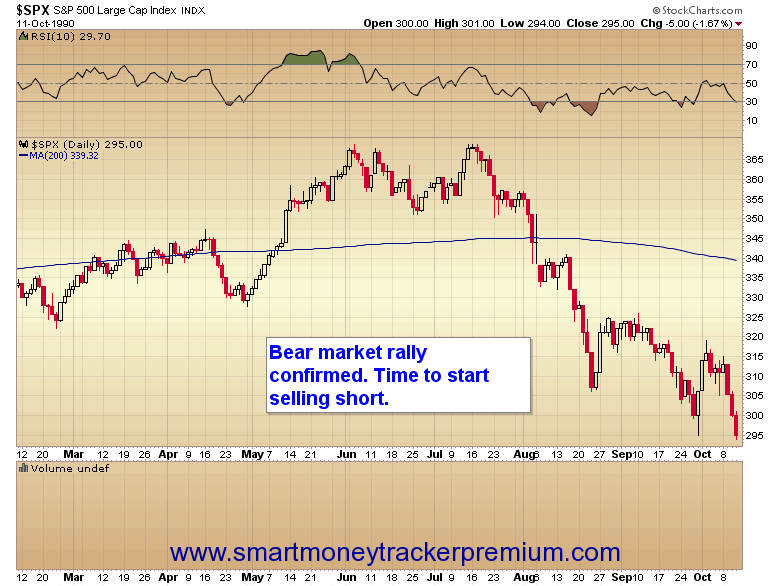

In August of 1990 the stock market stagnated, formed a double top, and proceeded to plunge sharply below the 200 day moving average. At this point, as we've heard many times, chartists were screaming that the market was clearly headed down.

Imagine your emotions on that Thursday in August. Realistically, how many people would have been able to pull the trigger and buy at that point? The answer is, not many.

But buying on that Thursday, even though one's emotions were screaming sell, was the correct move.

Or was it?

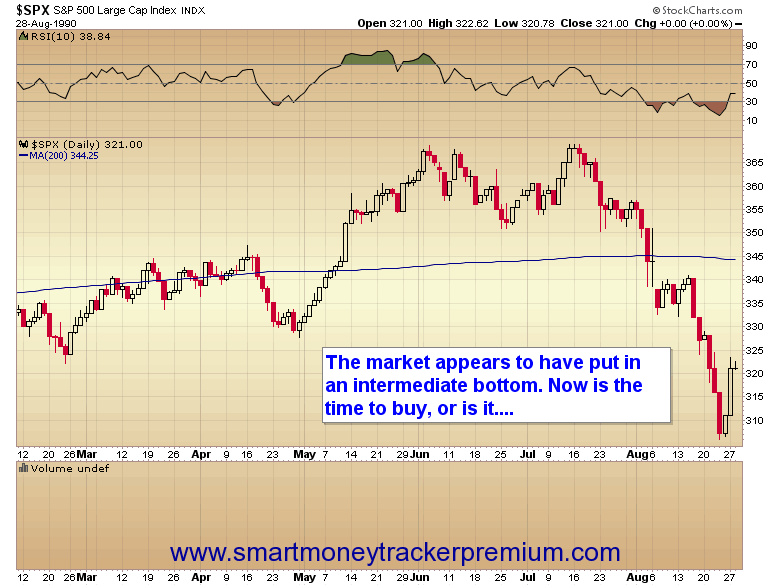

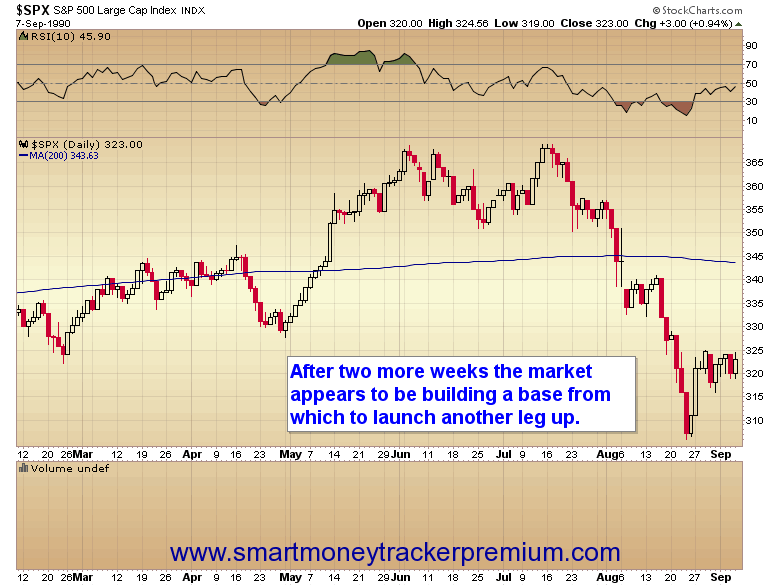

Well after two weeks the market certainly appears to be building a base for another leg higher. At this point, although almost certainly nervous, one could probably rationalize adding to positions.

So let's see how that worked out.

Holy crap! That was a mistake. A huge freaking mistake. Sell, sell, sell!

Whew, that was a close call.

No sooner did the market break down then we get a strong reversal candle followed by another reversal candle five days later. I have to say, it looks like we finally hit a bottom. Buy everything back.

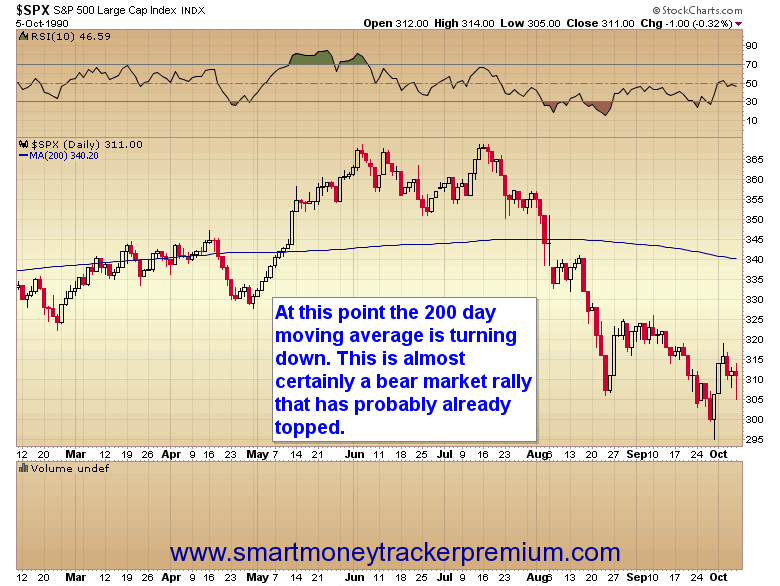

You've got to be kidding me! Wrong again. This is obviously a bear market, time to sell short.

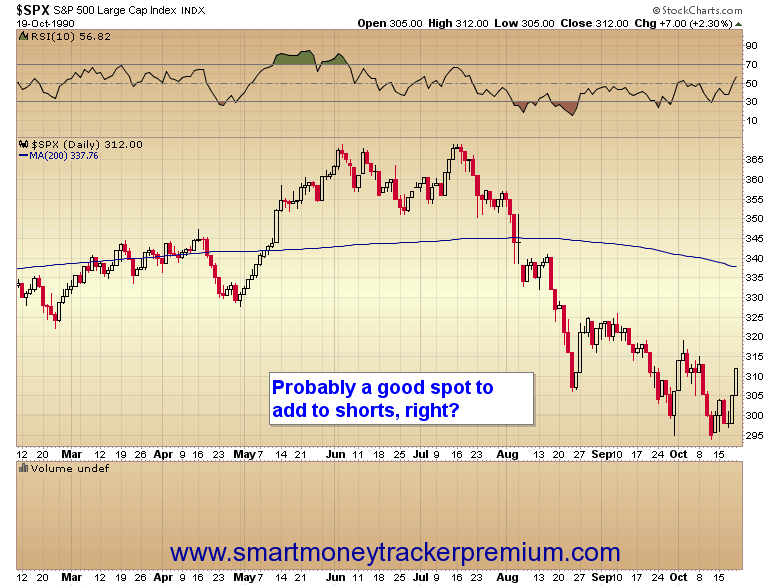

A couple of days later; Time to add to shorts.

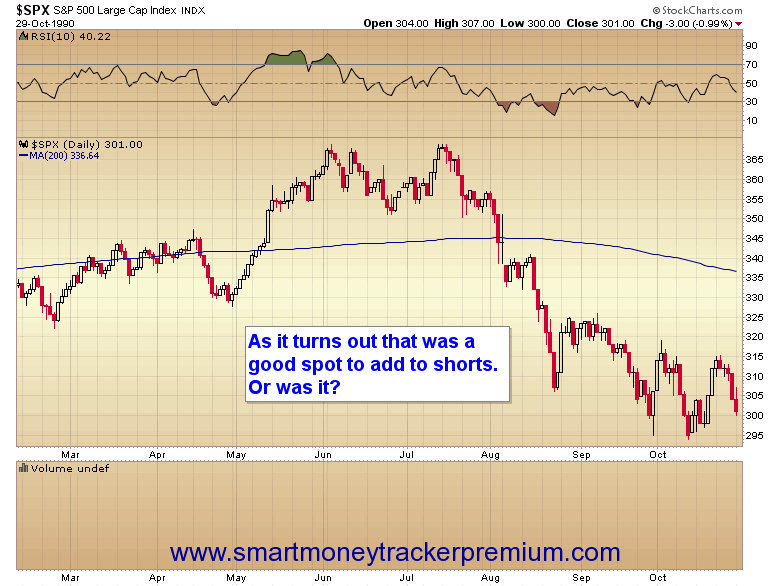

A week later; This sure looks like we finally made the right decision, as this is clearly a bear market, and obviously about to begin the next leg down.

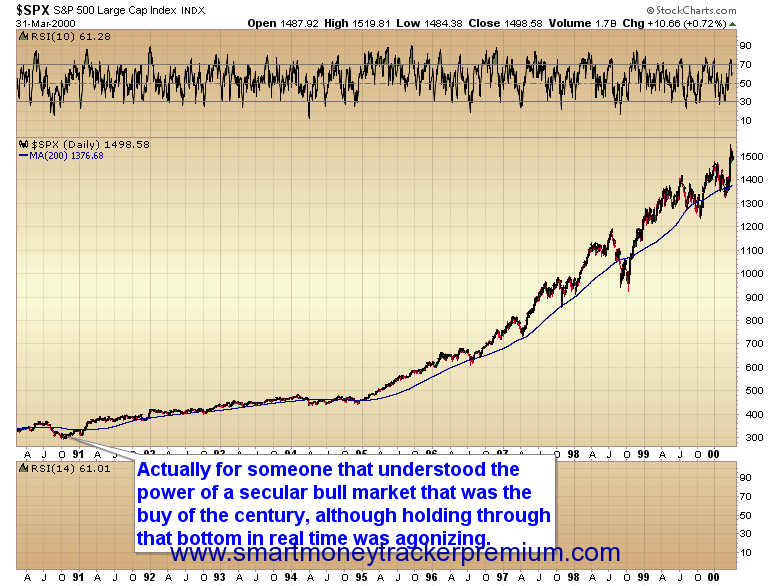

But did one really make the right decision? Remember this was a secular bull market. As Paul Harvey used to say, now let's look at the rest of the story.

As you can see, clearly this was the buy of the century, although actually doing so and holding through that bottoming process was agonizing to say the least, or more likely virtually impossible.

So might I suggest that when the gold bull becomes too frustrating, and you're ready to give up, you come back and review that 1990 bottom.

Bull markets never make it easy. Very few traders have the determination, stamina, foresight, and focus to make it all the way through one. But the rewards for the very few that can weather every punch the bull dishes out... are huge.

The SMT premium newsletter is a daily and weekend market report covering the stock market, commodities, and the precious metals markets.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2013 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Toby Connor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.