China Year of the Snake… U.S. Year of the Tank Car

Companies / Sector Analysis Feb 13, 2013 - 08:45 AM GMTBy: Investment_U

David Fessler writes: In China, 2013 is the Year of the Snake. According to the website HanBan.com, this means that 2013 should be a year of steady progress and attention to detail. Focus and discipline will be necessary in order to achieve goals.

David Fessler writes: In China, 2013 is the Year of the Snake. According to the website HanBan.com, this means that 2013 should be a year of steady progress and attention to detail. Focus and discipline will be necessary in order to achieve goals.

In the U.S., 2013 might well be called the Year of the Tanker Car, particularly if you are an oil producer in the Bakken or the Eagle Ford shale formations.

If you happen to live near a major rail line in Texas or the Dakotas, you’ve probably seen a train like the one below. It’s what’s known as a “unit train”. A unit train transports a single product or unit.

Photo courtesy of Dakota Plains Holdings, Inc.

In this case, the Canadian Pacific Railway engines are pulling tanker cars full of crude oil. They were loaded at the Dakota Plains Holdings, Inc. (NASDAQ:DAKP) transloading facility in New Town, North Dakota.

New Town just happens to be in the heart of the Williston Basin, also called the Bakken shale oil field. But the engines (if it wasn’t for the snow) could just as easily be Union Pacific Corporation’s (NYSE:UNP). The tanker cars could also just as easily be from a transloading facility in Texas’ Eagle Ford shale oil field.

Regardless, you can expect to see more unit trains like this one… a lot more. Crude oil from U.S. shale deposits is being pumped out of the ground in ever-increasing volumes. It has now outstripped the ability of existing pipelines to carry it.

Historically, 90% of crude oil shipments have been transported around the U.S. via pipelines. In the case of the Bakken, there are few existing pipelines. A number of new ones are in the planning stages, but they can take years to build.

East and Gulf coast refineries would love to get their hands on the inexpensive West Texas Intermediate (WTI) crude. They’re currently forced to pay the higher prices for the internationally priced Brent. It can sell for as much as $25 per barrel more than WTI.

That big differential between Brent and WTI has made crude transportation via rail very attractive. Right now, the only economically viable way to get this surplus crude from fields to refineries on the East and Gulf coasts is by rail.

Crude oil trains have been increasing in number since the BNSF Railway pulled the first one from EOG Resources, Inc.’s (NYSE:EOG) Stanley, North Dakota Terminal.

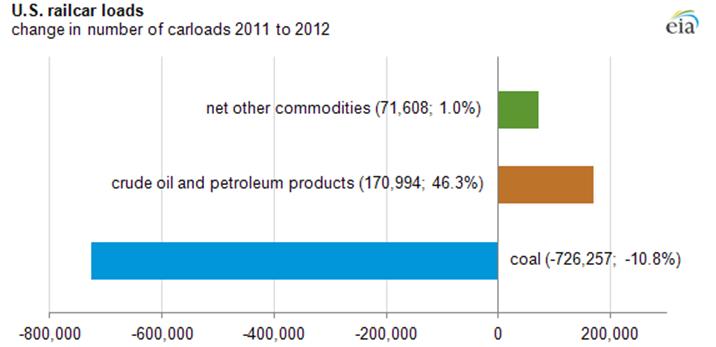

As you can see from the graph below, courtesy of the Energy Information Administration (EIA), tanker car shipments have dramatically increased in just the last year.

2012 saw a record increase in crude oil production, and a marked decrease in coal use. This is reflected in the movement of these two commodities by rail. Crude oil and related products were responsible for the largest increase in commodity rail car loadings in 2012.

Not surprisingly, coal had the largest decline. This was due to increased use of natural gas for power generation. However, coal is still king of carload shipments. It accounted for 41% of all carloads. This compares to 4% for all petroleum products combined.

It’s the growth of petroleum that’s absolutely stunning. In 2009, crude oil and related products made up just 3% of all carloads in the oil and petroleum products class. In 2012, that number jumped to 38%. The Association of American Railroads reported that nearly 171,000 carloads of crude were moved by rail in 2012.

Playing the Rail-Crude Connection

There are several ways for investors to play the oversupply of WTI crude. The most obvious would be an investment in one of the major rail carriers serving the Bakken or the Eagle Ford shale oil fields. But rail stocks carry a wide range of commodities.

Most major railroads haul coal. Many will be hard pressed to offset the drop in coal shipments as natural gas is the fuel of choice for new power plants.

A more subtle way to play the increase in crude shipments by rail is by investing in tank car manufacturers. Right now, there is a backlog of 40,000 tank cars on order from the top three manufacturers. If you order a tank car today, you’ll wait 18 months to take delivery.

The Union Tank Car Company is a privately held subsidiary of Marmon Holdings. Marmon is owned by Berkshire Hathaway Inc. (NYSE:BRK.A), Warren Buffet’s empire. Union is working flat out to meet its tank car order commitments.

A better way to play

the tank car boom would be to invest in a few shares of Trinity Industries, Inc. (NYSE: TRN). It sells a wide range of products, including wind towers, tanks and rail cars. One of its divisions also operates a barge leasing business.

Trinity’s rail car business is doing extremely well. So well, in fact, that it’s currently in the process of converting several wind tower manufacturing plants into rail tank car manufacturing facilities.

But the best tank car manufacturing play of all is going through the roof. Its manufacturing capacity is sold out through the end of 2014. This company’s stock is up 38% in a little over five months.

They’ll be announcing earnings in the next several weeks. I expect them to exceed analysts’ estimates for the coming quarter and likely for the rest of this year and next. Out of respect for my existing subscribers, I can’t give you the name of this company.

My Peak Energy Strategist newsletter contains the name of this tank car manufacturing powerhouse, along with a number of other great energy companies I follow in my Peak Energy Portfolio.

Right now, 14 of my 15 stocks are showing positive gains with 10 posting double-digit gains.

Click here to learn more about my Peak Energy Strategist newsletter and the name of this tank car manufacturer that could easily double in the next 12 – 18 months.

Good Investing,

by David Fessler, Investment U Senior Analyst

Copyright © 1999 - 2013 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.