Gold Rallies as Stock Markets Crash, Nikkei Falls 7.3%

Commodities / Gold and Silver 2013 May 23, 2013 - 04:22 PM GMTBy: GoldCore

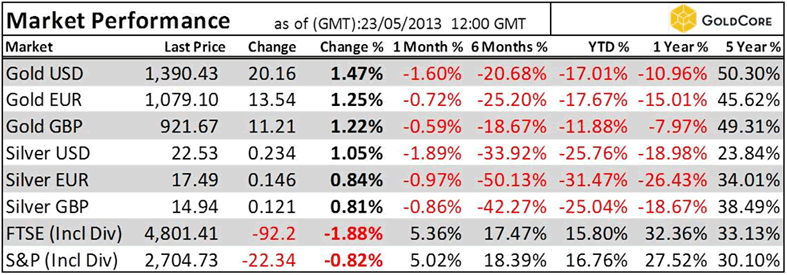

Today’s AM fix was USD 1,386.00, EUR 1,074.92 and GBP 919.16 per ounce.

Today’s AM fix was USD 1,386.00, EUR 1,074.92 and GBP 919.16 per ounce.

Yesterday’s AM fix was USD 1,385.25, EUR 1,071.43 and GBP 917.75 per ounce.

Gold fell $10.20 or 0.74% yesterday to $1,367.60/oz and silver finished up 0.07%.

Gold is up today while stock indices globally are sharply down after the Nikkei crashed 7.3%. The stock crash in Japan is leading to weakness in European equities and will lead to losses when U.S. markets open.

Gold - 1 Day – (Bloomberg)

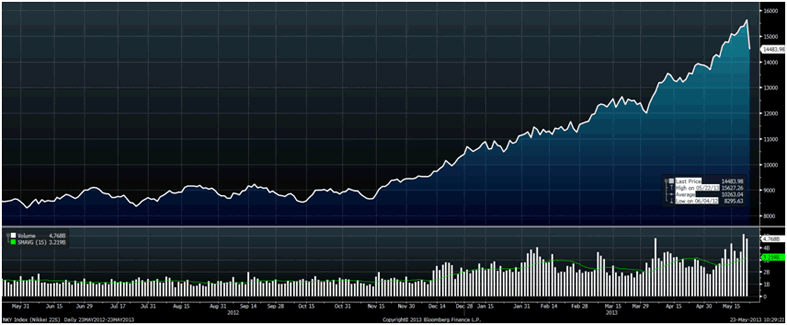

The Nikkei decline is being attributed to the poor Chinese PMI data but the more likely reason is speculators profit taking leading to panic selling. Currency debasement and rampant speculation had led the Nikkei to increase by an incredible 85% in just over 6 months.

Bernanke hinting at reducing Federal Reserve bond buying and balance sheet expansion and a more prudent U.S. monetary policy and the still very fragile Japanese economy likely also contributed.

Nikkei - 1 Year – (Bloomberg)

Gold is oversold on a host of benchmarks and was due a bounce and the Nikkei plummet and stock weakness in Europe, the FTSE is down by 1.9% and the CAC and DAX by more than 2.4%, have led to gold buying.

Stock losses appear to have contributed to speculators covering short positions and some speculators and investors buying gold again.

Silver too has benefitted from the renewed ‘risk off’ environment and risen 1.4%.

If there are sharp losses on Wall Street today –increased safe haven demand should be seen. Sharp falls in U.S. equities seem possible given the recent outsize gains despite increasingly poor fundamentals.

However, sharp losses on Wall Street could lead to further short term gold weakness if there is margin call selling.

There was short covering action yesterday and we expect more short covering however the scale of the losses in Japan overnight and risks of sharp falls in European and U.S. markets mean that in the short term, gold may be vulnerable.

There remains the risk of a massive short squeeze in the gold market as speculators such as Wall Street banks and hedge funds have made “the biggest bet ever against gold prices.”

Chart courtesy of Zero Hedge

This is likely to propel gold higher recovering much of the losses in recent months. It is likely to do so as the shorts are trend following speculators who are again completely ignoring the very positive gold fundamentals with massive demand for physical and rising premiums globally.

Gold’s price premium on the Shanghai Gold Exchange stood at $22/oz and remained above $20/oz for a fourth consecutive trading day overnight.

India is paying a premium of nearly $40 per 10 gramme bars. Dubai buyers are paying a premium of $7-10 per kilogramme.

Turkey is reported to be paying a premium of $25 an ounce over spot prices. Hong Kong and Singapore buyers are paying premium of $5 per ounce for gold bars.

Markets are becoming more and more casino like and are now the preserve of speculators.

For prudent pension owners, investors and savers this makes an allocation to physical gold more important than ever.

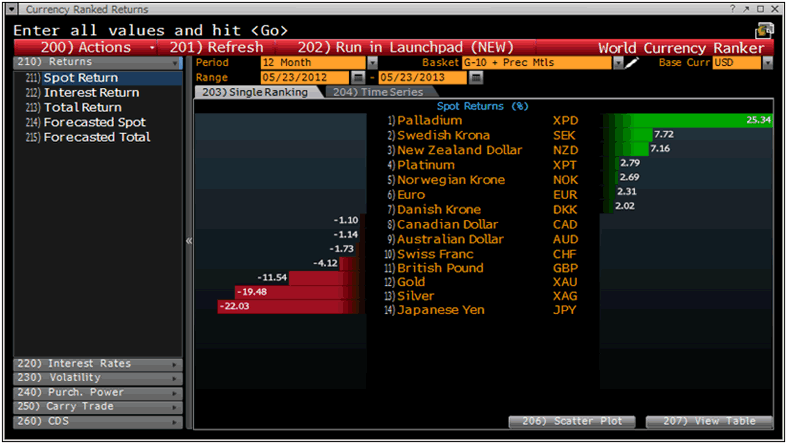

Precious Metals Currency Ranked Returns in USD – (Bloomberg)

Gold’s fundamentals remain sound and volatility in stock markets will lead to renewed safe haven demand for the precious metals.

Gold has had a difficult few months but will reassert itself as an important diversification and safe haven asset in the coming months.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.