Silver - Keep It Simple!

Commodities / Gold and Silver 2013 Mar 11, 2013 - 04:05 PM GMTBy: DeviantInvestor

-

Nixon dropped the link between the dollar and gold in 1971. Thereafter, the money supply rapidly expanded, consumer price inflation went wild, and both silver and gold increased in price by over a factor of 20 in early 1980.

Nixon dropped the link between the dollar and gold in 1971. Thereafter, the money supply rapidly expanded, consumer price inflation went wild, and both silver and gold increased in price by over a factor of 20 in early 1980.

-

Volcker raised interest rates, killed both inflation and inflationary expectations, and changed the economic landscape to allow for a nearly 20 year bull market in stocks. Silver and gold dropped below their long-term up-trend. Why put money into silver from 1982 - 2000 when it was easy to make money in stocks?

Volcker raised interest rates, killed both inflation and inflationary expectations, and changed the economic landscape to allow for a nearly 20 year bull market in stocks. Silver and gold dropped below their long-term up-trend. Why put money into silver from 1982 - 2000 when it was easy to make money in stocks? -

The stock market crashed in early 2000, and the world changed after September 2001 (9-11). After that event, borrowing, spending, massive deficits, exploding national debt, war, and even bigger government became the norm. Stocks have gone nowhere, on average, for the last 13 years. Silver and gold, anticipating the massive increases in debt and money supply, woke from a two decade sleep and began a bull market that is likely to run for many more years.

-

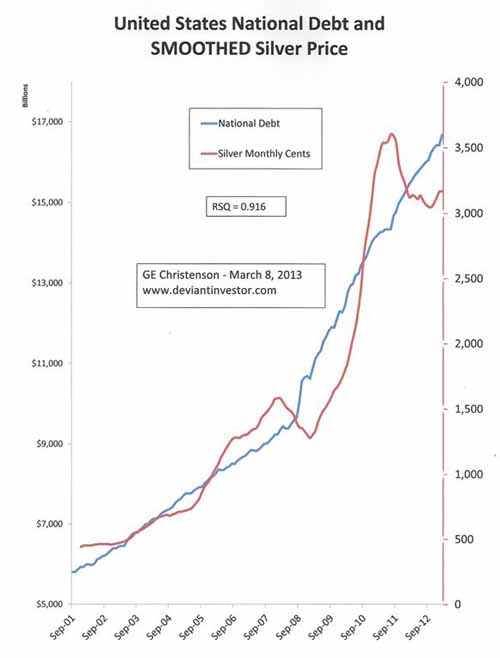

The correlation is simple. More debt means higher prices for silver. Examine the following graph. Note that RSQ = 0.916 for smoothed (13 period moving average) monthly silver prices vs. National Debt - a close correlation.

-

You may not believe the bull market in silver will continue, but I suspect that nearly everyone believes that debt will continue to increase - or until the system resets in some future catastrophic event. I'm not suggesting that increasing debt forever is good or sensible or even possible, but I have seen no evidence that indicates Congress or any president is willing to balance the budget and initiate a sane spending policy.

-

If silver and gold prices correlate, on average, with the national debt and debt will increase until a crash/implosion/hyperinflation event restructures our economy, then you can bet on much higher silver and gold prices in the future.

-

Volatility will increase. Gold accelerated into a new high in 2011, and silver almost exceeded its 1980 high that same year. Both markets have been ugly, from a bull's perspective, since then. Expect future parabolic rallies and vertical drops to become more intense in the next four years.

-

Expect more frightening and silly statements from Goldman Sachs et al about gold going down to $1,200, while they prepare to book fantastic profits from the rally they will encourage, when the time is right for them. The names differ, the game is the same. It hasn't changed in hundreds of years.

-

If you want stress, play the futures market in silver. If you want a long-term investment, buy silver at these low prices and wait for the powers-that-be to devalue the various Dollars, Euros, and Yen that we use. Silver and gold prices will be much higher four years from now, regardless of what you are told via the "party line" from the Goldmans of the world.

Conclusion

-

KEEP IT SIMPLE! Debt is increasing, money supply is increasing, silver and gold prices are increasing.

-

There is no political will to make any material change in the system until a crisis forces change upon all of us. After the crisis, would you rather own gold, silver, Goldman promises, paper dollars, or sovereign debt paper issued by an insolvent government? Read Ten Steps To Safety.

-

Buy silver at depressed prices (like now). Sell some, not all, after a big rally, such as in 2004, 2006, 2008, and 2011. Another big rally is coming. Read commentary from Jim Sinclair.

-

KISS: Keep Investing and Stacking Silver. Keep It Silver-Simple.

-

It is your choice. Silver or paper? Physical metal or computer-generated paper equivalents? Thousands of years of history where silver has functioned as a store of value and as valuable money or decades of broken economic promises? Keep Investing and Stacking Silver!

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.