Sign That a Stock Market Boom Is Headed Our Way

Stock-Markets / Stock Markets 2013 Apr 07, 2013 - 06:32 PM GMTBy: DailyWealth

Dr. David Eifrig writes: Last week, I showed you a handful of charts that dispel a common misconception... one that is keeping thousands of retirees up at night.

Dr. David Eifrig writes: Last week, I showed you a handful of charts that dispel a common misconception... one that is keeping thousands of retirees up at night.

I dispelled the idea that the U.S. economy is running off the rails... that we are in a recession, or worse, a depression.

Despite the facts I showed you... and despite the fact that stocks are still a good value (read more here), the stock market still hasn't boomed like I believe it will.

But that's about to change. Here's why...

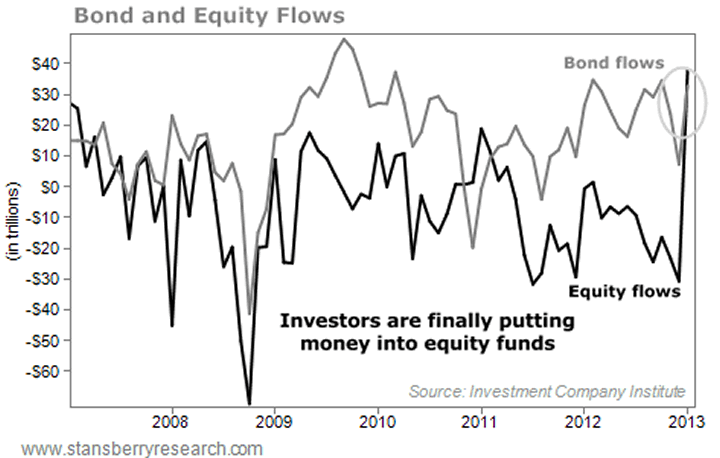

Investors spent much of 2012 "stampeding" into bond funds. Bonds are seen as "super safe" investment vehicles... much safer than stocks. A stampede into bonds is a classic sign that people are scared of a volatile and uncertain stock market.

And even with interest rates near all-time lows, people were still moving gobs of money into bonds and bond funds.

As the chart below shows, they're still putting money into bond funds... but they're finally starting to put money back into stocks as well.

This chart displays the amount of money flowing into bond funds (the gray line) and the amount of money flowing into stock funds (the black line). As you can see on the right side of the chart, the money flow into stocks just spiked higher... It's now equal to the money flowing into bonds.

This spike higher in equity flows tells us that "Mom and Pop" investors are finally getting interested in stocks again.

Yes, stocks have enjoyed big returns in the past few years... but it usually takes several years of great performance to draw in the public after it has been burned like it was in 2008.

The charts in last week's essay show that the economy is growing slowly. And despite what some folks tell you, inflation is still not a major concern right now. This is a good environment for stocks and – under normal times – bonds.

But after the "stampede" into bonds, I think the risk here is too high. Plus, the dividend yields on stable (and even growing) blue-chip companies like Automatic Data Processing, Wal-Mart, and Wells Fargo make stocks a better choice for your portfolio in 2013.

We've had low interest rates, muted inflation, and relatively cheap stock market valuations for a while. And no surprise, the market has responded by approaching all-time highs.

Now, shifting investor sentiment could kick the rally into a higher gear. The recent spike in money flow is a clue that this is happening. That's why it's best to stay long stocks right now. They've had a great first quarter (up 10%)... but they're going to go up even more in 2013.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.