Silver and the Dow

Commodities / Gold and Silver 2013 May 16, 2013 - 05:22 PM GMTBy: Hubert_Moolman

The Dow making new highs is likely to be very good news for silver investors, because nominal silver peaks tend to come after significant nominal peaks in the Dow. These stock market rallies are driven by the expansion of the money supply, causing a big increase in value of paper assets (including stocks) relative to real assets.

The Dow making new highs is likely to be very good news for silver investors, because nominal silver peaks tend to come after significant nominal peaks in the Dow. These stock market rallies are driven by the expansion of the money supply, causing a big increase in value of paper assets (including stocks) relative to real assets.

When the increase in credit or the money supply has run its course, and is unable to drive paper price higher; value then flees from paper assets to safe assets such as physical gold and silver, causing massive price increases.

The two most significant nominal peaks of the Dow were in 1929 and 1973. Silver made a significant peak in 1935, about six years after the Dow’s major peak in 1929. Again, in 1980, silver made a significant peak, about seven years after the Dow’s major peak in 1973. So, if the Dow is currently forming a major peak (like I think it is), we could possibly expect a major peak in silver, towards the end of this decade to early next decade. This means we are likely to have rising silver prices for many years to come.

In 1929, when the Dow was making its peak, silver was still in a downtrend which only bottomed in 1931. However, in 1973, silver was already in an uptrend by the time the Dow peaked:

The top chart is the Dow from 1966 to 1974, and the bottom one is silver during the same period. Silver was already in an uptrend when the Dow peaked. The Dow made a major nominal peak near the beginning of 1973, with silver peaking about a year after that. Furthermore, silver made a major peak in 1980, about seven years after the Dow’s 1973 peak.

Notice that silver was still trapped within a cup formation (lower than the cup’s high), out of which it only broke out after the Dow peaked.

Below is a current comparison between the Dow (top chart) and silver (bottom chart):

Like in 1973, silver is already in an uptrend long before the Dow’s possible major peak. The uptrend will still be intact, even if price falls further. If the Dow does peak very soon, will we have a silver top close to a year after the Dow’s peak? Also, will we have a major peak in silver coming some years after, like the 1980 peak?

Silver is again trapped within in a cup formation, lower than the cup high. This time the cup is much broader. Again, can we expect a breakout from the cup’s high sometime soon after the Dow tops – like it did in 1973?

I believe that given the two questions above, the near future of the Dow will be telling for future silver prices.

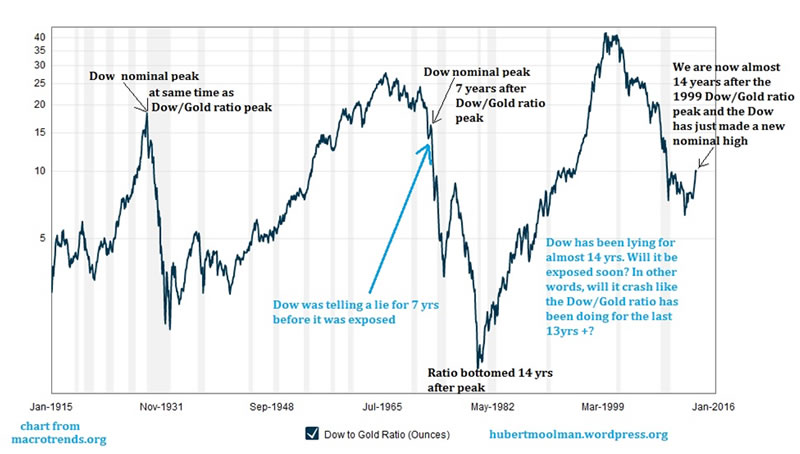

The Dow’s relationship with the Dow/Gold ratio is highlighting something interesting regarding this current silver bull market compared to the previous two. Below is a 100-year chart of the Dow/Gold ratio:

In 1929, the Dow peak came at the same time as the Dow/Gold ratio peak; therefore, the nominal peak and the real peak coincided. The 1973 nominal Dow peak came 7 years after the Dow/Gold ratio peak. We are currently almost 14 years past the Dow/Gold ratio peak, and we still have not had a nominal peak in the Dow.

What is this progression in the timing of the Dow’s nominal peak relative to the Dow/Gold ratio telling us? Is this a natural progression or is it proving how increasingly bigger efforts are applied to artificially prop up the stock markets?

Whatever the reason, it has created a setup for a massive financial panic. Value is likely to run from paper assets to silver and gold like never before. While the first part of this collapse of paper assets has been relatively controlled; the last phase is far more likely to result in chaos. This means that the Dow’s collapse could be vicious.

At the same time, after having had a relatively subdued rise since the beginning of this bull market, silver could explode higher like never before, once the bottom is in. The current decline is likely to bring attractive opportunities to increase physical silver positions.

For more silver and gold analysis and guidance, see my Long-term Silver Fractal Report or subscribe to my Premium Service.

Warm regards and God bless,

Hubert

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2013 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.