Gold Swift and Violent Plunge to $1100 Possible

Commodities / Gold and Silver 2013 May 15, 2013 - 11:32 AM GMT "It's not the size of the dog in the fight, it's the size of the fight in the dog."- Mark Twain (1835-1910)

"It's not the size of the dog in the fight, it's the size of the fight in the dog."- Mark Twain (1835-1910)

The more I look at gold the more I realize that very few people understand what’s going on with the yellow metal. In part this is do to the fact that gold brings emotions to the surface faster than any other investment I can think of, and emotions have little or no place in the markets. Bringing a varied group of investors together to discuss the yellow metal is like sticking Protestants and Catholics together in a room and telling them to discuss birth control. It may be entertaining, but the discussion goes nowhere. Right now the folks who like gold are complaining that the Fed and the bullion banks, financial institutions like Citibank and J P Morgan, are manipulating the price of gold. I believe there’s more than a grain of truth to that, but if I’m long gold it’s of no conciliation.

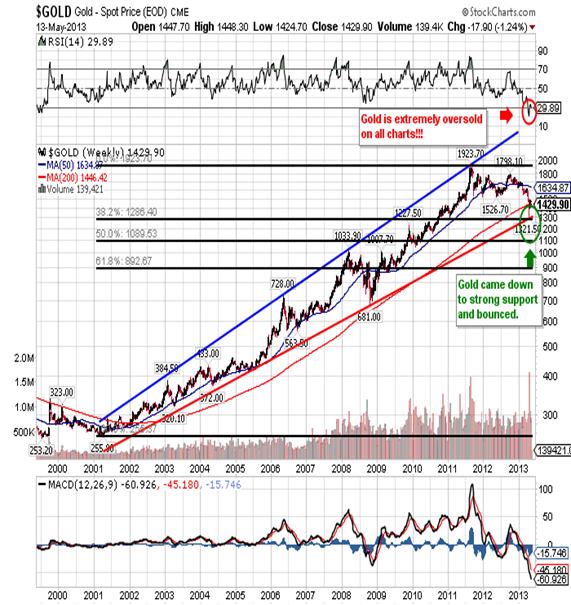

I believe that you can manipulate the price of gold until the cows come home and all you do is change the secondary and tertiary trends. If you’re really good, and these boys doing the manipulating are really good, you may even disrupt the primary trend, but you will not change it. A silk purse will never be a sow’s ear, and vice versa. If you want to see gold’s primary trend, here it is:

There are no mysteries! The primary trend was established in 2001 and it has been and is upward sloping. I never concern myself with the “why” of a price movement, but I’ll make an exception just this one time. The primary trend of gold is upward sloping because the United States began to print fiat currency excessively almost two decades ago, and since then every other major power in the world began to do the same thing. Currencies are not a store of value; they are promises to pay and that’s just a fancy term for debt! So when everybody goes off the deep end accumulating debt, the smart money searches out the one true store of value, gold. That’s where we are right now, searching for a store of value.

What if anything could change the primary trend from up to down? The only thing that could change the primary trend is if every major economic power announced today that they would live within their means and stop printing fiat currency. If that happened the price of gold would fall US $500/ounce that same night and it would keep falling for quite some time. Of course the chances of that happening are zero, so the trend will remain upward sloping for the foreseeable future. Why then the manipulation? Right now central banks have loaded their balance sheets with, for the most part, worthless debt and precious little real money. The manipulation is a play for time so they can somehow unload their worthless debt and accumulate gold. In short they want to print fiat paper and accumulate gold. Normally excessive printing would inflate the price of gold, but this time is different.

There are several factors contributing to lower gold prices right now, and they are cumulative:

- The fact that everybody is printing,

- Real interest rates are negative or at zero so bonds and cash offer no incentives,

- There is a paper (futures) market for gold that allows the bullion banks to pressure the physical market for gold lower,

- The Dow is recording new all-time highs every week so its an attractive alternative, and

- There is a media blitz against gold.

This combination of events has gold heading lower for the moment and that benefits the central banks and smart money that want to buy cheaper gold.

Since we know the primary trend is intact and likely to stay that way for quite some time, the logical question is when will the secondary trend turn up? Just like many other analysts I though that the bottom was already in and the strong support at 1,522.10 was impenetrable; and like many other analysts I was wrong. Making a mistake doesn’t bother because I treat it as a learning experience, but repeating the same mistake is inexcusable. So now when everybody rushes out to say that the April 16th low of 1,321.50 is the low, I’ll have to pass on that for the moment and here’s why:

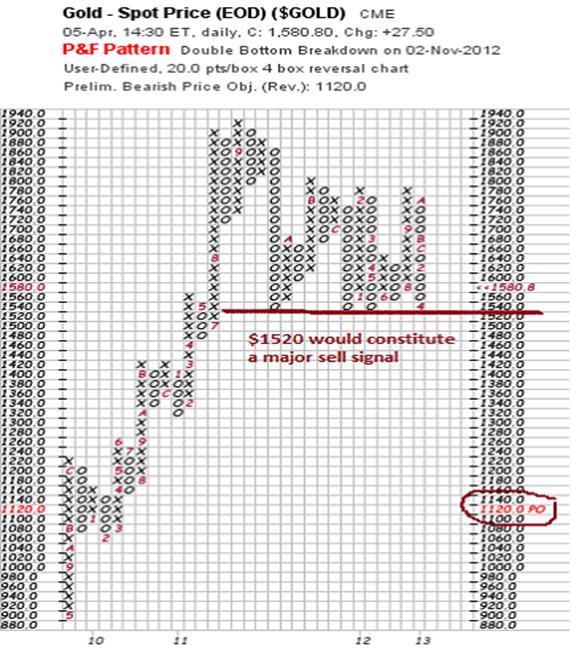

This is a Point & Figure chart that I published back in early April and is the work of John Strebler. At that time gold was at 1,580.00 and many were looking for a breakout to the upside. I noted back then that a break below the critical 1,522.10 support would leave gold in a sort of vacuum with nothing really to support it until it hit 1,089.00. That’s why I took my clients short as soon as price dipped below 1,522.00 and didn’t cover until it hit 1,345.00. Furthermore I only covered because RSI on the weekly and monthly charts hit 15.00 and I had never seen that before, in gold or anything else other than Dutch tulips. As it turned out the plunge stopped at 1,321.50 almost one month ago, rallied up to the 1,470.48 resistance

marking a 50% retracement from the point where it turned down and then it stopped. More than a half dozen attempts to punch through that resistance failed. As I type the spot gold is back down at 1,426.10 and has traded as low as 1,420.30. That is below both the 1,437.60 and 1,425.70 support levels I have mentioned in previous articles.

I know that some very intelligent people like Richard Russell believe the bottom is in, and I know that Jim Sinclair published a piece saying that we would see a secondary low in gold and silver between May 9th and 12th, but I’m not so sure. That empty void I pointed out in Strebler’s Point & Figure chart is huge and it literally jumps out at you. Then I take into consideration that the Fed needs lower prices right now to support the dollar, eliminate alternatives to the Dow and maintain credibility, so I have my doubts. That’s why I’m short paper gold from 1,471.00, looking for a test of strong support at 1,404.00 at the very least.

In conclusion, I hope gold holds here but my experience is that hope only disappears right after the margin call arrives. Even if gold breaks down here I do look for a bottom in gold over the next couple of weeks and I am convinced a decline to 1,100.00, should it occur, will be swift and violent. I am also sure that we’ll be at the bottom for minutes and the bounce that follows will also be quite strong as the desire for physical gold completely overwhelms the paper market. Finally, in the event that 1,404.00 holds here, and it’s possible, I’ll take in my short position and go long. In the mean time I have physical gold and silver that I’ve accumulated over the years that I never touch, and I have no doubt that it will come in handy once the wheels fall off of the fiat machine.

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2013 Robert M. Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Robert M. Williams Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.