Bitcoin Price Bubble Heard 'Round The World

Commodities / Gold and Silver 2013 Apr 17, 2013 - 09:32 PM GMTBy: Jeff_Berwick

Justin O’Connell writes: For many of our TDV Newsletter readers, who seek a Perpetual Traveler lifestyle, storing tangible wealth throughout the world remains problematic.

Justin O’Connell writes: For many of our TDV Newsletter readers, who seek a Perpetual Traveler lifestyle, storing tangible wealth throughout the world remains problematic.

For this reason and others, the Bitcoin price does not matter, just as it doesn't really matter with the gold and silver markets. As I write this, silver is below $24, yet US wholesale distributors CNT and Dillon Gage are out of the metal. Also, as I write this, despite the most massive volume ever in Bitcoin, virtually all on the sell-side, Bitcoin holds $50.

On and around April 10, Bitcoin Charts had issues keeping its site up, while leading Bitcoin exchange Mt. Gox also announced a cease to trading as if they were the Federal Reserve of Bitcoin. About its down-time, Bitcoin Charts posted on its website:

On and around April 10, Bitcoin Charts had issues keeping its site up, while leading Bitcoin exchange Mt. Gox also announced a cease to trading as if they were the Federal Reserve of Bitcoin. About its down-time, Bitcoin Charts posted on its website:

After tweaking the backend a little performance now should be better and 502 errors should happen much less often. Previously, this site was handling about 2000 simultaneous users. Now it is handling close to 50,000...

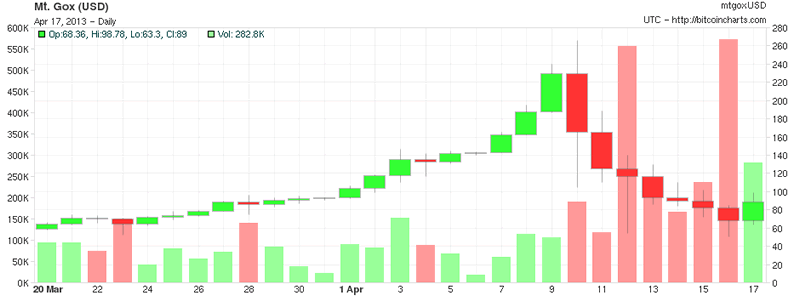

That is merely a glimpse into the mania that came to surround Bitcoin in recent weeks. On April 10, Bitcoin climbed to a high $266 and closed at $124.9 the next morning before Mt. Gox, the leading Bitcoin exchange and de facto bitcoin price-fixer, went down for nearly a day. This was the bubble heard around the world, as during this time Bitcoin was the talk of the mainstream financial world.

When trading began Thursday, Bitcoin fell again to a low of around $65, before rebounding to sit around $100 through Sunday night trading. It remains above $74 as this article goes live.

Those are unspeakable sale volumes in the context of Bitcoin. Most volume ever for sure, all mostly on the sale side, denoted in red.

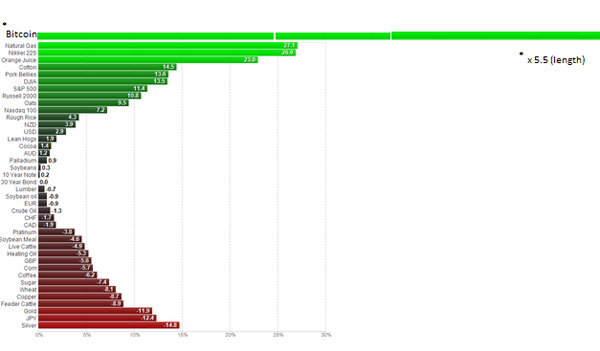

Bitcoin began the year around $13.51. It’s percentage increase is fluctuating around 500%. It has outperformed all other assets Year-To-Date. Natural Gas by comparison is up 27% since Jan. 1. The green line on top, BTC, would have to be extended 5.5 times to show bitcoin’s 2013 performance.

As I wrote at my blog Silver Vigilante in January:

In the last six months, according to Google trends, countries the world over searched the term “Bitcoin” for the second most amount of times since the digital currency was extremely volatile at the beginning of the 2011 summer. In December, “Bitcoin” was searched the third most amount of times in its history, behind June 2011 (the peak) and just this passed September.

- Egypt historical peak search volume, September 2012.

- Saudi Arabia, second highest search volume, December 2012

- Kazahkstan, 2nd highest search volume

- Pakistan, third highest behind February 2012 and June 2011

- India, November 2012 second highest behind June 2011

- Vietnam, August 2012 second highest behind June 2011,

- Turkey second highest December 2012 behind June 2011

- In Spain, December 2012 is third largest search volume behind August 2012 by one point, and the peak June 2011.

However, after months of gold and silver falling cheaper in terms of Bitcoin, the trend has reversed this past week, despite the break of key support for precious metals. Nonetheless, Bitcoin has in the last week become cheaper in terms of gold and silver due to its correction:

But Mt. Gox has been center-stage throughout a week of DDoS attacks on their server, failed customer service, locked funds and the volatile Bitcoin price largely due to how easy it is to disrupt the Bitcoin network by simply attacking the center for its unfortunately centralized exchange.

Mt. Gox held a Reddit “Ask Me Anything” on Friday for those worried by recent trading problems that culminated with a 12-hour trading halt. Currently, 20,000 new Mt Gox are being opened a day compared with the 60,00 opened in all of March, according to the website.

Mt. Gox explained some issues:

Our system was designed to handle 2~3x our normal load, but now we’re experiencing 10x the amount, which was difficult to prepare for (it takes weeks) with the sudden new accounts. We have two problems: the DDos and volume related to new accounts. The trade engine is capable of accepting much more of a load. Within 2~3 weeks we will completely rewrite the trade engine, in the meantime we shut down the system today and installed a new server with the current trade engine. Of course, if we didn’t have DDos everything would be fine, so now we’re dealing with two issues at once.

Who is attacking Mt.Gox with a DDoS? “We cannot disclose details, but we have some ideas…Basically because by naming them it makes our job harder because they will move to protect themselves.”

Trading Updates too much to ask for? “We absolutely understand this. The fact is that we are programmers and engineers, not PR guys, and we are still building out our capabilities beyond technology and into servicing our customers better. So, yes, we’re moving on this now and have secured help.”

Question from pmarches: Does mtgox run as a fractional exchange? Meaning, do you have 100% of the bitcoins your users have deposited in your system? “NO. Everything is accounted for (BTC and money). Fractional reserve is absolutely against our principles. In fact 90~95% of BTC are held in cold storage.”

No matter how Mt. Gox plays this off, the jugular of the issue is that users have been unable to withdraw their funds throughout most of the turbulence. Many former capacities of Mt. Gox have been nullified. With Mt. Gox transacting 80-90% of Bitcoin transactions, Bitcoin has suffered.

But, Mt. Gox is not to be mistaken with the actual Bitcoin protocol, which itself has proven unhackable by even the world’s foremost hackers and engineers, as this article at Business Insider demonstrates.

It is impossible to know if Bitcoin will rise and fall until an attack or sudden spike in demand falls upon the market. As Erik Vorhees, an early adopter of Bitcoin, wrote: “Guessing short term price movements is a fool’s game.”

In an Austrian’s eyes, some recent explanations for bitcoin’s price rise, which is really still the main story for Bitcoin in 2013, read as follows:

- The emergence of respected online merchants such as Mega, NameCheap, Reddit, Ok Cupid, Archive.org (which pays its employees in BTC) and others accepting Bitcoin has proven that businesses see its value, thus leading to the price increase.

- Europe’s confiscation of Cypriot bank accounts have led to an influx in Bitcoin purchasers, not so much in Cyprus, but in North America and Europe. This has led to greater levels of speculation upon the price of Bitcoin, with cliques of buyers-and-sellers pumping the price only to sell all at once, and buy in the aftermath of the ensuing panicked selloff.

- FATCA regulations, consistently covered and explained in the TDV Newsletter, have driven individuals to bitcoin for privacy.

- Venture Capitalists and other private investors, now moving into Bitcoin, also want Bitcoin at the best prices. While their bitcoin purchases help explain the price rise, they could also explain the volatility and even DDoS attacks on key websites. To DDoS a website, it costs under $500.

- Gold and silver buyers, moreover, have moved into the Bitcoin market. Largely thanks to the work of Trace Mayer, many former gold-and-silver bugs have seen the parallels in Bitcoin to precious metals.

- The recent FinCEN ruling could have been made at the request of venture capitalists who did not want to put money into Bitcoin only to see it shortly thereafter outlawed. Now, people can be assured the government sees it as just another financial instrument.

- Mainstream press interest in Bitcoin has been parabolic. This has led to incredible “hype” around Bitcoin.

- Many, many people who simply do not understand Bitcoin are now buying bitcoins due to its media-hype.

This increased demand has opened up unlimited opportunities for Dollar Vigilantes to sustain themselves in dynamic times. We bring you ideas for action in our newsletter. But, we thought Bitcoin deserved its own work.

That’s why TDV Media, in conjunction with Gold Silver Bitcoin, will release its first report on Bitcoin in the coming weeks going over in detail the Bitcoin basics, proper security, Bitcoin wealth management and even business ideas in/around the Bitcoin space. To give you a sneak peak into that guide, we focus on how you can safely store your bitcoin with a method known as “cold storage.” We will go into the cheapest, most convenient and secure way for you achieve this in our coming guide on Bitcoin.

Justin O’Connell, researcher at The Dollar Vigilante, runs Gold Silver Bitcoin and is a co-founder of BitcoinATM. He also writes at the Dollar Vigilante-inspired site, Silver Vigilante. Justin studied History and German Language at Linfield College in McMinnville, Oregon, where, in his spare time, he researched current events and their relationship to history. In his studies he has found that societies have been managed by philosophically-kindred ruling classes seeking persistently a singular, total order across the planet. Justin does not believe in government as a medium for human relationships, preferring instead the race of human ideas stemming from a diverse, vibrant culture.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.