Greece vs Iceland Unemployment - The Specter of Things to Come

Stock-Markets / Financial Markets 2013 Apr 05, 2013 - 06:02 AM GMTBy: Ty_Andros

The road to ruin is on plain display and the playbook is easily seen at this juncture. Let's take a look at how that playbook will unfold. Contrary to popular outrage of the SOLUTION being IMPOSED it is the correct one once the insured depositors where PROTECTED. In this edition the elites suffered FIRST followed by the private sector depositors who foolishly believed false BALANCE sheets which were POLITICALLY CORRECT but PRACTICALLY incorrect fictions approved by fiduciarily (regulations and regulators allowed ONGOING insolvent operations rather than protect the public by ending and prohibiting them) challenged governments (work for the banks and crony capitalists not for the public at large).

The road to ruin is on plain display and the playbook is easily seen at this juncture. Let's take a look at how that playbook will unfold. Contrary to popular outrage of the SOLUTION being IMPOSED it is the correct one once the insured depositors where PROTECTED. In this edition the elites suffered FIRST followed by the private sector depositors who foolishly believed false BALANCE sheets which were POLITICALLY CORRECT but PRACTICALLY incorrect fictions approved by fiduciarily (regulations and regulators allowed ONGOING insolvent operations rather than protect the public by ending and prohibiting them) challenged governments (work for the banks and crony capitalists not for the public at large).

The pecking order of the losses was the CORRECT one: Shareholders FIRST, bondholder's second and lastly uninsured depositors. Have we seen this anytime since the crisis began? It is clear that this is and what must be what's done in the future. But for the countries in question to RECOVER they must RECOVER the ability to PRINT and devalue their currency to competitiveness.

Ask Iceland and Greece how the different paths turn out? Iceland (wiped out bond holders, shareholders, prosecuted the banksters and devalued its currency and is in RECOVERY mode), versus Greece (where the Troika holds all the debt, refuses to take a haircut, the bank shareholders and current bondholders (TROIKA) are intact, is forcing INTERNAL devaluations (to get their new slaves in line) rather than external and is in a perpetual DEPRESSION). Let's look at how this is reflected in employment courtesy of www.zerohedge.com:

Which country would you choose to be in? One is internally devaluing (Greece) and Iceland externally. In Greece the future is BLEAK, in Iceland freedom and a good future only requires hard work and REAL wealth creation for the public at large. Italy, Spain, Portugal, Cypress, Ireland are internally devaluing and firmly on the road to ruin. France is up next.

This is why the euro is DOOMED as internal devaluations destroy many generations of citizens and allow unelected technocrats to gather POWER over all. Whereas external devaluations provide the path to recovery. Beppo Grillo is a hero to those who want a future and their freedom from the debt slave masters in Brussels, the IMF, BIS and European central bank.

In a rare moment of candor the Head of the Eurogroup of finance ministers spoke the truth:

"If there is a risk in a bank, our first question should be: 'Ok, what are you the bank going to do about that? What can you do to recapitalize yourself?' If the bank can't do it, then we'll talk to the shareholders and the bondholders. We'll ask them to contribute in recapitalizing the bank. And if necessary the uninsured deposit holders: 'What can you do in order to save your own banks?'..."

"If a bank can't recapitalize itself, then we will talk to the shareholders, bond holders and uninsured depositors."

- Dutch Finance Minister Jeroen Dijsselbloem, who heads the Eurogroup of euro zone finance ministers

Unfortunately the vast majority of banks in the Eurozone will CEASE to EXIST inside this TEMPLATE. This statement reflects reality and is practically correct but is politically incorrect. He quickly retreated to the standard of LYING after the proper amount of PRESSURE from Brussels was applied.

It is THE template and since the sovereigns in which these insolvent banks reside are ALSO insolvent themselves a belly button moment is at hand for the European central bank and the European commission in Brussels. CLOSE DOWN HALF of the banks (or more) within the Eurozone, stockholders, liquidate bomb...er...bond holders and confiscate the rest from uninsured depositors or get the printing press in HIGH GEAR!

There really is no alternative after this TRUTHFUL statement. Human behavior has been altered to the extent that bank runs in Italy have already begun in the weakest institutions. As they say: fool me once shame on you, fool me twice shame on me. The die is cast and buffoonery by the TROIKA will it gather speed and momentum.

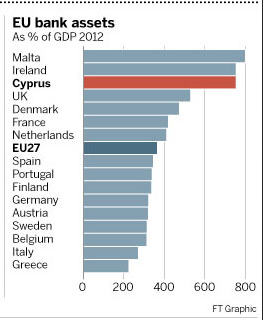

The average bank asset to GDP ratio in Europe is approximately 375% of GDP.

Switzerland is not included but its bank asset to GDP ratio is over 700% and according to the ECB Luxembourg is 22 times GDP. If those assets are written down by 20% (those assets are worth FAR LESS) you are still looking at a CUMULATIVE $14 trillion dollar price tag MINIMUM. The number does not include European sovereign debt which is the elephant in the room as most WILL NEVER BE REPAID but sovereign governments let the banks hold it as RISK FREE. LOL

"Most Europeans, even today, probably would be better off if over-indebted governments were allowed to default in accordance with the relevant bankruptcy precepts . But it can't happen in societies so trained to look to politicians to overrule the laws of arithmetic and economics whenever those laws are inconvenient."

- Holman Jenkins, wsj.com

The losses yet to be allocated or PRINTED AWAY by the TROIKA for the European banking systems is probably north of $30 trillion as the numbers above do not reflect off balance sheet and shadow banking activities. A lot of those bank assets are SOVEREIGN BOMBS...er...BONDS and are UNPAYABLE and inextinguishable although they are sitting on the BANK balance sheets as RISK FREE. HA, ha!

MONETARY monopolists who printed the MONEY out of THIN AIR and LENT IT OUT. The idea that these central bankers, sovereign governments and the IMF can't take a loss is a FICTION! There is no loss when the money lent was created out of thin air!

(Author's note: In my opinion, this is NOT Doom and GLOOM , it is one of the greatest opportunities in HISTORY. Invest properly for this outcome and Prosper, invest looking in the REARVIEW mirror and your wealth will be irreparably DAMAGED. Volatility is opportunity for the prepared investor. As it is priced in and markets ZOOM higher or LOWER to price in collapsing economies and money printing huge opportunities are created. Is your portfolio structured to thrive? The greatest transfer of wealth from those that hold it in paper and financial assets to those that don't is UNDERWAY. Restoring fiat currencies to sound money and absolute return alternative investments with the potential to thrive in all market (up, down and sideways) conditions is what I do. If you have an interest in learning more and working with Ty: CLICK HERE )

Look at little IRELAND whose citizens and their descendants are in a perpetual debt slavery to OFFICIAL (banksters of the TROIKA) bondholders as a result of a TROIKA rescue. Once again money printed out of thin air with the obligations sent to the public to SAVE THEM.

As Rahm Emanuel said: never let a crisis go to waste. Think about the IRISH rescue, a panic was created and the debt slave noose was fitted a la Cypress today!

The Germans, Austrians and Dutch citizens are now saying NO to borrowing money to bailout BANKSTERS and creating PERPETUAL generations of debt slaves out of themselves and their children. These people are practicing SELF defense by refusing to participate FURTHER. BRAVO!! This represents an impending acceleration of the Global financial crisis in EUROPE!

Any COMPETENT and self-respecting CFO, CEO, Family office, high net worth individuals, institutional investor, small businessman, retiree, etc. inside the PIIGS (Portugal, Italy, Ireland, Greece, and Spain) that is not moving or planning to move excess funds out of insolvent banks is insane. No matter what the EU and ECB say...

The ECB Target 2 system is still up and running, when it crumbles and it will, capital controls will descend in a HEARTBEAT.

Remember, Germany is on the hook for almost $1 trillion euros of lending to PIIGS central banks through the target 2 system. They will see this money back only in their dreams, the money is gone and the economies which must PAY IT BACK are COLLAPSING under Troika demands creating future crises to exploit. The ONLY thing that will stop this from gathering the big MOMENTUM is the OUTRIGHT MONEY PRINTING not in the form of MORE DEBT.

The ELITE leadership in Europe is HARD CORE socialists no matter where you look and deeply entrenched and like in Amerika the socialists are on both sides of the aisle. Rehn, Juncker, Merkel, Hollande, Monti, Baroso, etc. are easily revealed as SOCIALISTS to anyone researching their backgrounds and histories. These people DON'T change their STRIPES.

Blind ideologues, sociopaths and psychopaths who will sentence their constituents to any amount of destruction in their LUNGE for complete control of what wealth is left to extract from what's left of the respective private sectors. The same is true for the District of corruption (both sides of the aisle) and the crew in the White house.

Although you may believe you, your money and your property are yours. They believe it is THEIRS to allocate and confiscate as they wish. It is no different inside Washington DC (district of corruption). Private property ENDED at Breton Woods II in August 1971. Developed world governments have been devising ways to confiscate your wealth ever since, as governments which where a small fraction of their economies then, now are most of the economies NOW!

"The elites in the EU and IMF failed to learn their lesson from the popular backlash to these tax proposals, and have openly talked about using Cyprus as a template for future bank bailouts. This raises the prospect of raids on bank accounts, pension funds, and any investments the government can get its hands on. In other words, no one's money is safe in any financial institution in Europe. Bank runs are now a certainty in future crises, as the people realize that they do not really own the money in their accounts. How long before bureaucrats and bankers try that here?"

- Ron Paul

The European Union is itself a project of creating an unaccountable centrally controlled socialist government OUTSIDE the grasp of its CITIZENS. It is what the European project has been about since its inception. Control of the MONOPOLY MONEY printing press is central to their LONG RANGE plan working. Banksters have worked the booms and busts (caused by unsound money) for centuries to impoverish and enslave (debt slaves) those who labor and live under their currency monopolies. The founding fathers of the United States KNEW them well:

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property - until their children wake-up homeless on the continent their fathers conquered."

- Thomas Jefferson, 1802

We are QUICKLY approaching his conclusions in the developed world. The banksters have gathered these monopolies on money in exchange for the funding of progressive governments. How many monopolists that you know work to the benefit of their customers? I don't know of any...

Ask former president Woodrow Wilson about this, in the US he is the ultimate BENEDICT ARNOLD and traitor. Many Presidents have betrayed the public; Watergate is but an anecdote to the betrayal of America by Richard Nixon when he stole the "GOLD" backing off the US dollar at Breton woods II creating the INSTRUMENT (unsound money) of the serfdoms the developed world has become.

In order to get money printed out of thin air countries must surrender their sovereignty to Brussels and chain current and future generations as DEBT SLAVES to the banksters. The EFSF and ESM are the means of chaining the prudent northern countries ( debt slaves but haven't been notified yet) to the banksters through the indirect mechanism of GUARANTEEING the Borrowing to rescue the south. It is the stuff of George Orwell (1984 and Animal Farm).

The Eurozone is nothing but a group of elites (government, banksters, crony capitalists, and trade unions) which run EVERYTHING (economy) to their own benefit. It is a FLEECING machine designed only to prey as parasites on the public at large, its all-encompassing confiscation (inflation, taxes, and regulated demand to crony capitalists) of public wealth is the envy of every progressive in Washington on BOTH SIDES of the Aisle. It is the economic and political blueprint of the current tenants inside the Beltway!

Just today the troika dribbled $1 trillion euros of money printed out of thin air in exchange for DOUBLING the income tax in Cypress from 15 to 30% as if they have not done enough to steal the futures of its citizens and future generations already. Anyone who enters the troikas grasp hand their futures mortgaged in exchange for being SAVED. Can you say Vile and insidious?

Just as the United States is morphing into at LIGHTSPEED under the Chicago boys and the Chosen one in Washington DC (district of corruption) as constant crisis combined with a predatory government prey upon the ECONOMIC crisis which their policies have CAUSED.

As INCOMPETENT, INEPT socialist central planning collapses the European and US economies things shall continue deteriorate from here in REAL TERMS. Nowhere is there a plan for growth except in the increasing takings from the public, runaway currency debasement and the growth of unaccountable leviathan governments. As I said, SOCIALISTS smelling the end zone. An economic and banking collapse (CONSTANT CRISIS, FEAR and terrorizing the public at large) allows them to take everything to SAVE YOU and that is the PLAN on both sides of the Atlantic. They believe they OWN YOU!

In Conclusion: The die is CAST. The next stage of the Eurozone crisis has JUST begun! Any child with a calculator can tell you insolvency is entrenched on both sides of the Atlantic on ALL LEVELS of society: public and private. Some groups are within the radius of the printing presses (banksters, public serpents, government, crony capitalists) and others are outside (the public).

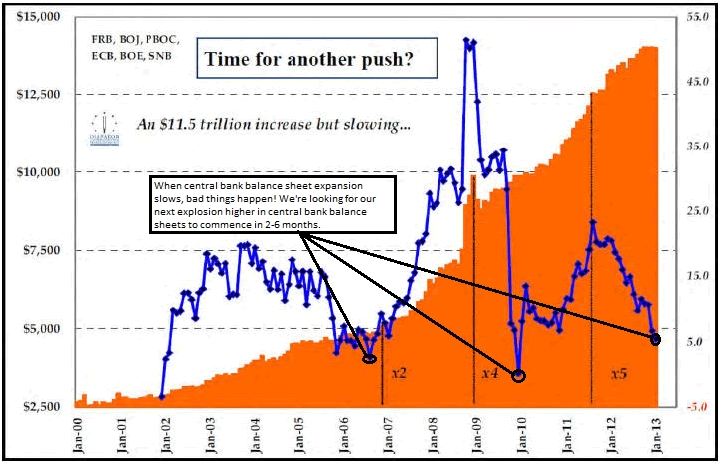

The public has to surrender everything (THEIR FUTURES) in exchange for the illusion of getting to safe ground. They are actually being delivered into hell as socialism is MISERY SPREAD WIDELY as REAL growth collapses and money is printed and lent out to provide illusions of growth. These episodes of currency and financial extinction events occur in waves of insolvency and the next wave is STRIKING right now. The creation of money out of thin air is not keeping up with the deleveraging/default of the insolvent borrowers.

This episode of the unfolding crisis will provide the spark for the next CENTRAL BANK balance sheet expansion. The next aggressive reflation is commencing.

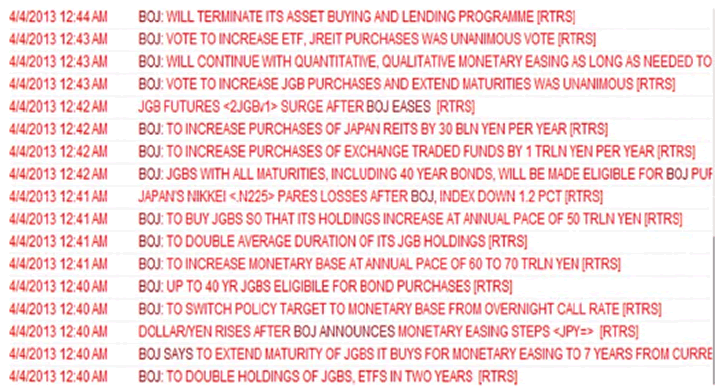

FLASH: As we go to press ABENOMICS and new BOJ president Kuroda has PRODUCED a STUNNING approach to the Global financial crisis as it announced over $81 TRILLION dollars of monetization of assets of all stripes PER MONTH. That is triple the size of QE 3 in the US (Japans economy is 1/3rd the size of the US but the money printing is about the same size, wowee). FIREHOSES of HOT money set to roll off the printing presses into every type of assets you can imagine. Take a look at this detail from the fabulous Gartman letter (www.thegartmanletter.com):

When I look at this I gasp in its breadth and depth. It is an incredible escalation in a KEYNESIAN monetary experiment. The biggest shock and awe assault on paper creation in the crisis. Between the Bank of England, Federal Reserve, and the Bank of Japan PRINTING over $160 billion a MONTH (160,000 million) to prevent the fall of asset markets and fund sovereign INSOLVENCIES! Hard to conceive.

Banks in Italy are under great strain as the smart money PULLS OUT for destinations unknown. Spain and Canada have just put into place the means (laws) for the upcoming episodes of being CYPRESSED!

Mario Draghli (look where he comes from: Goldman Sachs, BIS and Italian central bank, groomed as a master predator, notice Mark Carney incoming head of the bank of England has the EXACT SAME RESUME) in particular is playing the crisis like a maestro to deliver the Eurozone into the grasp of the BIS (the covert owners of all the big central banks) and their minions in Brussels.

He waits till he sees the whites of his victim's eyes, panic/fear in their hearts courtesy of main stream media, and then extracts their futures from them in exchange for the printed money. Bang, bang, enslaved nations into the grasp of the troika. Just this I am completing this missive Draghli is REFUSING to supply capital (crisis creation) to the BANKING systems, as he must be aware this is a recipe for Europe going to the barter system) OR a nationalization of the banking systems (opportunity for central banksters who own the central banks) with the ECB as OWNERS in exchange for the CAPITAL! WHICH will be printed out of THIN AIR...

This happened in the GREAT DEPRESSION as FED sponsored banks ROLLED up the weaklings. Think Wachovia, Merrill lynch, Bear Stearns, Lehman Brothers (outside MONEY PRINTING loop), JP Morgan Chase, Citigroup, Goldman Sachs, Bank of America (inside the loop) etc. It has been documented that the Federal Reserve printed and lent almost $15 trillion dollars during the October 2008 massacre. That money went to banks INSIDE the MONEY PRINTING LOOP! Capiche? This playbook has been played for centuries. Are you inside the loop of money printing or outside, which is the question?

The NEXT question becomes: will he blink and let the real printing press loose or miscalculate and set off the real nuclear detonation of the Eurozone banking and financial systems. We shall know the answer soon. He has and the troika have gathered untold power in the PIIGS and destroyed countless lives and futures. Beppo Grillo and his constituents are just the TIP of the SPEAR of citizens seeking to recover their freedoms and futures from the banksters. EXPECT MUCH MORE to emerge!

This decline in the rate of money printing is why you see silver and gold struggling in the face a disintegrating Europe. Couple that with massive paper gold and silver selling by the Federal Reserve and US treasury to kill the inflationary canaries in the coal mine. Fortunately the public and foreign central banks are taking delivery of physical gold and silver as fast as it is available at these bargain basement prices. A clash of TITANS so to speak.

The only antidote to this crisis, REAL economic growth, not nominal growth. In order for that to happen private property rights must be restored, CRONY CAPITALIST regulations repealed and CONFISCATORY taxes lowered. What's the chance of that? A snowball's chance in hell.

Don't worry; they will print the money... Historically the printing press has always emerged and I believe this time will be NO DIFFERENT! Don't miss the next edition of TedBits Witches Brew, subscriptions are free at www.Tedbits.com or www.TraderView.com, may God Bless you!

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2013 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.