US Banking System in a Vicious Circle Ending In Systemic Financial Meltdown

Stock-Markets / Credit Crisis 2008 Mar 15, 2008 - 05:27 PM GMTBy: Mike_Whitney

"It's another round of the credit crisis. Some markets are getting worse than January this time. There is fear that something dramatic will happen and that fear is feeding itself," Jesper Fischer-Nielsen, interest rate strategist at Danske Bank, Copenhagen; Reuters

"It's another round of the credit crisis. Some markets are getting worse than January this time. There is fear that something dramatic will happen and that fear is feeding itself," Jesper Fischer-Nielsen, interest rate strategist at Danske Bank, Copenhagen; Reuters

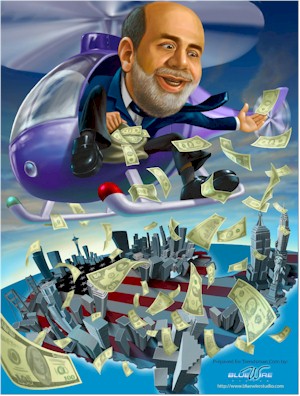

Wednessday's action by the Federal Reserve proves that the banking system is insolvent and the US economy is at the brink of collapse. It also shows that the Fed is willing to intervene directly in the stock market if it keeps equities propped up. This is clearly a violation of its mandate and runs contrary to the basic tenets of a free market. Investors who shorted the market yesterday, got clobbered by the not so invisible hand of the Fed chief.

In his prepared statement, Bernanke announced that the Fed would add $200 billion to the financial system to shore up banks that have been battered by mortgage-related losses. The news was greeted with jubilation on Wall Street where traders sent stocks skyrocketing by 416 points, their biggest one-day gain in five years.

In his prepared statement, Bernanke announced that the Fed would add $200 billion to the financial system to shore up banks that have been battered by mortgage-related losses. The news was greeted with jubilation on Wall Street where traders sent stocks skyrocketing by 416 points, their biggest one-day gain in five years.

“It's like they're putting jumper cables onto a battery to kick-start the credit market,'' said Nick Raich, a manager at National City Private Client Group in Cleveland. ``They're doing their best to try to restore confidence.''

“Confidence”? Is that what it's called when the system is bailed out by Sugar-daddy Bernanke?

To understand the real meaning behind the Fed's action; it's worth considering some of the stories which popped up in the business news just days earlier. For example, last Friday, the International Herald Tribune reported: “Tight money markets, tumbling stocks and the dollar are expected to heighten worries for investors this week as pressure mounts on central banks facing what looks like the “third wave” of a global credit crisis....Money markets tightened to levels not seen since December, when year-end funding problems pushed lending costs higher across the board.”

The Herald Tribune said that troubles in the credit markets had pushed the stock market down more than 3 percent in a week and that the same conditions which preceded the last two crises (in August and December) were back stronger than ever. In other words, liquidity was vanishing from the system and the market was headed for a crash.

A report in Reuters reiterated the same ominous prediction of a “third wave” saying: “The two-year U.S. Treasury yields hit a 4-year low below 1.5 percent as investors flocked to safe-haven government bonds....The cost of corporate bond insurance hit record highs on Friday and parts of the debt market which had previously escaped the turmoil are also getting hit.”

Risk premiums were soaring and investors were fleeing stocks and bonds for the safety of government Treasuries; another sure sign that liquidity was disappearing.

Reuters: "The level of financial stress is ... likely to continue to fuel speculation of more immediate central bank action either in the form of increased liquidity injections or an early rate cut," Goldman Sachs said in a note to clients.”

Indeed. When there's a funding-freeze by lenders, investors hit the exits as fast as their feet will carry them. That's why the lights started blinking red at the Federal Reserve and Bernanke concocted a plan to add $200 billion to the listing banking system.

New York Times columnist Paul Krugman also referred to a “third wave” in his article “The Face-Slap Theory”. According to Krugman, “The Fed has been cutting the interest rate it controls - the so-called Fed funds rate – (but) the rates that matter most directly to the economy, including rates on mortgages and corporate bonds, have been rising. And that's sure to worsen the economic downturn.”...(Now) “the banks and other market players who took on too much risk are all trying to get out of unsafe investments at the same time, causing significant collateral damage to market functioning.” What the Times' columnist is describing is a run on the financial system and the onset of “a full-fledged financial panic.”

New York Times columnist Paul Krugman also referred to a “third wave” in his article “The Face-Slap Theory”. According to Krugman, “The Fed has been cutting the interest rate it controls - the so-called Fed funds rate – (but) the rates that matter most directly to the economy, including rates on mortgages and corporate bonds, have been rising. And that's sure to worsen the economic downturn.”...(Now) “the banks and other market players who took on too much risk are all trying to get out of unsafe investments at the same time, causing significant collateral damage to market functioning.” What the Times' columnist is describing is a run on the financial system and the onset of “a full-fledged financial panic.”

The point is, Bernanke's latest scheme is not a remedy for the trillion dollar unwinding of bad bets. It is merely a quick-fix to avoid a bloody stock market crash brought on by prevailing conditions in the credit markets.

Bernanke coordinated the action with the other members of the global banking cartel---The Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, and the Swiss National Bank---and cobbled together the new Term Securities Lending Facility (TSLF), which “will lend up to $200 billion of Treasury securities to primary dealers secured for a term of 28 days (rather than overnight, as in the existing program) by a pledge of other securities, including federal agency debt, federal agency residential-mortgage-backed securities (MBS), and non-agency AAA/Aaa-rated private-label residential MBS. The TSLF is intended to promote liquidity in the financing markets for Treasury and other collateral and thus to foster the functioning of financial markets more generally.” (Fed statement)

The plan, of course, is wildly inflationary and will put additional downward pressure on the anemic dollar. No matter. All of the Fed's tools are implicitly inflationary anyway, but they'll all be put to use before the current crisis is over.

The Fed's statement continues: “The Federal Open Market Committee has authorized increases in its existing temporary reciprocal currency arrangements (swap lines) with the European Central Bank (ECB) and the Swiss National Bank (SNB). These arrangements will now provide dollars in amounts of up to $30 billion and $6 billion to the ECB and the SNB, respectively, representing increases of $10 billion and $2 billion. The FOMC extended the term of these swap lines through September 30, 2008.”

So, why is the Fed issuing loans to foreign banks? Isn't that a tacit admission of its guilt in the trillion dollar subprime swindle? Or is it simply a way of warding off litigation from angry foreign investors who know they were cheated with worthless toxic bonds? In any event, the Fed's largess proves that the G-10 operates as de facto cartel determining monetary policy for much of the world. (The G-10 represents roughly 85% of global GDP)

As for Bernanke's Term Securities Lending Facility (TSLF) it is intentionally designed to circumvent the Fed's mandate to only take top-grade collateral in exchange for loans. No one believes that these triple A mortgage-backed securities are worth more than $.70 on the dollar. In fact, according to a report in Bloomberg News yesterday: “AAA debt fell as low as 61 cents on the dollar after record home foreclosures and a decline to AA may push the value of the debt to 26 cents, according to Credit Suisse Group.

``The fact that they've kept those ratings where they are is laughable,'' said Kyle Bass, chief executive officer of Hayman Capital Partners, a Dallas-based hedge fund that made $500 million last year betting lower-rated subprime-mortgage bonds would decline in value. ``Downgrades of AAA and AA bonds are imminent, and they're going to be significant.'' Bass estimates most of AAA subprime bonds in the ABX indexes will be cut by an average of six or seven levels within six weeks.” (Bloomberg News) The Fed is accepting these garbage bonds at nearly full-value. Another gift from Santa Bernanke.

Additionally, the Fed is offering 28 day repos which --if this auction works like the Fed's other facility, the TAF---the loans can be rolled over free of charge for another 28 days. Yippee. The Fed found a way to recapitalize the banks with permanent rotating loans and the public is none the wiser. The capital-starved banksters at Citi and Merrill must feel like they just won the lottery. Unfortunately, Bernanke's move effectively nationalizes the banks and makes them entirely dependent on the Fed's fickle generosity.

The New York Times Floyd Norris sums up Bernanke's efforts like this: “The Fed's moves today and last Friday are a direct effort to counter a loss of liquidity in mortgage-backed securities, including those backed by Fannie Mae and Freddie Mac. Given the implied government guarantee of Freddie and Fannie, rising yields in their paper served as a warning sign that the crunch was worsening and investor confidence was waning. On Oct. 30, the day before the Fed cut the Fed funds rate from 4.75 percent to 4.5 percent, the yield on Fannie Mae securities was 5.75 percent. Today the Fed Funds rate is 3 percent, and the Fannie Mae rate is 5.71 percent, virtually the same as in October.....A sign of the Fed's success, or lack of same, will be visible in that rate. It needs to come down sharply, in line with Treasury bond rates. Today, the rate was up for most of the day, but it did fall back at the end of the day. Watch that rate for the rest of the week to see indications of whether the Fed's move is really working to restore confidence.”

Norris is right; it all depends on whether rates go down and whether that will rev-up the moribund housing market again. Of course, that is predicated on the false assumption that consumers are too stupid to know that housing is in its biggest decline since the Great Depression. This is just another slight miscalculation by the blinkered Fed. Housing will not be resuscitated anytime in the near future, no matter what the conditions; and you can bet on that. The last time Bernanke cut interest rates by 75 basis points mortgage rates on the 30-year fixed actually went up a full percentage point. This had a negative affect on refinancing as well as new home purchases. The cuts were a total bust in terms of home sales.

Still, equities traders love Bernanke's antics and, for the next 24 hours or so, he'll be praised for acting decisively. But as more people reflect on this latest manuver, they'll see it for what it really is; a sign of panic. Even more worrisome is the fact that Bernanke is quickly using every arrow in his quiver. Despite the mistaken belief that the Fed can print money whenever it chooses; there are balance sheets constraints; the Fed's largess is finite.

According to MarketWatch:" Counting the currency swaps with the foreign central banks, the Fed has now committed more than half of its combined securities and loan portfolio of $832 billion, Lou Crandall, chief economist for Wrightson ICAP noted. 'The Fed won't have run completely out of ammunition after these operations, but it is reaching deeper into its balance sheet than before. "

Steve Waldman at interfluidity draws the same conclusion in his latest post: “After the FAF expansion, repo program, and TSLF, the Fed will have between $300B and $400B in remaining sterilization capacity, unless it issues bonds directly.” (Calculated Risk) So, Bernanke is running short of ammo and the housing bust has just begun. That's bad. As the wave of foreclosures, credit card defaults and commercial real estate bankruptcies continue to mount; Bernanke's bag o' tricks will be near empty having frittered most of his capital away on his Beluga-munching buddies at the investment banks. But that's only half the story. Bernanke and Co. are already working on a new list of hyper-inflationary remedies once the credit troubles pop up again.

According to the Wall Street Journal, the Fed has other economy-busting scams up its sleeve:“With worsening strains in credit market threatening to deepen and prolong an incipient recession, analysts are speculating that the Federal Reserve may be forced to consider more innovative responses -– perhaps buying mortgage-backed securities directly.

“As credit stresses intensify, the possibility of unconventional policy options by the Fed has gained considerable interest, said Michael Feroli of J.P. Morgan Chase. He said two options are garnering particular attention on Wall Street: Direct Fed lending to financial institutions other than banks and direct Fed purchases of debt of Fannie Mae and Freddie Mac or mortgage-backed securities guaranteed by the two shareholder-owned, government-sponsored mortgage companies. ( “Rate Cuts may not be Enough”, David Wessel, Wall Street Journal)

Wonderful. So now the Fed is planning to expand its mandate and bail out investment banks, hedge funds, brokerage houses and probably every other brandy-swilling Harvard grad who got caught-short in the subprime mousetrap. Ain't the “free market” great?

But none of Bernanke's bailout schemes will succeed. In fact, all he's doing is destroying the currency by trying to reflate the equity bubble. And how much damage is he inflicting on the dollar? According to Bloomberg, “the risk of losses on US Treasury notes exceeded German bunds for the first time ever amid investor concern the subprime mortgage crisis is sapping government reserves....Support for troubled financial institutions in the U.S. will be perceived as a weakening of U.S. sovereign credit.''

America is going broke and the rest of the world knows it. Bernanke is just speeding the country along the ever-steepening downward trajectory.

Timothy Geithner, President of the New York Fed put it like this: “ The self-reinforcing dynamic within financial markets has intensified the downside risks to growth for an economy that is already confronting a very substantial adjustment in housing and the possibility of a significant rise in household savings. The intensity of the crisis is in part a function of the size of the preceding financial boom, but also of the speed of the deterioration in confidence about the prospects for growth and in some of the basic features of our financial markets. The damage to confidence—confidence in ratings, in valuation tools, in the capacity of investors to evaluate risk—will prolong the process of adjustment in markets. This process carries with it risks to the broader economy.”

Without a hint of irony, Geithner talks about the importance of building confidence on a day when the Fed has deliberately distorted the market by injecting $200 billion in the banking system and sending the flagging stock market into a steroid-induced rapture. Astonishing.

The stock market was headed for a crash this week, but Bernanke managed to swerve off the road and avoid a head-on collision. But nothing has changed. Foreclosures are still soaring, the credit markets are still frozen, and capital is being destroyed at a faster pace than any time in history. The economic situation continues to deteriorate and even unrelated parts of the markets have now been infected with subprime contagion. The massive deleveraging of the banks and hedge funds is beginning to intensify and will continue to accelerate until a bottom is found. That's a long way off and the road ahead is full of potholes.

"In the United States, a new tipping point will translate into a collapse of the real economy, final socio-economic stage of the serial bursting of the housing and financial bubbles and of the pursuance of the US dollar fall. The collapse of US real economy means the virtual freeze of the American economic machinery: private and public bankruptcies in large numbers, companies and public services closing down massively.” (Statement from The Global Europe Anticipation Bulletin (GEAB)

Is that too gloomy? Then take a look at these eye-popping charts which show the extent of the Fed's lending operations via the Temporary Auction Facility. The loans have helped to make the insolvent banks look healthy, but at great cost to the country's economic welfare. http://benbittrolff.blogspot.com/2008/03/really-scary-fed-charts-march.html

The Fed established the TAF in the first place; to put a floor under mortgage-backed securities and other subprime junk so the banks wouldn't have to try to sell them into an illiquid market at fire-sale prices. But the plan has backfired and now the Fed feels compelled to contribute $200 billion to a losing cause. It's a waste of time.

UBS puts the banks total losses from the subprime fiasco at $600 billion. If that's true, (and we expect it is) then the Fed is out of luck because, at some point, Bernanke will have to throw in the towel and let some of the bigger banks fail. And when that happens, the stock market will start lurching downward in 400 and 500 point increments. But what else can be done? Solvency can only be feigned for so long. Eventually, losses have to be accounted for and businesses have to fail. It's that simple.

So far, the Fed's actions have had only a marginal affect. The system is grinding to a standstill. The country's two largest GSEs, Fannie Mae and Freddie Mac, which are presently carrying $4.5 trillion of loans on their books, are teetering towards bankruptcy. Both are gravely under-capitalized and (as a recent article in Barron's shows) Fannies equity is mostly smoke and mirrors. No wonder investors are shunning their bonds. Additionally, the cost of corporate bond insurance is now higher than anytime in history, which makes funding for business expansion or new projects nearly impossible. The wheels have come of the cart. The debt markets are upside-down, consumer confidence is drooping and, as the Financial Times states, “A palpable sense of crisis pervades global trading floors.” It's all pretty grim.

So far, the Fed's actions have had only a marginal affect. The system is grinding to a standstill. The country's two largest GSEs, Fannie Mae and Freddie Mac, which are presently carrying $4.5 trillion of loans on their books, are teetering towards bankruptcy. Both are gravely under-capitalized and (as a recent article in Barron's shows) Fannies equity is mostly smoke and mirrors. No wonder investors are shunning their bonds. Additionally, the cost of corporate bond insurance is now higher than anytime in history, which makes funding for business expansion or new projects nearly impossible. The wheels have come of the cart. The debt markets are upside-down, consumer confidence is drooping and, as the Financial Times states, “A palpable sense of crisis pervades global trading floors.” It's all pretty grim.

The banks are facing a “systemic margin call” which is leaving them capital-depleted and unwilling to lend. Thus, the credit markets are shutting down and there's a stampede for the exits by the big players. Bernanke's chances of reversing the trend are nil. The cash-strapped banks are calling in loans from the hedge funds which is causing massive deleveraging. That, in turn, is triggering a disorderly unwind of trillions of dollars of credit default swaps and other leveraged bets. Its a disaster. Economist Nouriel Roubini predicted the whole sequence of events six months before the credit markets seized and the Great Unwind began”. Here's a sampling of his recent testimony before Congress:

Roubini's Testimony before Congress:

“There is now a rising probability of a "catastrophic" financial and economic outcome; a vicious circle where a deep recession makes the financial losses more severe and where, in turn, large and growing financial losses and a financial meltdown make the recession even more severe. The Fed is seriously worried about this vicious circle and about the risks of a systemic financial meltdown....Capital reduction, credit contraction, forced liquidation and fire sales of assets at below fundamental prices will ensue leading to a cascading and mounting cycle of losses and further credit contraction. In illiquid market actual market prices are now even lower than the lower fundamental value that they now have given the credit problems in the economy.

“There is now a rising probability of a "catastrophic" financial and economic outcome; a vicious circle where a deep recession makes the financial losses more severe and where, in turn, large and growing financial losses and a financial meltdown make the recession even more severe. The Fed is seriously worried about this vicious circle and about the risks of a systemic financial meltdown....Capital reduction, credit contraction, forced liquidation and fire sales of assets at below fundamental prices will ensue leading to a cascading and mounting cycle of losses and further credit contraction. In illiquid market actual market prices are now even lower than the lower fundamental value that they now have given the credit problems in the economy.

Market prices include a large illiquidity discount on top of the discount due to the credit and fundamental problems of the underlying assets that are backing the distressed financial assets. Capital losses will lead to margin calls and further reduction of risk taking by a variety of financial institutions that are now forced to mark to market their positions. Such a forced fire sale of assets in illiquid markets will lead to further losses that will further contract credit and trigger further margin calls and disintermediation of credit.

To understand the risks that the financial system is facing today I present the "nightmare" or "catastrophic" scenario that the Fed and financial officials around the world are now worried about. Such a scenario – however extreme – has a rising and significant probability of occurring. Thus, it does not describe a very low probability event but rather an outcome that is quite possible.”

Roubini has been right from the very beginning, and he is right again now. Bernanke can place himself at the water's edge and lift his hands in defiance, but the tide will come in and wash him out to sea anyway. The market is correcting and nothing is going to stop it.

By Mike Whitney

Email: fergiewhitney@msn.com

Mike is a well respected freelance writer living in Washington state, interested in politics and economics from a libertarian perspective.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.