Capex Set to Fuel a 5-Year Stock Market Rally

Stock-Markets / Stock Markets 2013 Feb 19, 2013 - 01:27 PM GMTBy: Money_Morning

David Zeiler writes: A rising tide of capital expenditure (capex) spending by U.S. companies will drive a stock market rally that could last as long as five years, BMO Capital Markets Chief Investment Strategist Brian Belski says.

David Zeiler writes: A rising tide of capital expenditure (capex) spending by U.S. companies will drive a stock market rally that could last as long as five years, BMO Capital Markets Chief Investment Strategist Brian Belski says.

In a message delivered to several news outlets, Belski argued that U.S. companies will soon start using their increasing cash piles to invest in their own businesses. He sees it as the next logical progression for companies with strong balance sheets.

Of the four ways a company can spend cash, he said, three have already been widely employed.

"What typically happens is you have a surge of [stock] buybacks, which has occurred. You have a surge of dividends, which has occurred," Belski told Bloomberg News. He also noted the wave of recent mergers and acquisitions.

Capex is the fourth way, and Belski not only thinks it's inevitable, he says the corporate growth that will result will power a stock market rally that will last "at least three to five years" and could well be the beginning of a "super bull market" that could go on for as long as 15 to 18 years.

"We think this train has a very long tail," Belski told Breakout.

How Capex Can Drive a Stock Market Rally

Many companies have been reluctant to invest in their businesses since the 2008 financial crisis, fearing weak demand, Belski said. That's also a big reason U.S. companies have accumulated so much cash.

"They've been cutting costs and rebuilding their balance sheets for 15 years," Belski said. "That puts them in exquisite position now to bring in more capital."

It's clear the companies have the money, but the key question is: What will jolt CEOs out of their defensive mindset and shift their focus away from capital preservation and toward growth and expansion?

"We think it's actually going to be forced upon them," Belski said.

He sees more global investment returning to the United States over the next several years.

"We've seen fundamental instability and volatility around the world - and look at what we're seeing in Europe," Belski said. "Companies are not going to want to do business as much with companies in Europe and emerging markets because of the stability that U.S. companies can provide them."

At that point, he said, the "lean and mean" U.S. companies will have no choice but to expand their businesses in order to meet demand.

"As business volumes and sales growth comes back, you can't get blood out of a turnip because capacity has been cut so much .... They have to start building property plant equipment again," Belski said.

Belski: Capex Already on the Rise

Belski said the trend toward higher capex spending is already evident.

"Guidance for capex this year is going up for the first year in a while," Belski said.

Several sectors are expecting higher capex spending in 2013. For instance, GlobalData, which analyzes the oil and gas industry, released a report at the end of January projecting 2013 capex in that sector to rise to $1.2 trillion, a 15.9% increase over 2012.

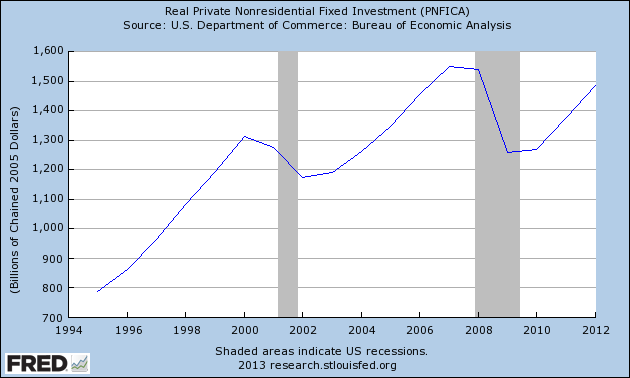

And according to the U.S. Bureau of Labor Statistics (BLS), real private nonresidential fixed investment, which includes business spending on structures, equipment and software, rose 8.9%

in the fourth quarter of 2012. Spending on equipment and software alone shot up 12.4%.

Such data has Belski optimistic that the U.S. stock market rally that carried us through 2012 is far from over.

"We think that the second half of the year will be led by a U.S. domestic recovery," Belski said.

And while he sees a broad-based stock market rally, Belski has pinpointed three sectors - industrials, energy and technology - that he believes will benefit the most from the capex spending trend.

"Stock prices have gone up the past couple of years," Belski said. "We believe the cycle is already in place."

Source :http://moneymorning.com/2013/02/15/is-this-growing-trend-about-to-fuel-a-5-year-stock-market-rally/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.