Real Risk of Imminent Implosion of Eurozone

Politics / Eurozone Debt Crisis May 24, 2013 - 08:44 AM GMTBy: Raul_I_Meijer

Last weekend, a group of influential British business people published a letter in the Independent which attempts to "make the economic case" for having the UK stay in the EU. The letter of course is a reaction to unrest within PM David Cameron's Conservatives (over half of Tory backbenchers demand a referendum on the topic), as well as the rise of Nigel Farage's UK Independence Party, which in recent polls is almost as big as the Tories (which trails Labor by a mile and a half). The letter raises a bevy of interesting questions, some of which are not nearly as easy to answer as people have come to believe.

Last weekend, a group of influential British business people published a letter in the Independent which attempts to "make the economic case" for having the UK stay in the EU. The letter of course is a reaction to unrest within PM David Cameron's Conservatives (over half of Tory backbenchers demand a referendum on the topic), as well as the rise of Nigel Farage's UK Independence Party, which in recent polls is almost as big as the Tories (which trails Labor by a mile and a half). The letter raises a bevy of interesting questions, some of which are not nearly as easy to answer as people have come to believe.

The benefit of European Union membership outweighs the cost

The economic case to stay in the EU is overwhelming. The creation of the Single Market was instigated by Britain, and is now the world’s largest trading bloc, containing half a billion people with a GDP of £10 trillion. To Britain, membership is estimated to be worth between £31 billion and £92 billion per year in income gains, orbetween £1,200 to £3,500 for every household.

What we should now be doing is fighting hard to deliver a more competitive Europe, to combat the criticism of those that champion our departure. We should push to strengthen and deepen the Single Market to include digital, energy, transport and telecoms, which could boost Britain’s GDP by £110 billion.

The Prime Minister is rightly working hard on a Free Trade Agreement between the EU and US which could be worth as much as £10 billion per year to the British economy. On exiting the EU, we would lose not only the benefits of this free trade agreement, but all 37 already in existence. Renegotiating these would be costly, time-consuming and the UK alone would lack the colossal bargaining power of the EU.

The City of London is Europe’s global financial centre. Some of the EU’s ideas put this standing at risk. So the Government needs to work hard to protect it. But there is also a huge opportunity to promote London’s capital markets to help solve the problems of the EU banking system. We should promote the cause of EU membership as well as defend our position. The benefits of membership overwhelmingly outweigh the costs, and to suggest otherwise is putting politics before economics.

(Signed in a personal capacity) Roland Rudd, chairman, Business for New Europe; Dame Helen Alexander, chairman, UBM; Sir Win Bischoff , chairman, Lloyds Banking Group; Sir Richard Branson, founder, Virgin Group; Sir Roger Carr, chairman, Centrica; Sir Andrew Cahn, vice chairman, Nomura, public policy EMEA; David Cruickshank, chairman, Deloitte LLP; Lord Davies of Abersoch, vice chairman, Corsair Capital; Guy Dawson, director, ASA International; Lord Kerr of Kinlochard, deputy chairman, Scottish Power; Sir Adrian Montague, chairman, 3i; Nicolas Petrovic, CEO, Eurostar; Sir Michael Rake, chairman, BT; Anthony Salz, vice chairman, Rothschild; Sir Nicholas Scheele, chairman, Key Safety Systems Inc; Sir Nigel Sheinwald, non-executive director, Shell; Sir Martin Sorr elL, chief executive, WPP; Malcolm Sweeting, senior partner, Clifford Chance; Bill Winters, CEO, Renshaw Bay

So being an EU member means up to £92 billion ($140 billion) in additional profit for the UK?! These fine businessmen and pillars of society give no source for their numbers, unfortunately, which raises the question where the data comes from, how it's calculated etc. Also, obviously, "between £31 billion and £92 billion per year in income gains" is quite a spread (the difference is close to $100 billion); perhaps throwing around large numbers is deemed more important than accuracy.

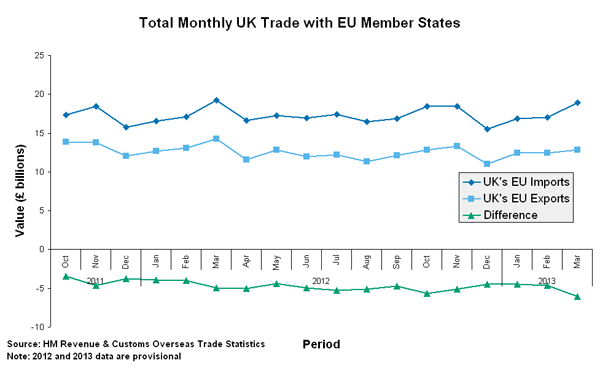

The graph below from Her Majesty's Trade and Customs Office not only shows a substantial trade deficit for the UK with the rest of the EU, an interesting fact by itself, it also suggests (in a rough estimate from adding up monthly numbers) that total UK exports to the other 26 EU countries is maybe £12.5 billion per month, or £150 billion annually, while the UK imports some £200 billion per year from them. How these numbers include "up to £92 billion inadditional profit for the UK" from the trade relationship is hard to see.

Probably Branson and co. are more interested in the promise of an even greater treasure up for grabs if the British government could achieve an EU law reform to "deepen the Single Market to include digital, energy, transport and telecoms", which they claim could boost Britain's GDP by £110 billion (which is quite a bit more than all other "additional" trade put together).

Or maybe they're really aiming for that "huge opportunity to promote London's capital markets to help solve the problems of the EU banking system". If we ignore for a moment how silly that sounds (Northern Rock, Bob Diamond anyone?), sure, grabbing control of Europe's entire banking system could be a huge winner. But it would never be accepted in Germany. Or France. So what then? Opening Virgin Money branches in Greece or Estonia or Slovenia can only have limited appeal, certainly if you have to share the spoils with Frankfurt.

Oh, and this one's good too: "What we should now be doing is fighting hard to deliver a more competitive Europe"... Really? Who's going to help you do the competing? Spain, Italy? They're bankrupt! Or how about "The Prime Minister is rightly working hard on a Free Trade Agreement between the EU and US which could be worth as much as £10 billion per year to the British economy."? That's just 0.6% of UK GDP, even if the number's correct. Maybe the Prime Minister would do better to focus his hard work somewhere else. I know, he won't: we'll globalize till we fall off the edge of the globe.

Britain's economy is far weaker than it appears - with bank "assets" at 800% of GDP and government debt at 90% of GDP-, the main difference with continental Europe being that it has its own currency, while the rest are constrained by the Euro, which can not now nor ever will be able to provide for every single different country what it needs. And grabbing bigger shares of the markets of broke economies hardly seems a recipe for Britain to grow out of its own funk.

The more interesting issue at hand might be to figure out which part of any profits Britain does achieve from its EU membership actually benefit the British population, and which part remains in the coffers of corporations and their staff and shareholders. Case in point: tax evasion as a whole, both corporate and individual, has apparently become so bad that even Cameron is looking to go after the perpetrators, not an obvious step for the most business friendly party in Britain, while at the same time Shell and BP are under serious EU investigation for price fixing in oil and gas markets (what was your heating bill again, grandma?).

Or one might ask how much resilience the UK economy has lost because of its EU membership; what part of what's now imported could still be grown or manufactured at home, if only the infrastructure was still there, and how many jobs have disappeared because of this?

I have no desire to mingle in internal political discussions about Britain's EU membership, but arguments like the ones made in the letter warrant scrutiny, as much as the still prevalent blind faith in the EU itself, does; not so much the underlying idea of unification as a deterrent for warfare, but the apparatus that has grown from the initial idea and that will lead to warfare if it isn't soon cut down to a healthier size.

That of course is where Nigel Farage comes in, who has firsthand experience of how and to what extent the European Parliament does or does not function. If you haven't seen them yet, YouTube has plenty of quite entertaining Farage videos. I have no opinion on Mr. Farage's political convictions, I don't know them nor do I care much. But I do understand some of his discontent regarding the EU.

And there's another point to make when pondering the numbers in the businessmen's letter. If it's true that the UK makes up to £92 billion in additional profit from being an EU member, where does that money come from? Who pays? Or is the EU truly a tide that lifts all boats? Where everybody wins? That would be hard to argue if you look at Spain or Greece. Ten years ago, perhaps, but not now.

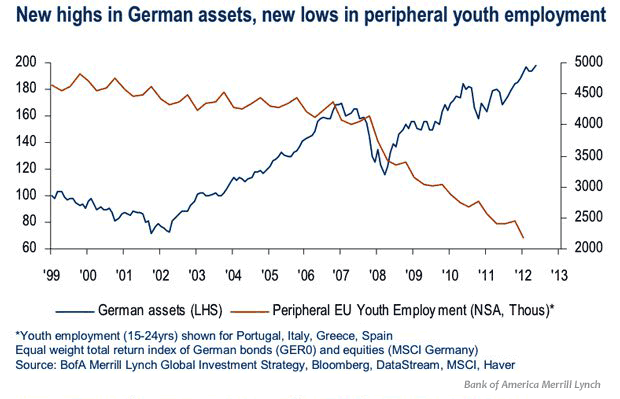

Looking at this BofA graph, what you see is that youth employment in Portugal, Italy, Greece and Spain has basically fallen since the very moment the Euro was introduced. How's that for a rising tide?

And if we are only halfway right in thinking that perhaps the tide doesn't lift all boats, whose boat do you think it does lift? If Britain is on the "positive" side of the equation, can we assume that Germany is too? As for the other European countries, are there any of them except these two that for now seem to be left standing? Among the larger ones, Italy and Spain are out. France? Does anyone still have faith in the French economy? Who else is there? Smaller nations like Sweden, Finland, Austria perhaps. Holland's household debt levels are too high to make it a contender.

All in all, a direly poor harvest, one large country and less than a handful smaller ones, and certainly no proof that the EU lifts all boats. Quite the opposite, in fact, it looks much more like proof that the EU has turned into a bitter disaster. With a bit of poetic license one could say that it eats poor people for breakfast so money flows to the rich can continue: no trickling down but flowing up. First you take their money, then you take their children's money and when there's no more money to be taken you eat them.

The EU was designed to lift all boats (or at least it was marketed to the European people that way). It has utterly failed to achieve this goal. And that makes the EU a failure. It doesn't matter that Brussels itself does not see it that way, the people and countries who end up on the wrong side of the equation are the ones who in the end decide. If Italy and Spain etc. opt to stay in either of the unions (EU and Eurozone), all they can expect is more of the same (or, rather, less). The history over the past few decades makes that bitingly clear.

And it's not as if now, when both the chickens and the cows have come home to roost, the richer countries or richer citizens within countries are going to say: here, take some more of mine. They will instead insist that only growth can help "everyone" out of the quicksand. But when your unemployment is 25% or so, growth is not an option, not even close. Not as long as you remain members of the Eurozone.

The best shot the PIIGSC have at growth - and at being masters of their own homes - is to leave the Eurozone, start off afresh with a new (or old) currency and devalue the heebees out of it. It's not just the best shot, it's the only shot, and that's why it'll inevitably happen. Not in all countries, and not everywhere at the same time, but there will be a first country to take that route, and then more will follow. Brussels simply has nothing left to offer that could forever convince all of them to stay put. Brussels has become an impediment.

From the moment the Euro was introduced, the economy - as measured by youth employment in the periphery - has deteriorated. Over the past 5 years, it has deteriorated as measured by just about any indicator. For sure, the deterioration has come first, and worst, to the poorer countries of the union, and to the poorer citizens of each country. The rich of each country are better off now, and the poor are poorer.

What that means is that first the eurozone, and after it the entire European union, have lost their legitimacy - in their present shape. The people who brought Europe this disaster still hold the reins, and they are trying to do more of the same: more centralization, more control, more European laws to overrule national ones. They're busy pushing through banking unions, fiscal unions, claiming that these are the recipe to right all that's gone wrong.

There are 37 separate trade agreements, but when you look at the recent downfall of the PIIGSC, you can only conclude that these agreements benefit mainly or only the rich. Which is why letters like the one above still get written.

Of course this is more true for the Eurozone than the EU, the former is where the inherent fault lines in the latter come to collide . And if Britain discusses a new form of EU membership, other countries can perhaps follow suit and some new kind of looser union may appear.

Don't put all your money on that shade of red though. The way things are going right now, the risk is very real that the imminent implosion of the Eurozone will mean curtains for the entire Brussels grand theater. In a very chaotic fashion that will leave open power vacuums for people of even more questionable moral standards.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.