Fiat Currency Witches Brew, Collapse of the Keynesian Ponzi Economic Model

Stock-Markets / Credit Crisis 2013 Feb 16, 2013 - 11:38 AM GMTBy: Ty_Andros

Throughout history Fiat currency and credit systems have failed upon the greed and avarice of those who controlled them and this episode will be no different. The currency and bomb...er...bond markets are GROUND ZERO of the unfolding Societal and financial system destruction. The money printed to date will be dwarfed by what is to come. This is the greatest OPPORTUNITY in HISTORY for applied Austrian investing and the demise of the KEYNESIAN PONZI model.

Throughout history Fiat currency and credit systems have failed upon the greed and avarice of those who controlled them and this episode will be no different. The currency and bomb...er...bond markets are GROUND ZERO of the unfolding Societal and financial system destruction. The money printed to date will be dwarfed by what is to come. This is the greatest OPPORTUNITY in HISTORY for applied Austrian investing and the demise of the KEYNESIAN PONZI model.

The greatest transfer of wealth from those that hold/store it in paper to those that don't is underway!

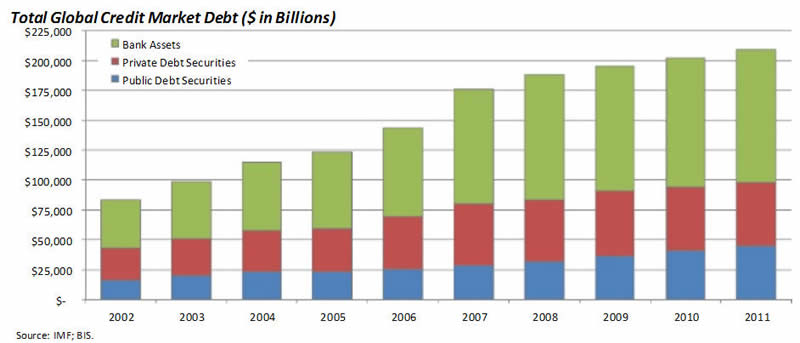

Trillions and trillions of bombs...er...bonds (IOU's denominated in IOU's: doubly dangerous) and IOU's known as currency's have created a pile of inextinguishable and unpayable DEBTS and future LIABILITIES that are inconceivable to the minds of men. Here is a peek of the WORLDWIDE debts accumulated to this point from a recent missive by Kyle Bass:

Notice how debt is up 300% since just 2002. In 2012 this measure EXCEEDED $220 TRILLION DOLLARS. This pile is compounding at approximately 11% per year. This is income brought forward from the future and requires economic growth to be repaid. Do you think the global economy can repay interest and principle over the next 30 or 100 years? NO. How can a global $60 trillion dollar economy growing 3 to 3.5% service this debt? It can't. Some of it will default and the rest will be printed out of THIN air.

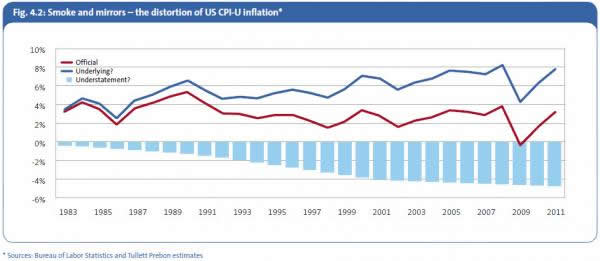

While growth properly adjusted for inflation is UNDERSTATED by 6 to 8% depending on who is doing the calculating chart 1 is from Dr. Tim Morgan of Tullet Prebon in London:

Now from www.shadowstats.com

Two different WELL DOCUMENTED methodologies coming to the SAME CONCLUSIONS!

This is the face of the soft default of the printing press (Adam Smith, Wealth of Nations) which is set to accelerate as Developed world welfare states run out of OTHER PEOPLES MONEY. If inflation is 6 to 8% greater than reported the value of global credit market debt is being reduced by the equivalent amount. This is called FINANCIAL REPRESSION and is set to continue and inflation has now become the core policy of GOVERNMENT!

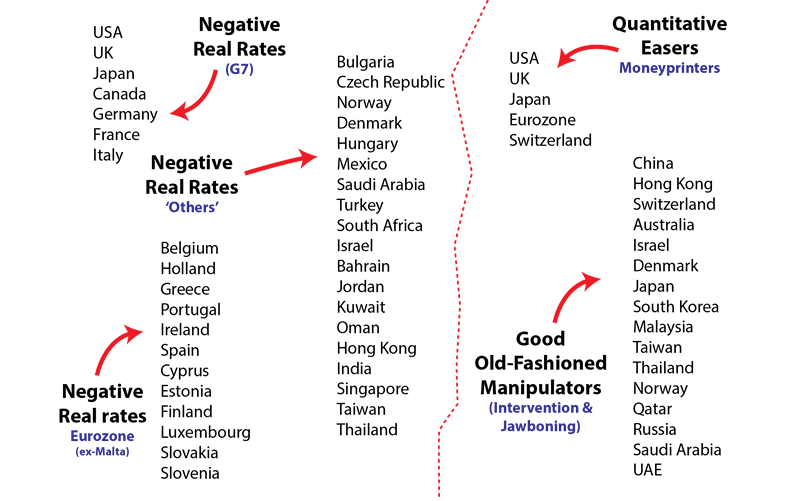

To complicate the situation currency wars are raging across the globe with politicians trying to "Beggar thy Neighbor" to devalue their currencies to gather what little REAL economic activity is being created worldwide. Thirty-eight countries have negative or zero rates and they are all actively involved in devaluating and manipulating their currencies, take a look:

Source: Raoul Pal, Global Macro Investor

Rather than embrace reformation of Tax, regulatory and government policies to restart REAL growth. As Quantitative Easing to infinity escalates the reason to reform economies DISAPPEARS from politicians radar screens.

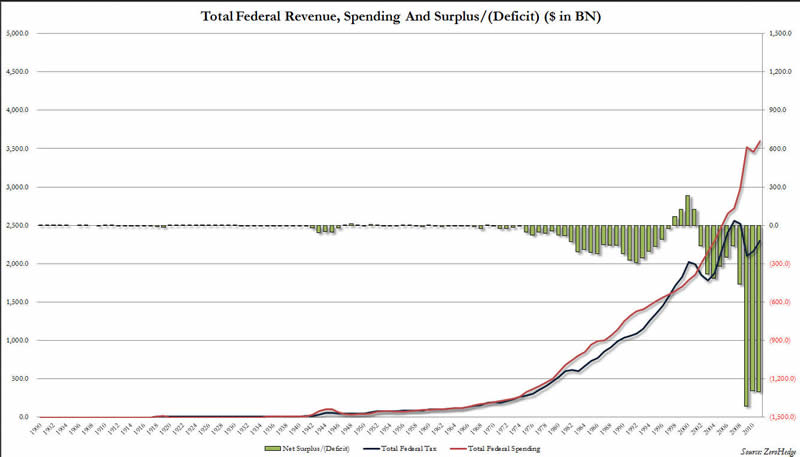

The banking systems and welfare states of the developed world are hopelessly INSOLVENT, wealth creation in real terms has collapsed and been replaced with nominal growth through runaway money printing out of thin air creating illusions of growth for the citizens of the respective governments. Take a look at the Jaws of death (courtesy of www.zerohedge.com) representing the unfolding demise of the US dollar as RESERVE currency to the world:

Remember as the world reserve currency approximately 62% of CENTRAL bank reserves are DOLLAR DENOMINATED CASH and BOMB'S...er...Bonds. As Obamacare, Dodd-frank, exploding regulatory expenses and the NEW TAX RATES kick in ECONOMIC ACTIVITY and thus TAX revenue will plummet and SPENDING will skyrocket. This is true in Europe and Japan as well.

The Jaws of death is the black swan of black swans, it is the coming destruction of all fiat currencies as THE DOLLAR is the PRIMARY RESERVE behind them, along with other worthless paper RESERVE currencies: Euros, British pounds, Yen. All have governments and financials systems VERIFIABLY INSOLVENT, Running deficits of up to 10% and banking systems many multiples of the GDP. This is known as a death...er...debt spiral.

The world is caught in a currency and financial system EXTINCTION event which will be written about and studied for centuries into the future. Normally these episodes occur as an anecdote to prudent financial systems in other corners of the world. This episode is a global insanity at work and the bust will be PROPORTIONAL.

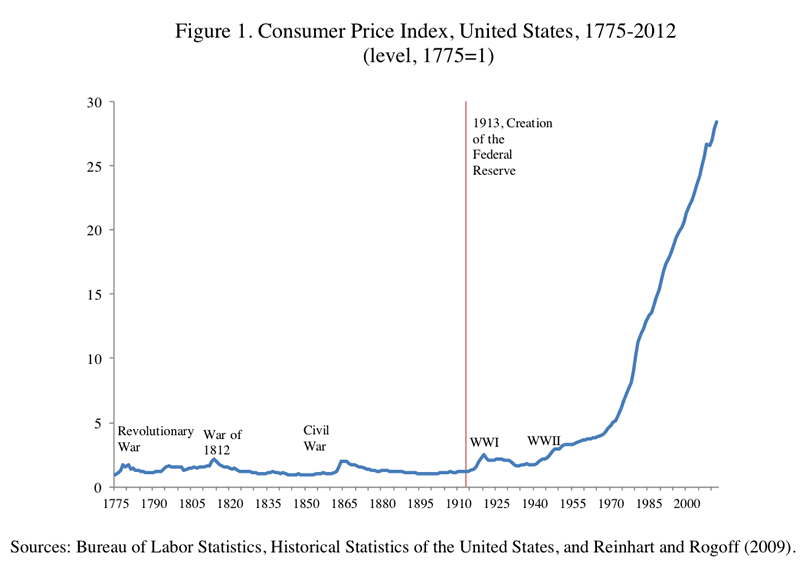

This FINAL destination was SET IN STONE on August 15th 1971 when President Richard Nixon closed the gold window to stop a GOLD run on the central bank of the United States. At that time he changed the US dollar from money to DEBT. The proverbial ROAD to SERFDOM began on that day. Here is what transpired on that day:

It is ground ZERO and source of the moral and fiscal insolvency of the developed world's politics and financial systems. On that day governments and bankster's dreams of unlimited expansion, redistribution from the private sector to the public sectors and theft of wealth through debasement became reality! FIAT CREDIT MONEY IS A WEALTH CONFISCATION DEVICE!

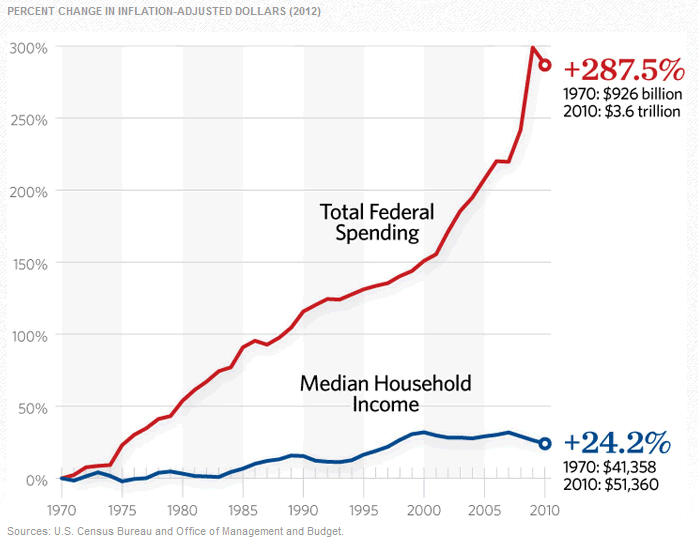

And here is the result:

This is the face of runaway central government courtesy of runaway LEVIATHAN credit creation. Properly adjust the median family income to the REAL CPI numbers and incomes in terms of real purchasing power has FALLEN 80%! Government has grown 12 times faster than NOMINAL income. It's why the middle class is desperate for sound money and the policies of GROWTH, SOUND MONEY and REAL wealth creation. Impoverished by the printing press and declining REAL wealth creation.

In order to sustain their living standards (as the money they are paid and store their wealth in loses purchasing power) the middle class has borrowed the money (printed out of THIN AIR) from the financial industry and become DEBT SLAVES to the banks.

For thousands of year's bankers and their government handmaidens have preyed upon the masses with PAPER currency systems until their actions hit the endpoint (debt compounds faster than money can be created and taxes collected fail to create the means to service it), the conflagration ignites (the public WAKES UP), and the stampede collapses their nations/empires into the dustbins of history. The operating statement then and now is:

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." ~ Ludwig von Mises

The elites are taking the latter route which they have throughout history. The outcome will be no different. For centuries POLITICIANS (Psychopaths and sociopaths) have risen to power and met their demise on the shoals of inflation and deflation.

Puppets of a global banking cartel that play the banjo of these cycles to gather wealth and power inconceivable to many and familiar to a few historians and Austrian economists. Investors need to learn how to fix their paper money (stop the theft of purchasing power) and play the banjo with them... This is what I do for a living!!!

REAL Wealth creation (producing more than you consume within a SOUND money economy creating capital to fuel savings and investment) has died in the developed world and in its place a PRINTING press has been substituted. It has created ILLUSIONS of growth during periods of economic collapse masking the truth to the broad publics of the developed world.

Additionally with the loss of PRIVATE property rights has destroyed the incentives to produce essential to MOTIVATE people to produce REAL wealth. Let's look at a bedrock of TRUTH:

- Gold is the currency of KINGS

- Silver is the currency of MERCHANTS

- Credit is the currency of SLAVES

- CREDIT IS NOT MONEY!

The unavoidable cleansing depression rolls on as the powers that be fight Mother Nature and Darwin tooth and nail to protect themselves and their entourage (public servants, leviathan government, crony capitalists, special interest elites) from the consequences of their greed, immorality and ignorance of the PAST history of man.

There is NO AVOIDING the final denouement as the developed world has slipped below the proverbial event horizon of a BLACK hole. The only question is when? How long will it take and how low will economic growth fall before the political and financial system policies in effect today are ABOLISHED.

It will only happen after the collapse. China had to descend to a level of economic collapse that caused an epiphany for Deng Xiao Ping as he declared "To get rich is glorious" in 1989, once private wealth rather the collective wealth was embraced human behavior took over and an economic GROWTH miracle has unfolded. The developed world is now ALL about collective wealth and until this changes the crisis of REAL wealth creation collapse will CONTINUE.

The developed world will sink into collapse until common sense becomes common again. Only a collapse which forces the changes necessary

In today's world ECONOMIC growth is a function of a printing press, consumption presented as production and credit creation versus the economic formulas that created the REAL wealth created by their descendants. REAL wealth can only be created by;

- Growing it

- Mining it

- Building it

- Manufacturing it

- Being rewarded for providing more goods and services for less to consumers (aka Capitalism) (crony capitalism is More money for less goods and services mandated and controlled by government policies/central planning)

- Having a sound or semi sound money financial system.

In order to do these things governments must create the conditions which allow these things to thrive. The elimination of the conditions for growth is what is driving the ECONOMIC collapse and have been PILING UP since Bretton Woods II on that fateful day in August 1971. Hedge fund giant Paul singer commented about the monetary tsunami recently:

"We do not know exactly what to do about it, except to urge policymakers to STOP substituting QE for sound tax, regulatory, labor, environmental, and fiscal policies."

Unfortunately this approach is NOTHING NEW as BIG GOVERNMENT progressives in the developed world have been using that recipe for over 40 plus YEARS. Bretton Woods II and the run on the bank was a result of substituting money printing for sound policies.

Now those unsound economic policies have COMPOUNDED since that time and are woven deeply into the developed world's economies and societies. What policy changes needed to restore growth in 1971 can be considered a roadside bomb next to the nuclear bomb of the policy changes required today.

"We all know what to do, we just don't know how to get re-elected after we have done it." " When it gets serious, you have to lie" ~ Jean Claude Juncker, prime minister of Luxembourg

Fixing the bad policies is NOW impossible until the pain of economic and societal failure FORCES the public servants and their handmaidens (crony capitalists, banksters, special interest elites) to change them or be destroyed. A real Marie Antoinette moment approaches. The GLOBAL elites have painted themselves into a corner from which there is only ONE ESCAPE ROUTE. THE PRINTING PRESS!

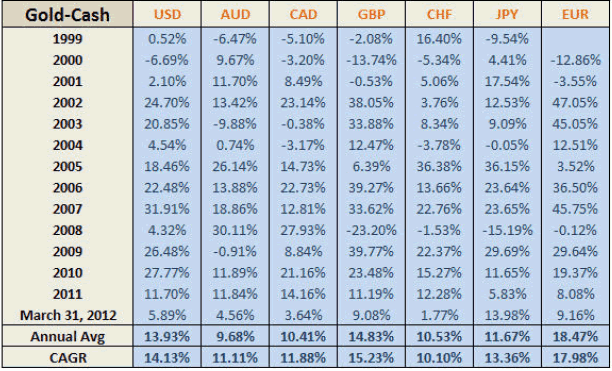

YOU must understand CURRENCIES DON'T FLOAT they just SINK at different rates! Here is an illustration:

Notice how uniform the debasement is between the various currencies? If your investment portfolios did not rise roughly the same amount in those years YOU LOST MONEY. This is a controlled DECLINE in value orchestrated by the BIS and global central banks in COORDINATED fashion.

Globally currencies are no more than JUNK BOND markets vying with each other to see which country have the least damaging policies inhibiting growth and attacking capital and investment. It is why China, Switzerland, Japan, South Korea, Australia and many others have a massive bid on them.

Additionally, the floats in these currencies are dwarves compared to the dollar. The US primary export is worthless dollars and as currency holders flee the printing press those currencies are bid to the moon; it is one of the reasons for CURRENCY wars to PRESERVE competitiveness.

Gresham's law (bad money pushes out good money) written large. Gresham's law applies to government and investing policies as well. Which side are you on? The bad "Keynesian" decisions or the sound "Austrian" ones?

(Author's note: In my opinion, this is NOT Doom and GLOOM, it is one of the greatest opportunities in HISTORY. Invest properly for this outcome and Prosper, invest looking in the REARVIEW mirror and your wealth will be irreparably DAMAGED. Volatility is opportunity for the prepared investor. As it is priced in and markets ZOOM higher or LOWER to price in collapsing economies and money printing huge opportunities are created. Is your portfolio structured to thrive? The greatest transfer of wealth from those that hold it in paper and financial assets to those that don't is UNDERWAY. Restoring fiat currencies to sound money and absolute return alternative investments with the potential to thrive in all market (up, down and sideways) conditions is what I do. If you have an interest in learning more and working with Ty: CLICK HERE

Unsound money (money printed out of thin air, backed by nothing, yields nothing, always losing purchasing power and redeemable in nothing) is the father of the something for nothing societies we live in today. It is the impoverishment of the middle class as the money they are paid and store their wealth in is debased as is their future prospects. Lord Keynes and Vladimir Lenin knew this clearly (thank you Paul Brodsky of www.qbamco.com for the expanded quote):

"Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some (authors note: banksters, leviathan government, crony capitalists, and special interest elites).

The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become 'profiteers,' who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat.

As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose"

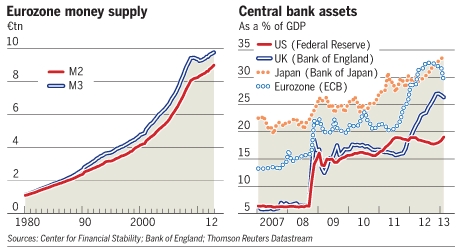

Of course, we can see this in every corner of the developed world today as they expand the money supply geometrically so do these DESTRUCTIVE PATHOLOGIES grow and destroy what created the wealthy societies with vibrant middle classes we once were. Our societies and standards of living are being DEBAUCHED courtesy of the institutions and governments you have placed your FAITH in! They are preying on you and eating you and your CHILDRENS futures.

As more generations pass away the new ones DO NOT KNOW sound policies from the unsound . THEY THINK MONEY and WEALTH can be PRINTED or confiscated from the producers of wealth (this used to be called SLAVERY) at the point of a government gun! Today's citizens are product of GOVERNMENT public schools which under central planning have created what Lenin called "USEFUL IDIOTS".

Adam Smith detailed how the skills and educations of countries citizens are a VERY IMPORTANT part of the WEALTH of Nations. China is now #1 and the United States has slid into the 30's. CAPISCH?

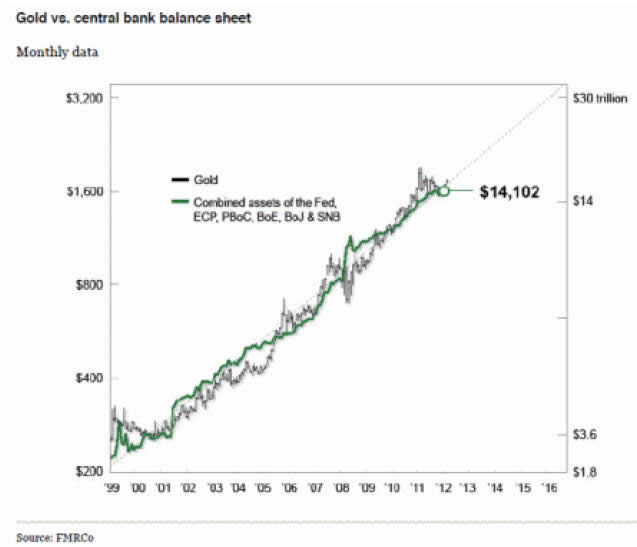

The REAL crisis began in 2001-2001 but was quickly PAPERED over by the maestro Alan Greenspan. Central bank balance sheets are UP approximately 600 to 700% since 1999 and will double or triple from here or we will all be thrown into the barter system when sovereigns and their financial and monetary systems collapse into BANKRUPTCY. Notice what money creation does for REAL money gold!!!

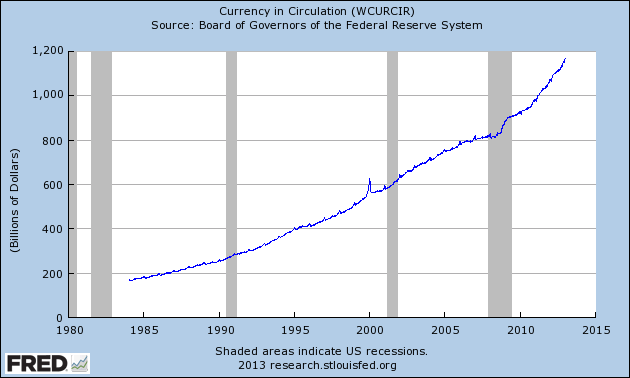

Meanwhile money creation has gone BALLISTIC (dwarfing previous episodes) to service the debt outlined at the beginning of this commentary to prevent the collapse of the PONZI economies they have created:

Now for the United States:

Do you think economic activity has GROWN 500 to 600% as base money supply has? This is how much money has been created to support PONZI values of FINANCIAL ASSETS also known as your stocks bonds and real estate. This is substitution of the printing press and asset inflation to MASK NO REAL ECONOMIC GROWTH only nominal growth from the illusions created FIAT currency. What has the purchasing power of your credit masquerading as money done?

Notice how all the runaway growth in government, banking, and asset prices begins in 1971? How has this affected your REAL portfolios?

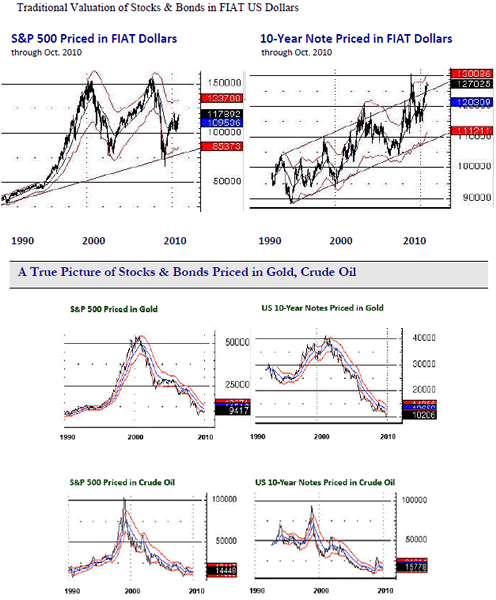

The result of this is a number of illusions about the REAL value of your stocks and bombs...er...bonds. Take a look at how your portfolio looks when denominated in Fake Credit money versus REAL money (gold and black gold/oil).

Notice how the rally from the 2000 low's DISSAPEARS? These illusions are all courtesy of the shrinking of the purchasing power of the currency they are denominated in. If most people who hold their wealth in stocks and bombs understood this there would be rioting in the street.

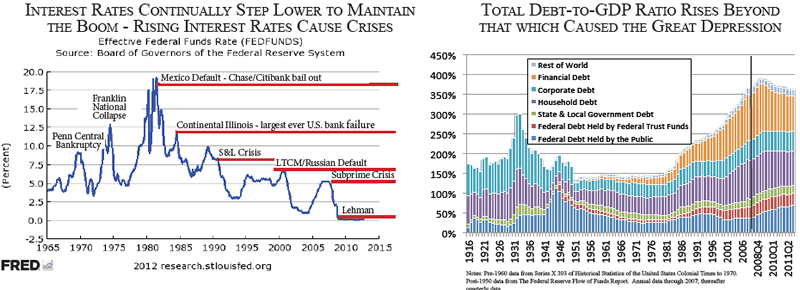

Take a look how (Malinvestments caused by runaway leverage) markets have FAILED at lower and lower rates of return since 1980 and debt to GDP (from www.myrmikan.com ) FAR exceeds the great depression era:

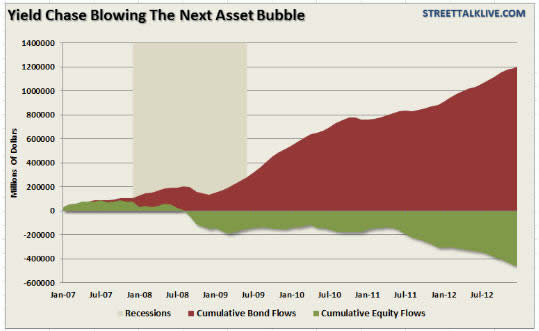

Interest rates are now zero, easing now comes from the printing press and negative real rates to KEEP THE ILLUSIONS INTACT. And the public is PILING into bonds and accumulating cash balances in inconceivable amounts take a look at this BUBBLE forming (courtesy of www.streettalklive.com) courtesy of fright of governments and distrust of WALL STREET:

Trillions and trillions of dollars have RUSHED into the bomb...er...bond markets worldwide. Junk, investment grade, sovereign bonds are at all-time values and issuance as CASH chases TRASH. Desperate for yield, perceived safety and not knowing what money is and the functions it must PERFORM to allow for wealth storage. Bonds are IOU's denominated in IOU's and if one borrower doesn't get you the other one WILL. What is a Sovereign, investment grade or Junk bond worth if it is denominated in a paper currency that is losing 6 to 10% a year in purchasing power?

Von Mises explains the dash for cash during this period:

"This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy." ~ Ludwig Von Mises

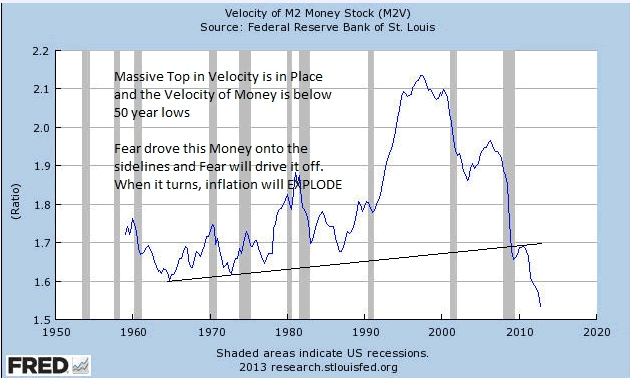

There are TWO reasons why INFLATION has not really accelerated to hyperinflation as all this money has been PRINTED and it is:

The second reason as the real economic activity must collapse as you saw in Zimbabwe, Weimar Germany, and as you see TODAY in socialist paradises known as Venezuela and Argentina. The developed world is just a step or two behind them, but rapidly following the same path...

In closing: Unsound FIAT/CREDIT money PRINTED OUT OF THIN AIR is the source of the crisis. It is all the public servants and banksters know, expect NO solutions other than this. They have no new tricks up their sleeves. They have a gun pointed at their heads. So it's inflate or die. You can count on them ducking and the PUBLIC (You) TAKING THE BULLET...

TRILLIONS and TRILLIONS of Dollars, Yen, Pounds, and Euros have piled up in banks and BOMBS...er Bond markets and sit directly in the path of the most destruction also known as central bank printing presses. At least 15% (low ball estimate) of the interest rate instruments in chart number 1 of this missive are WORTHLESS and sit as assets on the books of the financial systems and lender/savers.

Keep in mind ALL DEBT is PAID either by the lender or the borrower. By that calculation well over $36 trillion dollars (36,000 billion, also known as 36,000,000 million) has to default or have money printed to preserve it on the balance sheets of the financial systems. Can you see a "Crack up Boom" on the horizon? You can bet on it...

The public and institutions are in bomb...er...bonds at overvaluations which seldom if ever been seen. They are holding the BAG AT THE TOP. Can bonds go higher go higher? Yes. You cannot store wealth in them and you are losing 2 to 8% compounded annually, ditto for CASH. When the debasement has finally been achieved to RESCUE the sovereign's and their financial systems you will probably lost 40 to 90% of the wealth you stored in them.

Now Quantitative easing is limitless, the starts and stops are ending and the debasement is daily FOREVER to keep their illusions from being DISCOVERED by the public. In fact the public is demanding it, the financial industry is demanding it, the MAIN STREAM media is demanding it, and the OTHER predators throughout the system are demanding it.

They can never raise INTEREST rates again, to do so a collapse in assets will ensue. Even the mention of withdrawing the STIMULUS from a credible source will collapse asset markets. They use the threat of withdrawal to cool off markets knowing full well they can never do so. Overtly or covertly interest rates will be kept negative and financial repression will only mushroom.

Your stocks and bombs will APPEAR to hold or rise in value while continuing their crash in REAL purchasing power terms. 90% of the investors of the world are on the wrong side of the fence. They hold it in paper or HIGHLY leveraged investments. The baby boomers WILL NOT escape with their lifetimes worth of wealth creation in stocks, bombs...er...bonds and real estate!

To fail to re-inflate is to recognize the insolvency of the developed world sovereigns and banking systems. You can expect the banksters, crony capitalists, and special interest elites to fight REALITY tooth and nail to preserve the ability to victimize you as they have for DECADES.

There are TWO sets of canaries in the coal mine concerning the future and both singing very different tunes. In one corner you have: Ray Dalio of Bridgewater, Bill Gross of Pimco, Kyle Bass of Hayman capital, George Soros, David Einhorn all telling you to take your paper money get into real things, gold, commodities, CASH flowing businesses, etc. In Austrian terms this is called the INDIRECT exchange. It is sound advice from REAL money managers, in fact some of the best in the world.

In the other corner you have Paul Krugman, Larry Summers, Tim Geithner, Barack Obama, Mario Draghli, Francois Hollande, Mariano Rajoy, Mervyn King, Mark Carney, Ben Bernanke, Martin Wolf and The European Commission to name a few. Telling you they "will do whatever it takes" and PRINT THE MONEY as required. All Socialists and academics, with NO experience in the real world or have experience in the belly of the beast known as Banks and Government Treasury departments.

Which canaries are you listening to? Real world or Academics and government hacks? What do you do to preserve and build your wealth? Use Applied Austrian economics, fix your paper currencies (I am a paper currency repair specialist) and restore the functions of money to stop the printing press. Learn to diversify your portfolio into absolute return investments which can thrive in the winds of inflation and deflation as bubbles rise and fall as this disaster unfolds. I help people do this. For a free consultation and portfolio recommendations CLICK HERE.

Don't miss the next issue of Tedbits 2013 Outlook witches brew. Subscriptions are free.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2013 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.