Holiday In Cyprus - Cypriots Forced to Pay for Bailout

Stock-Markets / Credit Crisis 2013 Mar 17, 2013 - 05:05 PM GMTBy: Andy_Sutton

Buried among the weekend news stories, the battle for the few remaining NCAA basketball slots, and the new Pope’s shoes is a growing crisis on a small island far removed from mainstream America. Perhaps at first glance one might wonder why I am even spending the time covering this developing story. After all, Cyprus is just a little island nation of around a million people and our Congress borrows more money in one day than the GDP of Cyprus for an entire year. What relevance could the goings on in Cyprus possibly have to do with the mightiest nation on Earth?

Buried among the weekend news stories, the battle for the few remaining NCAA basketball slots, and the new Pope’s shoes is a growing crisis on a small island far removed from mainstream America. Perhaps at first glance one might wonder why I am even spending the time covering this developing story. After all, Cyprus is just a little island nation of around a million people and our Congress borrows more money in one day than the GDP of Cyprus for an entire year. What relevance could the goings on in Cyprus possibly have to do with the mightiest nation on Earth?

Every once in a while we are given an opportunity to see our future. Myself and many others have been railing for years now about the concepts of economic slavery, debt, and wealth confiscation. And we’ve been called nuts, extremists and many other things I cannot repeat.

Yet here we are in 2013 with a crystal clear sampling of what is undoubtedly going to take place across the rest of the globe – and already has taken place here, but not in such clear terms. The government of Cyprus, much like the vast majority of governments globally, is broke. However, its people are not. There is a massive distinction here. The self-ascribed European Benevolent Society, aka the European Central Bank and IMF cabal, has arrived on the scene with a Cypriot solution – another bailout. Surprise surprise. But this time there is a catch. The ECB/IMF (as well as the rest of the EU nations!) are demanding a supposedly one-time ‘tax’ of 6.7% on the savings of every Cypriot bank account containing less than $131,000. And a 9.9% ‘tax’ on every account greater than that.

I use the term tax very loosely in this case. While the banking shysters may call this a tax, this is an outright confiscation. A penalty. I think we had SCOTUS case not too long ago in which there was an argument over exactly what constitutes a tax. Ironically enough, the ECB and IMF have finally laid bare one of the mechanisms by which the remainder of the world’s wealth will be confiscated and consolidated over the next period of years. The Cypriots are going to pay (directly) for the bailout of their government and banks – pending a vote of Parliament, which is supposed to happen tomorrow.

Obviously there is a good deal of resistance on the part of lawmakers to ascend to such a scam. Probably because they know that the $12 billion and change bailout will be the first of many such measures and it is not wise for a political figure trapped on an island with a million people to act in a manner inherently contrary to their interests. The Australian newspaper ‘The Age’ portrayed the scene in Cyprus:

In a move that could set off new fears of contagion across the Eurozone, anxious depositors drained cash from ATMs in Cyprus on Saturday, hours after European officials in Brussels required that part of a new €10 billion ($12.6 billion) bailout must be paid for directly from the bank accounts of savers.

The move - a first in the three-year-old European financial crisis - raised questions over whether bank runs could be set off elsewhere.

Jeroen Dijsselbloem, president of the group of euro-area ministers, on Saturday declined to rule out taxes on depositors in countries beyond Cyprus, although he said such a measure was not currently being considered. Although banks placed withdrawal limits of €400 on ATMs, most of them had run out of cash by early evening. People around the country reacted with disbelief and anger.

I beg the forbearance of those who have been reading this column for many years. You’ve already heard this many times before, but since there are new folks waking up each week, it needs to be said again. It comes in the form of a question. We know that the ECB/IMF create their ‘money’ from nothing in a manner similar to their cousin, the not-so-USFed. Given that this is the case, why then is it necessary to raid the personal savings accounts of Cypriot citizens? The answer is that none of these machinations really have anything to do with money, but have everything to do with creating a population of debt slaves.

While you’re cogitating on that concept, let’s talk about the reaction of the Cypriot citizens to the ECB/IMF demands. They’re cleaning out their bank accounts as best they can over a weekend and via ATMs. Conveniently, tomorrow is a national holiday and the banks will be closed. By the time they wake up Tuesday it is rather likely that their government will have capitulated and it will be too late to do anything about it. The point is that the Cypriot people were given no quarter by the European Benevolent Society.

The parallels between that little island and America are too distinct to ignore. Think back to October of 2008. Lehman had failed, the markets were crashing, and a bailout of the US banking system was on the floor of the US House. The fear mongering was at fever pitch. There were enough Chicken Littles to keep the Perdue boys working three shifts for a generation.

What was at stake? $750 billion to get tacked on the tab of the US Taxpayer to bail out the same banks who had trashed the financial system. However, the world clearly wasn’t psychologically conditioned to tolerate the cleaning out of Americans’ bank accounts to pay for the bailout. So we became further indebted to the same banker-shysters who made the mess in the first place. The means were different, but the ends are the same for both America and Cyprus. We will soon be bound for eternity in the commonality that both our governments sold the people into debt slavery, all for the benefit and at the whim of international bankers.

What is the disposition of the Cypriot wealth confiscation? From the AP:

The decision by Cyprus' 16 Eurozone partners and the International Monetary Fund to impose a one-time tax of 6.75 percent on all deposits under (EURO) 100,000 ($131,000) and 9.9 percent over that amount was a significant shift. It marks the first time they have dipped into people's savings to finance a bailout - a move that analysts worry may roil international markets and jeopardize Europe's fragile economy.

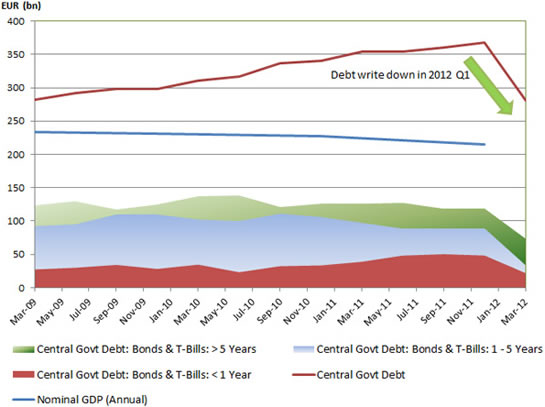

The levy is expected to raise (EURO) 5.8 billion to recapitalize the nation's banks and service the country's debt. Cypriot banks got into trouble after losing some (EURO) 4.5 billion on their Greek government bond holdings after Eurozone leaders decided to write down Greece's debt last year.

For the balance of the Eurozone leaders to have approved of such a ramp job with overt and blatant disregard for their own citizens suggests either ignorance and sheer stupidity of an epic magnitude or complicity with the banker-shysters in fleecing yet another population. You can decide which.

As most of you know, with regards to the 2008 American bailout, aka TARP, the Congress voted ‘no’ on a Monday, only to swing to ‘yes’ on Friday after immense pressure from then Secy of the Treasury and former Goldman Sachs CEO Hank Paulson, among others. The threats and scare tactics went as far as to suggest the government would even declare martial law if the Congress voted ‘no’ and refused the banker-shysters their billions. One must wonder if the delay in the vote in Cyprus is an effort to provide more time for similar arm-twisting. The tactics of fear are already being deployed on the Cypriots as well as the rest of the Eurozone:

“The stakes are high for the tiny island nation of one million people, because a rejection of the levy by lawmakers could push Cyprus into bankruptcy and possibly out of the common euro currency. Officials also fear a massive run Tuesday on Cypriot banks - after a national holiday on Monday - no matter which way the voting goes.” - AP

I will say it right here, on the record – for even the cheap seats. This type of maneuver will become more and more common. There are still large pools of private assets that exist globally and these folks want them all. Their hubris is unlimited and their greed held in check only by the bounds of their wicked imaginations. They have been fully given over to their reprobate minds, and it is high time that the ostriches of the world grow a spine, pull their heads out of the sand, and stop pretending that these people have anyone’s best interest in mind other than their own.

My fellow Americans, you are not immune. All the patriotic slogans uttered on national holidays, the fireworks, and the tripe will not protect a people that is so ignorant of its surroundings as to allow such a group to remain a determining factor of its destiny. We have a responsibility to either learn from our own previous mistakes and those of the other nations in this world or succumb to the repetition thereof.

I am not going to tell anyone what to do. My job with regards to the general public is only to inform. The responsibility now falls on you, but I will say this: if you disregard the goings on in Cyprus and the rest of the Eurozone, you do so to the detriment of not only yourself, but your children as well. Because I guarantee, one day it will be you racing to an ATM machine along with the rest of the masses in a futile attempt to protect the last vestiges of your wealth from men who have no country, no allegiances, and have pledged their lives, fortunes and sacred dishonor to nothing less than the total domination of all four corners of this Earth.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.