The Real Reason U.S. Government Is Paying Down the National Debt

Interest-Rates / US Debt May 01, 2013 - 11:55 AM GMTBy: Money_Morning

David Zeiler writes: After six years of non-stop deficit spending that has added $8.2 trillion to the national debt, the U.S. Treasury has announced that it expects to reduce the country's debt by $35 billion this quarter.

David Zeiler writes: After six years of non-stop deficit spending that has added $8.2 trillion to the national debt, the U.S. Treasury has announced that it expects to reduce the country's debt by $35 billion this quarter.

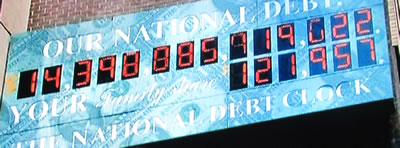

Given that national debt growth has rocketed past $16.7 trillion and is on track to exceed $17 trillion at some point in the fall, a $35 billion reduction is laughably tiny. It's just 0.02% of what we as a nation owe.

And in the very same statement, the Treasury admitted that in the following quarter it expects to be back to borrowing as usual - $223 billion worth, more than six times the amount it plans to pay down this quarter.

And in the very same statement, the Treasury admitted that in the following quarter it expects to be back to borrowing as usual - $223 billion worth, more than six times the amount it plans to pay down this quarter.

So why bother?

"I don't believe in coincidences," said Money Morning Chief Investment Strategist Keith Fitz-Gerald. "Our leaders in Washington on both sides of the aisle are terribly under pressure from the American public right now, and I think this is a very convenient announcement to say, "Hey, we're doing the right thing, keep us all in office for a little while longer.'"

And apart from any political motivations, Fitz-Gerald wonders whether the plan to pay down $35 billion of the national debt can even be considered legitimate, given the way the government borrows money from itself.

"It's like taking blood from the left arm and putting in in the right arm and calling it a transfusion," Fitz-Gerald said.

Where the Money to Pay Down the National Debt Came From

And there's another good reason not to read too much into Treasury's ability to pay back an infinitesimal amount of the national debt this quarter - it's as much of a quirk of the calendar as anything.

Because the government reaps higher-than-usual tax receipts in the April-June quarter, it usually needs to do less borrowing. In better times, in fact, the April-June quarter often posted a surplus that allowed some of the national debt to be paid down.

That such a surplus has been absent since 2007 (when the government reduced the national debt by $139 billion) is testament to the extent of the profligate spending that has consumed Washington since the Great Recession struck in 2008.

This year, several events coincided to push the Treasury into the black for one quarter. The restoration of the full payroll tax in January, along with some tax increases on the wealthy, meant that this quarter's tax take was higher than it had been in recent years.

Add in the forced sequester cuts, and the tens of billions saved from the drawdown of U.S. forces in Iraq and Afghanistan, and you get... a paltry $35 billion.

One would expect that number to be higher, but that just goes to show how bad the nation's fiscal situation has gotten.

"Let's see them do it three, four, five quarters in a row," Fitz-Gerald said. "That would be good. Then we can say, somebody finally gets it, somebody in Washington has their head on straight. But until that time, I'm very leery."

Why Washington Must Address the National Debt

While $35 billion is better than nothing, Fitz-Gerald thinks the national debt, as it rapidly approaches $17 trillion, has nearly grown beyond our ability to cope with it.

"We've spent so much money at this point that we cannot pay it back...ever," Fitz-Gerald said. "We're either going to default or we're going to pay our way out of it - and the former is much more likely than the latter."

That doesn't mean catastrophe is around the corner. But unless Washington starts to take the national debt more seriously - certainly more seriously than a one-time 0.02% installment - the crisis will continue to fester under the surface until it finally explodes.

"No one wants a default, so they'll do everything they can to prevent it for 25, maybe even 50 years," Fitz-Gerald said. "The thing is, our leaders don't want to make the tough decisions now, even though the consequences of not doing so grow more acute with each passing day. Personally, I'd rather they make the effort than have the system blow up and do it for us - which is the risk we're running today."

Further Reading: Let Keith Fitz-Gerald tell you about the "Most Dangerous Man in the World"

Source :http://moneymorning.com/2013/04/30/the-real-reason-government-is-paying-down-the-national-debt/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.