CFTC Probe Gold Price Plunge “No Visible Central Bank Activity” Say Blackrock

Commodities / Gold and Silver 2013 Apr 18, 2013 - 05:06 PM GMTBy: GoldCore

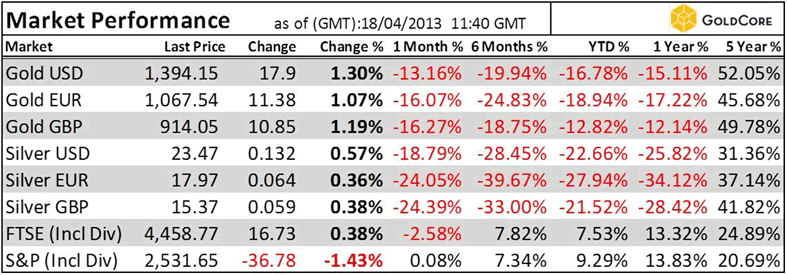

Today’s AM fix was USD 1,397.00, EUR 1,070.17 and GBP 917.09 per ounce.

Today’s AM fix was USD 1,397.00, EUR 1,070.17 and GBP 917.09 per ounce.

Yesterday’s AM fix was USD 1,379.00, EUR 1,046.12 and GBP 903.14 per ounce.

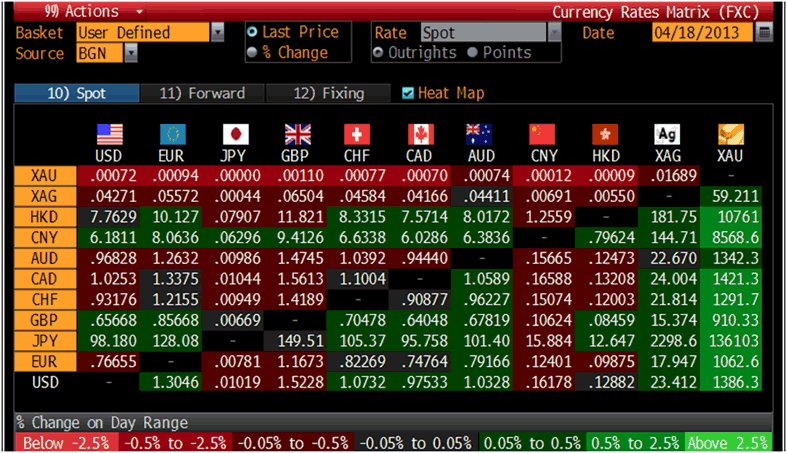

Cross Currency Table – (Bloomberg)

Gold lost $0.20 or 0.01% yesterday to $1,373.20/oz and silver also finished with a slight loss of 0.9%.

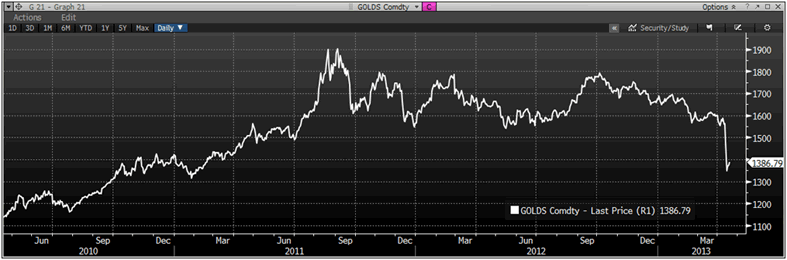

Gold in USD, Daily – (Bloomberg)

Lower gold prices have led to a rush to buy gold coins and bars globally. Value investors and store of wealth buyers are more than happy to exchange devaluing paper currencies for physical gold at these much cheaper prices.

It is ironic that manipulative selling by a large hedge fund or bullion bank may have ignited a mini gold rush globally.

US Mint data shows that a record 63,500 ounces, or a massive 2 tons, of gold were sold on Wednesday (April 17th) alone. This means that total sales for the month of April have surged to a significant 147,000 ounces. This is more than the previous two months combined with just half of April gone.

Gold Ounces Sold By Mint – Zero Hedge

Similar strong demand is being seen throughout Asia and in western markets. We saw more buying than selling again yesterday and most of the selling was of small orders, less than fifty ounces, while buy orders were lumpier and from high net worth clients.

Demand is again particularly strong in India as Indian consumers are buying gold jewelry, coins and bars in record numbers which will boost gold imports this quarter as traders and banks run out of gold bullion inventories.

Overseas purchases may jump 36% to 305 metric tons in the three months ending June from 225 tons a year earlier, Mohit Kamboj, president of the Bombay Bullion Association Ltd., said in a phone interview with Bloomberg.

Imports may climb as much as 20% this month from year earlier, he said.

Buyers are flocking to jewelry stores and bank outlets to buy ornaments, coins and bars ahead of India’s main wedding and festival seasons after gold slumped to a two-year low.

The Commodity Futures Trading Commission (CFTC) is looking at the role of market speculators, CFTC Commissioner Bart Chilton told Bloomberg TV overnight after gold futures on Monday suffered their biggest one-day decline since at least 1983. Some have said that it was the largest decline ever.

The CFTC may take a deeper look into the price of gold following Monday's price plunge. Democratic CFTC Commissioner Bart Chilton told Bloomberg TV today that the drop doesn't necessarily mean "anything nefarious" happened but whenever something like this happens "we got to look at it."

“When you see such sharp move that is obviously something that raises our concern and we look at the trades and see what is going on,” he said.

Regulators must look out for end-users first and ensure markets perform “properly”.

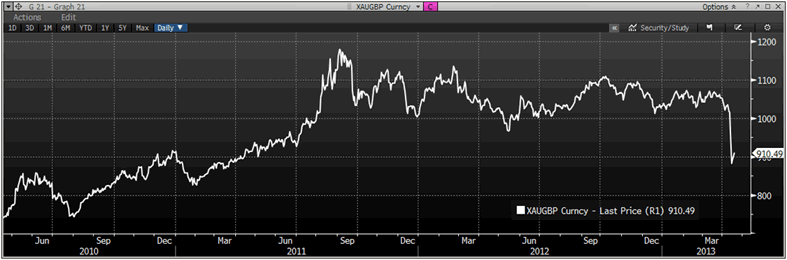

XAU/GBP, Daily – (Bloomberg)

The CFTC is already scrutinizing whether gold prices are being manipulated in London by a handful of banks who meet two times a day to set the spot price for a troy ounce of physical gold. The CFTC said in March that it is looking at issues including whether the setting of prices for gold—and the smaller silver market — is transparent and if it is fixed.

The $20 billion gold futures sale and concentrated selling of gold futures on the COMEX on Friday and Monday is far more likely to be “nefarious” than the gold fixings in London.

The CFTC’s track record to date has not been great and regulatory capture remains a real risk with the CFTC seeming to be reluctant to hold Wall Street banks who may be involved in price manipulation in the futures market to account.

After the Libor revelations, it is surprising that there is not more scrutiny and hard questions asked of banks and regulators in this regard.

Separately, large institutional fund manager Blackrock said that there was “no visible central bank activity” as the gold price plunged.

They said that gold's fundamentals remain strong and that the fall in price was driven by an outflow of "hot money" and that gold prices are now near the marginal cost of new supply which should provide strong support at these levels and lead to higher prices again.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.